If you’re trying to decide when to sell your house, there may not be a better time to list than right now. The ultimate sellers’ market we’re in today won’t last forever. If you’re thinking of making a move, here are four reasons to put your house up for sale sooner rather than later.

1. Your House Will Likely Sell Quickly

According to the Realtors Confidence Index released by the National Association of Realtors(NAR), homes continue to sell quickly – on average, they’re selling in just 17 days. As a seller, that’s great news for you.

Average days on market is a strong indicator of buyer demand. And if homes are selling quickly, buyers have to be more decisive and act fast to submit their offer before other buyers swoop in.

2. Buyers Are Willing To Compete for Your House

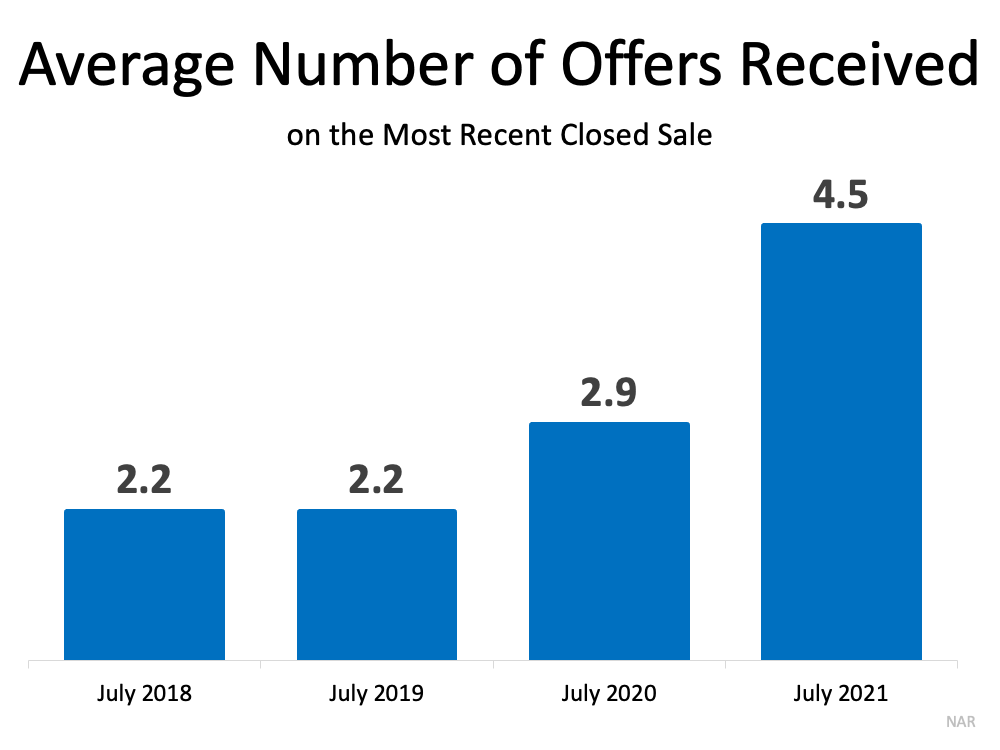

In addition to selling quickly, homes are receiving multiple offers. That same survey shows sellers are seeing an average of 4.5 offers, and they’re competitive ones. The graph below shows how the average number of offers right now compares to previous years: Buyers today know bidding wars are a likely outcome, and they’re coming prepared with their best offer in hand. Receiving several offers on your house means you can select the one that makes the most sense for your situation and financial well-being.

Buyers today know bidding wars are a likely outcome, and they’re coming prepared with their best offer in hand. Receiving several offers on your house means you can select the one that makes the most sense for your situation and financial well-being.

3. When Supply Is Low, Your House Is in the Spotlight

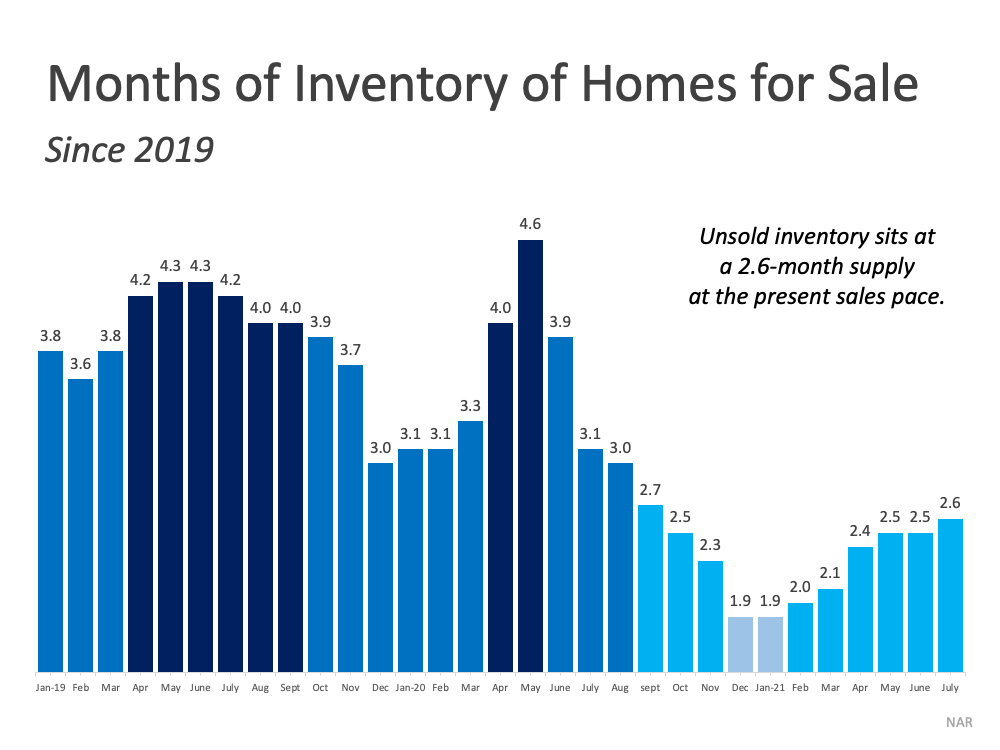

One of the most significant challenges for motivated buyers is the current inventory of homes for sale. Though it’s improving, it remains at near-record lows. The chart below shows how today’s low inventory stacks up against recent years. The lighter the blue is in the chart, the lower the housing supply. If you’re looking to take advantage of buyer demand and get the most attention for your house, selling now before more listings come to the market might be your best option.

If you’re looking to take advantage of buyer demand and get the most attention for your house, selling now before more listings come to the market might be your best option.

4. If You’re Thinking of Moving Up, Now May Be the Time

If your current home no longer meets your needs, it may be the perfect time to make a move. Today, homeowners are gaining a significant amount of wealth through growing equity. You can leverage that equity, plus current low mortgage rates, to power your move now. But these near-historic low rates won’t last forever.

Experts forecast interest rates will rise. In their forecast, Freddie Mac says:

“While we forecast rates to increase gradually later in the year, we don’t expect to see a rapid increase. At the end of the year, we forecast 30-year rates will be around 3.4%, rising to 3.8% by the fourth quarter of 2022.”

When rates rise, even modestly, it’ll impact your monthly payment and by extension your purchasing power.

Bottom Line

Don’t delay. The combination of housing supply challenges, low mortgage rates, and extremely motivated buyers gives sellers a unique opportunity this season. If you’re thinking about making a move, let’s chat about why it makes sense to list your house now.