Coast One Mortgage | November 27, 2020The holiday months and winter may not be traditional peak homebuying seasons – there are historically less homes on the market – but there are actually advantages to being a buyer during the holiday season. With less competition, tax benefits, and motivated sellers, the holidays are actually a great time to buy a home. According to a report from ATTOM Data Solutions, December 26 is the #1 day of the year to purchase a home. Think of it like the Black Friday of real estate.

Here are some benefits and tips on buying a home during the holiday season.

1. Have a clear focus

In order to take advantage of savings during this time, you need to be organized and have a clear idea of what you want in a home so you can act quickly if needed. Make sure you have all of your financial documentation ready, have saved up a down payment, and have your “wants/needs” list on hand.

2. Look for motivated sellers

Many sellers who list their home during the holidays are motivated to sell for a variety of reasons. Whatever the reason, you can benefit by negotiating a great price on the house. Consider other incentives to ask for, like an adjusted closing date that works for you.

Available homes might have been on the market for some time, or you could even come across an “old expired listing” that didn’t previously sell during the original listing period and is active again. Private sellers are not the only motivated sellers during this season. Banks and other financial institutions are motivated to get foreclosed properties off of their books before the end of the year. Ask your real estate agent about these types of properties.

3. Tax benefits

Depending on your financial situation, and what your tax liability looks like for the upcoming calendar year, you could qualify for some tax benefits purchasing a home this time of year.

If you itemize deductions when you file taxes, you may be able to deduct points purchased upon closing, property taxes, and mortgage interest rates. If you’re purchasing a home as an investment asset, and have a business entity, there may be even more tax benefits available to you. Make sure you talk to your accountant for specific details.

4. Work with a well-connected real estate agent

Since fewer properties are listed between Halloween and New Year’s, you’ll want early access to the homes you’re most interested in. If you have a connected real estate agent, they’ll know about available properties ahead of time and be on the lookout for hidden gems or unpublicized listings.

Make sure your real estate agent’s communication style gels with yours, too. If you’re trying to take advantage of holiday listings, you’ll want your realtor to be responsive to both you and the seller’s agent of the property you’re interested in.

5. Inquire about Pocket Listings

Pocket listings are homes not listed on the local MLS (multiple listing service) or otherwise publicized. Sellers who want to maintain a certain level of privacy will often put their home up as a pocket listing. This is when having a savvy, connected real estate agent will really help you. Less visibility also means less competition for you as a buyer!

If you’ve found a home you love, or are ready to purchase a home, now might be the time for you! With less competition, you might have more luck putting down a smaller earnest money deposit – something that could be less successful when sellers are fielding multiple offers during busier times of year.

Take advantage of the perks and don’t let the holidays deter you from making an offer on a home this season.

Keeping Current Matters | Dec 3, 2024

A lot of people assume spring is the ideal time to sell a house. And sure, buyer demand usually picks up at that time of year. But here’s the catch: so does your competition because a lot of people put their homes on the market at the same time.

So, what’s the real advantage of selling your house before spring? It’ll stand out.

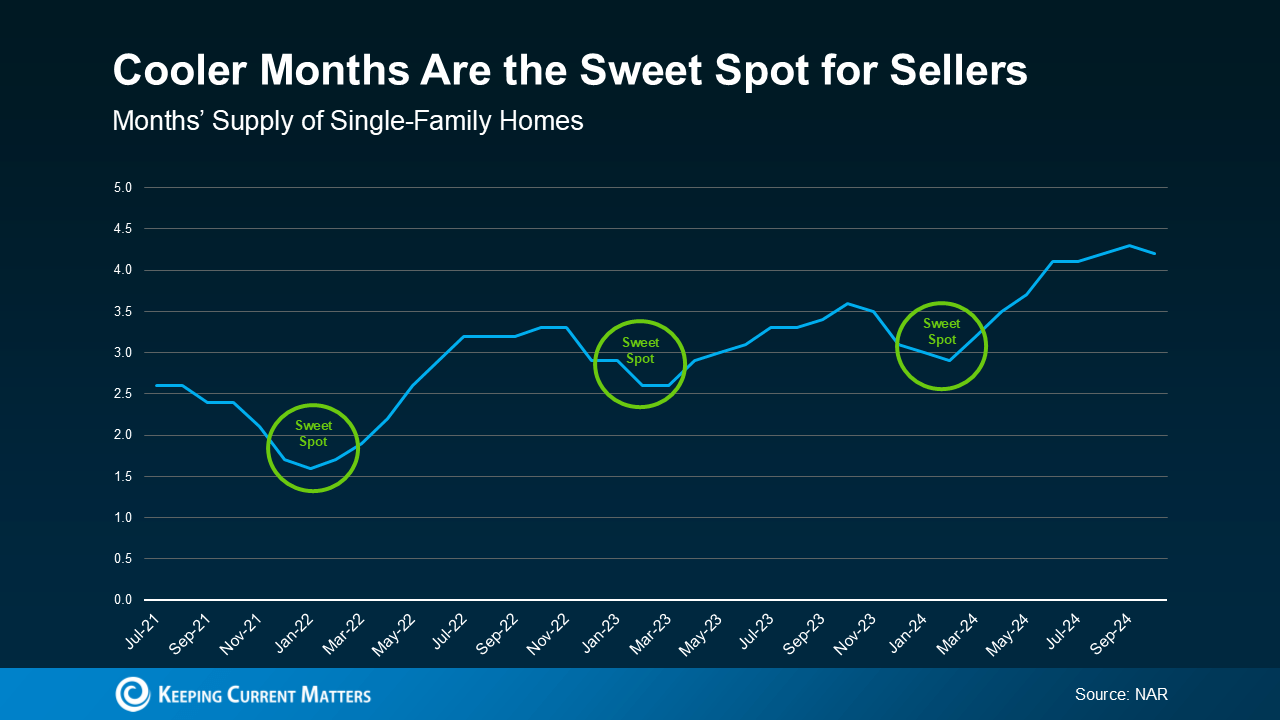

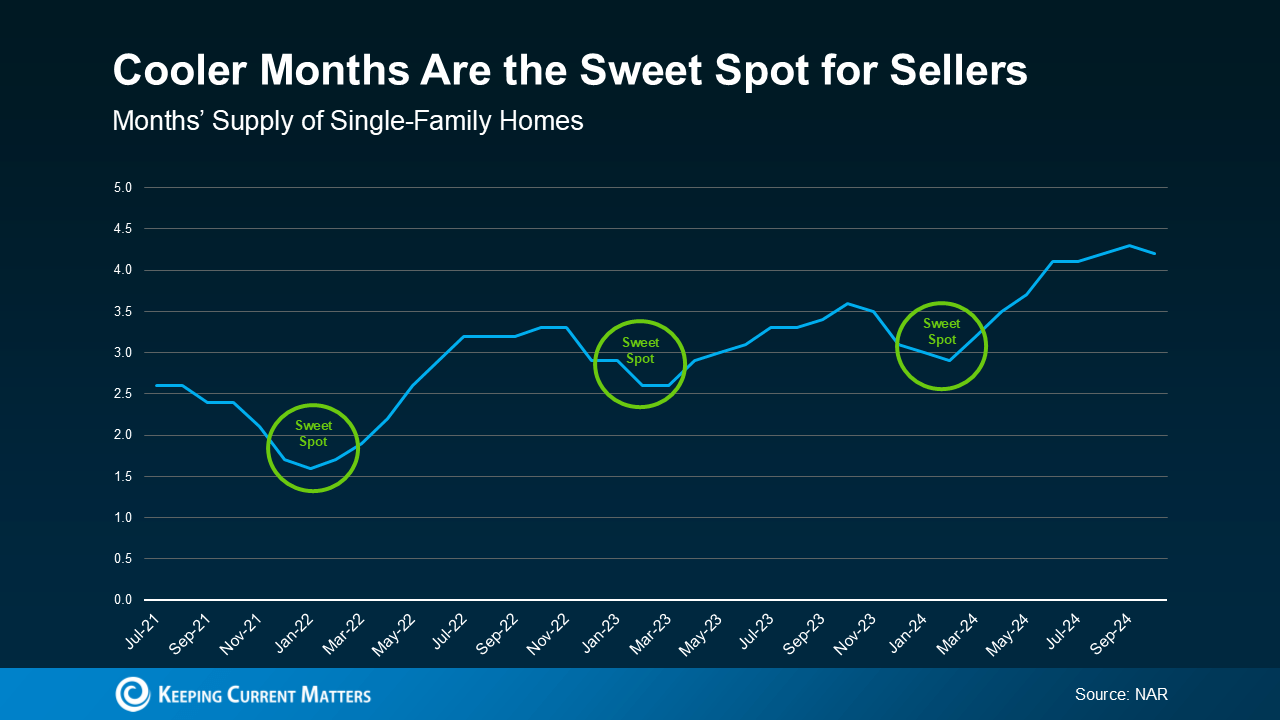

Historically, the number of homes for sale tends to drop during the cooler months – and that means buyers have fewer options to choose from.

You can see how that trend played out over the past few years in this data from the National Association of Realtors (NAR). Each time, the supply of homes for sale dipped during these cooler months. And then, after each winter lull, inventory started to climb as more sellers jumped into the market closer to spring (see graph below):

Here’s why knowing how this trend works gives you an edge. While inventory is higher this year than it‘s been in the last few winters, if you work with an agent to list now, it’ll still be in this year’s sweet spot. So, while other sellers are taking their homes off the market, you can sell before the spring wave of new listings hits, and your house will have a better chance of standing out.

Here’s why knowing how this trend works gives you an edge. While inventory is higher this year than it‘s been in the last few winters, if you work with an agent to list now, it’ll still be in this year’s sweet spot. So, while other sellers are taking their homes off the market, you can sell before the spring wave of new listings hits, and your house will have a better chance of standing out.

Why wait until spring when you can get ahead of the curve now?

Fewer Listings Also Means More Eyes on Your Home

Another big perk of selling in the winter? The buyers who are looking right now are serious about making a move.

During this season, the window-shopper crowd tends to stay busy with other things, like holiday celebrations, and avoids looking for homes when the weather’s cooler. So, the buyers out looking aren’t casually browsing—they’re motivated, whether it’s because of a job relocation, a lease ending, or some other time-sensitive reason. And those are the types of buyers you want to work with. Investopedia explains:

“. . . if your house is up for sale in the winter and someone is looking at it, chances are that person is serious and ready to buy.”

Bottom Line

With less competition and serious buyers on the hunt, you’ll be in a great position to sell your house this winter. Connect with CA Real Estate Group to get the process started. Call Team Lead Christine Almarines for a free consultation at (714) 476-4637.

Tackling these projects now will set you up for an even better New Year.

Test water quality

Checking water quality is one of those home maintenance tasks that’s easy to forget. But it never hurts to test the mineral content or hardness of your water, especially if you’re hosting guests for the holidays. “Testing your water is an easy, indoor home project to complete over the holidays,” says Chris Counahan, president at LeafFilter Gutter Protection. Purchase a water testing kit and follow the package instructions by filling a glass of water and dipping the testing stick in to assess the quality. “If your tests find hard water or contaminants, consider calling a professional to install a whole-home reverse osmosis system to ensure clean water throughout your home,” Counahan says.

Refresh the walls

Whether it’s wallpapering a feature wall in the primary bedroom or giving the bathroom a fresh coat of paint, try refreshing your interior walls over the holiday break. Painting projects can easily be done in a couple of days, depending on the size of the room, so they’re perfect for completing over a long holiday weekend. Wallpapering can be done in around a maximum of 8 hours, again depending on the size and number of walls you’re tackling. So, if you’ve been pondering a wall upgrade, the holiday break is the perfect time to check it off the list.

Patio or deck maintenance

For homes not covered in snow during the holiday season, exterior maintenance should be top of the to-do list. “Holiday breaks offer a great opportunity for homeowners to freshen up their outdoor spaces, and catch up on deck maintenance,“ says Michelle Hendricks, Deckorators’ category marketing manager. Cleaning rust stains, tightening railings or loose joints, reorganizing the deck box, or even refinishing deck wood can all be done over the course of a few days.

Deep clean floors and carpets

Not all home projects for the holidays have to be renovations—deep cleaning is just as important. High-traffic areas like hardwood floors and carpets can always use a deep cleaning. Aside from the usual sweeping and vacuuming, try using the wet vac for carpets and rugs. Target baseboards and try a carpet cleaner, especially in high-traffic areas used by people and pets.

Add insulation

Holiday breaks are the perfect time to work on energy-efficient upgrades. “With the colder temperatures that arrive before the holidays, homeowners inevitably start noticing how well their home holds up against the elements,” says DR Richardson, co-founder of Elephant Energy. “For many homeowners, that is the perfect time of the year to weatherize their homes by adding air sealing or extra insulation,” he says. Try weatherstripping to seal gaps where air can enter, window caulking to seal gaps or cracks, or adding insulation—professionally or DIY—to basements, garages, or attics.

Declutter

With days off on holiday break, there’s extra time to look around and notice items you no longer need. Spend some time decluttering neglected areas of your home. Closets, pantries, and home offices are often home to lots of outdated junk. Decluttering can make it easier to find items you really do need and to keep spaces clean. It’s also worthwhile to tidy spaces before guests come over for holiday celebrations. Try tackling one room at a time and have a plan. Have a pile for what you’ll keep, trash, and donate. For clothing and furniture, try organizing a pickup from a charity, so you’ll have a deadline for completion and no excuse to wave goodbye to items that will be put to better use elsewhere.

Revisit Landscaping

If you’re tired of spending time inside, it’s worth considering what upgrades you can make outdoors. Revisit your landscaping and outdoor living spaces. “Additions like outdoor heaters, fire pits, and lighting will help extend the use of your outdoor living space throughout the seasons,” says Hendricks. These features can make the outdoor space more comfortable just in time for the holidays. Lawncare, repotting plants, cleaning outdoor furniture, refreshing mulch, or finishing hardscaping features can set you up for success in the warmer months.

Upgrade light fixtures

Another easy project to take on during the holiday break is to upgrade indoor lighting. Get a new fixture above the dining table, bring a new lamp to the living room, or replace sconces in the bathroom. Replacing or refreshing lighting fixtures can completely transform the look and feel of your home. Usually, putting up simple task lighting does not require a professional technician, so you can try this fix yourself. If you need an electrician or lighting specialist, use the holidays to call around, visit showrooms, and finally place your orders.

Clean the fireplace and chimney

If your home has one, your fireplace will be the focal point of the holiday season. Cleaning up the fireplace area is more complicated than it looks. Even minor renovations can make a huge difference. Small upgrades include re-tiling the floor and redecorating the mantle. Cleaning the chimney, however, is a professional job. Doing regular maintenance can prevent allergens and fire hazards. Remember to plan and call ahead, as pros in your neighborhood may be in high demand this time of year.

Refresh the cabinets

Are your kitchen cabinets looking worse for wear? Refresh or refinish them this holiday season. Try replacing hardware, repainting, or refinishing cabinet faces. If you’re happy with the outside of your cabinets, try reorganizing the inside. Refreshing kitchen cabinets can bring new life into your space without hiring a professional to replace them. The same applies to bathroom vanities and storage cabinets, which are often neglected.

Good Housekeeping | Sep 11, 2024

Hosting a Thanksgiving that your family will remember for years to come includes more than just serving up an amazing meal. (Though, that’s still a major part of it.) What will really leave you and your loved ones with lasting memories will be the experience you have while spending time with each other.

That’s why Thanksgiving games are the perfect way to make Turkey Day tons more fun, especially if you have kids. We’ve rounded up a combination of festive crafts, engaging activities and challenging trivia that will keep the entire family entertained.

While bingo and scavenger hunts will almost certainly ensure a day full of fun for large groups or teams, there are also games like word search, “I spy” and Thanksgiving riddles that are still fun to play even with one or two people.

If your family happens to be partial to minute-to-win-it games, we have a few of those, too. Just don’t forget to give out special prizes to the winners. If you need inspiration, our Thanksgiving gifts can help with that.

Keeping Current Matters | Oct 30, 2024

No one likes making mistakes, especially when they happen in what’s likely the biggest transaction of your life – buying a home.

That’s why partnering with a trusted agent and real estate team like CA Real Estate Group is so important. Here’s a sneak peek at the most common missteps buyers are making in today’s market and how a great agent will help you steer clear of each one.

Trying To Time the Market

Many buyers are trying to time the market by waiting for home prices or mortgage rates to drop. This can be a really risky strategy because there’s so much at play that can have an impact on those things. As Elijah de la Campa, Senior Economist at Redfin, says:

“My advice for buyers is don’t try to time the market. There are a lot of swing factors, like the upcoming jobs report and the presidential election, that could cause the housing market to take unexpected twists and turns. If you find a house you love and can afford to buy it, now’s not a bad time.”

Buying More House Than You Can Afford

If you’re tempted to stretch your budget a bit further than you should, you’re not alone. A number of buyers are making this mistake right now.

But the truth is, it’s actually really important to avoid overextending your budget, especially when other housing expenses like home insurance and taxes are on the rise. You want to talk to the pros to make sure you understand what’ll really work for you. Bankrate offers this advice:

“Focus on what monthly payment you can afford rather than fixating on the maximum loan amount you qualify for. Just because you can qualify for a $300,000 loan doesn’t mean you can comfortably handle the monthly payments that come with it along with your other financial obligations.”

Missing Out on Assistance Programs That Can Help

Saving up for the upfront costs of homeownership takes some careful planning. You’ve got to think about your closing costs, down payment, and more. And if you don’t work with a team of experienced professionals, you could miss out on programs out there that can make a big difference for you. This is happening more than you realize.

According to Realtor.com, almost 80% of first-time buyers qualify for down payment assistance – but only 13% actually take advantage of those programs. So, talk to a lender about your options. Whether you’re buying your first house or your fifth, there may be a program that can help.

Not Leaning on the Expertise of a Pro

This last one may be the most important of all. The very best way to avoid making a mistake that’s going to cost you is to lean on a pro. With the right team of experts, you can easily dodge these missteps.

Bottom Line

The good news is you don’t have to deal with any of these headaches. Connect with CA Real Estate Group so you have a pro on your side who can help you avoid these costly mistakes.

CA Real Estate Group | Caliber RE Group

Christine Almarines @christine_almarines

Realtor DRE# 01412944 | (714) 476-4637

Anaid Bautista @wealthwithanaid

Realtor DRE# 02179675 | (949) 391-8266

Letty Luna @lettylunarealestate

Realtor DRE# 02174000 | (562) 879-4181

PT Nguyen @sellsocalbuypt

Realtor DRE# 02223919 | (714) 756-0240

SeeCalifornia.com | Nov 8, 2024

Californians celebrate Veteran’s Day in nearly every city and community throughout the state. The events take place on November 11 and surrounding days to honor U.S. veterans who have served in the United States Armed Forces.

Veteran’s Day Offers

Veterans Day National Ceremony is held annually on November 11th, with one national service at Arlington National Cemetery. It starts with a wreath laying at the Tomb of the Unknowns and continues inside the Memorial Amphitheater with a parade of colors by veterans’ organizations.

The day will be filled with solemn pride in the heroism of those who died in the country’s service and with gratitude for the victory, both because of the thing from which it has freed us and because of the opportunity it has given America to show her sympathy with peace and justice in the councils of the nations, said President Woodrow Wilson when he declared the first celebration would be called Armistice Day. Congress amended it in 1954, replacing “Armistice” with “Veterans.”

Veterans Day 2024

ALHAMBRA: Veterans Day November 11, 2024, 10-11:30 a.m. to be celebrated at Alhambra Park. The annual veterans ceremony at the Veterans Memorial in Alhambra Park, 500 N. Palm Ave. The City of Alhambra and American Legion Post 139 host the annual ceremony which includes continental breakfast at 10 a.m. followed by the ceremony at 11 a.m. The public is welcome. cityofalhambra.org

AMERICAN CANYON: Veterans Day November 11, 2024, 11 a.m.-12 p.m. City of American Canyon Community Center Gym, 100 Benton Way. Includes presentation, invocation and guest speakers. Keynote Speaker, Student performances, veterans service organization booths, and refreshments, Free, cityofamericancanyon.org

ANAHEIM: Veteran’s Day Flags of Honor November 8-11, 2024, at Eucalyptus Park in Anaheim Hills. Remembrance Ceremony November 10, 2024, 10 a.m. 200+ U.S. flags stand in solemn formation to honor our heroes. The flags fly for three days so visitors can walk through the field to read the posted dedications attached to each flag. Location: 100 N. Quintana Drive, Anaheim, CA. Free, Sponsored by Anaheim Rotary Club. facebook.com/AnaheimHillsRotaryClub/

ANAHEIM: Veteran’s Day Tribute, November 11, 2024 (must confirm), at 241 S. Anaheim Blvd, Anaheim, CA. Annual event normally taking place on Nov.11. anaheim.net/1626/Veterans-Tribute

ANTIOCH: Rivertown Veterans Day Parade memorial at the Antioch Marina November 11, 2024. Pancake Breakfast at the Antioch Veterans Memorial, 5 Marina Plaza, L Street at 8 a.m. is hosted by the Antioch Rivertown Veterans Lions Club. Veteran’s Day Ceremony starts at 9:30 a.m. The Parade starts at 11 a.m. at the Marina heads east on Second Street. deltaveteransgroup.org

ARTESIA: Veterans Day Celebration November 9, 2024, 10 a.m.-1 p.m. in Artesia Park at Veterans Memorial. Music, a Veteran’s Breakfast (free while supplies last), display booths, kids area, vehicle display of a Vietnam era Huey Helicopter, and an Air Force Flyover! Honored guest speaker for the event is Retired U.S. Army Major Ed Choi, a Purple Heart and Bronze Star recipient. Location: 18750 Clarkdale Ave., Artesia, CA cityofartesia.us

ATASCADERO: Faces of Freedom Veterans Memorial November 11, 2024 at 11 a.m. Live music and a community BBQ hosted by Kiwanis follow the ceremony. visitatascadero.com

AUBURN: Veterans Day Parade Honoring Cold War Veterans 1945 – 1991, November 11, 2024, 10:50 a.m. Parade begins at the corner of Lincoln Way and Cleveland Street and proceeds down Lincoln Way. The parade will pause at the Central Square at 11 a.m. There will be a brief patriotic ceremony with the release of doves, followed by a fly-over (weather permitting), a three volley rifle salute followed by TAPS. The parade resumes onto High Street and end at the Gold Country Fairgrounds. auburnveteransparade.org

AVALON: Veterans Day Ceremony, November 11, 2024, 11 a.m.-12 p.m. at Pebbly Beach. The Avalon VFW will host a Veterans Day Ceremony at Veterans Memorial Park in Avalon. The event includes a Presentation of the Colors by the VFW Post 4682 Honor Guard, and guest speakers. cityofavalon.com

BAKERSFIELD: Veterans Day Parade and Celebration November 11 , 2024, 10 a.m. outside KGET studios at 21st and L Streets, then heads west on 21st Street, south on G Street, then east on 20th Street. American Legion breakfast 6 a.m. Post 26 ( Veteran’s eat free) Flag Raising Ceremony 8 a.m. at Veteran’s Memorial Truxtun & S St. Veteran’s Day Parade 10 a.m. Lunch served after parade (Veteran’s eat free) eagleinfaith@gmail.com

BALDWIN PARK: Veterans Day Ceremony November 11, 2024, 1 p.m. honoring all Veterans from the community during a very special ceremony. Held at Morgan Park, Morgan Park, Cesar E. Chavez Amphitheater, 4100 Baldwin Park. Free, baldwinpark.com

BEAUMONT: Veterans Day Celebration & Parade November 11, 2024, 10 a.m. Parade begins at Beaumont & 12th St. and ends at the Beaumont Civic Center, 550 E. 6th Street where the ceremony takes place at 11 a.m. All welcomed! Free, beaumontca.gov

BELLFLOWER: Veteran’s Day Ceremony November 7, 2024, 10 a.m.-12 p.m. The public is invited to join in and honor those who have served. Veteran’s Memorial, 9918 Flower St., Bellflower, CA. bellflower.org

BREA: Brea Veterans Day Ceremony November 11, 2024, 10-11 a.m. at Brea Veterans Memorial. Join the Brea community t0 pay tribute to all military heroes, including veterans, active duty and those that made the ultimate sacrifice for our Country. Location: Civic & Cultural Center. 1 Civic Center Circle, Brea, CA. Free, breaspecalevents.com

BRENTWOOD: Brentwood Veterans Day Parade November 10, 2024, 9:30 a.m.-12 p.m. in Downtown Brentwood included veterans and veteran-owned businesses. Civilians can participate by signing up for the Flag Walk. brentwoodca.gov

BUENA PARK: Veterans Honor Luncheon November 6, 2024, 12 p.m. Location: Ehlers Event Center, 8150 Knott Ave., Buena Park, CA buenapark.com

BURBANK: Veterans Day Ceremony and War Memorial Dedication November 11, 2024, 10:15 a.m. concert with Burbank Community Band and flyover by Condor Squadron; 11 a.m. ceremony at McCambridge Park War Memorial (at the corner of Amherst & San Fernando) Cost: Free Event, burbankca.gov

CARLSBAD: Veterans Day Parade and Military Review presented by Army & Navy Academy. November 11, 2024, tribute to the brave men and women who have served and continue to serve our nation in the Army, Navy, Marine Corps, Air Force, Space Force, and Coast Guard. Location: 2605 Carlsbad Blvd., Carlsbad, CA. Free, armyandnavyacademy.org

CARMEL: Veterans Day Ceremony November 11, 2024, 11 a.m. Ceremony held in Devendorf Park on Ocean Avenue, honoring our veterans, sponsored by the Carmel by the Sea chapter of the American Legion. alpost512carmel.org | posted on carmelcalifornia.com

CARSON: Veterans Day Ceremony November 11, 2024, 10 a.m.-12 p.m. held in Veterans Park. Keynote speech. Location: 2400 Moneta Ave, Carson, CA. Free, ci.carson.ca.us

CASTRO VALLEY: Veterans Day Program November 11, 2024, 11 a.m. at Castro Valley Veterans Memorial, 3567 Quail Ave. Veterans of Castro Valley welcome you to cerebrate our Veterans Past and Present with a full program, including Military Honors. Special remembrance events are held every Veterans Day at 11 a.m. The public is invited. Veterans are encouraged to wear their uniforms or other clothing that distinguishes them as military veterans.

CERRITOS: Veterans Day Ceremony November 11, 2024, 10 a.m. The community is invited to attend the City of Cerritos Veterans Day Ceremony near the Cerritos Veterans Memorial in the Cerritos Civic Center. Patriotic selections performed by the Cerritos College Community Band, City Council and dignitary comments, wreath laying, and a moment of silence. In addition, children’s patriotic crafts will be offered. Parking is available at the Civic Center.Parking is available at the Civic Center. Event will occur rain or shine. Location: 18125 Bloomfield Ave., Cerritos, CA. Free, cerritos.us

CHOWCHILLA: VFW Veterans Commemoration Ceremony on November 11, 2024, 11 a.m.- 12:p.m. Veterans Memorial Park, 600 W. Robertson Blvd. Veterans Ceremony is held to pay tribute to the men and women that have given their service to our country. The public is encouraged to attend. The event is co-sponsored by Veterans of Foreign Wars & VFW Ladies Auxiliary and American Legion. Free, cityofchowchilla.org

CLAREMONT: Veterans Day Ceremony 11 a.m. at Memorial Park. The keynote speaker is General (Ret.) Austin Scott Miller. Location: 840 N. Indian Hill Boulevard, Claremont, CA. ci.claremont.ca.us

COLTON: Veterans Day Parade November 11, 2024, 10 a.m. Honor and celebrate our Colton Veterans who have served in the United States Armed Forces. Parade starts on O Street, Head North and end at ‘D’ Street. Light refreshments at the Colton Downtown Paseo, located at 135 West Valley Boulevard. Honor Ceremony immediately following the parade at Fleming Park, 525 N. La Cadena Drive. Free, ci.colton.ca.us

COMMERCE: Veterans Day Ceremony November 11, 2024, 9 a.m. at Commerce City Hall. Ceremony followed by light refreshments. Location:2535 Commerce Way, Commerce, CA. Free, (323) 887-4434

COSTA MESA: Salute to Veterans November 9, 2024, 12-3 p.m. Swing dancing and musical performances, arts & crafts, a cookie decorating contest, opportunities to connect with local veterans’ organizations, free hot dogs and drinks, and more! The community is invited to this free event. Location: OC Fair & Event Center – Heroes Hall, 88 Fair Dr., Costa Mesa, CA. Free. ocfair.com

CUPERTINO: Veterans Day Memorial Event November 11, 2024, 11 a.m.-1 p.m. Cupertino Veterans Memorial Veterans Memorial at Memorial Park, Mary Ave & Stevens Creek. Line up: Invocation with Chaplain Richard Veit US Army Viet Nam Combat Veteran | National Anthem by Reyna Padron, Police Cadet, on Violin | Speakers Major General Tracy Smith, USA Commanding General 63rd Readiness Division; and Former Navy Seal Team 5 Captain CDR Tom Deitz (USN, Ret) Leadership by Example | Taps by SGT Sam Grinels, USMC | Music by West Bay Community Band. Location: 10110 Parkwood Drive, Cupertino, CA. cupertinoveteransmemorial.org

DANA POINT: P0st 9934 Veterans of Foreign Wars, Ladies Auxiliary and the City invite the public on November 11, 2024, 10 a.m. (must confirm time) at Strands Vista Park, 34201 Selva Rd. Free, vfwpost9934.org

DIAMOND BAR: Veterans Celebration November 7, 2024, 9-11 a.m. at Diamond Bar Center, 1600 Grand Ave. includes patriotic musical performances and light refreshments. Attendance is free and open to everyone, diamondbarca.gov/specialevents

DOWNEY: Veterans Day Ceremony November 11, 2024, 10-11 a.m. at The Columbia Memorial Space Center 12400 Columbia Way. The City of Downey will be holding its annual Veterans Day Ceremony. City officials will be present to take part in this special event and the public is invited to attend to help honor and pay tribute to those who have served our Country. downeyca.org

DUARTE: Veterans Day Ceremony November 11, 2024, 9 a.m. at Veterans Memorial Thorsen Park, honoring all who served. Location: Thorsen Park, 2801 Huntington Drive. Seating available at the ceremony and refreshments, donated by the Duarte Kiwanis Club will be served immediately after the ceremony. accessduarte.com

EL CERRITO: El Cerrito Flag Ceremony November 11, 2024, 8 a.m. at Sunset View Cemetery. Join El Cerrito Lions Club for a brief ceremony in honor of veterans and the annual Veterans Day placement of flags on the graves of those who served. Coffee, juice, and doughnuts. Location: 101 Colusa Ave.

ELK GROVE: Elk Grove Veterans Day Parade & Picnic. Join Cosumnes CSD and the Elk Grove American Legions with a ceremony, parade, and community picnic. 10 am ceremonial Reading of the Names to commemorate the community’s service men and women at Cosumnes CSD Administration Building, 8820 Elk Grove Blvd. The parade begins at 11:11 am at Cosumnes CSD Administration Building, 8820 Elk Grove Blvd. Travel east on Elk Grove Blvd. Turn right and head south along Elk Grove-Florin Road Turn right into Elk Grove Park and end there. Community Picnic Immediately following the parade Elk Grove Park, 9950 Elk Grove-Florin Road, Picnic sites 9A & 9B Open to the public First come, first served. cosumnescsd.gov/ 1370/Veterans-Day-Parade

FAIRFIELD: Veterans Day Parade “Never Forget, Forever Honor” & Commemoration Ceremony November 11, 2024 at 10 a.m. At 10 a.m. listen to a patriotic concert hosted by Travis Air Force Base and conducted by the Fairfield/Suisun City American Legion Reams Post 182. It kicks off inside the Downtown Theatre located at 1035 Texas Street. The Veterans Day Parade assembles at 12:30 p.m. at Webster and Kentucky Street. The parade route: Kentucky Street to Great Jones then turn up Texas Street to Washington. visitfairfieldca.com

FALLBROOK: Veterans Day Parade November 11, 2024, 10 a.m.-1 p.m. Parade begins at 10 a.m. at corner of Fallbrook Street and Main Avenue, and ends at Alvarado Street. At 11 a.m. there’s a ceremony at Village Square. At 12 p.m. Noon veterans can attend a free lunch at VFW Post 1925. Fallbrook, CA. Free, fallbrookchamberofcommerce.org

FOLSOM: Wayne Spence Veterans Day Parade November 11, 2024, 9 a.m. Starts at E. Bidwell Street from Montrose Drive, heading westbound on E. Bidwell Street, then northbound on Coloma Street to Natoma Street. At the Folsom Lions Park the parade concludes with a brief ceremony at the Veterans Memorial in Folsom City Lions Park. 3,000 participants include marching bands, floats, classic cars, riders on horseback, color guard and more. Free, folsom.ca.us

FOUNTAIN VALLEY: Veteran’s Day Ceremony November 11, 2024, 10 a.m. at Veteran’s Park. Location: 17635 Los Alamos Street, Fountain Valley, CA. Free, fountainvalley.gov

FRESNO: Veterans Day Parade, Largest Veterans Day Parade on the West Coast marks 105 years on November 11, 2024, 11:11 a.m. in front of Fresno City Hall. Pre-program starts at 10 a.m. The goal is to honor all of our service men and women in a huge show of appreciation each year. In 2024 the parade offers a special salute to the United States Navy! centralvalleyvdp.org

FULLERTON: Fullerton Veterans Day Parade & Ceremony November 11, 2024, 10:30 a.m.-12 p.m.

The parade begins at Harbor Blvd and Wilshire Avenue at 10:30 a.m. The parade goes north on Harbor Blvd and culminates at the Hillcrest Park Great Lawn at 1200 N. Harbor Blvd. The ceremony is held next to the War Memorial at 11 a.m. The program consists of songs, prayers, inspirational messages, and other remembrances to honor those who served their country through military service. The event hosted by the American Legion Post 142 is free and all are welcome to attend. cityoffullerton.com

GRAND TERRACE: The City of Grand Terrace Veterans Day Celebration November 11, 2024, 11 a.m. The Veterans Wall of Freedom Organization and the Foundation of Grand Terrace present the Veterans Wall of Freedom at 21950 Pico Street. The Veterans Day Celebration will salute veterans who have served or are serving in the United States military. The Veterans Wall of Freedom was dedicated on Veterans Day 2016. The monument spells out the word FREEDOM in six-foot block letters with over 1600 granite plaque spaces for veterans covering the front of the letters. veteranswalloffreedom.org

GREENVILLE: Annual Veterans Day Parade November 11, 2024, 11 a.m. The parade begins on Main Street and crosses Highway 89 with the ceremony being held on Main Street, Greenville, CA. Free hot dog lunch, dessert and bingo after the parade sponsored by Wolf Creek Blue Star Mothers. Free, eventbrite.com or indianvalleychamber.org

HAWAIIAN GARDENS: Veteran’s Day Commemoration November 8, 2024, 8-10 a.m. at C. Robert Lee Activity Center, 21815 Pioneer Blvd., Hawaiian Gardens, CA. Free, hgcity.org

HAYWARD: Veterans Day Ceremony November 9, 2024, 1-2 p.m. at Lone Tree Cemetery. Location: 24591 Fairview Avenue, Hayward, CA. Public invited, lonetreecemetery.com

HOLLISTER: Veteran’s Day Parade November 11, 2024, 11 a.m.-3 p.m. Schedule: 11 a.m. Veterans Appreciation Ceremony and Banner Presentation at Veteran’s Memorial Building Plaza. 12 p.m. Noon BBQ Lunch $15 & veterans are free! 1:30 p.m. Veteran’s Day Parade in Downtown Hollister. Come downtown to celebrate and remember the courageous men and women of the armed forces who protect and serve the nation. downtownhollister.org

HOLTVILLE: Veterans Day Parade November 2, 2024. 10 a.m. Free Breakfast for all Veterans 7:30-9 a.m. at American Legion, 225 W. 6th Street. Veteran’s Day Parade at 10 a.m. on 5th Street from Walnut Ave. to Pine Ave, Farmer’s Market goes 9 a.m.-1 p.m. at Holt Park, 121 W. 5th St. Free, holtville.ca.gov

HUNTINGTON BEACH: Veterans Day Ceremony November 11, 2024, 11 a.m. at Pier Plaza. The event includes a flag ceremony, music and dignitary speeches. Join the City of Huntington Beach and American Legion Huntington Beach Post 133. All are welcome to honor our Vets. Location: Pacific Coast Highway at Main Street, paid parking at Huntington City Beach next to Huntington Beach Pier. hbpost133.com

IRVINE: Veterans Day November 11, 11 a.m.-12:30 p.m. at Colonel Bill Barber Marine Corps Memorial Park. The City of Irvine hosts a special ceremony in the Formal Garden to pay tribute to our nation’s troops past and present. The event is free and open to the public. Location: 1 Civic Center Plaza, Irvine, CA. Free, cityofirvine.org/specialevents or call 949-724-6606.

IRWINDALE: Veterans Day Ceremony – November 11, 2024, 11 a.m. at Veterans Memorial. Location: 5050 N. Irwindale Avenue, Irwindale, CA. Join the city in honoring Irwindale Veterans at the annual Veterans Day Ceremony. Free, irwindaleca.gov

JACKSON: Jackson Veterans Day Parade November 11, 2024, 10 a.m.-12:30 p.m. Downtown Jackson, Jackson, CA. According to the City of Jackson, this event begins every November 11 at 11 a.m. in Downtown Jackson. ci.jackson.ca.us

LAGUNA NIGUEL: Veterans Day Ceremony November 11, 2024, 11 a.m.-12:30 p.m. at Sea Country Senior & Community Center, 24602 Aliso Creek Road, Laguna Niguel, CA Free, cityoflagunaniguel.org

LA HABRA: Veterans Day Program November 11, 2024, 11 a.m. at Community Center, 101 W. La Habra Blvd. The formal part of the program starts at 11 a.m. All are invited to attend this free event, lahabracity.com, (562) 383-4200.

LAKE ELSINORE: Veterans Day Observance Ceremony November 11, 2024, 9-10:30 a.m. at Lake Elsinore Stadium, 500 Diamond Drive. Everyone is welcomed and encouraged to attend this event that honors those who have selflessly and bravely served our country to protect and maintain our freedom. Recent Veteran Memorial Brick honorees will be announced and unveiled at the event. Honor a Veteran and purchase a personalized engraved brick at the City’s Veterans Memorial. Free ceremony, lake-elsinore.org

LAKE FOREST: 35th Annual Veterans Day Program November 11, 2024, 11 a.m. at El Toro Memorial Park. provided by the South Coast Chapter, Sons of the American Revolution Color Guard, Veterans and Blue & Gold Star Mothers, wreath presentation, VFW Edward J. Kearns Post 6024 honor guard firing salute, vocalist John Huntington, and Amazing Grace on the bagpipes by Richard Cook. Rain or shine. Questions (949) 951-9102. 25751. Location: 25752 Trabuco Road, Lake Forest, CA. Free, public invited, occemeterydistrict.com

LA PUENTE: Veterans Day Ceremony November 11, 2024, 9 a.m. at La Puente City Hall. Help honor the brave men and women who have selflessly served and sacrificed for our nation. Questions: (626) 855-1550. Location: 15900 Main St., La Puente, CA. Free, lapuente.org/ veterans-day-ceremony-2/

LA QUINTA: Veterans Day Ceremony November 11, 2024, 9-11 a.m. at La Quinta Civic Center Courtyard. All invited, free. Location: 78495 Calle Tampico, La Quinta, CA. laquintaca.gov

LA VERNE: Veterans Day Ceremony November 11, 2024, 11 a.m. at Veterans Hall, 1550 Bonita Ave., Free, cityoflaverne.org

LAWNDALE: Annual Field of Honor November 7-12, 2024 at Lawndale Civic Center, 14717 Burin Avenue, Lawndale, CA 90260 Flags fly in tribute to Veterans, those currently serving in the Armed Forces and those who died defending our nation on battlefields far from home. healingfield.org

LEMOORE: 11th Annual Veterans Day Parade “Heroes Welcome” November 11, 2024, 6-8 p.m. in Downtown Lemoore. The Parade honors all who served. The route is on D Street between Follett Street and Hill Street. Floats, lights and sounds encouraged. Hosted by the American Legion Post 100. Free, facebook.com/CityofLemoore/

LOMITA: Veteran’s Day Ceremony in Veteran’s Park, November 11, 2024, 11 a.m. (approx.) Location: 257th Street & Walnut. Free, lomita.com

LONG BEACH: Veterans Day Festival November 9, 2024, 11 a.m.-4 p.m. at Houghton Park. Food trucks, live music and this year Beach Streets open streets event is held in conjunction with Veterans Day event to make for more attendance as bikes, blades and pedal power takes over. The Veterans Hub of this mega event features Grand Marshal JB Jaso, Mr. Quick DJ sets, Flyovers with historic aircraft at 2 p.m., food trucks and a beer garden, boot camp style obstacle course, Skate Zone with skate park demos and skateboarding lessons by Skate Dogs Kids Zone with live performances by the Bob Baker Marionette Theater and DJ Mike, plus the Aquarium of the Pacific’s Aquarium on Wheels. Veterans Recognition Ceremony at 2 p.m. Location: Houghton Park near Veterans Valor Plaza, 6301 Myrtle Ave., Long Beach, CA. Free, longbeach.gov

LOS ANGELES: Forest Lawn Veterans Day Celebration November 11, 2024, 11 a.m. Keynote speaker, patriotic music, family friendly performances and light refreshments, public invited. Location: 6300 Forest Lawn Drive, Los Angeles, CA. forestlawn.com

MANHATTAN BEACH: Veterans Day Multi-Generation Ceremony November 11, 2024, 11 a.m.-12 p.m. at Manhattan Beach Veterans Monument, Ardmore and Valley Drive. Entertainment, guests and dignitaries, Presentation of the Colors by the Manhattan Beach Police Department Honor Guard, Singing of the National Anthem, The Pledge of Allegiance and Keynote Address. Manhattan Beach, CA 90266. citymb.info

MARTINEZ: Contra Costa County Veterans Day Ceremony November 5, 2024, 11 a.m. at Board of Supervisors Chambers where the Board will honor the Port Chicago sailors and their families. Martinez, CA. contracosta.ca.gov

MARYSVILLE: Yuba-Sutter Veterans Day Parade “Supporting Our Troops, Past, Present and Future” November 11, 2024, 11 a.m.-1 p.m. The parade route follows D Street in Historic Downtown Marysville like this: Starts at 7th Street on D Street, making a left turn across 3rd Street, then left down C Steet. Breakfast 7-10 a.m. at Elks Lodge; BBQ Lunch following parade at River’s Edge Pub. facebook.com/yubasutterveteransdayparade/

McCLELLAN: Veterans Day Open Cockpit at McClellan Park November 11, 2024, 10 a.m.-2 p.m. Explore the cockpits of historic aircraft and learn about their fascinating history. Celebrate and honor our veterans while gaining a deeper appreciation for their service. Location: Aerospace Museum of California, 3200 Freedom Park Drive, McClellan, CA. $17, veterans free admission, aerospaceca.org

MERCED: Merced County Veterans Day Parade November 11, 2024, 11 a.m., Parade begins at 12 p.m. The parade, which began in 1960, travels along Main Street in downtown Merced, starting at Calimyrna Avenue and ending at O Street. All entries honor the military veterans of Merced County. co.merced.ca.us/1585/Veterans-Day-Parade

MERCED: Field of Honor November 9-16, 2024, 1-6 p.m. Includes $ Run for the Fallen 5K, 10K at Merced College on 11/10 and Veterans Parade on 11/11. Free, mercedfieldofhonor.org/

MILPITAS: Veterans Day Ceremony November 11, 2024, 9-10 a.m. Held to honor men and women who have served for the cause of America’s freedom, show your appreciation for all veterans. Light refreshments will be served following the ceremony, rain or shine. Location: Veterans Plaza at Milpitas City Hall 455 E. Calaveras Blvd. between City Hall & Community Center. ci.milpitas.ca.gov

MISSION VIEJO: Veterans Day Observance November 11, 2024, 8:30-9:30 a.m. Norman P. Murray Community Center. Keynote speaker Colonel Charles Readinger, Commanding Officer of Headquarter Battalion, First Marine Division and guest speaker retired Senior Chief, United States Navy, Gary Tegel; patriotic songs; presentation of colors by the Marine Color Guard; three-volley rifle salute; taps; sign language interpretation. Outdoor reception in the Veterans Plaza after ceremony. Location: 24932 Veterans Way, Mission Viejo, CA. Free, cityofmissionviejo.org/events/veterans-day-observance-1

MORAGA: Veterans Day Ceremony November 11, 2024, 9-10 a.m. at Moraga Commons Veterans Memorial with speakers and free refreshments. Join Moraga Boy Scout Troops 212, 234 and 246 at 1425 St. Marys Road, Moraga. moraga.ca.us

MURRIETA: Field of Honor November 9-16, 2024 at Town Square Park. Veterans Day Parade November 11, 2024, 10 a.m. Starts with National Anthem, possibly a flyover, too. Ivy & Washington, B Street to Town Square, Murrieta, CA murrietaca.gov

NEWPORT BEACH: Veterans Day BBQ November 11, 2024, 11:30 a.m.-6 p.m. at Post 291. The Funk Doctors Band performs, and BBQ is sold with a $20 deal featuring 2 meat options of BBQ Chicken, BBQ Ribs, Pulled Pork, Burger, Hot Dog and cole slaw, baked beans, potato salad. Location: 215 15th Street, Newport Beach, CA. No reservations, al291.com

ORANGE: Field of Valor November 9-15, 2024. Opening ceremony Nov.9, 2:30 p.m.; Marine Corps Birthday Nov.10, 10 a.m.; Veterans Day Ceremony Nov.11, 11 a.m.; all events at Handy Park. Flag sponsorship $35. Location: 2143 E. Oakmont Ave., Orange, CA. Free, communityfoundationoforange.org

OROVILLE: Veterans Day Parade November 11, 2024, 11 a.m. Honors service men and women with a parade down Montgomery St. from 5th St. in historic Downtown Oroville to Oroville Veterans’ for all of Butte County Memorial Park. See marching bands, floats, historic military vehicles and more. Join Exchange Club of Oroville in showing gratitude and support on this special day, honoring those who served. visitoroville.com/veterans-day-parade.html

PALM SPRINGS: Palm Springs Veterans Day Parade November 11, 2024, 3:30 p.m. The City of Palm Springs proudly presents the annual parade begins at Ramon Road and Palm Canyon Drive and heads northbound on Palm Canyon Drive to Alejo Road.

PALO ALTO: Veterans Day Recognition Event, “A Legacy of Loyalty and Serive” November 11, 2024, 3-4 p.m. The City of Palo Alto and Stanford University again partner Keynote Speaker: Congresswoman Anna Eshoo

Guest speakers: City of Palo Alto Mayor, Greer-Stone, and Stanford University Vice President and Chief External Relations Officer, Martin Shell. South Bay Blue Star Moms present a quilt to World War II Veteran Ernestine, Ernie Faxon, an American Legion member and third generation Palo Altan. Stanford University Department of Music soloist Nova Jimenez. A reception follows in the MacArthur Park Restaurant. Enjoy hors d’oeuvres, cake, and company with other attendees.

Parking is available in the adjacent parking lots to the Mac Arthur Park. Location: 3801 Miranda Ave., Palo Alto, CA. Free, public invited, cityofpaloalto.org

PASADENA: Veterans Day Celebration November 11, 2024, 10:30 a.m.-12 p.m. City Hall, Centennial Square. Flyover at 11:11 a.m. All are invited to join the City of Pasadena and the Pasadena Veterans Day Committee to pay tribute to veterans in the community. Enjoy Guest speaker, displays of World War II memorabilia, children’s arts and crafts, free food, Condor Squadron flyover, and more. Location: 100 N. Garfield Ave., Pasadena, CA. Free, cityofpasadena.net

PERRIS: Veterans Day Parade November 2, 2024, 9 a.m. on Downtown D Street Route. Entertainment starts at 9, parade begins at 10 a.m. Free, cityofperris.org

PETALUMA: Petaluma Veterans Day Parade and Flyover November 11, 2024, 12 p.m. Concert, 1 p.m. parade begins. Theme: Welcome Home to All Vietnam Veterans is a special tribute to armed forces who served from 1961 to 1975. Event begins with music in Walnut Park at 12 p.m. The parade starts at 1 p.m. Huey helicopters, tanks, and more than 100 entries offer pomp and circumstance. At 2:45 p.m. the service offers prayer, the Pledge of Allegiance and guest speakers at Walnut Park, 201 Fourth Street. petalumaveteransparade.com

PICO RIVERA: Veterans Ceremony “A Salute to Our Armed Forces: Those Who Served and Those That Are Serving” November 11, 2024, 10 a.m. Pico Rivera Veterans Memorial & Eternal Flame, 9001 Mines Avenue. The City of Pico Rivera hosts Veterans Day Ceremony at the Pico Rivera Veterans Memorial Plaza and Eternal Flame. Federal, state and local officials attend along with members of Pico Rivera’s Veterans of Foreign Wars and American Legion posts. Free, pico-rivera.org

PINOLE: Veterans’ Day Memorial and Flag Retirement Ceremony November 11, 2024, 11 a.m.-12 p.m. at Fernandez Park. Honor our veterans, past and present, living and deceased. Worn U.S. flags by the Boy Scouts will highlight the hour-long ceremony. Please bring your worn and tattered flags to the ceremony, where they will be retired with proper respect. There is no charge to retire a flag. facebook.com/cityofpinole

PLACENTIA: Annual Veterans Day Observance Ceremony November 11, 2024, 10 a.m. at Civic Center, 401 East Chapman Avenue. Special guest speakers, patriotic music, and the new Military Banner Recognition Program recipients will be included in the event program. In addition, the added service members to the veterans monument will be honored, and their name inscriptions will be unveiled. (714) 993-8211. placentia.org

PLEASANTON: Tri-Valley Veteran’s Day Parade (and Concert) November 3, 2024, 1 p.m. marches down Main Street. 27th annual parade theme in 2024 is Military Chaplains. Organized and hosted by the Veterans of Foreign Wars Post 6298, American Legion Post 237 and the city of Pleasanton to honor all who serve or have served in the nation’s armed forces, the parade includes military, equestrian, bands and around 70 groups. A patriotic concert with Pleasanton Community Concert Band follows the parade near Veterans Memorial Building. Address: 301 Main Street Pleasanton CA. Free, trivalleyvdp.com

PORTERVILLE: Veterans Day Parade “Never Forgotten”10 a.m. in Downtown Porterville. 106th annual parade, the longest running veterans day parade west of the Mississippi, is produced by American Legion Post 20 with additional sponsorship from city and other entities. Free to see, Bob Atchley, 559-359-7932 or post20adj@gmail.com

PORTERVILLE: Veterans Day Run 5K/10K, November 11, 2024, 7:30 a.m. in front of City Hall, 291 N. Main Street, Porterville, CA. $28, $10 for veterans. Race starts downtown. ci.porterville.ca.us or runsignup.com

POWAY: Veteran’s Day Ceremony in the Park. November 11, 2024, 11 a.m. Join VFW Post 7907 and the Poway Veterans Park Committee for a ceremony to honor those who selflessly served our Country. Location: 14134 Midland Road Poway, CA. Cost: Free. poway.org

REDLANDS: Redlands Veterans Day Celebration & Parade November 11, 2024, 9 a.m. RHS on Redlands Blvd. and Citrus Ave. to Jennie Davis Park. Veterans Day Observance at Jennie Davis Park at 10:45 a.m. Celebration immediately follows with food vendors, beer garden with live music, fly overs, military vehicles, vendor booths and more. Hosted by American Legion Post 106 and Post 650.

RIVERSIDE: A Salute to Veterans Parade and Expo November 9, 2024, 10 a.m. Parade: starts near the Upper Parking lot at RCC. It makes its way down Magnolia Avenue turning right on 10th, then left on Main Street. The Expo is held at the end of the parade at John G. Gabbert Judicial Plaza, 3650 11th St.. Pancake Breakfast 7-9 a.m. at Lower RCC Parking Lot is fundraiser charging fee. Free to see, asalutetoveteran.org

ROHNERT PARK: Veterans’ Day Celebration November 11, 2024, 11 a.m.-12 p.m. Free admission. Rohnert Park Community Center, 5401 Snyder Lane. rpcommunityservices.org

SACRAMENTO: City of Sacramento Veterans Day Parade November 11, 2024, 11 a.m. at The Parade begins at 11 a.m. at Crocker Museum on 216 O Street, Sacramento, traveling east on Capitol Mall, south-bound on 9th St., then to the east on N St., then north on 15th St., west on L St., and then south on 10th St. Six food trucks sell ‘eats’ after the parade. Free, calvac.org or cityofsacramento.org

SALINAS: Annual Monterey County Veterans Day Parade November 11, 2024, 1-4 p.m. Old Salinas South Main: Chestnut to Central Avenue. Opening ceremony begins at 1 p.m. and parade at 2 p.m. Over 25,000 people attend this amazing parade featuring 150 units, bands, equestrian units, military vehicles, war heroes and more. Salinas, CA Free, montereycountyveteransdayparade.org

SAN BERNARDINO: Veterans Day Salute November 11, 2024, 9 a.m. in front of the Soldiers and Sailors Monument at the Feldheym Library. Event includes veterans groups, presentations and music. sbcity.org/parks

SAN DIEGO: Veteran’s Day Parade November 11, 2024, 10 a.m. on N. Harbor Drive. Route: The one mile route proceeds south on N Harbor Drive past a long row of grand stands, and past the Wyndham Bayside Hotel, and past the B Street Pier, to Broadway where the route turns left onto Broadway for one block to Pacific Highway, and turns right onto Pacific Highway to proceed south for two blocks to end at G Street and the Dismissal Area. sdvetparade.org

SAN FERNANDO VALLEY / PACOIMA: Veteran’s Day Parade November 11, 2024, 11:11 a.m. San Fernando Mission Blvd. and Laurel Canyon Blvd. 2024 Grand Marshal Specialist 4 Edward Landin U.S. Army 1971-1973. Route: Corner of Laurel Canyon Blvd. and San Fernando Mission Blvd, proceed down Laurel Canyon Blvd.1.1 miles and culminate at the Ritchie Valens Recreation Center and Park, 10736 Laurel Canyon Blvd., Pacoima, CA (corner of Laurel Canyon Blvd. and Paxton St.). This is the largest Veterans Day event for vets in Los Angeles County. sfvveteransdayparade.com

SAN GABRIEL: Veterans Day Ceremony November 9, 2024, 10-11 a.m. at Plaza Park, 428 S. Mission Drive, San Gabriel,

CA. Brought to you by the City of San Gabriel and the San Gabriel Veterans Memorial Coalition. For additional information or questions call the Community Services Office at 626-308-2875 or email CommSrvInfo@sgch.org.

SAN JOSE: 106th Annual Veterans Day Parade November 11, 2024, 11 a.m. Opening ceremony begins at 11 a.m. at the reviewing stands in front of Plaza de Cesar Chavez. Parade begins at 12 p.m., traveling from intersection of Almaden Boulevard and Santa Clara Street; Proceeds east on Santa Clara Street; Turns right onto Market Street passing Plaza de Cesar Chavez; Ends at San Carlos Street. Silicon Valley Chapter (SVC) of Military Officers is an affiliate of the Military Officers Association of America (MOAA) sjveteransparade.org

SANTA FE SPRINGS: Military Veterans Luncheon November 8, 2024, 11:30 a.m. Free event, register with City of Santa Fe Springs, santafesprings.org

SANTA MARIA: Freedom Monument Veterans Memorial Ceremony 23rd Anniversary November 11, 2024, 11 a.m. Pay tribute to 113 Santa Maria Valley Veterans who died in conflicts from World War I through the latest wars on terrorism. Free Breakfast 10-10:45 a.m. The Santa Maria Valley Chamber of Commerce and the City of Santa Maria welcome you to a special Veterans Day event at the Freedom Monument Veterans Memorial, Location: In front of the Abel Maldonado Community Youth Center, 600 S. McClelland, Santa Maria, CA. Free, santamaria.com

SHASTA LAKE: Shasta Lake Lions Veterans Day Parade November 9, 2024, 10 a.m.-12 p.m. Shasta Lake Lions 31st Annual Veteran’s Day Parade, the second largest Veteran’s Day Parade in California, begins with a pancake breakfast at the fire hall (7am), followed by the parade down Shasta Dam Blvd (10am), and concludes with a luncheon at the American Legion Hall. Location: Highway 51 and Shasta Dam Boulevard, Shasta Lake CA. facebook.com/events/1692618844820365

SIMI VALLEY: Veterans Day at Ronald Reagan Presidential Library November 11, 2024, 10 a.m.-3 p.m. Flyover by the Condor Squadron, Abbe Road A Cappella, Wind Ensemble 10:30 a.m.; Iwo Jima Flag Raising 10:50 a.m.; Program honoring all branches of our nation’s military, keynote speech by United States Marine Chief Warrant Officer-4 Randy Gaddo (Ret.) 11 a.m.; Reenactors from the Washington Artillery of New Orleans, Naval Base Ventura County Construction Battalion Vehicles on Display, and ‘For The Troops’ letters you can write 10 a.m.-3 p.m. Location: 40 Presidential Drive, Simi Valley, CA. Free admission to outdoor activities and ceremony (indoor museum requires ticket purchase). RSVP on website: bit.ly/4dha7t7

STANTON: Veterans Day Ceremony November 11, 2024, 9 a.m. at Stanton Civic Center. You are invited to attend the Veterans Day Ceremony in honor of the men and women in our community that have served or are serving in the U.S. Armed Forces. A light breakfast is served. Location: 7800 Katella Avenue, Stanton, CA. Pre-registration required: StantonCA.gov/VeteransDay

TEMPLE CITY: Veterans Day Celebration November 11, 2024, 10:30 a.m. @ Temple City Park Honor our local heroes with a celebration that includes the Posting of Colors, live entertainment, and possibly a vintage aircraft flyover. Location: 9701 Las Tunas Dr. Temple City, CA 91780, ci.temple-city.ca.us

TUSTIN: Veterans Day Celebration and Car Show November 9, 2024, 10 a.m.-2 p.m. at Veterans Sports Park. Location: 1645 Valencia Ave., Tustin, CA. Free, tustinca.org/1272/Veterans-Day-Celebration

VENTURA: Veterans Day Ceremony November 11, 2024, 11 a.m. at Ventura County Veterans Memorial. Distinguished speakers and a presentation honoring a local veteran from each military branch. Location: 800 South Victoria Avenue (Victoria Ave. & Telephone Rd.) Ventura, CA. Free, gcvf.org/veterans-day

VICTORVILLE: Veterans Day Parade and Ceremony, November 11, 2024, 9-11 a.m. at 7th and Tracy. Parade begins at 9 a.m. in Old Town Victorville. Veterans Day Ceremony immediately follows the parade at 7th Street and Forrest Avenue at approx. 9:30 a.m. Victorville, CA. Free. victorvilleca.gov

YORBA LINDA: Brick LayingVeterans Day Memorial November 11, 2024, 2 p.m. at Yorba Linda Veterans Memorial. Keynote speaker US Marine Corps Veteran Adam Sikes, Mayor Tara Campbell, Esperanza HS Army Junior ROTC presents the Colors, Los Angeles Police Emerald Society Pipes and Drums, concluding with traditional Gold Star Roll Call and Taps. The event is open to the public; a large tent set up to provide shade; bringing your lawn chairs. Location: 4756 Valley View Ave., Yorba Linda, CA. Free, yorbalindaveteransmemorial.com

Here are some other Veterans Day events and offers!

events/veterans-day-parades

events/veterans-day-free-offers

holidays/veterans-day

events/veterans-day-uss-iowa

museums/costa-mesa-veterans-museum

visit/veterans-day-parades-in-california

festivals/palm-springs-veterans-parade

events/veterans-day

visit/veterans-day-celebrations-in-california

An Unforgettable Weekend of Cultural Celebration

Dia de Los Muertos 2024 in Santa Ana promises an extraordinary weekend journey filled with rich cultural experiences—an immersive blend of art, music, food, and deep community connections. From the vibrant public festivals to the intimate beauty of family altars, each day offers a deeper appreciation of this cherished tradition that honors both life and death.

As you explore Santa Ana, you’ll witness a city that proudly celebrates its Latino heritage, weaving together past and present in a dynamic tapestry of remembrance, joy, and togetherness. Whether you’re drawn to the colorful altars, the lively performances, or the heartfelt community gatherings, Santa Ana’s Dia de Los Muertos is an experience you won’t want to miss.

📅 Date: Friday, November 1, 2024

🕒 Time: 5:00 PM to 7:30 PM

📍 Location: 816 E. Chestnut Ave.

Explore the Magic of the Altars with Santa Ana’s Roosevelt-Walker Community.

Immerse yourself in the vibrant culture of Santa Ana by engaging with the Roosevelt-Walker Community during their magical altar displays. Located near the intersection of E. Chestnut Ave. and S. Standard Ave., the Roosevelt-Walker Community Center serves as a hub for connection, culture, and recreation. Join this festive gathering celebrating local traditions for Día de Los Muertos 2024. This is a unique opportunity to engage directly with the people who call Santa Ana home.

Fairhaven Memorial Park-Dia de los Muertos Festival

📅 Date: Saturday, November 2, 2024

🕒 Time: 11:00 AM to 3:00 PM

📍 Location: 1702 Fairhaven Ave.

Visit Fairhaven Memorial Park for a peaceful day of reflection and community memorials.

For those looking for the most authentic and historic example of Dia de Los Muertos, join the Santa Ana community for family reflection day on Dia de los Muertos, November 2nd, by visiting Fairhaven Memorial Park (a historic cemetery where several notable individuals, including local celebrities, athletes, and influential figures, have been laid to rest) for a day dedicated to honoring the deceased. Participate in the community’s memorial, where families gather to remember and celebrate their loved ones. This day is about joy and remembrance, so bring flowers, photos, and offerings for the graves. Join in the celebrations, share stories, and embrace the vibrant energy of life. This historic cemetery becomes a serene space for families to gather and honor their loved ones with prayers, flowers, photos, and offerings. The tranquil atmosphere offers a time to reflect on the deeper themes of life and death that define Dia de Los Muertos and watch as families pay their respects with beautifully decorated graves and offerings for loved ones to cross over and spend the day with family.

📅 Date: Saturday, November 2, 2024

🕒 Time: 12:00 PM to 9:00 PM

📍 Location: Downtown Santa Ana, 4th Street between Ross and Birch

Noche de Altares (Night of the Altars), now in its 21st year, is the highlight of Santa Ana’s Día de Los Muertos celebrations and one of the most anticipated events of the season. Organized by El Centro Cultural de México, this vibrant event transforms the streets of Downtown Santa Ana into a stunning display of altars (ofrendas)—each one a unique tribute of love and remembrance for lost loved ones.

From noon until evening, the streets will be filled with an electric atmosphere of live music, traditional dance performances, community art installations, and dozens of intricately designed altars. Whether you’re creating an altar to honor someone special or simply enjoying the creativity of others, the air will be thick with emotion, laughter, and the tantalizing scents of delicious food.

Since 2002, Noche de Altares has invited families, artists, and local organizations to participate with beautifully crafted altars, art workshops, and live performances throughout the day. Street food vendors will offer traditional Mexican dishes such as pan de muerto (bread of the dead) and tamales, adding to the sensory richness of the celebration. This event is more than just a display—it’s a community-wide tribute that brings together people of all ages to celebrate life, memory, and the bonds that connect us to those who have passed.

Día de los Muertos by El Poder de la Cultura Morelense

📅 Date: Saturday, November 2, 2024

🕒 Time: 2:00 PM to 10:00 PM | Parade 5:00 PM

📍 Location: 120 W. 4th St.

Celebrate Día de los Muertos with El Poder de la Cultura Morelense as they bring the colorful tradition of the Chinelos de Morelos to Santa Ana. This exciting event, which runs from 2:00 PM to 10:00 PM, will feature a stunning parade of Chinelos, Catrinas, and the lively Band Carnaval at 5:00 PM, creating a festive atmosphere filled with music, dance, and culture.

The term “Chinelos” comes from the Nahuatl word “zineloquie,” meaning “disguised.” This traditional dance originated after the Spanish conquest as a way for indigenous people to mock the elaborate and formal clothing of European colonizers. However, the dance’s components can be traced back to ancient Aztec origins, making it a meaningful blend of pre-Hispanic and colonial history. The Chinelos are famous for their exaggerated costumes, featuring large hats, colorful robes, and masks, and their energetic, rhythmic dances that enliven any celebration.

With the additional presence of the iconic Catrinas—elegant skeletal figures symbolizing the blending of life and death—this event promises to be an immersive cultural experience that honors Mexican traditions and heritage.

📅 Date: Saturday, November 2, 2024

🕒 Time: 3:00 PM -10:00 PM

📍 Location: 4th Street & Between Main and French St:

At Viva La Vida experience a vibrant celebration of Life in the streets of Downtown Santa Ana

Viva La Vida is an extraordinary celebration that brings together the vibrant energy of contemporary Chicano culture and the cherished traditions of Día de Los Muertos (Day of the Dead). The streets of Downtown Santa Ana burst with life through captivating art installations created by local artists, turning the area into a colorful canvas of murals, sculptures, and interactive exhibits. Among the highlights are lowrider cars, their polished exteriors adorned with altars (called ofrendas)—carefully crafted displays that honor the memories of loved ones with photos, food, and personal mementos.

As evening falls, the figure of La Catrina—a traditional representation of death, dressed in elegant clothing and painted in skeletal form—graces the festival, reminding us to embrace life with laughter and joy, even in the presence of death. Viva La Vida beautifully captures the essence of the community as families and friends come together to celebrate and honor those who have passed. With faces painted and spirits high, attendees are encouraged to express themselves through dance and celebration, fully embracing the joyous spirit of life that defines this festival.

📅 Date: Sunday, November 3, 2024

🕒 Time: 11:00 AM to 3:00 PM

📍 Location: 2002 N. Main St.

Join the celebration with face painting, mariachi music, and a communal ofrenda (memorial altar).

On Sunday, November 3, 2024, head to the Bowers Museum, a cultural gem showcasing global art and history, for their Mexican Day of the Dead Festival. From 11:00 AM to 3:00 PM, enjoy live performances, art-making sessions, and face painting. Visitors are invited to bring a photo of a loved one to add to the ofrenda (memorial altar), honoring those who have passed.

This vibrant cultural event features face painting, mariachi music, folklórico dances, and a communal ofrenda where attendees can honor their loved ones by adding photos and mementos. You’ll also enjoy traditional foods like pan de muerto (bread of the dead) and tamales and take part in workshops like sugar skull decorating. The event offers an educational yet celebratory atmosphere, blending art, culture, and community, truly capturing the essence of Día de Los Muertos.

Author

Madeleine Thérèse Spencer is a resident of Santa Ana and a visionary leader dedicated to community development, placemaking, and the celebration of authentic cultural vibrancy in the community. As Co-Director of PlacemakingUS, a national network organization, she is dedicated to transforming the social life of public spaces and fostering inclusive, living, and thriving communities.