ListReports | Aug 4, 2022

“Depreciation” and “Deceleration” are two similar but different terms that you may be seeing in headlines right now.

If you follow the news you may be reading headlines right now that give the impression that home prices are going to take a dive. The reality is that this isn’t completely accurate, and headlines don’t provide a full picture into what’s going on. If you have questions about the market and current trends I’m here to help shed some light.

Leave us a comment or call us and let’s start the conversation!

📞 Call us today!

👩 Christine Almarines @christine_almarines

Realtor DRE # 01412944

714-476-4637 | christine@carealestategroup.com

👩 Michelle Kim @michellejeankim_homes

Realtor DRE # 01885912

714-253-7531 | michelle@carealestategroup.com

linktr.ee/carealestategroup

Does your washer give off a stinky odor? Usually the icky smell comes from build up of detergent and moisture so mold and mildew grow. Saturating an area in vinegar is a great way to prime spaces for easier cleaning with 10 to 30 minutes of soaking. Let’s double down and add baking soda action to this!

The city of Laguna Beach California has a high concentration of named beaches along it’s nine mile long waterfront. Thirty-six to be exact! While each of these beaches are excellent places to visit some have their limitations or are just not one of “best” that Laguna has to offer.

Unfortunately (for most of us) there are beachfront gated communities such as Irvine Cove, Emerald Bay, and Three Arch Bay that close off access to their beaches from the general public. Others such as Totuava have difficult access and some are simply all wet at higher tides.

On the brighter side, Laguna is known for its stunning cove beaches such as Thousand Steps, Crecent Bay, and Victoria Beach. But the focal point of the beach scene in Laguna is at Main Beach where you’ll find grass lawns, volleyball courts, shops, restaurants, and lots of people. It’s the best people-watching spot in all of Laguna.

One section of the shoreline from Main Beach to the Keyhole Rock at Pearl Street Beach is a continuous sandy beach, but it has stairwells at each street so the city has created 12 separate beach names between these end points. Walking on the sand from Main Beach to Pearl Street is a thrill and you can return on the sidewalks of Coast Highway if you’d like. There are many shops and restaurants along this route. Of course it’s possible to turn around or loop back at any of the stairways you find on the way to the end at the Keyhole. If you do the whole thing you can cross many of the Laguna beaches off your to do list.

There are a few parks in Laguna Beach worth mentioning. The crown jewel by far is Crystal Cove State Park at the north end on the border with Newport Beach. This park has six different beaches with two of them in Laguna. You can hike the trails in the park on the bluff or walk long distances on the brown sand below. Heisler Park is another worthy stop in Laguna. It’s just a few paces north from Main Beach and is home to a large picnic area above Picnic Beach and excellent tide pools at Rockpile Beach. Finally in South Laguna there is a huge park called Aliso and Wood Canyons Wilderness Park with loads of hiking and mountain biking trails. At the bottom of this canyon is family-friendly Aliso Creek Beach.

Below is our list of the best beaches in Laguna Beach ordered from north to south. As we said, even the smaller hard-to-find beaches in Laguna are worth a visit. So if you have extra time, then check this complete list of Laguna Beaches and see how many you can find!

Beaches on this list

Moro Beach is the southern beach in Crystal Cove State Park located between Laguna Beach and the Corona Del Mar area of Newport Beach, CA. For many years this was […]

SEE DETAILS

Crescent Bay Beach is a large popular beach in northern Laguna Beach, CA. The main public access is on Cliff Drive one block from where it begins at North Coast […]

SEE DETAILS

Shaw’s Cove is a small sandy locals beach tucked away below homes in Laguna Beach, CA. There is a public entrance to Shaw’s at the intersection of Fairview Street and […]

SEE DETAILS

Fisherman’s Cove Beach is a small south-facing beach tucked away in Laguna Beach, CA. The signage at the entrance to this beach is clearly signed Fisherman’s Cove, but locals also […]

SEE DETAILS

Picnic Beach is the northern beach of Heisler Park in Laguna Beach, CA. The park above the beach offers grassy areas to spread out on and many picnic tables as […]

SEE DETAILS

Main Beach is the simple name given to the main centrally-located city beach in Laguna Beach, California. Main Beach is a nice sandy beach in a broad cove that faces […]

SEE DETAILS

Pearl Street Beach is located below a stairway that begins at the west end of Pearl Street in Laguna Beach. Pearl Street ends at Ocean Way just one block off […]

SEE DETAILS

Woods Cove Beach is in a sandy cove that has rocky points at both ends and fancy Laguna Beach homes high above the bluff. Bette Davis lived in the English […]

SEE DETAILS

Victoria Beach is a long white sandy beach south of Victoria Drive in Laguna Beach. The majority of this southwest-facing beach lies in front of the private gated Lagunita housing […]

SEE DETAILS

Treasure Island Beach is south of the Montage Resort in Laguna Beach, CA. This sandy beach is the north end of the same large cove that begins at Aliso Beach […]

SEE DETAILS

Aliso Beach County Park is a popular sandy beach in South Laguna Beach, CA. Unlike many of the nearby beaches, Aliso Beach has a large off-street parking area next to […]

SEE DETAILS

Table Rock Beach is a locally-known tucked away beach in south Laguna Beach, CA. This is an excellent sandy beach in a deep cove with homes high above. Rocks of […]

SEE DETAILS

Thousand Steps Beach is one of the largest beaches in south Laguna Beach, CA. It’s a wide sandy beach with volleyball courts, restrooms, and tide pools and even caves to […]

SEE DETAILS

If you have a fruit fly infestation, take a look here! We love following @theboardhousewifepdx and she says that she’s tried a lot of fruit fly traps in her time, but this is the most effective method. EVER.

South OC Beaches | Jul 27, 2022

Southocbeaches.com has all the info for you to enjoy The Pageant of the Masters!

The Laguna Beach 2022 Pageant of the Masters Theme is Wonderful World.

A kaleidoscope of international art becomes your passport to distant lands, cultural celebrations and fascinating history in the 2022 production of Wonderful World.

This one-of-a-kind theatrical event, featuring live narration and original music performed live by the Pageant’s orchestra, takes place in the beautiful Irvine Bowl on the grounds of Laguna’s Festival of Arts July 7-September 2, 2022, every evening starting at 8:30 p.m.

Pageant of the Masters is at the Festival of Arts in Laguna Beach.

You can check out the Festival of Arts when you are attending the Pageant of the Masters.

Pageant of the Masters 2022 Program Lineup is Online

You can Purchase Pageant of the Masters Tickets Online or at The Festival Box Office

Celebrity Benefit Saturday August 22, 2022 Features Priscilla Presley and Arturo Sandoval

Festival of Arts Raffle Information Is Online

All summer long, Festival of Arts and Pageant of the Masters guests have the opportunity to purchase raffle tickets for the chance to win a brand new 2022 C40 Recharge Twin Ultimate (approximate retail value $60,540). On Saturday August 27, 2022, the lucky winning ticket will be pulled. Tickets are sold for $5 each or 5 tickets for $20.

Festival of the Arts Pageant of the Masters Dining

- Terra Laguna Beach: Sit-down restaurant and full bar available. Reservations recommended. Call (949) 494-9650

- Intermission By Terra: Casual walk-up window ordering. Food, desserts, coffee and espresso bar. Dine on the Patio or the Festival Green

- Terra Wine Bar: Walk-up counter located near Festival Green. Open during Pageant of the Masters intermission.

Laguna Beach Pageant of the Masters Parking

The Festival of the Arts Pageant of the Masters is located at 650 Laguna Canyon Road.

Laguna Beach Parking Guide Is Online

Laguna Beach Free Summer Trolleys to Pageant of the Masters

The Festival of the Arts is a 5-10 minute walk from downtown Laguna, Main Beach and the other Laguna Beach art festivals.

realtor.com | 07/24/2022

With summer and hot weather upon us, you’d better make sure your HVAC system is in tip-top shape. No need to call in the pros; here’s a DIY instructional video to help you clean your air-conditioner coils yourself!

Some Highlights:

- It’s worth considering the many benefits of homeownership before you make the decision to rent or buy a home.

- When you buy, you can stabilize your housing costs, own a tangible asset, and grow your net worth as you gain equity. When you rent, you face rising housing costs, won’t see a return on your investment, and limit your ability to save.

- If you want to learn more about the benefits of homeownership, let’s connect today.

Christine Almarines @christine_almarines

Realtor DRE # 01412944

714-476-4637 | christine@carealestategroup.com

Michelle Kim @michellejeankim_homes

Realtor DRE # 01885912

714-253-7531 | michelle@carealestategroup.com

We love quaint and charming Old Town Seal Beach, Main Street with all its shops and restaurants, and of course, the beach, pier, jetty, surf, and everything in the sun! Check out our blog for a collection of the best things to do and see in and around Old Town Seal Beach.

Many travel bloggers write about Old Town Seal Beach because of the quaint charm that it has. We loved how TanamaTales.com described the gem of Seal Beach:

If you are looking for underrated beach towns in California, check out the best things to do in Seal Beach!

California’s beach towns are famous all over the world. A lot of visitors come to our shores in search of the lifestyle and vibe that is presented in TV shows and movies.

On the contrary, residents and connoisseurs of the area miss the authenticity many towns had before the booming age of travel. It has been said that ‘Old California’ does not exist anymore near big population centers.

But, I digress. I have found my slice of ‘Old California’ not that far from Los Angeles.

Enjoy your day in Old Town Seal Beach. We love it and hope that you do too!

THINGS TO DO IN SEAL BEACH

The Community & Visitor’s Guide published by Seal Beach’s Chamber of Commerce includes a Old Town Seal Beach Map and Walking Tour on page 14 for your enjoyment.

VacationIdea.com gives their take on the 12 Best Things to Do in Seal Beach, California

DayTrippen.com brings all the best of Seal Beach in a day in Seal Beach Day Trip Things To Do

Check out the newly finished River’s End Park featuring a paved pedestrian/biking recreational trail that meanders through the park connecting the San Gabriel River Bike Trail to the First Street/Ocean Avenue intersection at the First Street Beach Parking Lot entrance. There’s a nature trail, playground, access to the jetty and water, picnic tables, and it’s a romantic spot for sunset gazing with unobstructed views according to CA Real Estate Group‘s very own Christine Almarines! Her Instagram page is dotted with photos and videos of breathtaking sunset views!

SEAL BEACH RESTAURANTS

TripAdvisor ranks the Best Restaurants in Old Town Seal Beach!

Little outdated, but a fun site by ThingsToDoPost.org to see the well organized reviews and scores of what people are saying in this Seal Beach Food Guide. (Call before heading over!)

WHERE TO PARK IN SEAL BEACH

There is plenty of free parking on the city’s streets. Now, if you choose this parking option, pay attention to time restrictions. Most spots have a 1 or 2-hour limit.

Public lots (next to the pier and at the end of 1st Street) allow you to park for a longer period of time. You pay according to the time spent on site. These lots allow you to pay (and extend your time) from your phone (you need to download the application though).

Enjoy these helpful real estate tips and advice in this month’s edition of Insights in Real Estate:

1️⃣ Buyers Consider ARMs as Interest Rates Rise

2️⃣ Making an Offer on a House That’s Contingent

3️⃣ Which Amenities Are Buyers Seeking?

4️⃣ Tapping Home Equity

5️⃣ Don’t Skimp on Home Inspections

Find more helpful real estate insights, homeownership updates, and money talk newsletters in our archive.

💡 Find out if we’re the right Realtor Team for you! Check out @carealestategroup

👩 Christine Almarines @christine_almarines

Realtor DRE # 01412944

714-476-4637 | christine@carealestategroup.com

👩 Michelle Kim @michellejeankim_homes

Realtor DRE # 01885912

714-253-7531 | michelle@carealestategroup.com

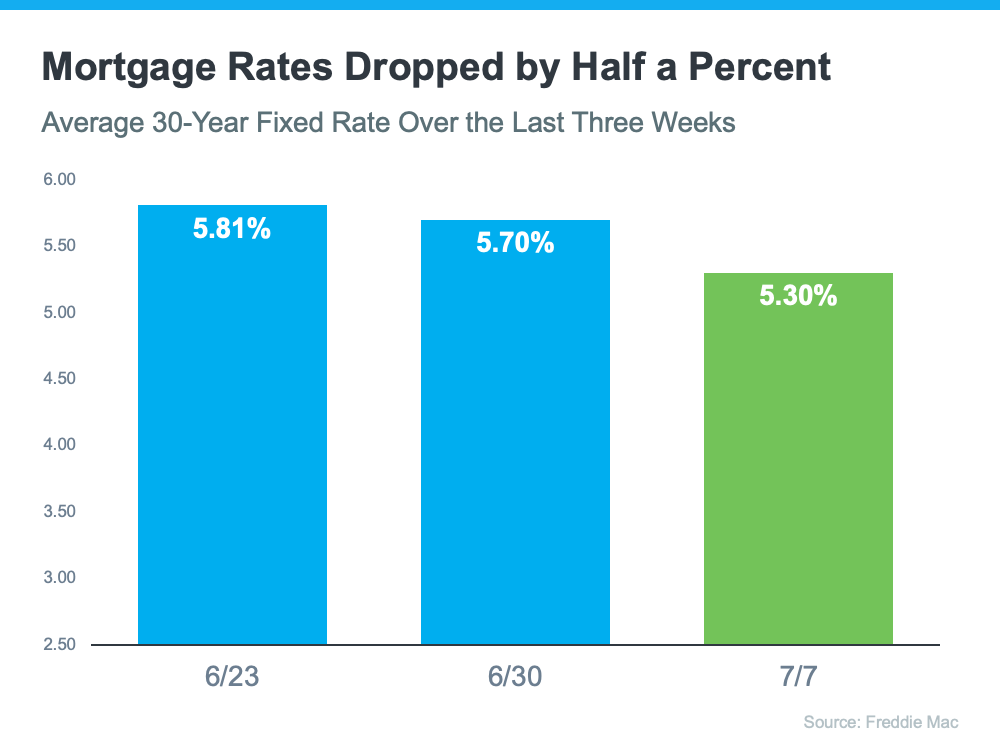

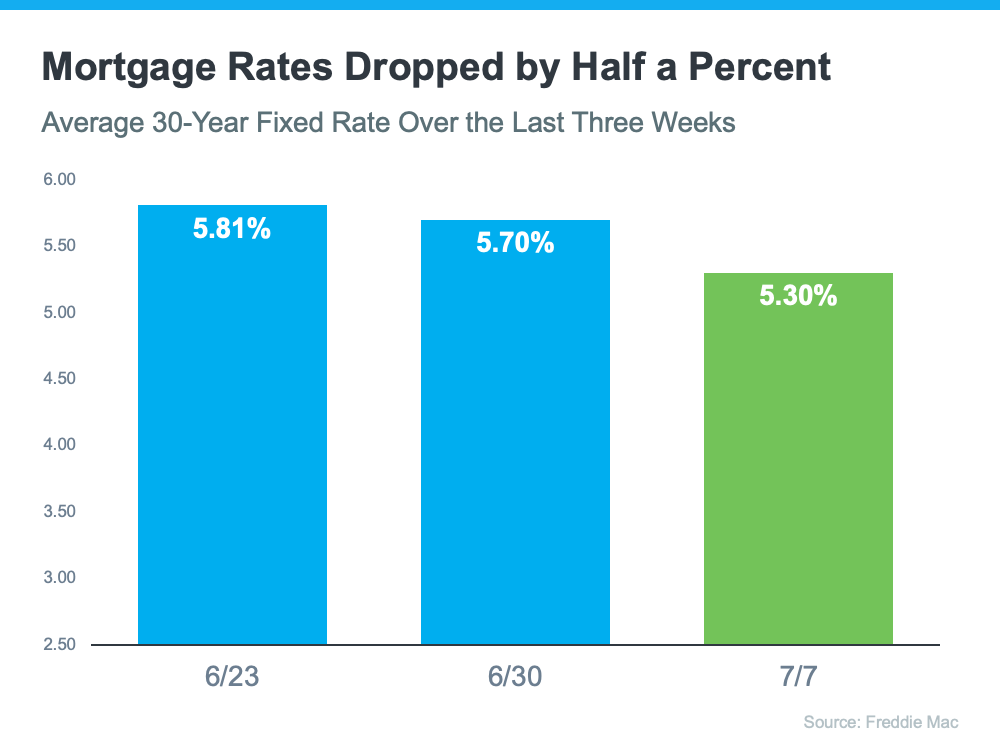

Over the past few weeks, the average 30-year fixed mortgage rate from Freddie Mac fell by half a percent. The drop happened over concerns about a potential recession. And since mortgage rates have risen dramatically this year, homebuyers across the country should see this decline as welcome news.

Freddie Mac reports that the average 30-year rate was down to 5.30% from 5.81% two weeks prior (see graph below):

But why is this recent dip such good news for homebuyers? As Nadia Evangelou, Senior Economist and Director of Forecasting at the National Association of Realtors (NAR), explains:

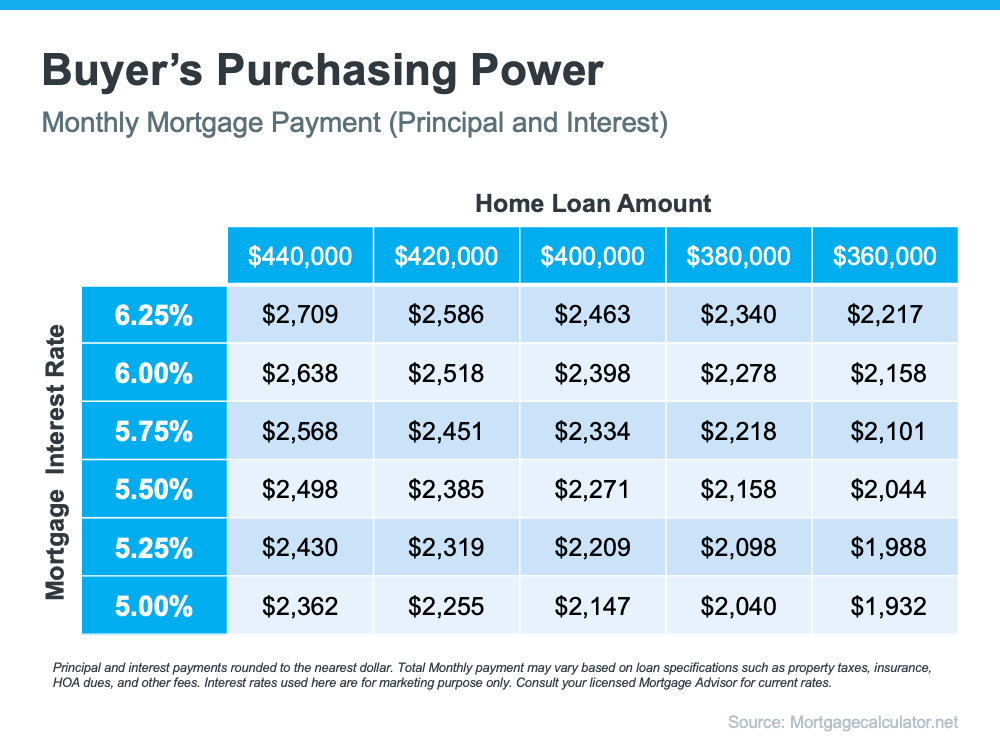

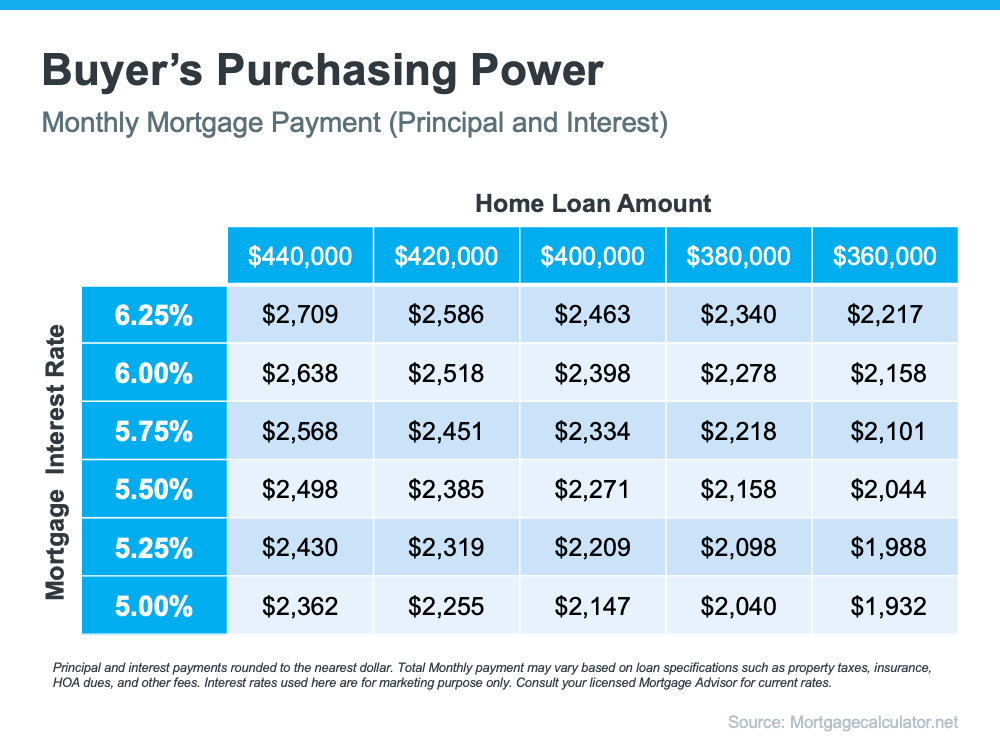

“According to Freddie Mac, the 30-year fixed mortgage rate dropped sharply by 40 basis points to 5.3 percent. . . . As a result, home buying is about 5 percent more affordable than a week ago. This translates to about $100 less every month on a mortgage payment.”

That’s because when rates go up (as they have for the majority of this year), they impact how much you’ll pay in your monthly mortgage payment, which directly affects how much you can comfortably afford. The inverse is also true. A decrease in mortgage rates means an increase in your purchasing power.

The chart below shows how a half-point, or even a quarter-point, change in mortgage rates can impact your monthly payment:

Bottom Line

If your home doesn’t meet your needs, this may be the opportunity you’ve been waiting for. Let’s connect to see how you can benefit from the current drop in mortgage rates.

![Should I Rent or Should I Buy? [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/07/14124050/20220715-MEM-1046x2129.png)