Enjoy these helpful real estate tips and advice in this month’s edition of Insights in Real Estate:

1️⃣ Buyers Consider ARMs as Interest Rates Rise

2️⃣ Making an Offer on a House That’s Contingent

3️⃣ Which Amenities Are Buyers Seeking?

4️⃣ Tapping Home Equity

5️⃣ Don’t Skimp on Home Inspections

Find more helpful real estate insights, homeownership updates, and money talk newsletters in our archive.

💡 Find out if we’re the right Realtor Team for you! Check out @carealestategroup

👩 Christine Almarines @christine_almarines

Realtor DRE # 01412944

714-476-4637 | christine@carealestategroup.com

👩 Michelle Kim @michellejeankim_homes

Realtor DRE # 01885912

714-253-7531 | michelle@carealestategroup.com

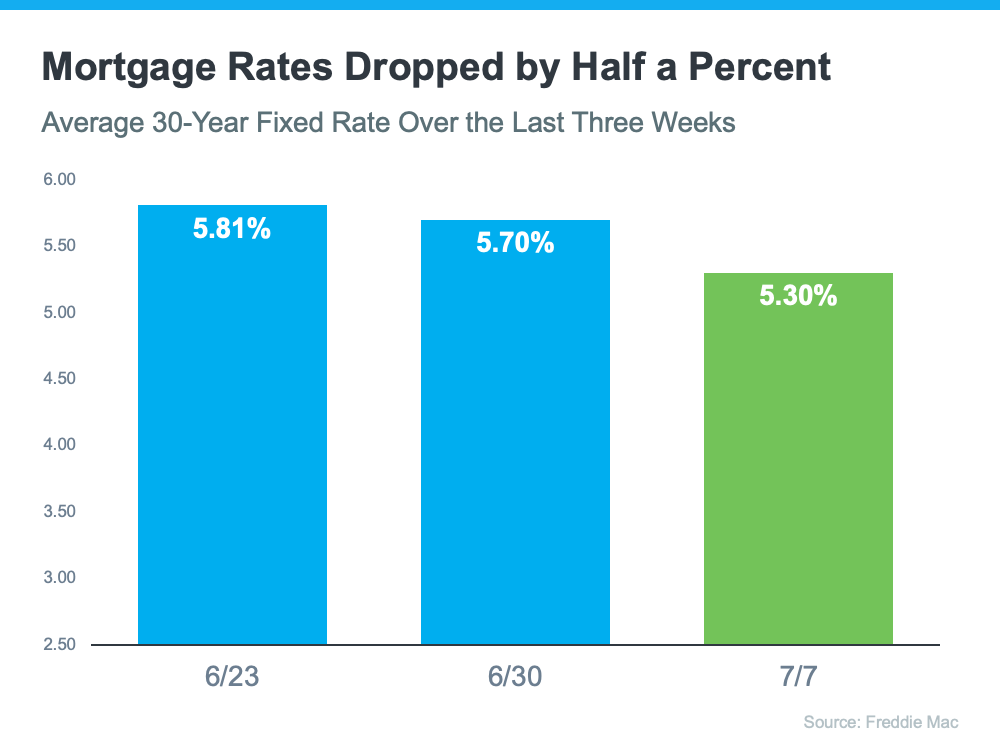

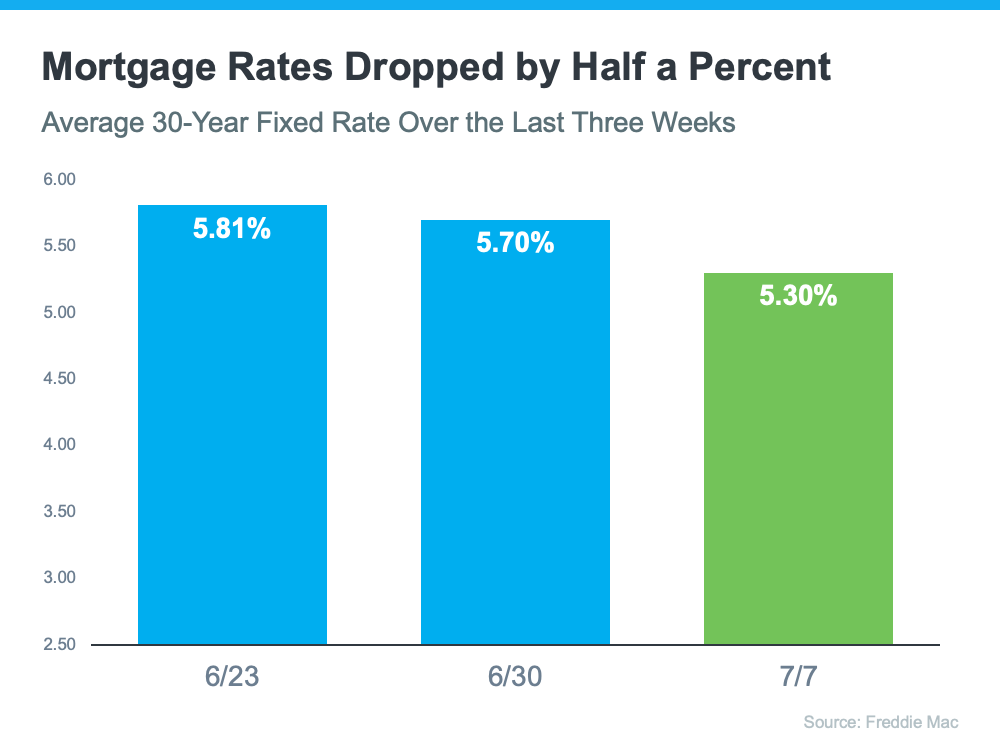

Over the past few weeks, the average 30-year fixed mortgage rate from Freddie Mac fell by half a percent. The drop happened over concerns about a potential recession. And since mortgage rates have risen dramatically this year, homebuyers across the country should see this decline as welcome news.

Freddie Mac reports that the average 30-year rate was down to 5.30% from 5.81% two weeks prior (see graph below):

But why is this recent dip such good news for homebuyers? As Nadia Evangelou, Senior Economist and Director of Forecasting at the National Association of Realtors (NAR), explains:

“According to Freddie Mac, the 30-year fixed mortgage rate dropped sharply by 40 basis points to 5.3 percent. . . . As a result, home buying is about 5 percent more affordable than a week ago. This translates to about $100 less every month on a mortgage payment.”

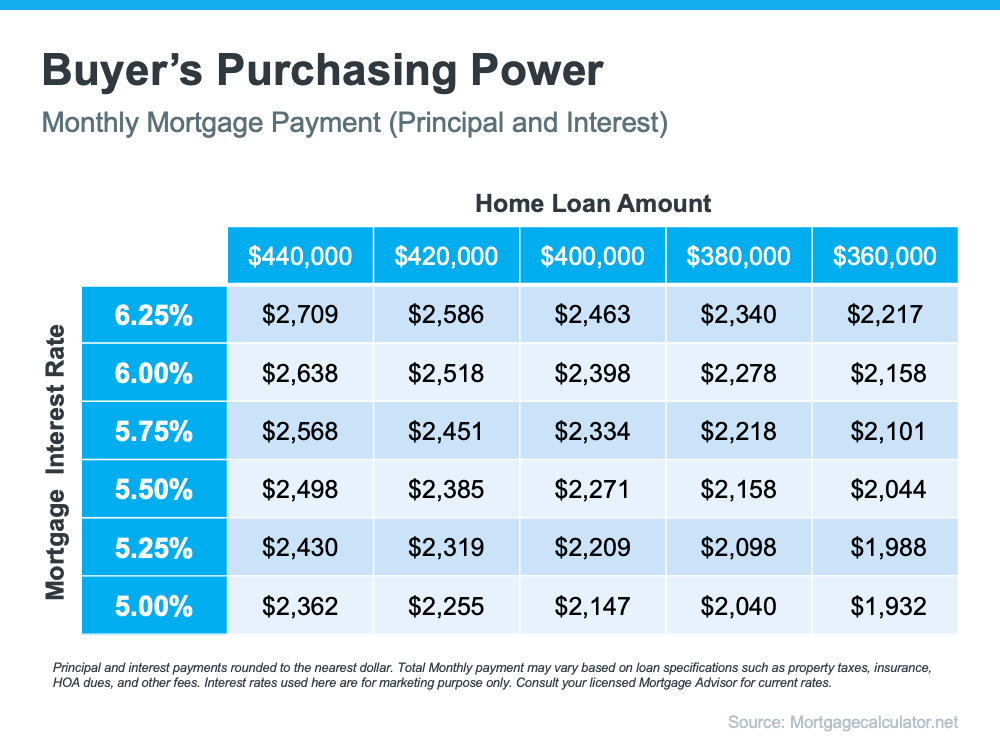

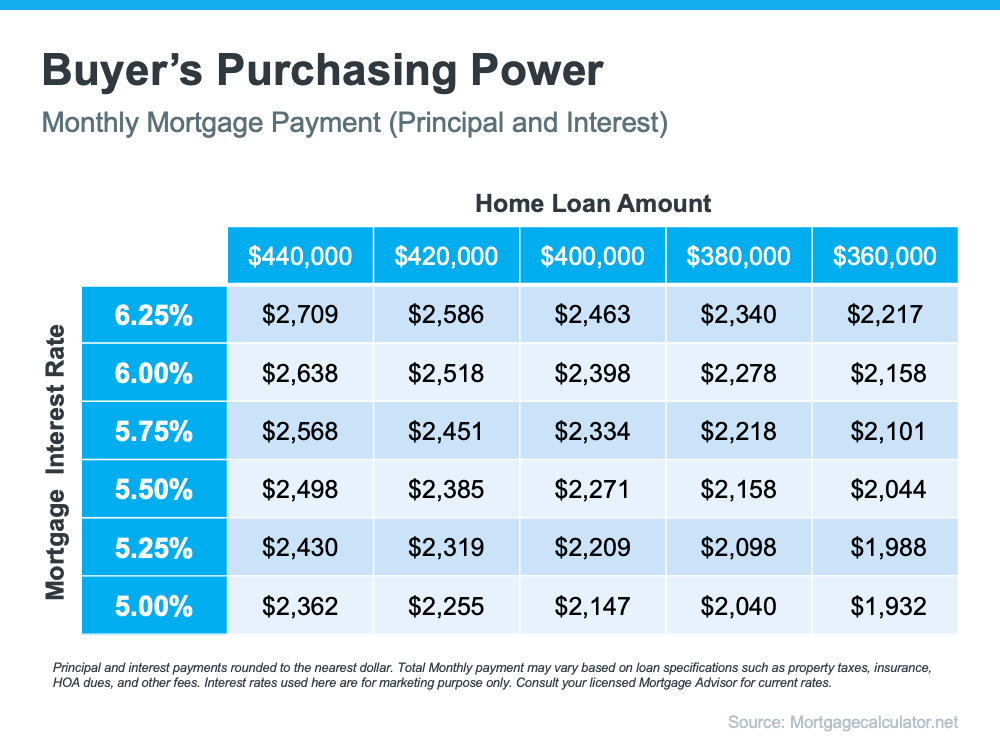

That’s because when rates go up (as they have for the majority of this year), they impact how much you’ll pay in your monthly mortgage payment, which directly affects how much you can comfortably afford. The inverse is also true. A decrease in mortgage rates means an increase in your purchasing power.

The chart below shows how a half-point, or even a quarter-point, change in mortgage rates can impact your monthly payment:

Bottom Line

If your home doesn’t meet your needs, this may be the opportunity you’ve been waiting for. Let’s connect to see how you can benefit from the current drop in mortgage rates.

This myth can stop potential homebuyers cold. The median listing price in the U.S. is $385,000 [$1.1 million in Orange County]. You would have to have $77,000 [$220,000 in Orange County] readily available if you wanted to make a 20% down payment, an amount that can be daunting for a lot of people.

“It’s one of the biggest myths out there,” says John Mallett, founder of mortgage broker MainStreet Mortgage. “It stops more people from entering the market or even seeing if they can qualify.”

In reality, 20% down is more of a guideline than a hard and fast rule. In fact, the average down payment equals 12%. For first-time buyers it goes down to 7%.

Government-backed options, such as FHA loans and USDA loans, can be secured with as little as 3.5% down. If you are a member of the armed forces or a veteran and you qualify for a VA loan, you can buy a home with 0% down.

Conventional loans also don’t require a 20% down payment, but with less money down you will generally need to pay for private mortgage insurance. PMI costs 0.5% to 1% of your loan amount per year and is paid in monthly installments. So, if you have the money to pay 20% down, however, it can make sense to do it. Having more equity also protects you if home values fall.

You can also apply for a number of different grants and homebuyer assistance programs that can provide money for a down payment. These programs can include grants, forgivable loans and second mortgages that can provide partial or full down payment help. (Brokerage Redfin has put together a list of down payment assistance programs available nationwide and by state.)

CA Real Estate Group can find solutions for you and connect you with our preferred mortgage experts. Call us today!

Christine Almarines @christine_almarines

Realtor DRE # 01412944

714-476-4637 | christine@carealestategroup.com

Michelle Kim @michellejeankim_homes

Realtor DRE # 01885912

714-253-7531 | michelle@carealestategroup.com

Source: https://money.com/housing-myths-debunked-home-buying/

Keeping Current Matters | Jun 24, 2022

![Why an Agent Is Essential When Pricing Your House [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/06/23153223/20220624-MEM-1046x2115.png)

Some Highlights

- When it comes to pricing your house, there’s a lot to consider. The only way to ensure you price it right is by partnering with a local real estate professional.

- To find the best price, your agent balances current market demand, the values of homes in your neighborhood, where prices are headed, and your home’s condition.

- Don’t pick just any price for your house. If you’re ready to sell, let’s connect to find the perfect price for your house.

💡 Find out if we’re the right Realtor Team for you! Check out @carealestategroup

👩 Christine Almarines @christine_almarines

Realtor DRE # 01412944

714-476-4637 | christine@carealestategroup.com

👩 Michelle Kim @michellejeankim_homes

Realtor DRE # 01885912

714-253-7531 | michelle@carealestategroup.com

https://www.carealestategroup.com/monthly-newsletters/june-2022-newsletter/

Keeping Current Matters | May 26, 2022

You may be someone who looks forward to summer each year because it gives you an opportunity to rest, unwind, and enjoy more quality time with your loved ones. Now that summer is just around the corner, it’s worthwhile to start thinking about your plans and where you want to spend your vacations this year. Here are a few reasons a vacation home could be right for you.

Why You May Want To Consider a Vacation Home Today

Over the past two years, a lot has changed. You may be one of many people who now work from home and have added flexibility in where you live. You may also be someone who delayed trips for personal or health reasons. If either is true for you, there could be a unique opportunity to use the flexibility that comes with remote work or the money saved while not traveling to invest in your future by buying a vacation home.

Bankrate explains why a second home, or a vacation home, may be something worth considering:

“For those who are able, buying a second home is suddenly more appealing, as remote working became the norm for many professionals during the pandemic. Why not work from the place where you like to vacation — the place where you want to live?

If you don’t work remotely, a vacation home could still be at the top of your wish list if you have a favorite getaway spot that you visit often. It beats staying in a tiny hotel room or worrying about rental rates each time you want to take a trip.”

How a Professional Can Help You Find the Right One

So, if you’re looking for an oasis, you may be able to make it a second home rather than just the destination for a trip. If you could see yourself soaking up the sun in a vacation home, you may want to start your search. Summer is a popular time to buy vacation homes. By beginning the process now, you could get ahead of the competition.

The first step is working with a local real estate advisor who can help you find a home in your desired location. A professional has the knowledge and resources to help you understand the market, what homes are available and at what price points, and more. They can also walk you through all the perks of owning a second home and how it can benefit you.

A recent article from the National Association of Realtors (NAR), mentions some of the top reasons buyers today are looking into purchasing a second, or a vacation, home:

“According to Google’s data, the top reasons that homeowners cited for purchasing a second home were to diversify their investments, earn money renting, and use as a vacation home.”

If any of the reasons covered here resonate with you, connect with a real estate professional to learn more. They can give you expert advice based on what you need, your goals, and what you’re hoping to get out of your second home.

Bottom Line

Owning a vacation home is an investment in your future and your lifestyle. If this is one of your goals this year, you still have time to buy and enjoy spending the summer in your vacation home. When you’re ready to get started, let’s connect.

![Bright Days Are Ahead When You Move Up This Summer INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/05/26132018/20220527-MEM-1046x1913.png)

Some Highlights

- Warmer weather and longer days mean summer is almost here. Celebrate by upgrading to the home of your dreams so you can enjoy all the season has to offer.

- When you list your house, you can capitalize on today’s sellers’ market to fuel your upgrade. Then, you can move to a home with the features you want, like space to entertain or rooms for work and play.

- If you’re ready to upgrade to a home that matches your changing needs, let’s connect.

💡 Find out if we’re the right Realtor Team for you! Check out @carealestategroup

👩 Christine Almarines @christine_almarines

Realtor DRE # 01412944

714-476-4637 | christine@carealestategroup.com

👩 Michelle Kim @michellejeankim_homes

Realtor DRE # 01885912

714-253-7531 | michelle@carealestategroup.com

If you’re a first-time buyer looking to break into the housing market but struggling to find a home to buy, condominiums (or condos) could be a great alternative for you.

Here are a few reasons condos may be something you’ll want to consider.

Exploring Condos Could Add Options That Fit Your Budget

Supply challenges are a reality across the board in today’s housing market. Broadening your home search to include condos could increase your overall pool of options. Just keep in mind, condos generally differ from single-family homes in average space and floorplans.

In a recent article, Bankrate covers some of these differences:

“Condos are generally more affordable because they come with less space — you likely won’t have your own backyard, for example, and the interior tends to be smaller than the square footage of a single-family home.”

But if the size of a condominium meets your needs, they could match your budget as well. Data from the National Association of Realtors (NAR) shows the difference in the median price for both housing types. For single-family homes, the median price is $363,800. And for condominiums, the median price is lower at $305,400.

So, if budget is top of mind for you, a condominium could be a great fit within your target price range.

Not to mention, buying a condo is a great way to break into the market and start building equity that can help power a future move up. The condo you purchase today may not be your forever home, but it can be a great stairstep that can help you buy your dream home later on.

Find Out if Condo Living Is Right for You

In addition, owning and living in a condo is also a lifestyle choice. While it’s true they may be smaller than single-family homes, the amenities condos provide could be a draw for many buyers. Less space in your home might mean minimal upkeep, lower maintenance, and more time for you to spend doing the things you enjoy.

To understand if condo life is for you, Bankrate recommends asking yourself a few simple questions:

“Hate to mow the lawn and trim the hedges? What about pressure washing your driveway? Are your finances such that having to lay out $5,000 or more for a new roof will be a burden? . . . Condos tend to work best for those comfortable with most of the aspects of apartment living, minus the built-in maintenance.”

Ultimately, talking with an expert real estate advisor is the best first step to determining if condo living might work for you.

Bottom Line

Condominiums are a great option for many buyers, especially those looking to buy their first home. If you’re willing to consider condos in your search, you could find something that’s in line with your target numbers and your needs. To learn more, let’s connect so you have an expert in the condo-buying process on your side.

💡 Find out if we’re the right Realtor Team for you! Check out @carealestategroup

👩 Christine Almarines @christine_almarines

Realtor DRE # 01412944

714-476-4637 | christine@carealestategroup.com

👩 Michelle Kim @michellejeankim_homes

Realtor DRE # 01885912

714-253-7531 | michelle@carealestategroup.com

🛠 Projects that add the most value at resale are the favorites of fix-it-and-flip-it professionals—and they should be high on a homeowner’s list, too. While these upgrades will not recoup all of their cost, some will come close.

🏠 The National Association of Realtors (NAR) cites wood flooring (new or refinished), kitchen renovations (new countertops and state-of-the-art appliances), upgraded bathrooms, and basement or attic conversions as projects with some of the highest return on investment, often recouping 80% or more of their cost at resale. Certain exterior work—including roofing, siding, doors, windows, refurbished decks, and energy upgrades—also delivers a lot of bang for the buck at resale.

Keeping Current Matters | Published May 10, 2022

Many people are wondering: will home prices fall this year? Whether you’re a potential homebuyer, seller, or both, the answer to this question matters for you. Let’s break down what’s happening with home prices, where experts say they’re headed, and how this impacts your homeownership goals.

What’s Happening with Home Prices?

Home prices have seen 121 consecutive months of year-over-year increases. CoreLogic says:

“Price appreciation averaged 15% for the full year of 2021, up from the 2020 full year average of 6%.”

So why are prices climbing so much? It’s because there are more buyers than there are homes for sale. This imbalance is expected to maintain that upward pressure on home prices because homes for sale are a hot commodity in today’s low-inventory housing market.

Where Do Experts Say Prices Will Go from Here?

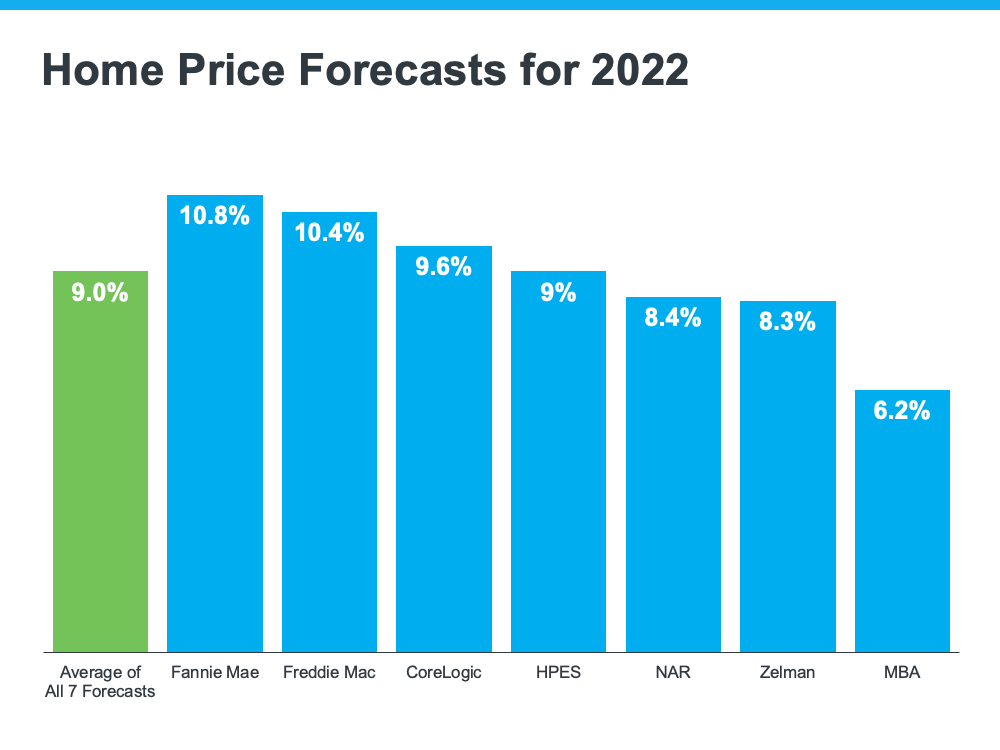

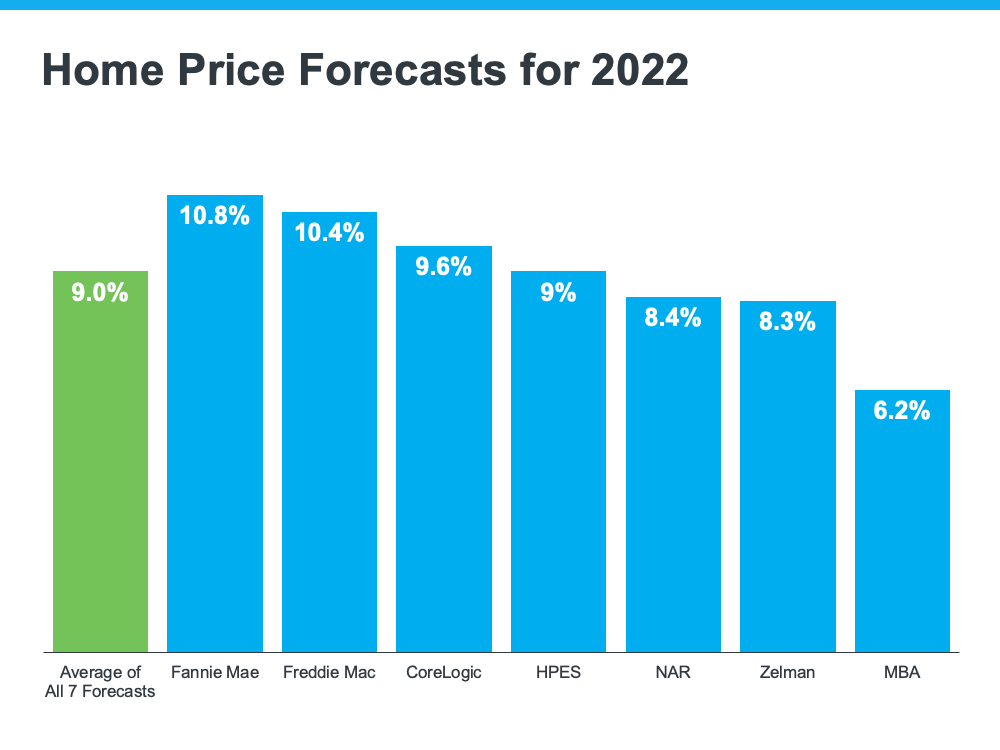

Experts say the housing market isn’t set up for a price decline due to that ongoing imbalance between supply and demand. In the latest home price forecasts for 2022, they’re calling for ongoing appreciation throughout the year (see graph below):

While the experts are forecasting more moderate price appreciation, the 2022 projections show price gains will remain strong throughout this year. First American explains it like this:

“While house price growth is expected to moderate from the rapid pace of 2021, strong home buyer demand against a backdrop of historically tight inventory of homes for sale will likely keep appreciation positive in the coming year.”

What Does That Mean for You?

The biggest takeaway is that none of the experts are projecting depreciation. If you’re a homeowner thinking about selling, the higher price appreciation over the last two years has been great for your home’s value, but it’s also something you should factor in when planning your next steps. If you’ll also be buying a home after selling your current house, you shouldn’t wait for prices to fall. Waiting will only cost you more in the long run because climbing mortgage rates and rising home prices will have an impact on your next home purchase. Freddie Mac says:

“If you’re thinking about waiting until next year and that maybe rates are higher, but you’ll get a deal on prices – well that’s risky. It may be more advantageous to purchase this year relative to waiting until 2023 at this time.”

Bottom Line

If you’re thinking of selling to move up, you shouldn’t wait for prices to fall. Experts say prices will continue to appreciate this year. That means, if you’re ready, buying your next home before prices climb further may make the most financial sense. Let’s connect to begin the process of selling your current home and looking for your next one before prices rise higher.

![Why an Agent Is Essential When Pricing Your House [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/06/23153223/20220624-MEM-1046x2115.png)

![Bright Days Are Ahead When You Move Up This Summer INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/05/26132018/20220527-MEM-1046x1913.png)