Keeping Current Matters | Jan 21, 2022

![Americans Choose Real Estate as the Best Investment [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/01/20142632/20220121-MEM-1046x2199.png) 💰🇺🇸 Americans choose real estate as the best investment once again!

💰🇺🇸 Americans choose real estate as the best investment once again!

🏠 According to a Gallup poll, real estate has been rated the best long-term investment for eight years in a row.

🏠 Real estate tops the list because you’re not just buying a place to call home – you’re investing in your future. Real estate is typically considered a stable and secure asset that can grow in value over time.

🏠 Let’s connect today if you’re ready to make real estate your best investment this year.

💡 Find out if we’re the right Realtor Team for you! We’re active in our community…check out @carealestategroup

👩 Christine Almarines @christine_almarines

Realtor DRE # 01412944

714-476-4637 | christine@carealestategroup.com

👩 Michelle Kim @michellejeankim_homes

Realtor DRE # 01885912

714-253-7531 | michelle@carealestategroup.com

CA Real Estate Group is powered by Keller Williams Realty

Homelight | Jan 28, 2021

We’re continuing in our Weekly Series of “The 7 Most Painfully Expensive Home Repairs to Avoid.”

Today, we’re covering “Water damage.”

The average homeowner spent a total of $4,832 on routine and emergency home repairs in 2019. However, some of the most expensive home repairs have the ability to wipe out your entire yearly maintenance savings and then some.

On top of being pricey, major problems like pest infections and structural instability can make your home difficult to market and sell, not to mention tank your property value. With this guide, real estate experts identify the worst home repairs for your wallet and offer expert insights into preventive maintenance and early detection.

Water damage ($1,000-$5,000)

Water in a home can destroy your ceiling, walls, flooring, and personal belongings, while moisture in the wrong places can lead to harmful mold. You don’t need a flood or other catastrophic event for water to intrude your home, either. A burst pipe, roof leak, clogged gutter, sewage backup, rotted siding, or broken fixture like an old bathtub can all cause water damage.

Unfortunately, water damage is a common home occurrence. Every day 14,000 Americans face a water damage emergency, while 98% of basements will have water damage at some point in their lifetime. However, there are steps you can take to protect your home from water intrusion.

Estimated cost to repair:

- Average: $3,030

- Low end: $1,170

- Mid-range: $4,890

(Source: Data reported by 1,106 HomeAdvisor members)

Warning signs:

Beyond walking down the stairs to find a flooded basement, these are few signs that you’ve got a water leak:

- Bubbling or peeling paint on your walls

- Stains and water marks on your walls or ceilings

- Damaged flooring

- High water bills

- Low water pressure

- Odd plumbing sounds

Key prevention tactics:

Since water damage can stem from a bunch of places including your plumbing, roof, or basement, you’ll need a multi-pronged prevention strategy:

- Take good care of your drains: Don’t pour grease down your kitchen sink and check under sinks around the house to make sure drains aren’t leaking on a regular basis.

- Install a sump pump: A sump pump protects your basement from flooding. When the pump senses water, it activates and sends moisture through a discharge pipe, keeping your carpet nice and dry.

- Check for damaged siding and repair it right away: Look for any discolored areas on your home’s siding, fascia, or soffit, which can be a sign of rotten or decayed wood. “You use a screwdriver to push into the wood to see if it penetrates the wood,” says Kennamer. “If so, it will need to be replaced.”

Who to call for help: If you have a leaky pipe or stained ceiling or wall, call CA Real Estate Group at (714) 476-4637 for our preferred plumbing experts to evaluate the situation. To remediate water damage, we can refer you to the remediation experts that we work with or you can contact a water damage cleanup professional or restoration service.

Source: https://www.norwalk.org/city-hall/departments/community-development/housing-neighborhood-development/emergency-rental-assistance-program-erap

Source: https://www.norwalk.org/city-hall/departments/community-development/housing-neighborhood-development/emergency-rental-assistance-program-erap

The COVID-19 Emergency Rental Assistance Program’s (“ERAP”) objective is mitigating potential homelessness and displacement of existing Norwalk residents and workers who may not be residents, but support the local economy by working in the City, who are experiencing a decrease in household income due to the COVID-19 pandemic and unable to pay their rent, mortgage and/or utilities. By providing a grant to assist eligible tenants to pay for delinquent rent, mortgage and/or utilities, the City is providing a much-needed resource to ensure residents of Norwalk stay in their homes and not become homeless.

The program is funded through the Department of Housing and Urban Development’s Community Development Block Grant program, including special one-time funding available through the CARES Act. The Program shall be operated in compliance with CDBG and CARES Act regulations, including 24 CRF 570.201(e) and 570.207(b)(2)(4).

The Application Period begins May 3, 2021.

Click here for the flyer for the Emergency Rental Assistance Program

Click here for program application.

Click here for upload instructions.

Click here to upload application and supporting documents.

Applicant Eligibility

To be considered eligible for the Norwalk’s Emergency Rental Assistance Program, applicants must meet the following requirements, as determined by CDBG and CARES Act regulations:

- Live or work in the City of Norwalk

- Experiencing a loss of income due to COVID-19

- Not be eligible for or receiving other Federal financial assistance

- Be able to provide a lease agreement or letter confirming tenancy from your landlord (rental assistance); or able to provide most recent mortgage payment statement issued by mortgage company (mortgage assistance); and/or most recent utility payment statement issued by utility company (utility assistance)

- Have been current on rent, mortgage and/or utility payments prior to COVID-19

- Make less than 80% of Area Median Income

Income Limits:

Amount of Assistance

In accordance with CDBG regulations, the City will provide a maximum of three (3) months of rental, mortgage, and/or utility assistance. Payments will be made directly to the applicant’s landlord or property management firm. No direct payments will go to Emergency Rental Assistance Program applicants. Eligible applicants are funded on a first come, first serve basis.

Required Documentation

Applicants must provide the following documentation to the City of Norwalk Community Development Department:

- Cover Letter explain your situation and why rental, mortgage, and/or utility assistance is needed.

- Most recent Federal income tax returns

- Most recent bank statement for checking and savings accounts

- Lease Agreement or letter from landlord confirming tenancy; or most recent mortgage payment statement issued by mortgage company; and/or most recent utility payment statement issued by utility company

- Photo ID for each member of the household

- Most recent paystub (if still employed)

- Hour reduction notification from employer (if hours reduced)

- Unemployment Award Letter (if unemployed)

- Rent Due notices; or Mortgage Payment Due notices; and/or Utility Payment Due notices

- Landlord verification that applicant was current on rent prior to COVID-19

- Landlord’s W9 and contact information for payment.

Homelight | Jan 28, 2021

We’re continuing in our Weekly Series of “The 7 Most Painfully Expensive Home Repairs to Avoid.”

Today, we’re covering “Roof replacements.”

The average homeowner spent a total of $4,832 on routine and emergency home repairs in 2019. However, some of the most expensive home repairs have the ability to wipe out your entire yearly maintenance savings and then some.

On top of being pricey, major problems like pest infections and structural instability can make your home difficult to market and sell, not to mention tank your property value. With this guide, real estate experts identify the worst home repairs for your wallet and offer expert insights into preventive maintenance and early detection.

Roof replacement ($5,000-$10,000)

Many homeowners, especially those in areas with a lot of sun, wind, and rain, are surprised when an inspection reveals the need for a new roof so soon. Robb Harrison, a top real estate agent in Ocala, FL, says that Florida weather can damage roofs prematurely, and a lack of ongoing maintenance can lead to irreparable problems.

“From the ground a roof can look amazing, but when someone gets up on the roof, you may find that it needs a new one,” says Harrison.

“It’s happened a few times where the inspection report came back that the house needed a new roof and everyone is shocked when it’s only been 15 or 20 years on 30-year shingles. You just really need to keep an eye on it.”

Estimated cost to repair:

- Low end: $3,500-$4,500

- Average: $5,250-$10,500

- High end: $12,000-$40,000

(Source: Fixr, estimates based on data from contractors, subcontractors, material suppliers, and more)

The good news is that a new roof adds value to your home. Data from HomeLight’s Top Agent Insights Survey for Q3 2019, featuring the expertise of over 400 real estate agents, found that a roof replacement costs an estimated $11,992, but recoups an average $10,842 for a 94% cost recovery.

Warning signs:

If you have a ladder long enough to see the roof safely, check for these red flags that it’s time for a roof replacement:

- Missing or curling shingles

- Missing flashing on chimneys or wall intersections

- Nails that need to be tamped down

Stains, streaks, or water in the attic are additional signs of a roof problem.

Key prevention tactics:

Kennamer, the general contractor in Alabama, recommends keeping an eye on cracks in roof boots and flanges.

“If they are cracked, you can re-caulk them with an all-weather caulk or replace them if they are decayed. Usually, to do it yourself it would cost in the range of $20-$30 or to hire a professional it will range from $75-$150,” he says.

Consider these additional tips to preserve your roof:

Who to call for help: Call CA Real Estate Group at (714) 476-4637 for our preferred roof experts or you can use the Better Business Bureau’s Roofing Contractors Near Me feature. When in doubt, cross-reference a few different sites to gauge client ratings and reviews for any particular roofer you’re considering.

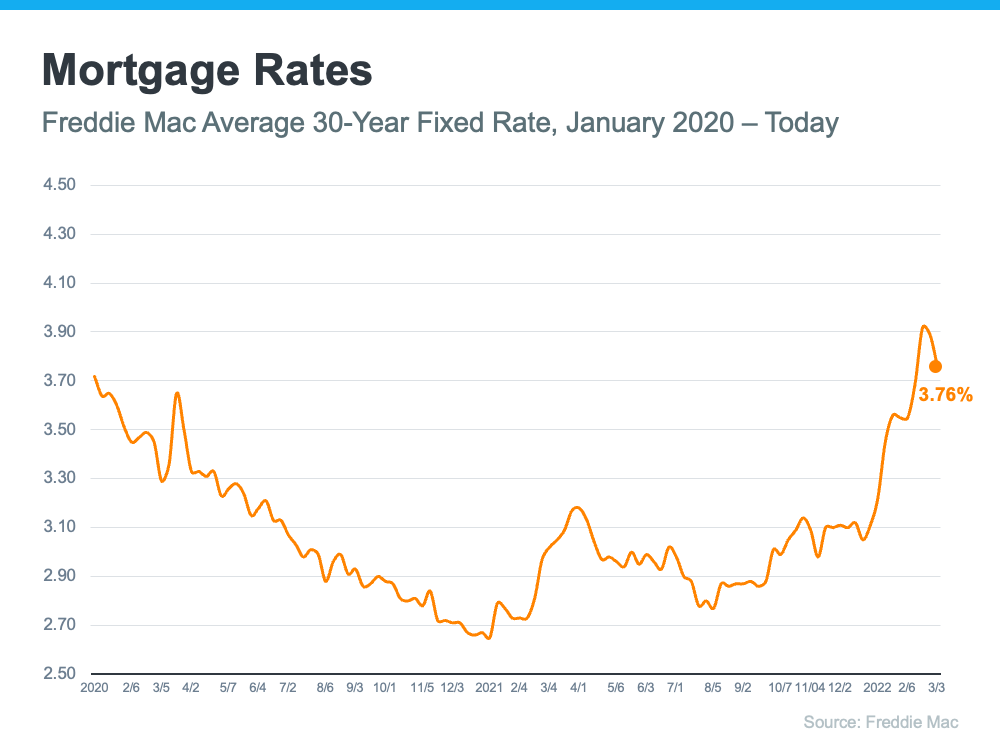

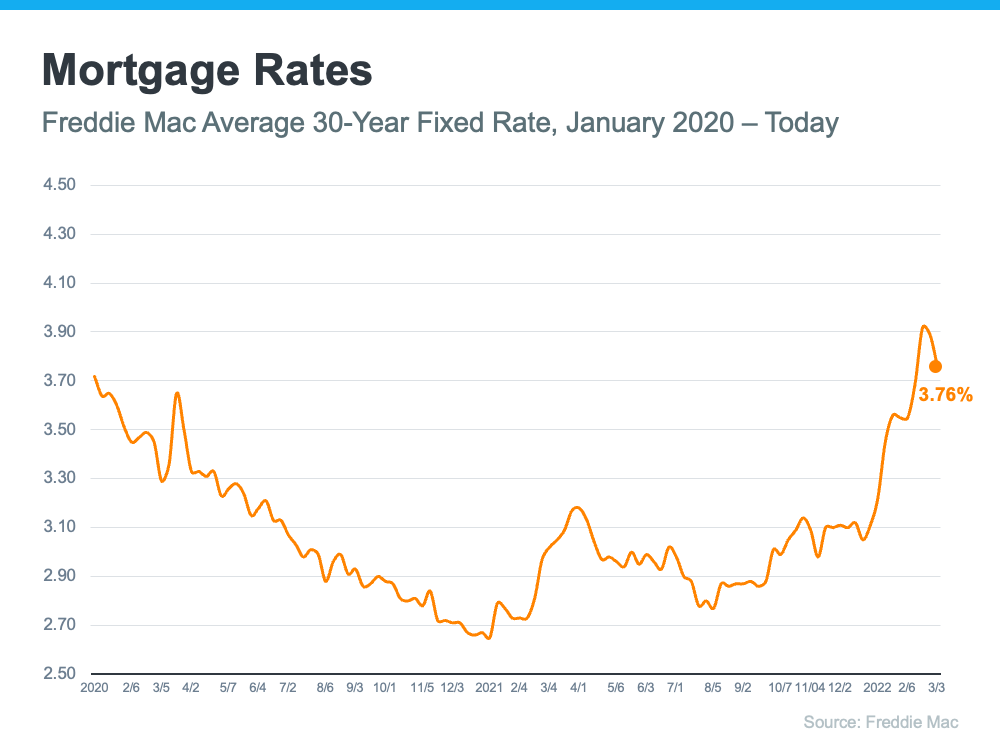

Keeping Current Matters | Mar 8, 2022

If you’re thinking about buying or selling a home, you’ll want to keep a pulse on what’s happening with mortgage rates. Rates have been climbing in recent months, especially since January of this year. And just a few weeks ago, the 30-year fixed mortgage rate from Freddie Mac approached 4% for the first time since May of 2019. But that climb has dropped slightly over the past few weeks (see graph below):

The recent decline in mortgage rates is primarily due to growing uncertainty around geopolitical tensions surrounding Russia and Ukraine. But experts say it’s to be expected.

Here’s a look at how industry leaders are explaining the impact global uncertainty has on mortgage rates:

Odeta Kushi, Deputy Chief Economist at First American, says:

“While mortgage rates trended upward in 2022, one unintended side effect of global uncertainty is that it often results in downward pressure on mortgage rates.”

In another interview, Kushi adds:

“Geopolitical events play an important role in impacting the long end of the yield curve and mortgage rates. For example, in the weeks following the ‘Brexit’ vote in 2016, the U.S. Treasury bond yield declined and led to a corresponding decline in mortgage rates.”

Kushi’s insights are a reminder that, historically, economic uncertainty can impact the 10-year treasury yield – which has a long-standing relationship with mortgage rates and is often considered a leading indicator of where rates are headed. Basically, events overseas can have an impact on mortgage rates here, and that’s what we’re seeing today.

Will Mortgage Rates Stay Down?

While no one has a crystal ball to predict exactly what will happen with rates in the future, experts agree this slight decline is temporary. Sam Khater, Chief Economist at Freddie Mac, echoes Kushi’s sentiment, but adds that the decline in rates won’t last:

“Geopolitical tensions caused U.S. Treasury yields to recede this week . . . leading to a drop in mortgage rates. While inflationary pressures remain, the cascading impacts of the war in Ukraine have created market uncertainty. Consequently, rates are expected to stay low in the short-term but will likely increase in the coming months.”

Rates will likely fluctuate in the short-term based on what’s happening globally. But before long, experts project rates will renew their climb. If you’re in the market to buy a home, doing so before rates start to rise again may be your most affordable option.

Bottom Line

Mortgage rates are an important piece of the puzzle because they help determine how much you’ll owe on your monthly mortgage payment in your next home. Let’s connect so you have up-to-date information on rates and trusted advice on how to time your next move.

💡 Find out if we’re the right Realtor Team for you! We’re active in our community…check out @carealestategroup and call 714-476-4637!

👩 Christine Almarines @christine_almarines

Realtor DRE # 01412944

714-476-4637 | christine@carealestategroup.com

👩 Michelle Kim @michellejeankim_homes

Realtor DRE # 01885912

714-253-7531 | michelle@carealestategroup.com

CA Real Estate Group is powered by Keller Williams Realty

We’re kicking off our Weekly Series of “The 7 Most Painfully Expensive Home Repairs to Avoid.”

Today we cover “Sinking or Settling Foundation.”

Homelight | Jan 28, 2021

The average homeowner spent a total of $4,832 on routine and emergency home repairs in 2019. However, some of the most expensive home repairs have the ability to wipe out your entire yearly maintenance savings and then some.

On top of being pricey, major problems like pest infections and structural instability can make your home difficult to market and sell, not to mention tank your property value. With this guide, real estate experts identify the worst home repairs for your wallet and offer expert insights into preventive maintenance and early detection.

Sinking or settling foundation ($4,000-$10,000)

Your foundation serves as the base for your entire home. It needs to be in solid condition for the rest of your house to remain structurally sound. If it becomes damaged, the issue can spread and compromise almost any other part of the home in the form of jammed doors or sinking or uneven floors.

One of the most common foundation problems you can encounter is settling. Any foundation is going to settle gradually over time. However, trouble arises when there are drastic or sudden shifts in soil moisture levels, which can put pressure on the foundation and cause it to crack.

Here’s a summarized example provided by Family Waterproofing Solutions serving Illinois and Indiana for 25 years: Let’s say your house was built during the rainy season when the soil was damp and swollen. A few years later there’s a drought and the soil dramatically retracts. Because the soil wasn’t properly prepared at the time of the build, the house plunges five inches downward, damaging the foundation in the process.

Estimated cost to repair:

- Average foundation repair: $4,488

- Minor cracks: $500

- Major foundation repair (involving hydraulic piers): $10,000

(Source: HomeAdvisor, project costs reported by 3,102 HomeAdvisor members)

Key prevention tactics: You need to catch and fix foundation problems early on or they will only get more expensive to repair. “Check for cracks in brick or block foundations. If the crack is small and runs in a straight line, it could be settling,” advises Ray Kennamer, a general contractor of nearly 25 years in Albertville, Alabama.

If you suspect a foundation issue, a professional can help identify and diagnose it. Most likely, they will fill in any cracks with a cement mixture and install drainage solutions to halt the changes in moisture levels. Your foundation will thank you for it!

Warning signs:

- Foundation cracks that grow longer and wider over time

- Cracked or bowing walls

- Fractures above windows or door frames

- Doors or windows that stick

- Uneven floors

Who to call for help: Call CA Real Estate Group at (714) 476-4637 for our preferred foundation experts or search the Foundation Repair Network to find a local professional who can inspect and make recommendations for foundation repair.

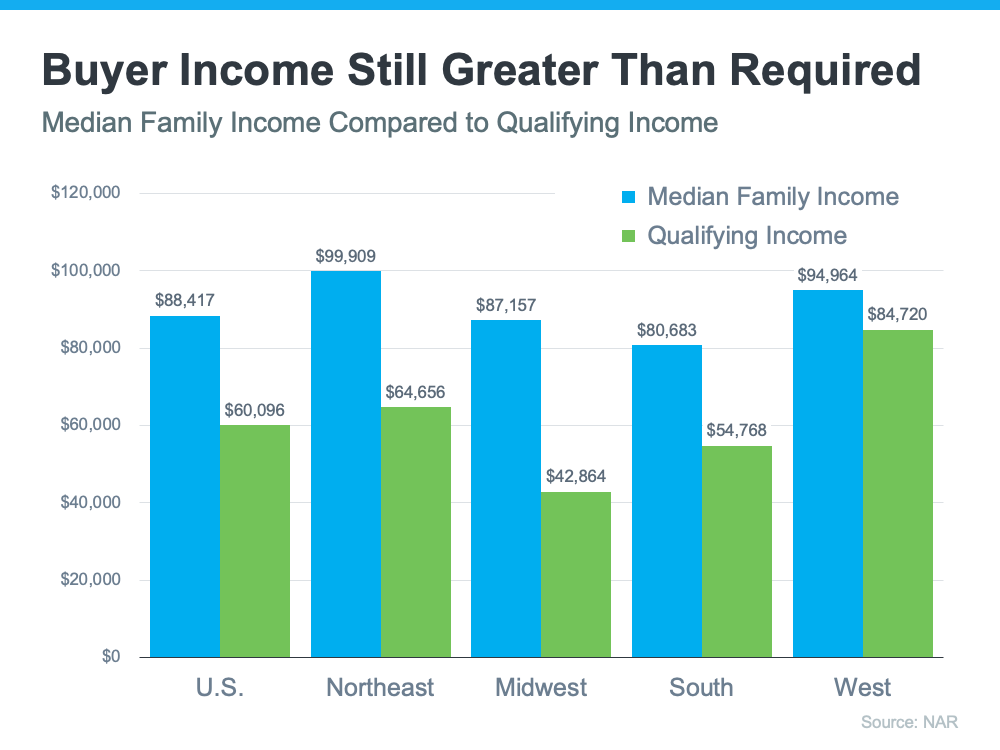

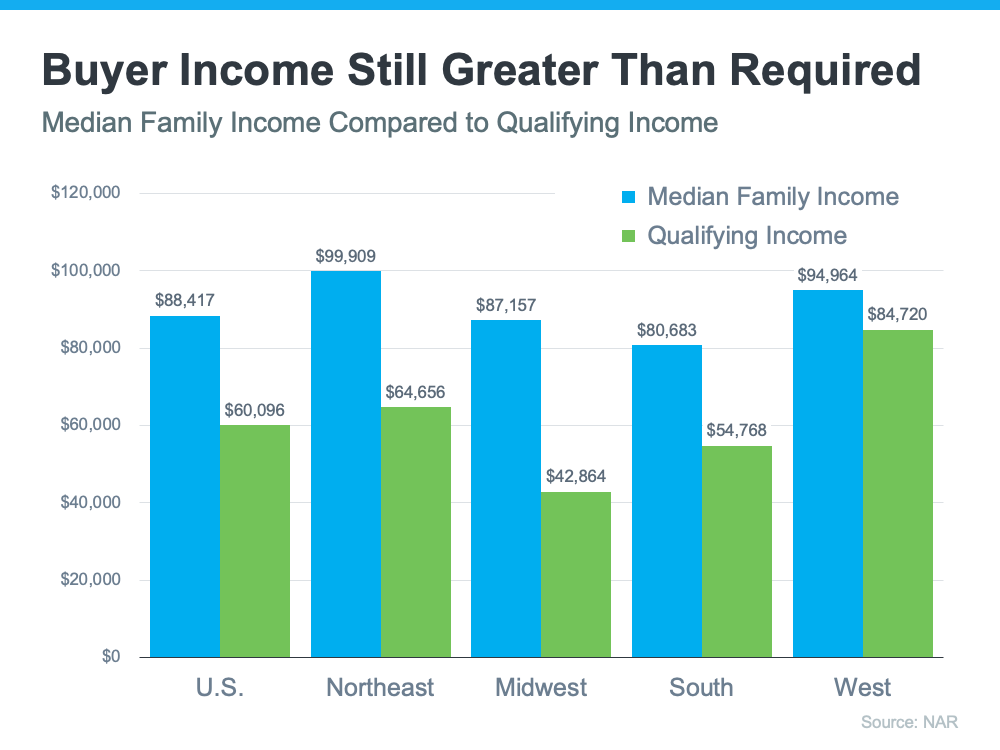

You can’t read an article about residential real estate without the author mentioning the affordability challenges that today’s buyers face. There’s no doubt homes are less affordable today than they were over the last two years, but that doesn’t mean homes are now unaffordable.

There are three measures used to establish home affordability: home prices, mortgage rates, and wages. Let’s look closely at each of these components.

1. Home Prices

The most recent Home Price Insights report by CoreLogic shows home values have increased by 19.1% from last January to this January. That was one reason affordability declined over the past year.

2. Mortgage Rates

While the current global uncertainty makes it difficult to project mortgage rates, we do know current rates are almost one full percentage point higher than they were last year. According to Freddie Mac, the average monthly rate for last February was 2.81%. This February it was 3.76%. That increase in the mortgage rate also contributes to homes being less affordable than they were last year.

3. Wages

The one big, positive component in the affordability equation is an increase in American wages. In a recent article by RealtyTrac, Peter Miller addresses that point:

“Prices are up, but what about wages? ADP reports that job holder incomes increased 5.9% last year but rose 8.0% for those who switched employers. In effect, some of the higher cost to buy a home has been offset by more cash income.”

The National Association of Realtors (NAR) also recently released information that looks at income and affordability. The NAR data provides a comparison of the current median family income versus the qualifying income for a median-priced home in each region of the country. Here’s a graph of their findings:

As the graph shows, the median family income (shown in blue on the graph) is greater than the qualifying income needed to buy a median-priced home (shown in green on the graph) in all four regions of the country. While those figures may vary in certain locations within each region, it’s important to note that, in most of the country, homes are still affordable.

So, when you think about affordability, remember that the picture includes more than just home prices and mortgage rates. When prices rise and rates rise, it does impact affordability, and experts project both of those things will climb in the months ahead. That’s why it’s less affordable to buy a home than it was over the past two years when prices and rates were lower than they are today. But wages need to be factored into affordability as well. Because wages have been rising, they’re a big reason that, while less affordable, homes are not unaffordable today.

Bottom Line

To find out more about affordability in our local area, let’s discuss where home prices are locally, what’s happening with mortgage rates, and get you in contact with a lender so you can make an informed financial decision. Remember, while less affordable, homes are not unaffordable, which still gives you an opportunity to buy today.

Home maintenance and repairs never come at a convenient time. It’s a good idea to set aside a certain amount each year to pay for expected and unexpected things that may arise.

Keeping Current Matters | March 4, 2022

Some Highlights

- Today’s housing market is the direct result of low supply and high buyer demand. Here’s what that means for you and your plans to buy or sell.

- For buyers, expect competition, be ready to move fast, and be prepared to submit your strongest offer. For sellers, know your house will be the center of attention and that it’ll likely sell quickly and get multiple offers.

- If you’re ready to move, let’s connect to talk about our local area and how you can take advantage of today’s unprecedented housing market.

👩 Christine Almarines @christine_almarines

Realtor DRE # 01412944

714-476-4637 | christine@carealestategroup.com

👩 Michelle Kim @michellejeankim_homes

Realtor DRE # 01885912

714-253-7531 | michelle@carealestategroup.com

CA REAL ESTATE GROUP @carealestategroup

powered by Keller Williams Realty

https://linktr.ee/carealestategroup

What are automatic shut-offs? Much like breakers within your home’s electric panel, did you know there are technologies available to stop or limit damage that may be caused by a gas or water leak as well?

Automatic Gas Shut-Off Valves were invented to limit the possibly disastrous consequences of gas leaks within the home, primarily as the result of an earthquake. As of 2000, all newly constructed buildings in California must install automatic earthquake shut-off valves. These devices (seen here in red) can be installed on older homes as well. More info here

Automatic Water Shut-Off Valves vary widely in their capabilities, and technological know-how requirement of their owners 😉 Control freaks rejoice! You can know within seconds if there is unwanted water anywhere in your home, and with a tap on your phone (or automatically of course), you can have the water turned off.

More info here

-Discounts on homeowners insurance may be available to homeowners who have these safety devices in place. Be sure to ask your agent!

-Ask your local, trusted plumber about suitability and installation.

Contact CA Real Estate Group

👩 Christine Almarines @christine_almarines

Realtor DRE # 01412944

714-476-4637 | christine@carealestategroup.com

👩 Michelle Kim @michellejeankim_homes

Realtor DRE # 01885912

714-253-7531 | michelle@carealestategroup.com

CA Real Estate Group is powered by Keller Williams Realty

![Americans Choose Real Estate as the Best Investment [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/01/20142632/20220121-MEM-1046x2199.png) 💰🇺🇸 Americans choose real estate as the best investment once again!

💰🇺🇸 Americans choose real estate as the best investment once again!