Keeping Current Matters | Oct 30, 2024

No one likes making mistakes, especially when they happen in what’s likely the biggest transaction of your life – buying a home.

That’s why partnering with a trusted agent and real estate team like CA Real Estate Group is so important. Here’s a sneak peek at the most common missteps buyers are making in today’s market and how a great agent will help you steer clear of each one.

Trying To Time the Market

Many buyers are trying to time the market by waiting for home prices or mortgage rates to drop. This can be a really risky strategy because there’s so much at play that can have an impact on those things. As Elijah de la Campa, Senior Economist at Redfin, says:

“My advice for buyers is don’t try to time the market. There are a lot of swing factors, like the upcoming jobs report and the presidential election, that could cause the housing market to take unexpected twists and turns. If you find a house you love and can afford to buy it, now’s not a bad time.”

Buying More House Than You Can Afford

If you’re tempted to stretch your budget a bit further than you should, you’re not alone. A number of buyers are making this mistake right now.

But the truth is, it’s actually really important to avoid overextending your budget, especially when other housing expenses like home insurance and taxes are on the rise. You want to talk to the pros to make sure you understand what’ll really work for you. Bankrate offers this advice:

“Focus on what monthly payment you can afford rather than fixating on the maximum loan amount you qualify for. Just because you can qualify for a $300,000 loan doesn’t mean you can comfortably handle the monthly payments that come with it along with your other financial obligations.”

Missing Out on Assistance Programs That Can Help

Saving up for the upfront costs of homeownership takes some careful planning. You’ve got to think about your closing costs, down payment, and more. And if you don’t work with a team of experienced professionals, you could miss out on programs out there that can make a big difference for you. This is happening more than you realize.

According to Realtor.com, almost 80% of first-time buyers qualify for down payment assistance – but only 13% actually take advantage of those programs. So, talk to a lender about your options. Whether you’re buying your first house or your fifth, there may be a program that can help.

Not Leaning on the Expertise of a Pro

This last one may be the most important of all. The very best way to avoid making a mistake that’s going to cost you is to lean on a pro. With the right team of experts, you can easily dodge these missteps.

Bottom Line

The good news is you don’t have to deal with any of these headaches. Connect with CA Real Estate Group so you have a pro on your side who can help you avoid these costly mistakes.

CA Real Estate Group | Caliber RE Group

Christine Almarines @christine_almarines

Realtor DRE# 01412944 | (714) 476-4637

Anaid Bautista @wealthwithanaid

Realtor DRE# 02179675 | (949) 391-8266

Letty Luna @lettylunarealestate

Realtor DRE# 02174000 | (562) 879-4181

PT Nguyen @sellsocalbuypt

Realtor DRE# 02223919 | (714) 756-0240

🏡 5045 Twilight Canyon Rd 33F, Yorba Linda

🏡 2 bd | 2 ba | 1,252 SQ FT

———–

OPEN HOUSE SCHEDULE:

🚩 SAT, SEP 28, 1:00-4:00 PM

🚩 SUN, SEP 29, 1:00-4:00 PM

———–

🌴 Welcome to the Hills Condominium Community in Yorba Linda. This unit is an end unit on the 2nd floor. Better views of the hills and trees from this unit from the balcony that is a wraparound connecting the living room, kitchen, and primary bedroom all with sliders to exit. Refurbished throughout with paint, carpet, redone counters and sinks and bathtubs and showers. Beautifully decorated for your visiting pleasure to give you great ideas when you are the buyer. New appliances in the kitchen include the stove, dishwasher, and microwave. This is a perfect home for somebody that likes to dine in or sit in the living room and enjoy the fireplace or venture outside onto the balcony. With high ceilings, this space seems to grow as you sit back and relax. With all the great amenities of a pool, spa, gym, tennis court and well as water and trash paid, why would you look anywhere else?

———–

See more photos of this gorgeous property here: https://carealestategroup.com/search/listing/5045-twilight-canyon-road-33f-yorba-linda-ca–PW24200003/

———–

Letty Luna @lettylunarealestate

Buyers Agent Realtor DRE # 02174000

(562) 879-4181 | letty@carealestategroup.com

———–

(Listing by Edie Israel [DRE#01399225] and Keller Williams Realty)

🏡 5015 Twilight Canyon Rd 36D, Yorba Linda

🏡 2 bd | 2 ba | 1,252 SQ FT

———–

🚩 SUN, SEP 29, 1:00-4:00 PM

———–

🌴

Here is your opportunity to get in on the ground floor for this special 2 bedroom and 2 bath condo in the Hills Condominium Community in Yorba Linda. Located at the back of the development gives you a better view of the hills. This unit has received a lot of love with paint, carpet, and redone kitchen counters as well as a new stove and microwave and dishwasher! Just sit down in your breakfast nook and enjoy the views to the hills, maybe feed the birds, or read a book. Walk out the slider from the kitchen and relax on the balcony. That same balcony is also accessible from the living room slider or the primary bedroom slider. At the end of the balcony is the laundry room. One full bath is a part of the master suite with a walk-in closet. The other bath has a shower and both bathrooms have had the counters, tub and shower refurbished. So many good things about the condo as it also has a dining room and a good-sized living room with a fireplace. The HOA is generous as it provides great amenities with the pool and spa area, and the gym, in addition to the tennis court. The HOA pays for the water and the trash and parking is accessible right outside your front door.

———–

See more photos of this gorgeous property here:

https://carealestategroup.com/search/listing/5015-twilight-canyon-road-36d-yorba-linda-ca–PW24200010/

———–

Anaid Bautista

@wealthwithanaid

Buyers Agent Realtor DRE # 02179675

(949) 391-8266 | anaid@carealestategroup.com

CA Real Estate Group | Caliber RE Group

———–

(Listing by Edie Israel [DRE#01399225] and Keller Williams Realty)

Lower mortgage rates and rising inventory are giving home buyers a window of opportunity at an unusual time of year. Lower mortgage rates have improved affordability significantly for home buyers, and competition among them could extend into the fall instead of fading away as is typical at this time of year.

Mortgage rate drops equate to serious savings

Mortgage rate declines have made buying a home “affordable” again at the national level (meaning monthly payments generally take less than one-third of median household income), assuming a buyer puts 20% down and before taxes and insurance are accounted for. Nationwide, the monthly payment on a typical home purchase has fallen by more than $100 since a peak in May. That drop is more than $300 a month in the ultraexpensive San Francisco metro area.

Lower rates also make it easier for buyers to qualify for a mortgage on more of the inventory listed in a given area, functionally increasing the choices available to them.

Home shoppers gain choices, bargaining power

Beyond lower costs, a number of metrics are moving in buyers’ favor. The Zillow market heat index shifted from being in favor of sellers into neutral territory in July. For the past two years, sellers held their edge nationally until October.

Homes are taking longer to sell than in recent history, but shorter than in pre-pandemic times. Homes that sold in August took 20 days to go pending, two more than in July, but about six days faster than at this time of year before the pandemic. And while inventory growth has slowed, nearly 1.18 million homes are on the market, more than any month since September 2020.

Added interest could extend summertime competition

Lower rates could stall or slow the cooldown in housing market activity that typically takes place this time of year, because right now buyers are more likely to be motivated by lower rates than sellers are.

Spring is normally the prime time to list because sellers often want to make sure they are in their new home before the school year and fall holidays start. Most homeowners (80%) are influenced to sell by life events, such as an addition to the family or a new job, and not necessarily by optimizing the mortgage rate on their next home, according to Zillow surveys.

Some signals are already pointing to an altered trajectory in the housing market. The share of listings on Zillow with a price cut ticked down from July to August, reversing an upward trend of rising every month since March. Just under 26% of homes on the market had a price cut in August. That’s relatively high for this time of year, but not a record, as seen in recent months.

Home values

This month, the typical home in the US was $362,143. The typical monthly mortgage payment, assuming 20% down, was $1,827. Lower mortgage rates pushed monthly mortgage costs down 3.4% from July to August.

- Home values climbed month-over-month in 9 of the 50 largest metro areas in August. Gains were biggest in Buffalo (0.7%), New York (0.6%), Providence (0.4%), Hartford (0.3%), and Philadelphia (0.3%).

- Home values fell, on a monthly basis, in 37 major metro areas. The largest monthly drops were in San Francisco (-1.3%), San Jose (-1.1%), Austin (-1%), Denver (-0.7%), and New Orleans (-0.6%).

- Home values are up from year-ago levels in 44 of the 50 largest metro areas. Annual price gains are highest in San Jose (9.1%), Hartford (8%), Providence (7.1%), New York (7%), and San Diego (6.2%).

- Home values are down from year-ago levels in 5 major metro areas. The largest drops were in New Orleans (-4.6%), Austin (-4.6%), San Antonio (-2.9%), Birmingham (-0.9%), and Dallas (-0.4%).

- The typical mortgage payment is down 2.9% from last year and has increased by 103.8% since pre-pandemic.

Inventory & new listings

- New listings decreased by 1.1% month-over-month in August.

- New listings increased by 0.8% this month compared to last year.

- New listings are 21.3% lower than pre-pandemic levels.

- For-sale inventory (the number of listings active at any time during the month) in August increased by 0.2% from last month.

- There were 22.1% more for-sale listings active in August compared to last year.

- Inventory levels are -30.8% lower than pre-pandemic levels for the month.

Price cuts & share sold above list

- 25.9% of listings in August had a price cut, compared to 26.2% in July and 23.4% in August 2023.

- 33.4% of homes sold above their list price last month. That’s compared to 35.4% in June and 39.1% in July of 2023.

Newly Pending Sales

- Newly pending listings decreased by 5% in August from the prior month.

- Newly pending listings decreased by 2.9% from last year.

- Median days to pending, the typical time since initial list date for homes that went under contract in a month, is at 20 days in August, up 2 days since last month.

- Median days to pending increased by 7 days from last year.

Market Heat Index

- Zillow’s market heat index shows the nation is currently a neutral market.

- The strongest seller’s markets in the country are Buffalo, Hartford, San Jose, Boston, and New York.

- The strongest buyer’s markets in the country are New Orleans, Miami, Jacksonville, Austin, and Tampa.

Rents

- Asking rents increased by 0.2% month-over-month in August. The pre-pandemic average for this time of year is 0.4%.

- Rents are now up 3.4% from last year.

- Rents fell, on a monthly basis, in 2 major metro areas – Austin (-0.4%) and Boston (-0.1%).

- Rents are up from year-ago levels in 49 of the 50 largest metro areas. Annual rent increases are highest in Hartford (7.7%), Cleveland (7.2%), Louisville (7.1%), Richmond (6.8%), and Virginia Beach (6.6%).

Zillow Writer: Skylar Olsen

August 17, 2024 marks a seismic shift in the real estate industry.

It’s a day that will reshape how buyers and sellers interact, and most importantly, it will redefine the relationship between buyers and their agents.

For those of us who have been in real estate for decades, this change feels almost revolutionary. But the seeds of this transformation were planted back in the 1990s when buyers first began advocating for buyer’s agents to be true fiduciaries, safeguarding their interests above all else. This movement was driven by a desire for transparency, accountability, and a partnership that ensured buyers were fully represented in one of the most significant financial decisions of their lives.

The Shift in Commissions

Traditionally, buyer agents were compensated through the MLS, with commissions often baked into the sale price of a home. Come August 17th, however, this practice will no longer be the default. Commissions for buyer agents will be removed from the MLS, meaning buyers and agents alike will be in the dark about whether compensation is available. This is a significant departure from the status quo, where both parties had clear expectations going into a transaction.

New Requirements for Buyers

Another key change is the introduction of mandatory signed agreements before buyers can even tour a property privately with an agent. These agreements come in various forms:

- Exclusive Buyer Agency Contract: A commitment that binds the buyer to an agent for a specified period, often requiring compensation upfront for their services.

- Single Property Tour Form: A more flexible agreement for buyers who want to tour a specific property without long-term commitment.

- Non-Exclusive Buyer Agency Contract: Ideal for investors, this agreement allows buyers to work with multiple agents simultaneously, offering flexibility in their search.

The introduction of these forms signals a new era where the choice of representation matters more than ever. Buyers must be more strategic in selecting their agents, ensuring they align with their needs and goals.

Historical Context: The Evolution of Buyer Representation

In the 1990s, the concept of a buyer’s agent being a fiduciary was a radical idea. Before that, most agents worked primarily for the seller, even if they were showing homes to buyers. The introduction of buyer agency contracts changed the game, giving buyers their own advocates in the transaction process. Today’s changes build on that legacy, pushing the industry toward even greater transparency and fairness.

What Buyers Need to Do Now

As we navigate this new landscape, it’s crucial for buyers to understand their options and the implications of these changes:

- Educate Yourself: Understanding the different types of agreements and how they affect your buying power is more important than ever.

- Choose Wisely: The agent you work with will significantly impact your experience and outcome. Make sure they are fully informed and able to articulate their value proposition.

- Plan Ahead: The days of casually touring homes without a plan are over. Buyers must now be more deliberate in their approach, ensuring they have the right representation in place from the start.

Questions to Consider

- Are you prepared for the new requirements in the home-buying process starting August 17th?

- How will the removal of buyer agent commissions from the MLS affect your home search strategy?

- What should you look for in a buyer’s agent in this new era of real estate?

Conclusion

The real estate market is on the cusp of a significant change, but with the right preparation and understanding, buyers and sellers can navigate these new waters successfully. Who you work with matters more than ever, and having the right representation can make all the difference in achieving your real estate goals. That’s why you can call any of our CA Real Estate Group agents to help you navigate your next real estate purchase or sale.

CA Real Estate Group | Caliber RE Group

👩🏻 Christine Almarines @christine_almarines

Realtor DRE# 01412944 | (714) 476-4637

👩🏻 Anaid Bautista @wealthwithanaid

Realtor DRE# 02179675 | (949) 391-8266

Hablo español

👩🏻 Letty Luna @lettylunarealestate

Realtor DRE# 02174000 | (562) 879-4181

👩🏻 PT Nguyen @sellsocalbuypt

Realtor DRE# 02223919 | (714) 756-0240

Mike Urban is an Award-Winning Boston Realtor. Featured In: 🏆Boston 25 News, Times-Tribune, Abington Suburban. Published on Aug 9, 2024.

Are you on the fence about whether to sell your house now or hold off? It’s a common dilemma, but here’s a key point to consider: your lifestyle might be the biggest factor in your decision. While financial aspects are important, sometimes the personal motivations for moving are reason enough to make the leap sooner rather than later.

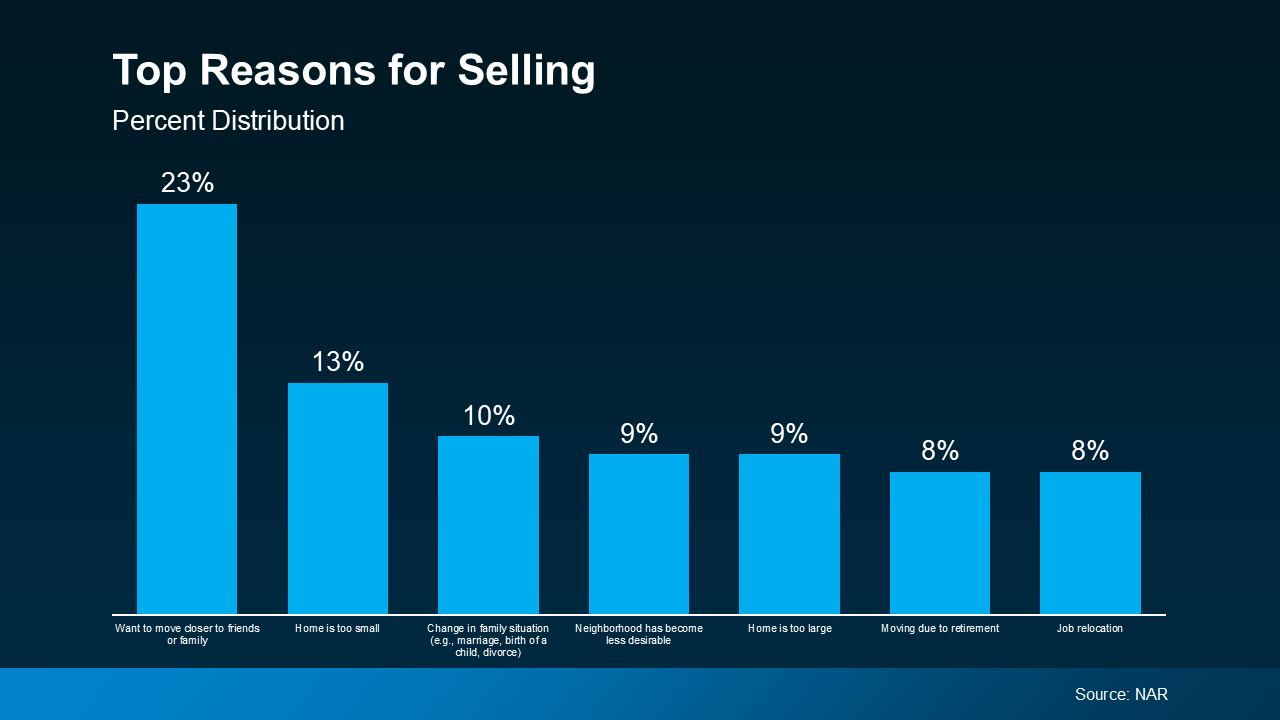

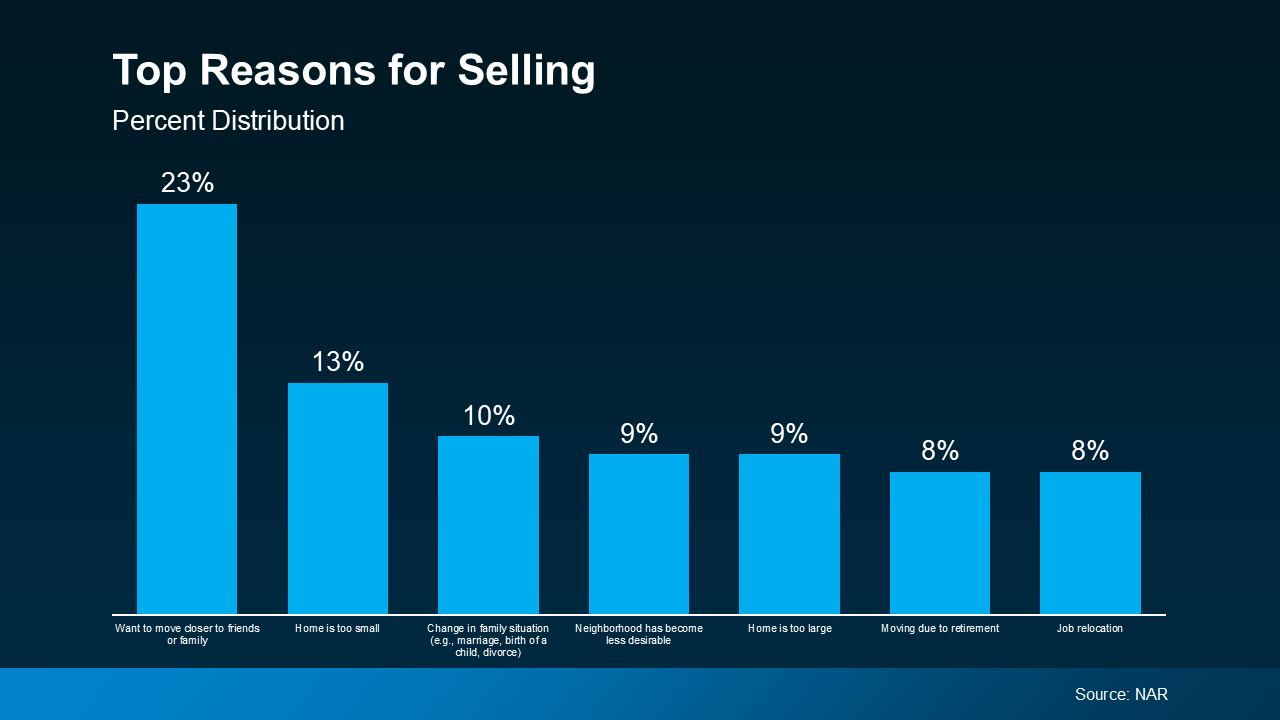

An annual report from the National Association of Realtors (NAR) offers insight into why homeowners like you chose to sell. All of the top reasons are related to life changes. As the graph below highlights:

As the visual shows, the biggest motivators were the desire to be closer to friends or family, outgrowing their current house, or experiencing a significant life change like getting married or having a baby. The need to downsize or relocate for work also made the list.

As the visual shows, the biggest motivators were the desire to be closer to friends or family, outgrowing their current house, or experiencing a significant life change like getting married or having a baby. The need to downsize or relocate for work also made the list.

If you, like the homeowners in this report, find yourself needing features, space, or amenities your current home just can’t provide, it may be time to consider talking to a real estate agent about selling your house. Your needs matter. That agent will walk you through your options and what you can expect from today’s market, so you can make a confident decision based on what matters most to you and your loved ones.

Your agent will also be able to help you understand how much equity you have and how it can make moving to meet your changing needs that much easier. As Danielle Hale, Chief Economist at Realtor.com, explains:

“A consideration today’s homeowners should review is what their home equity picture looks like. With the typical home listing price up 40% from just five years ago, many home sellers are sitting on a healthy equity cushion. This means they are likely to walk away from a home sale with proceeds that they can use to offset the amount of borrowing needed for their next home purchase.”

Bottom Line

Your lifestyle needs may be enough to motivate you to make a change. If you want help weighing the pros and cons of selling your house, connect with CA Real Estate Group today.

CA Real Estate Group | Caliber RE Group

👩🏻 Christine Almarines @christine_almarines

Realtor DRE # 01412944

(714) 476-4637 | christine@carealestategroup.com

👩🏻 Anaid Bautista @wealthwithanaid

Realtor DRE# 02179675

(949) 391-8266 | anaid@carealestategroup.com

👩🏻 Letty Luna @lettylunarealestate

Realtor DRE# 02174000

(562) 879-4181 | letty@carealestategroup.com

👩🏻 PT Nguyen @sellsocalbuypt

Realtor DRE# 02223919

(714) 756-0240 | letty@carealestategroup.com

When you’re thinking about buying a home, your credit score is one of the biggest pieces of the puzzle. Think of it like your financial report card that lenders look at when trying to figure out if you qualify, and which home loan will work best for you. As the Mortgage Report says:

“Good credit scores communicate to lenders that you have a track record for properly managing your debts. For this reason, the higher your score, the better your chances of qualifying for a mortgage.”

The trouble is most buyers overestimate the minimum credit score they need to buy a home. According to a report from Fannie Mae, only 32% of consumers have a good idea of what lenders require. That means nearly 2 out of every 3 people don’t.

So, here’s a general ballpark to give you a rough idea. Experian says:

“The minimum credit score needed to buy a house can range from 500 to 700, but will ultimately depend on the type of mortgage loan you’re applying for and your lender. Most lenders require a minimum credit score of 620 to buy a house with a conventional mortgage.”

Basically, it varies. So, even if your credit isn’t perfect, there are still options out there. FICO explains:

“While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy, including the level of risk it finds acceptable. There is no single “cutoff score” used by all lenders, and there are many additional factors that lenders may use . . .”

And if your credit score needs a little TLC, don’t worry—Experian says there are some easy steps you can take to give it a boost, including:

1. Pay Your Bills on Time

Lenders want to see that you can reliably pay your bills on time. This includes everything from credit cards to utilities and cell phone bills. Consistent, on-time payments show you’re a responsible borrower.

2. Pay Off Outstanding Debt

Paying down what you owe can help lower your overall debt and make you less of a risk to lenders. Plus, it improves your credit utilization ratio (how much credit you’re using compared to your total limit). A lower ratio means you’re more reliable to lenders.

3. Don’t Apply for Too Much Credit

While it might be tempting to open more credit cards to build your score, it’s best to hold off. Too many new credit applications can lead to hard inquiries on your report, which can temporarily lower your score.

Bottom Line

Your credit score is crucial when buying a home. Even if your score isn’t perfect, there are still pathways to homeownership. Let’s connect if you want to go over your options with an expert.

Let’s connect and plan your next steps. Find out if we’re the right real estate team for you!

CA Real Estate Group | Caliber RE Group

👩🏻 Christine Almarines @christine_almarines

Realtor DRE# 01412944 | (714) 476-4637

👩🏻 Anaid Bautista @wealthwithanaid

Realtor DRE# 02179675 | (949) 391-8266

Hablo español

Realtor.com | Aug 13, 2024

The high mortgage rates that have paralyzed America’s housing market are falling—and could nosedive further by the end of the year.

Rates for a 30-year fixed mortgage plunged to 6.47%—the lowest in over a year—for the week ending Aug. 8, according to Freddie Mac.

And with inflation losing steam and the economy cooling, expectations are high that the Federal Reserve could make not just one, but two rate cuts by the end of this year.

As a result, Realtor.com® senior economist Ralph McLaughlin expects mortgage rates to drop further in September and December, which is “encouraging news for potential homebuyers who have been waiting to participate in the market.”

This is also encouraging news for homeowners who might be thinking of selling. Is it time to finally list their property on the market? And if they do, what should they expect?

To help shed some light on what’s coming down the pike for home sellers, here’s what real estate experts predict will happen to the housing market once rates take the plunge.

The ‘lock-in effect’ will ease—and homeowners will start selling

A recent Realtor.com analysis found that 86% of homeowners have mortgage rates below 6%. Understandably, many feel “locked in,” unwilling to trade in their low rate for today’s higher ones if they sell and buy again.

“Home sellers have been sitting on the sidelines, not wanting to give up their COVID-era interest rates,” says Tan Tunador, vice president and senior loan officer with Atlantic Coast Mortgage.

But once rates drop further, that could change.

“The faster rates drop, the less homeowners will be held in place and we could see both new inventory and more sales,” says Danielle Hale, chief economist of Realtor.com.

“There are a significant number of sellers that couldn’t stomach—right or wrong—going from a 4% rate to a 7.5% rate,” says Mason Whitehead, a Dallas-based branch manager for Churchill Mortgage. “But they can stomach going from 4% to something in the 5% to 6% range.”

More homebuyers will enter the market

In the same vein that sellers have felt frozen in place, buyers have felt iced out of the market. But if mortgage rates continue to decline, then experts predict more buyers who’ve been on the sidelines finally jump into the market.

“When rates drop, I think you will see pent-up demand hit the market again,” says Whitehead.

Some buyers, like sellers, shelved their house hunt because they felt the payment was too high, but a lower rate makes home shopping more affordable.

“For some that didn’t qualify at 7.5%, they will qualify at 6%,” says Whitehead. “So you have more people able to buy as well.”

In other words, once rates fall, the market will see both more sellers willing to sell, and buyers willing and able to buy.

Sales will come on fast and strong

Any seller thinking of listing would be wise to start prepping right now.

“Mortgage rates have been improving, and they are bringing potential buyers out early, many of whom gave up on buying, either because of the low housing inventory or the higher rate environment the past few years,” says Tunador. “For sellers, listing their house early may give them the opportunity to sell before their competition hits the market.”

Other experts agree: There are definitely signs homebuying activity is beginning to bounce off the mat.

“Mortgage applications have perked up, and refinancing activity also looks to be picking up as rates go lower and owners carrying elevated mortgage rates seek to reduce their monthly payments,” says Charlie Dougherty, director and senior economist at Wells Fargo.

“All told, mortgage applications remain low, but the recent upturn is a promising sign that buying activity is starting to heat up and defrost a housing market frozen by higher interest rates,” adds Dougherty.

And if mortgage rates continue to shift south, things might get even toastier.

“When mortgage rates [stay in] a sub-6.5% average, we will really see the housing inventory increase and sales activity boom,” says Tunador.

Home prices will likely remain high

The good news for sellers is that even as the market gets moving, home prices are expected to remain high, or dip only slightly.

“Sellers will continue to be in a historically strong position, as the U.S. housing market is still short millions of homes,” says Dan Hnatkovskyy, co-founder and CEO of NewHomesMate. “Assuming there isn’t a severe recession, we will likely see only modest price decreases in most markets in 2024.”

However, Hnatkovskyy says that formerly hot markets like Denver, Austin, TX, and Phoenix may see a more significant drop in housing prices as smaller investor money sits on the sidelines for most of 2024. But in general, experts don’t see home prices taking a major dive as interest rates start to descend.

Even so, it will be smart for sellers not to get too cocky with their home pricing.

“Sellers may benefit from realistic pricing and encouraging buyer competition,” says Cassandra Happe, an analyst for WalletHub. “Working with a real estate agent to price strategically and enhancing online presence with 3D tours can maximize the chances of a quick and profitable sale.”

In other words, sellers shouldn’t set their hopes price too high lest they price themselves out of the market.

“Housing affordability will likely remain strained given still-high mortgage rates and the rapid run-up in home prices over the past three years,” says Dougherty. A shaky economy could “keep the pace of home sales relatively tepid.”

Multiple offers may make a comeback

The increase in competition among buyers might mean that sellers once again find themselves in the enviable position of being able to choose from several offers for their homes.

“Sellers will be in luck when mortgage rates start to drop: They’ll have multiple offers to consider and have some extra leverage when negotiating,” predicts Bryson Taggart, senior agent partnership manager for Opendoor. “For example, sellers receiving multiple offers can drive up the price of their home or waive contingencies for an easier close and a more convenient timeline.”

Still, sellers need to remember that the highest offer isn’t always the best offer.

“I advise sellers to evaluate offer terms holistically and select the one that aligns best with their wants and needs,” says Taggart.

For some, that could be an offer from a more qualified buyer or a cash buyer, which provides less of a risk for fall-throughs. If a seller is planning to also purchase a home, they should pick a buyer with favorable terms for an efficient close.

🏡 15216 Maidstone Ave, Norwalk 90650

🏡 3 bd | 1.75 ba | 1,241 sq ft | 5,000 sq ft lot | $825,000

———–

OPEN HOUSE SCHEDULE:

🚩 THU, AUG 15, 3:00-6:30 PM

🚩 FRI, AUG 16, 3:00-6:30 PM

🚩 SAT, AUG 17, 1:00-4:00 PM

🚩 SUN, AUG 18, 1:00-4:00 PM

🍹 Come enjoy our iced tea and iced coffee bar!

———–

🌴 YOU CAN HAVE IT ALL…. Experience the best of modern living with this beautifully remodeled home, complete with a $20,000 NO-REPAYMENT GRANT. Use the grant for a rate buy-down, closing costs, down payment, or a combination of all three.

🌴 This home features 3 bedrooms, 2 bathrooms, and a 2-car garage, plus a convenient in-home laundry room.

🌴 Enjoy a primary bedroom with an en-suite bathroom and a versatile private space that can serve as a gym, office, dressing room, or a possible rental unit.

🌴 Additional highlights include oak wood-like floors, an upgraded kitchen with newer appliances, renovated bathrooms, split AC and a fully finished garage with its own AC and vaulted ceiling.

🌴 Located within walking distance to parks, schools, and stores, this home offers easy access to major freeways (91, 605, 5, 105, 710) and the Norwalk Green Line Station.

🌴 Come see this exceptional property for yourself!

———–

Stop by during our Open House or call and make an appointment for a private showing any day after Aug 15! See more photos of this gorgeous property here: https://marshalladamsmedia.hd.pics/15216-Maidstone-Ave

———–

👩🏻 Christine Almarines @carealestategroup

Buyers Agent Realtor DRE # 01412944

714-476-4637 | christine@carealestategroup.com

CA Real Estate Group | Caliber RE Group

———–

(Listed By Christine Almarines and Caliber Real Estate Group)

🏡 15303 Jersey Ave, Norwalk, CA 90650

🏡 3 bd | 2 ba | 1,434 sq ft | 5,002 sq ft lot | $699,000

———–

OPEN HOUSE SCHEDULE:

🚩 SAT, AUG 17, 1:00-4:00 PM

🚩 SUN, AUG 18, 1:00-4:00 PM

———–

🌴 Spacious living room with laminate flooring opens to the dining room with a built-in cabinet.

🌴 The kitchen has new linoleum, maple cabinets, a Kitchen Aid oven and microwave combo, and a 4-burner cooktop.

🌴 Plenty of cabinet and counter space with a breakfast nook and laundry just off the kitchen area.

🌴 To service the three bedrooms is the hall bath with tile flooring and a tub/shower combo, sink with a solid Corian-like counter. The other bath also has a shower.

🌴 Double-pane windows, fresh paint both inside and out, and new carpet in all bedrooms.

🌴 The addition family room houses a fireplace, built-in bookshelves, and ¾ bathroom.

🌴 Possible workshop space in the 2- car garage with a newer garage door.

🌴 Amply shaded backyard is mostly brick for ease of care.

———–

Stop by during our Open House or call and make an appointment for a private showing! Take a virtual tour & more see more photos of this gorgeous property here: https://carealestategroup.com/15303-jersey-ave-norwalk/

———–

👩🏻 Anaid Bautista @wealthwithanaid

Buyers Agent Realtor DRE # 02179675

(949) 391-8266 | anaid@carealestategroup.com

CA Real Estate Group | Caliber RE Group

———–

(Listing by Edie Israel [DRE#01399225] and Keller Williams Realty)

Keeping Current Matters | Apr 16, 2024

If you’ve got a move on your mind, you may be wondering whether you should wait to sell until mortgage rates come down before you spring into action. Here’s some information that could help answer that question for you.

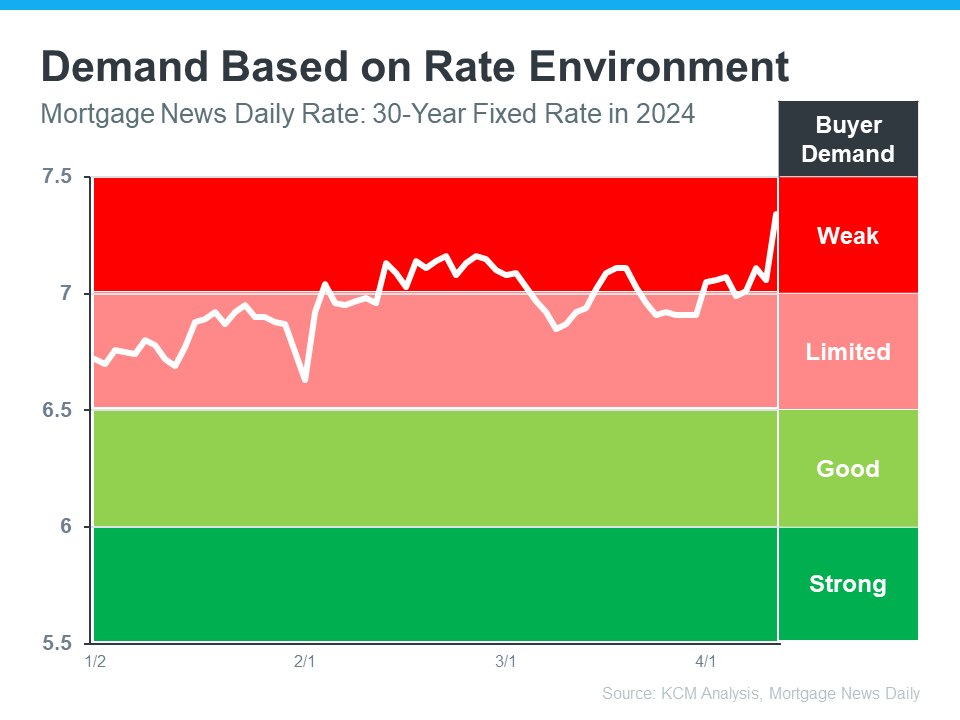

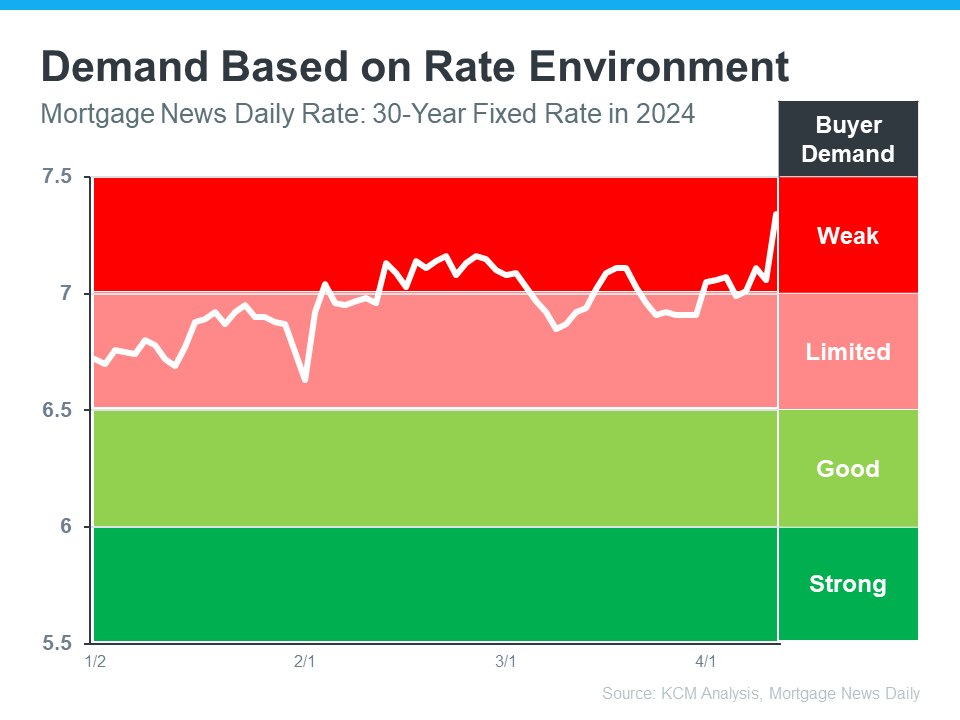

In the housing market, there’s a longstanding relationship between mortgage rates and buyer demand. Typically, the higher rates are, you’ll see lower buyer demand. That’s because some people who want to move will be hesitant to take on a higher mortgage rate for their next home. So, they decide to wait it out and put their plans on hold.

But when rates start to come down, things change. It goes from limited or weak demand to good or strong demand. That’s because a big portion of the buyers who sat on the sidelines when rates were higher are going to jump back in and make their moves happen. The graph below helps give you a visual of how this relationship works and where we are today:

As Lisa Sturtevant, Chief Economist for Bright MLS, explains:

“The higher rates we’re seeing now [are likely] going to lead more prospective buyers to sit out the market and wait for rates to come down.”

Why You Might Not Want To Wait

If you’re asking yourself: what does this mean for my move? Here’s the golden nugget. According to experts, mortgage rates are still projected to come down this year, just a bit later than they originally thought.

When rates come down, more people are going to get back into the market. And that means you’ll have a lot more competition from other buyers when you go to purchase your next home. That may make your move more stressful if you wait because greater demand could lead to an increase in multiple offer scenarios and prices rising faster.

But if you’re ready and able to sell now, it may be worth it to get ahead of that. You have the chance to move before the competition increases.

Bottom Line

If you’re thinking about whether you should wait for rates to come down before you move, don’t forget to factor in buyer demand. Once rates decline, competition will go up even more. If you want to get ahead of that and sell now, talk to a CA Real Estate Agent.

Let’s connect and plan your next steps. Find out if we’re the right real estate team for you!

CA Real Estate Group | Caliber RE Group

👩🏻 Christine Almarines @carealestategroup

Realtor DRE# 01412944 | 714-476-4637

👩🏻 Anaid Bautista @wealthwithanaid

Realtor DRE# 02179675 | 949-391-8266

Hablo español