While higher mortgage rates are creating affordability challenges for homebuyers this year, there is some good news for those people still looking to buy a home.

As the market has cooled this year, some of the intensity buyers faced during the peak frenzy of the pandemic has cooled too. Here are just a few trends that may benefit you when you go to buy a home today.

1. More Homes To Choose from

During the pandemic, housing supply hit a record low at the same time buyer demand skyrocketed. This combination made it difficult to find a home because there just weren’t enough to meet buyer demand. According to Calculated Risk, the supply of homes for sale increased by 39.5% for the week ending October 28 compared to the same week last year.

Even though it’s still a sellers’ market and supply is still lower than more normal levels, you have more to choose from in your home search. That makes finding your dream home a bit less difficult.

2. Bidding Wars Have Eased

One of the top stories in real estate over the past two years was the intensity and frequency of bidding wars. But today, things are different. With more options, you’ll likely see less competition from other buyers looking for homes. According to the National Association of Realtors (NAR), the average number of offers on recently sold homes has declined. This September, the average was 2.5 offers per sale. In contrast, last September, the average was 3.7 offers per sale.

If you tried to buy a house over the past two years, you probably experienced the bidding war frenzy firsthand and may have been outbid on several homes along the way. Now you have a chance to jump back into the market and enjoy searching for a home with less competition.

3. More Negotiation Power

And when you have less competition, you also have more negotiating power as a buyer. Over the last two years, more buyers were willing to skip important steps in the homebuying process, like the appraisal or inspection, to try to win a bidding war. But the latest data from the National Association of Realtors (NAR) shows the percentage of buyers waiving those contingencies is going down.

As a buyer, this is good news. The appraisal and the inspection give you important information about the value and condition of the home you’re buying. And if something turns up in the inspection, you have more power today to renegotiate with the seller.

A survey from realtor.com confirms more sellers are accepting offers that include contingencies today. According to that report, 95% of sellers said buyers requested a home inspection, and 67% negotiated with buyers on repairs as a result of the inspection findings.

Bottom Line

While buyers still face challenges today, they’re not necessarily the same ones you may have been up against just a year or so ago. If you were outbid or had trouble finding a home in the past, now may be the moment you’ve been waiting for. Let’s connect to start the homebuying process today.

Keeping Current Matters | Oct 19, 2022

While the Federal Reserve is working hard to bring down inflation, the latest data shows the inflation rate is still high, remaining around 8%. This news impacted the stock market and added fuel to the fire for conversations about a recession.

You’re likely feeling the impact in your day-to-day life as you watch the cost of goods and services climb. The pinch it’s creating on your wallet and the looming economic uncertainty may leave you wondering: “should I still buy a home right now?” If that question is top of mind for you, here’s what you need to know.

Homeownership Is Historically a Great Hedge Against Inflation

In an inflationary economy, prices rise across the board. Historically, homeownership is a great hedge against those rising costs because you can lock in what’s likely your largest monthly payment (your mortgage) for the duration of your loan. That helps stabilize some of your monthly expenses. James Royal, Senior Wealth Management Reporter at Bankrate, explains:

“A fixed-rate mortgage allows you to maintain the biggest portion of housing expenses at the same payment. Sure, property taxes will rise and other expenses may creep up, but your monthly housing payment remains the same.”

And with rents being as high as they are, the ability to stabilize your monthly payments and protect yourself from future rent hikes may be even more important. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains what happened to rents in the latest inflation report:

“Inflation refuses to budge. In September, consumer prices rose by 8.2%. Rents rose by 7.2%, the highest pace in 40 years.”

When you rent, your monthly payment is determined by your lease, which typically renews on an annual basis. With inflation high, your landlord may be more likely to increase your payments to offset the impact of inflation. That may be part of the reason why a survey from realtor.com shows 72% of landlords said they plan to raise the rent on one or more of their properties in the next year.

Becoming a homeowner, if you’re ready and able to do so, can provide lasting stability and a reliable shelter in times of economic uncertainty.

Bottom Line

The best hedge against inflation is a fixed housing cost. If you’re ready to learn more and start your journey to homeownership, let’s connect.

Keeping Current Matters | Octo 21, 2022

![3 Questions You May Be Asking About Selling Your House Today [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/10/20151852/3-questions-you-may-be-asking-about-selling-your-house-today-MEM-1046x2637.png)

- If you’re planning to sell your house this year, you likely have questions about what the shift in the housing market means for your home sale.

- You might be wondering: Should I wait to sell? Are buyers still out there? And can I afford to buy my next home?

- Let’s connect so you can get answers to these questions and learn about the opportunities you still have in today’s housing market.

Keeping Current Matters | Oct 6, 2022

Rising interest rates have begun to slow an overheated housing market as monthly mortgage payments have risen dramatically since the beginning of the year. This is leaving some people who want to purchase a home priced out of the market and others wondering if now is the time to buy one. But this rise in borrowing cost shows no signs of letting up soon.

Economic uncertainty and the volatility of the financial markets are causing mortgage rates to rise. George Ratiu, Senior Economist and Manager of Economic Research at realtor.com, says this:

“While even two months ago rates above 7% may have seemed unthinkable, at the current pace, we can expect rates to surpass that level in the next three months.”

So, is now the right time to buy a home? Anyone thinking about buying a home today should ask themselves two questions:

1. Where Do I Think Home Prices Are Heading?

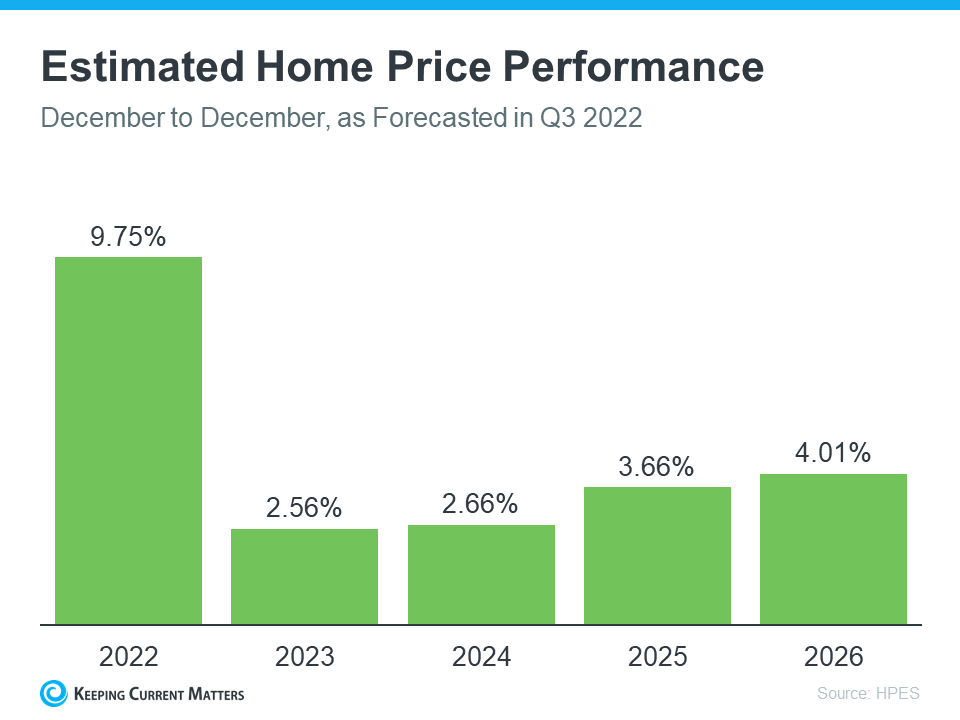

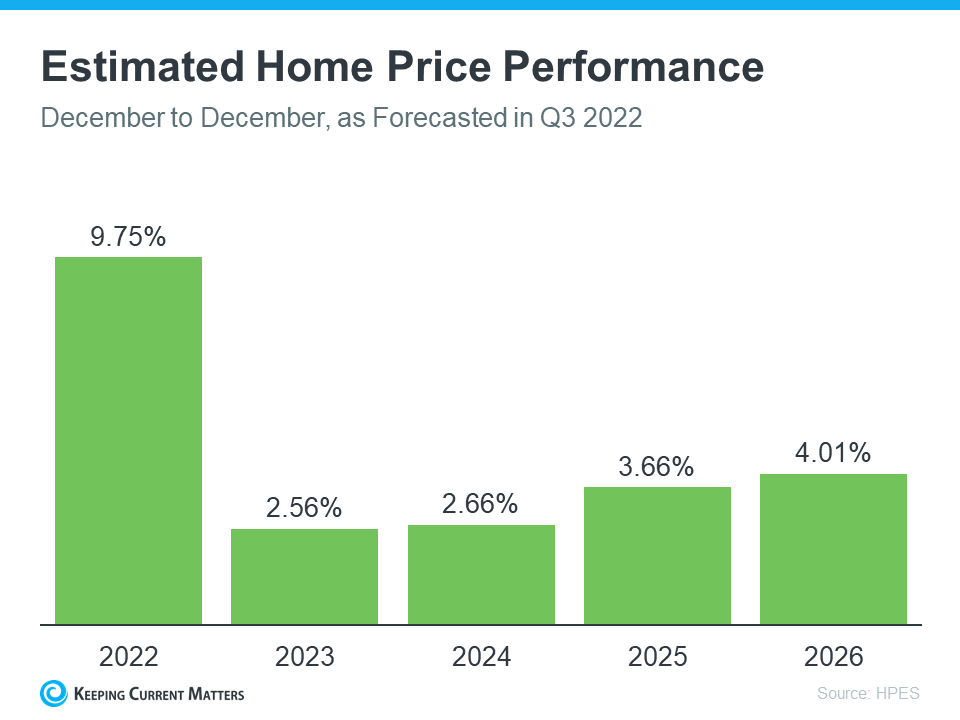

There are two places to turn to answer this question. First is the consensus of what experts are saying. If you look at what experts are projecting for home prices in 2023, they’re forecasting home price appreciation around 2%. While it’s true some are calling for depreciation, most are calling for appreciation in home values over the next year.

The second spot to turn to for information is the Home Price Expectation Survey from Pulsenomics – a survey of a national panel of over one hundred economists, real estate experts, and investment and market strategists. According to the latest release, the experts surveyed are also calling for home price appreciation for the next several years (see graph below):

2. Where Do I Think Interest Rates Are Heading?

Like mentioned above, Ratiu sees mortgage rates rising over the next several months. Another expert agrees. Mark Fleming, Chief Economist at First American, says:

“While mortgage rates are expected to continue to drift higher over the coming months, much of the rapid increase in rates is likely behind us.”

The instability in the world and higher inflation are driving this volatile market, resulting in higher borrowing rates for those looking to buy homes.

Bottom Line

If you’re thinking about buying a home, asking yourself about home prices and mortgage rates will help you make a powerful and confident decision. Experts see both prices and rates rising in the future. The alternative is to rent, but rents are also increasing. That may mean buying a home makes more sense than renting.

Let’s chat and connect!

Christine Almarines @carealestategroup

Realtor DRE # 01412944

714-476-4637 | christine@carealestategroup.com

Michelle Kim @michellejeankim_homes

Realtor DRE # 01885912

714-253-7531 | michelle@carealestategroup.com

Esther Oh @estheroh_realtor

Realtor DRE # 02155451

323-0899-7065 | esther@carealestategroup.com

While watching the stock market recently may have started to feel pretty challenging, checking the value of your home should come as welcome relief in this volatile time. If you’re a homeowner, your net worth got a big boost over the past few years thanks to rising home prices. And that increase in your wealth came in the form of home equity. Here’s how it works.

Equity is the current value of your home minus what you owe on the loan. Because there was a significant imbalance between the number of homes available for sale and the number of buyers looking to make a purchase over the past few years, home prices appreciated substantially. And while rising inventory and mortgage rates have cooled the market some in recent months, home prices nationally remain strong.

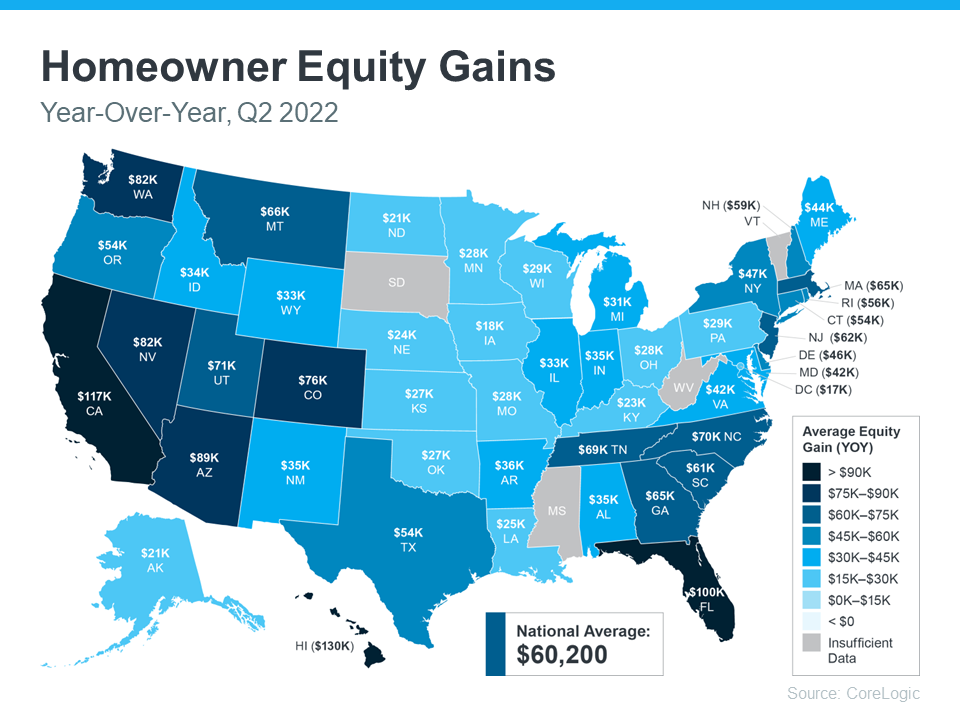

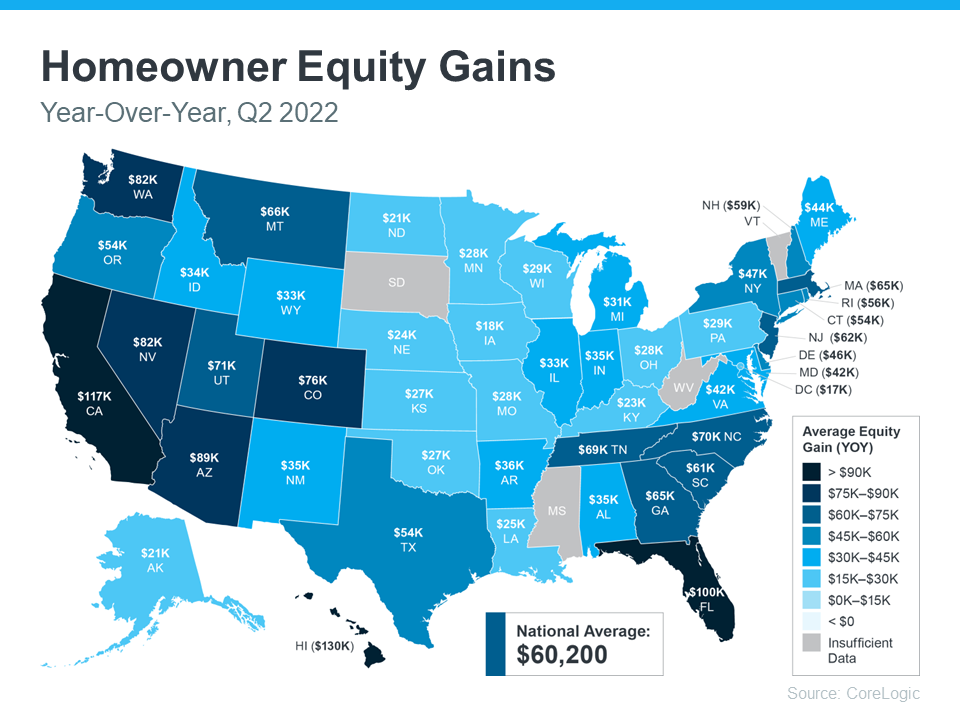

That’s why, according to the latest Homeowner Equity Insights from CoreLogic, the average homeowner equity has grown by $60,000 over the last 12 months. While that’s the national number, if you want to know what happened, on average, over the past year in your area, look at the map below from CoreLogic:

Why This Is So Important Right Now

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), helps explain why this matters so much today:

“. . . the decline in the stock market has dented overall net wealth. It has fallen by $6 trillion from the first to the second quarter. Only housing wealth has held on, with homeowners’ real estate wealth (home value minus mortgage balance) rising by $1.2 trillion.”

While equity helps increase your overall net worth, it can also help you achieve other goals like buying your next home. When you sell your current house, the equity you built up comes back to you in the sale, and it may be just what you need to cover a large portion – if not all – of the down payment on your next home.

Bottom Line

There’s volatility in today’s stock market, but home equity is still incredibly strong. To find out just how much equity you have in your current home, let’s connect.

Keeping Current Matters | Sep 8, 2022

There’s no denying the housing market is undergoing a shift this season as buyer demand slows and the number of homes for sale grows. But that shift actually gives you some unique benefits when you sell. Here’s a look at the key opportunities you have if you list your house this fall.

Opportunity #1: You Have More Options for Your Move

One of the biggest stories today is the growing supply of homes for sale. Housing inventory has been increasing since the start of the year, primarily because higher mortgage rates helped cool off the peak frenzy of buyer demand. But what you may not realize is, that actually could benefit you.

If you’re selling your house to make a move, it means you’ll have more options for your own home search. That gives you an even better chance to find a home that checks all of your boxes. So, if you’ve put off selling because you were worried about being able to find somewhere to go, know your options have improved.

Opportunity #2: The Number of Homes on the Market Is Still Low

Just remember, while data shows the number of homes for sale has increased this year, housing supply is still firmly in sellers’ market territory. To be in a balanced market where there are enough homes available to meet the pace of buyer demand, there would need to be a six months’ supply of homes. According to the latest report from the National Association of Realtors (NAR), in July, there was only a 3.3 months’ supply.

While you’ll have more options for your own home search, inventory is still low, and that means your home will still be in demand if you price it right. That’s why the most recent data from NAR also shows the average home sold in July still saw multiple offers and sold in as little as 14 days.

Opportunity #3: Your Equity Has Grown by Record Amounts

The home price appreciation the market saw over the past few years has likely given your equity (and your net worth) a considerable boost. Danielle Hale, Chief Economist at realtor.com, explains:

“Home owners trying to decide if now is the time to list their home for sale are still in a good position in many markets across the country as a decade of rising home prices gives them a substantial equity cushion . . .”

If you’ve been holding off on selling because you’re worried about how rising prices will impact your next home search, rest assured your equity can help. It may be just what you need to cover a large portion (if not all) of the down payment on your next home.

Bottom Line

If you’re thinking about selling your house this season, work with a real estate professional so you have the expert insights you need to make the best possible move today.

💡 For more Real Estate Tips like these, Home Maintenance Tips on Mondays, and Fun Fridays, follow us at @carealestategroup — we are more than just real estate!

👩 Christine Almarines @christine_almarines

Realtor DRE # 01412944 714-476-4637 | christine@carealestategroup.com

👩 Michelle Kim @michellejeankim_homes

Realtor DRE # 01885912 714-253-7531 | michelle@carealestategroup.com

👩 Esther Oh @estheroh_realtor

Realtor DRE # 02155451 323-0899-7065 | esther@carealestategroup.com

As a homebuyer, it’s important to plan and budget for the expenses you’ll encounter when you purchase a home. While most people understand the need to save for a down payment, a recent survey found 41% of homebuyers were surprised by their closing costs. Here’s some information to help you get started so you’re not caught off guard when it’s time to close on your home.

What Are Closing Costs?

One possible reason some people are surprised by closing costs may be because they don’t know what they are or what they cover. According to U.S. News and World Report:

“Closing costs encompass a variety of expenses above your property’s purchase price. They include things like lender fees, title insurance, government processing fees, upfront tax payments and homeowners insurance.”

In other words, your closing costs are a collection of fees and payments made to a variety of individuals and organizations who are involved with your transaction. According to Freddie Mac, while they can vary by location and situation, closing costs typically include:

- Government recording costs

- Appraisal fees

- Credit report fees

- Lender origination fees

- Title services

- Tax service fees

- Survey fees

- Attorney fees

- Underwriting Fees

How Much Will You Need To Budget for Closing Costs?

Understanding what closing costs include is important, but knowing what you’ll need to budget to cover them is critical to achieving your homebuying goals. According to the Freddie Mac article mentioned above, the costs to close are typically between 2% and 5% of the total purchase price of your home. With that in mind, here’s how you can get an idea of what you’ll need to cover your closing costs.

Let’s say you find a home you want to purchase for the median price of $350,300. Based on the 2-5% Freddie Mac estimate, your closing fees could be between roughly $7,000 and $17,500.

Keep in mind, if you’re in the market for a home above or below this price range, your closing costs will be higher or lower.

What’s the Best Way To Make Sure You’re Prepared at Closing Time?

Freddie Mac provides great advice for homebuyers, saying:

“As you start your homebuying journey, take the time to get a sense of all costs involved – from your down payment to closing costs.”

The best way to understand what you’ll need at the closing table is to work with a team of trusted real estate professionals. An agent can help connect you with a lender, and together they can provide you with answers to the questions you might have.

Bottom Line

In today’s real estate market, it’s more important than ever to make sure your budget includes any fees and payments due at closing. Work with a local real estate professional to be sure you have the knowledge you need to be confident going into the homebuying process.

🙌 We can help make sure you’re not surprised by closing costs. DM us with any questions you may have.

👩 Christine Almarines @christine_almarines

Realtor DRE # 01412944

714-476-4637 | christine@carealestategroup.com

👩 Michelle Kim @michellejeankim_homes

Realtor DRE # 01885912

714-253-7531 | michelle@carealestategroup.com

Reator.com | Jun 19, 2022

If you’re raring to buy a home, chances are you’ll need a mortgage. But which kind of mortgage should you get?

Home loans aren’t one size fits all, but come in a variety of forms to suit home buyers in different circumstances. One good place to start figuring out your options is a mortgage calculator, where you can plug in various home prices and and have this sum broken down into monthly payments. Still, in addition to a home’s price, you should carefully consider the type of loan you get.

Two of the main types of mortgages home buyers consider getting are a fixed-rate mortgage and an adjustable-rate mortgage, or ARM.

So what’s the difference between these two types of home loans? In a nutshell, a fixed-rate mortgage has an interest rate that stays the same over the life of the loan. An ARM, by contrast, has an interest rate that changes over time.

Before you seek out mortgage pre-approval, let’s break down the pros and cons of each loan so you can decide which one is right for you.

Fixed-rate mortgage

According to Wells Fargo Home Mortgage Area branch manager Chris Jurilla, the majority of homeowners tend to prefer fixed-rate mortgages. And for good reason: A fixed interest rate means your mortgage payments remain steady over the life of your loan.

“Fixed-rate mortgages provide more long-term stability,” Jurilla says. “And with rates still low, borrowers prefer the security of not risking a rate increase or adjustment if the market were to turn.”

If you’re a home buyer with steady employment who wants to put down roots in a community, a fixed-rate mortgage might appeal to you. This kind of loan is also advantageous to people approaching retirement, because the fixed payments make it easier to plan their finances.

The pros of a fixed-rate mortgage:

- Predictability: The interest rate doesn’t change for the life of the loan, giving home buyers peace of mind.

- Fixed costs: You can budget more easily as the rate and payments remain constant.

- Straightforward numbers: The math involved with figuring out your loan is way easier than for an ARM.

- Stability: This predictable loan is more appealing for the risk-averse.

And the cons:

- You’re locked in: You won’t be able to take advantage of falling interest rates without refinancing.

- Your borrowing has a ceiling: You may not qualify for as much house as you would like, because those mortgage payments are typically higher.

Adjustable-rate mortgage

An ARM starts out at a fixed, predetermined interest rate, likely lower than what you would get with a comparable fixed-rate mortgage. However, the rate adjusts after a specified initial period—usually three, five, seven, or 10 years—based on market indexes. If those indexes go up, your payment will go up, too (sometimes way up).

If you’re a more mobile or first-time home buyer who wants to keep your long-term options open, an ARM’s low introductory interest rate is certainly tempting. As long as you’re ready to move on before the introductory period ends, you’ll benefit from the advantage of making lower payments while you’re living in the home. And because your lender will be qualifying you based on a lower monthly payment, you could qualify for a more expensive house than you would with a fixed-rate mortgage.

“ARMs are best suited for investors or home buyers who have short-term ownership goals in mind,” says Jurilla. “Most opt for an ARM if they don’t foresee themselves staying in the home for an extended period of time. There are some who use it as a stepping-stone loan, a short-term solution with a lower monthly payment.”

The pros of an ARM:

- Low initial rate: There are lower rates and payments early in the loan term than in a traditional fixed-rate mortgage.

- You can borrow more: You have a chance of being approved for a more expensive house because your lender will look at the lower payment when qualifying you for the loan.

- Falling rates: Some ARMs allow you to automatically take advantage of lower rates without the hassle and expense of refinancing.

And the cons:

- Unpredictable rates: After the introductory term, payments and rates can rise substantially. However, if market indexes go down, that doesn’t necessarily mean your mortgage payments will, too. Be sure to read the fine print on your mortgage.

- Complicated mortgage agreements: You’ll need to understand the complex terms of your agreement, such as margins, caps, and adjustment indexes.

- Math and more math: You have to put in significantly more work to figure out the math of an ARM and how it could potentially affect your budget.

- Prepayment penalty: You can’t pay off your loan for the number of years specified in your agreement. So if interest rates jump while you still have a prepayment penalty in place, you can’t refinance or sell your home without incurring a huge cost.

Choose the loan that’s best for you

The 30-year fixed-rate mortgage is the most popular in America, but that doesn’t mean it’s perfect for you. An adjustable-rate mortgage can work well for many young or financially savvy homeowners. Still, many borrowers would rather deal with the stability of a fixed rate than the fluctuating payments of an ARM.

So, who wins? Either mortgage can—it all depends on your individual circumstances. Talk to a mortgage lender or mortgage broker to learn more about which one is right for you. And be sure you understand each loan’s terms, and always compare rates before signing onto a mortgage.

ListReports | Aug 4, 2022

“Depreciation” and “Deceleration” are two similar but different terms that you may be seeing in headlines right now.

If you follow the news you may be reading headlines right now that give the impression that home prices are going to take a dive. The reality is that this isn’t completely accurate, and headlines don’t provide a full picture into what’s going on. If you have questions about the market and current trends I’m here to help shed some light.

Leave us a comment or call us and let’s start the conversation!

📞 Call us today!

👩 Christine Almarines @christine_almarines

Realtor DRE # 01412944

714-476-4637 | christine@carealestategroup.com

👩 Michelle Kim @michellejeankim_homes

Realtor DRE # 01885912

714-253-7531 | michelle@carealestategroup.com

linktr.ee/carealestategroup

Some Highlights:

- It’s worth considering the many benefits of homeownership before you make the decision to rent or buy a home.

- When you buy, you can stabilize your housing costs, own a tangible asset, and grow your net worth as you gain equity. When you rent, you face rising housing costs, won’t see a return on your investment, and limit your ability to save.

- If you want to learn more about the benefits of homeownership, let’s connect today.

Christine Almarines @christine_almarines

Realtor DRE # 01412944

714-476-4637 | christine@carealestategroup.com

Michelle Kim @michellejeankim_homes

Realtor DRE # 01885912

714-253-7531 | michelle@carealestategroup.com

![3 Questions You May Be Asking About Selling Your House Today [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/10/20151852/3-questions-you-may-be-asking-about-selling-your-house-today-MEM-1046x2637.png)

![Should I Rent or Should I Buy? [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/07/14124050/20220715-MEM-1046x2129.png)