The headlines are screaming “Crash coming!”

Rates are spiking, buyers are stalling—and suddenly it feels like 2008 all over again, right?

This is Christine Almarines with CARE Group, that’s CA Real Estate Group.

But guess what?

The sky is not falling.

Here’s what you’re not hearing about the 2025 housing market:

Prices? They’re still holding. Some markets are up. Some are softening. A few are dipping—but a dip is not a crash.

After years of double-digit price jumps, the market is finally returning to a healthier, more sustainable pace.

Let’s look at real numbers:

Nationwide, home prices are up 3.9% year-over-year.

Sure, that’s down from the wild growth we saw before—but it’s still growth.

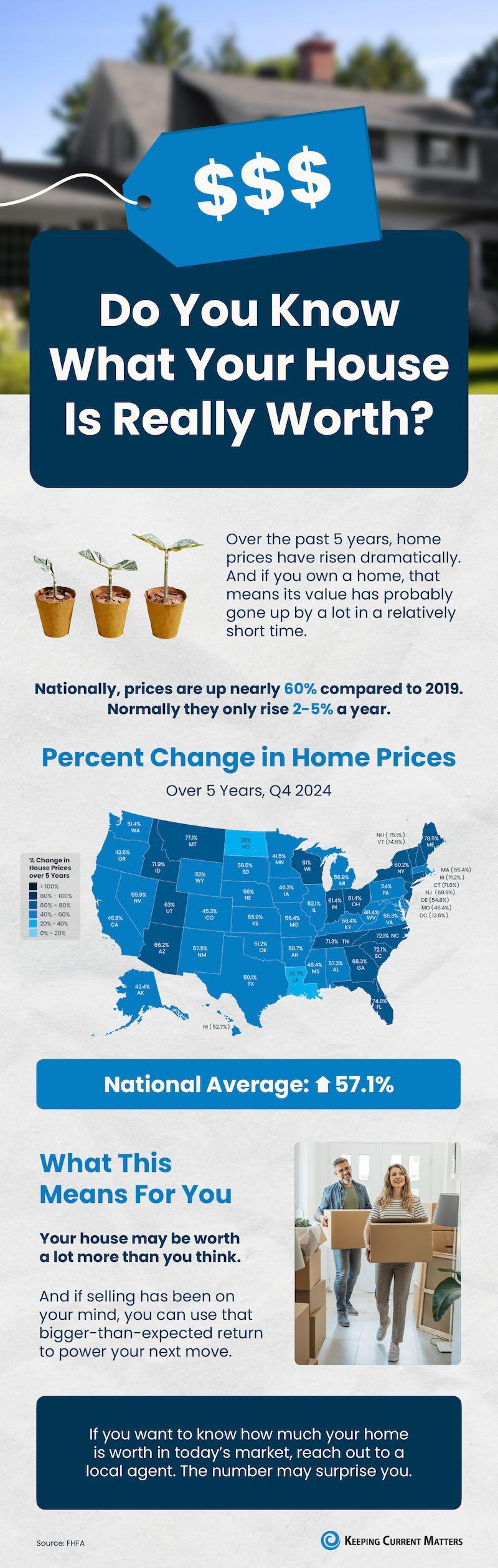

And over the past 5 years? We’ve seen a massive 57% price increase.

This market isn’t broken—it’s balancing.

And we’re not set up for a crash because we don’t have the inventory to crash.

In fact, we’re still sitting about 16% below typical pre-pandemic supply levels.

But fear is gripping the market.

A recent survey showed that 70% of Americans believe a crash is coming. That fear has buyers and sellers freezing up.

→ 1 in 4 buyers are hitting pause.

→ 1 in 8 sellers are holding back.

And rates? Yeah, it’s been a rollercoaster.

Spring gave us a little breather, but summer brought more uncertainty—between tariff talks and Fed indecision, rates jumped again.

The good news?

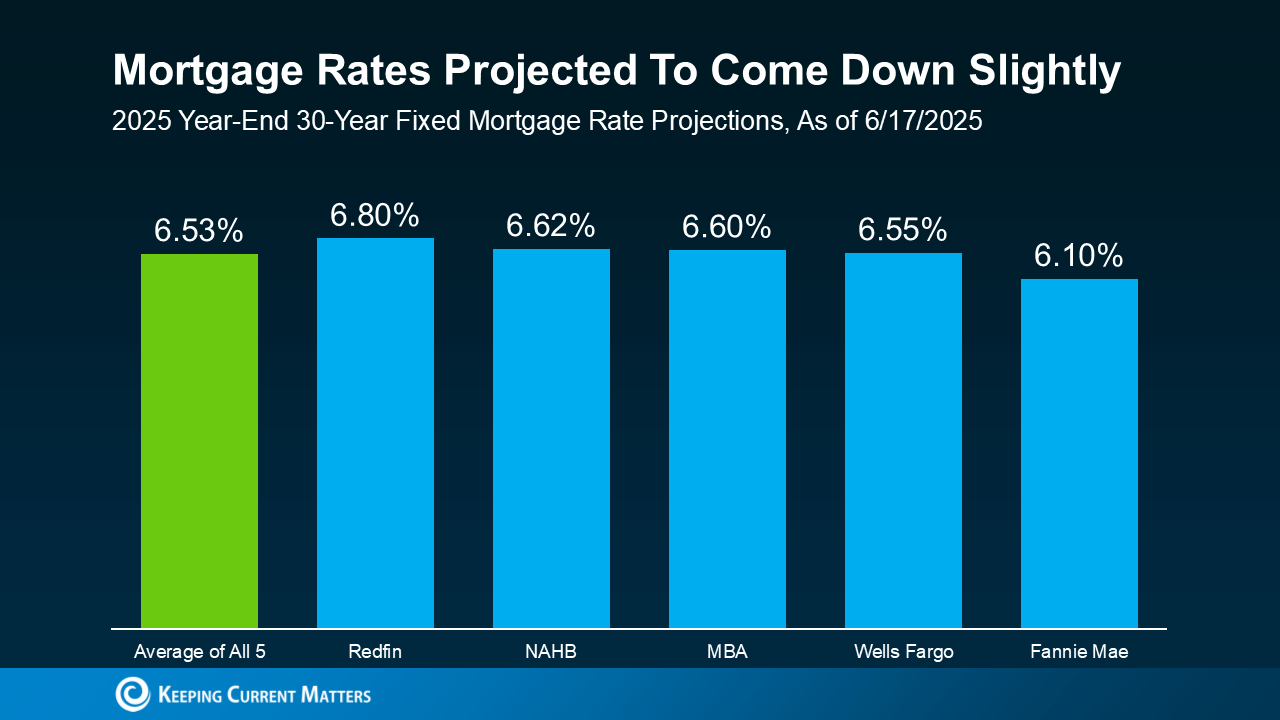

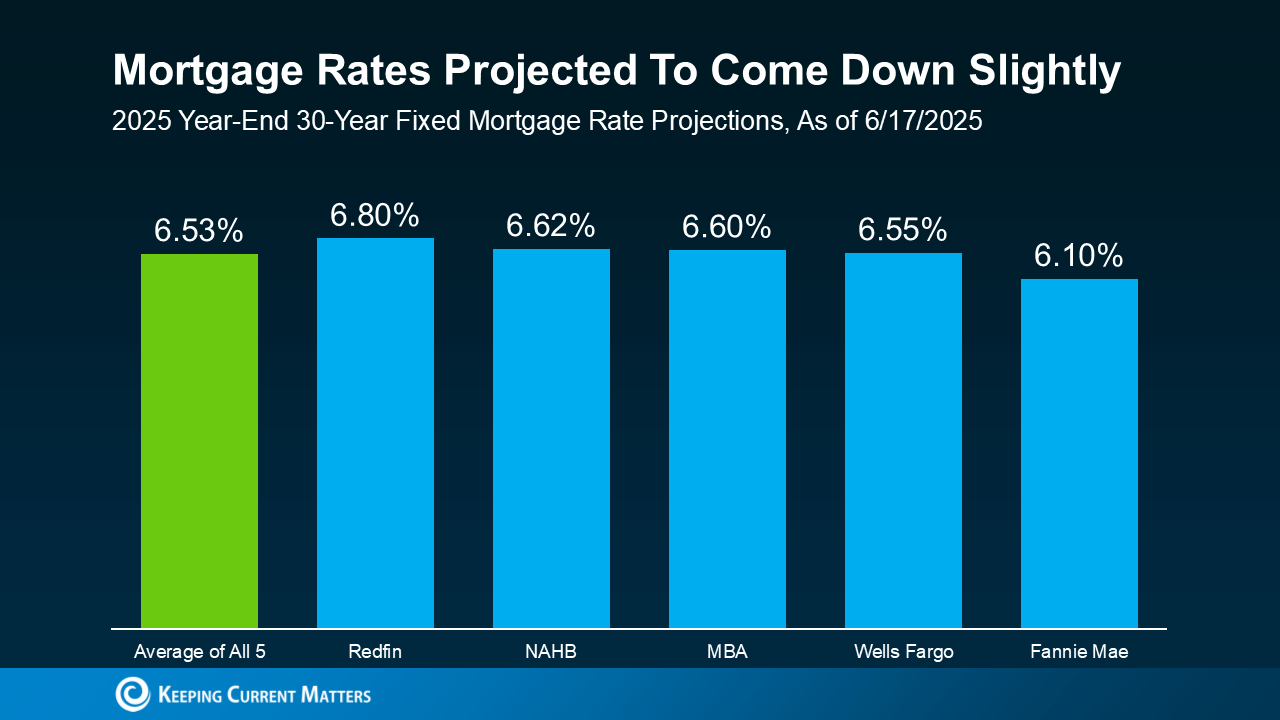

Experts are predicting rates to settle in the low-to-mid 6% range by Q4 2025. That could unlock serious movement heading into the fall.

So, here’s the takeaway:

2025 is not the year of the crash.

It’s the year of strategy.

Whether you’re thinking of buying or wondering if you’ve missed your moment to sell—don’t get paralyzed by fear.

Get informed. Get a plan. Get the right team.

My team and I are here to give you the insights and strategies you need to win in this market—from expert negotiation to powerful marketing, we’ve got you covered.

Thanks for watching—and if you’re ready to take your next step, let’s talk.

At CARE Group, we understand that no one cares how much we know, until they know how much we CARE.

Christine Almarines, Realtor

CA Real Estate Group

714-476-4637

christine@CARealEstateGroup.com

DRE 01412944

powered by Caliber Real Estate

Luxury Agent Designation

Senior Real Estate Specialist, SRES

Short Sale Certified

Probate Specialist Certified

Pricing Strategy Advisor, PSA

Some Highlights

- If recent home price headlines have you feeling worried, here’s some perspective.

- Home values almost always go up in the long run. And the long-term gains offset any short-term dips. Basically, if you plan to live there for 5 or more years, you should be able to buffer yourself against any short-term declines.

-

Connect with CARE Group to have a conversation about what’s happening with prices in your market. Call or text us right now!

CA Real Estate Group | Caliber RE Group

Christine Almarines @christine_almarines

Realtor DRE# 01412944 | (714) 476-4637

Anaid Bautista @anaidrealtor

Realtor DRE# 02179675 | (949) 391-8266

Letty Luna @lettylunarealestate

Realtor DRE# 02174000 | (562) 879-4181

Keeping Current Matters | Jun 18, 2025

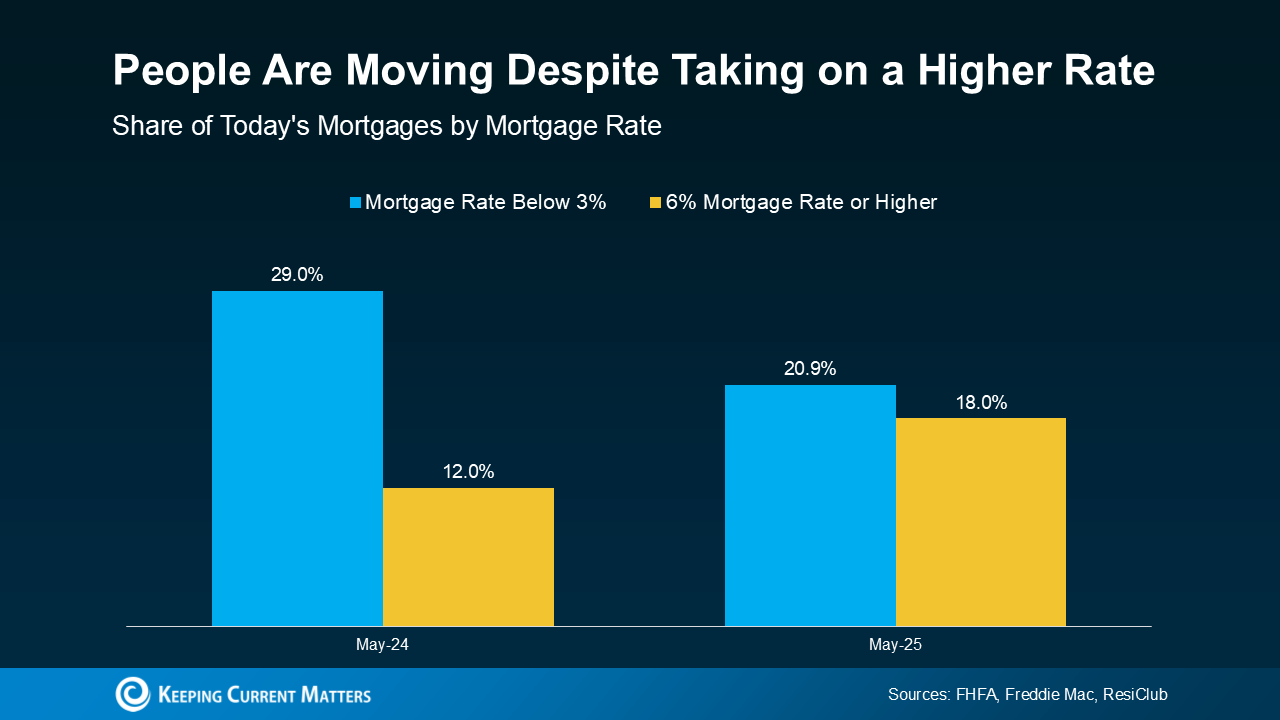

It’s hard to let go of a 3% mortgage rate. There’s no question about it. It’s the main reason why so many homeowners have delayed their move in recent years. But here’s something to consider.

While your low rate might be ideal, it doesn’t make up being too cramped, having a staircase your knees can’t handle anymore, or being 1,000 miles from your family. And those real-life needs are pushing more sellers off the fence despite today’s rates.

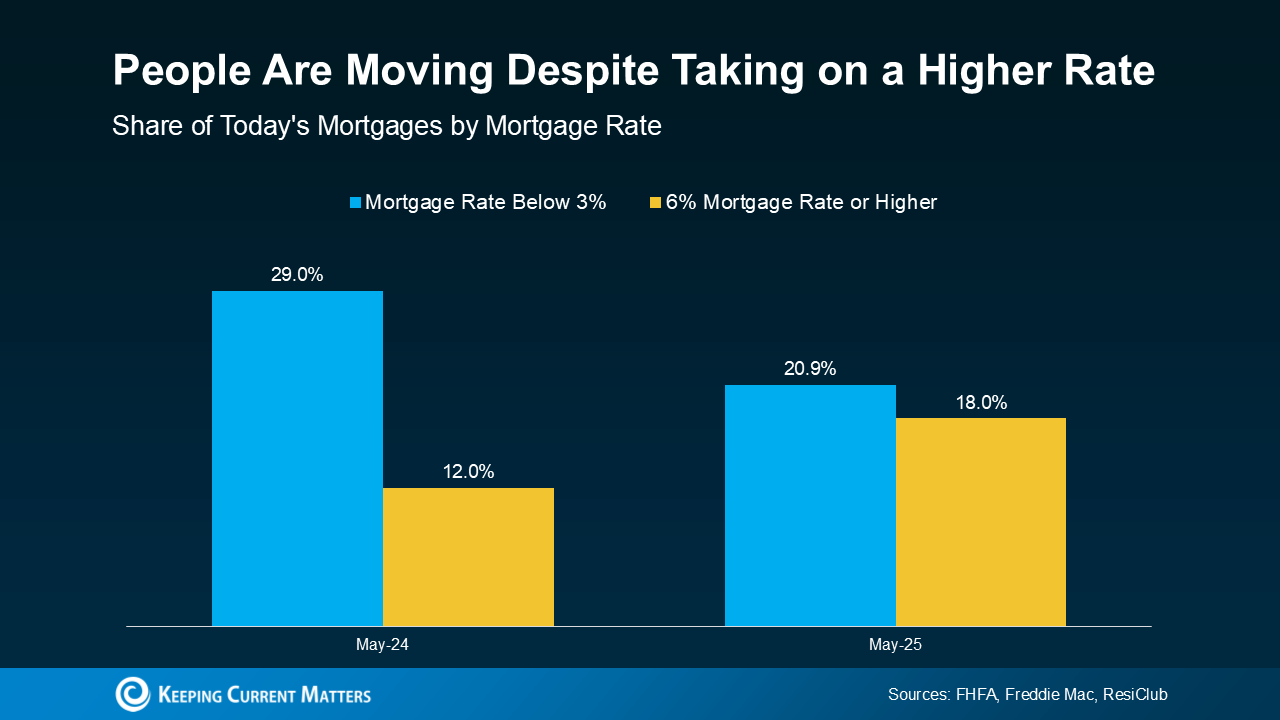

Data shows the share of homeowners with a mortgage rate below 3% is dropping as more people move. And, as a result, the share of homeowners taking on a mortgage rate above 6% is rising, too (see graph below):

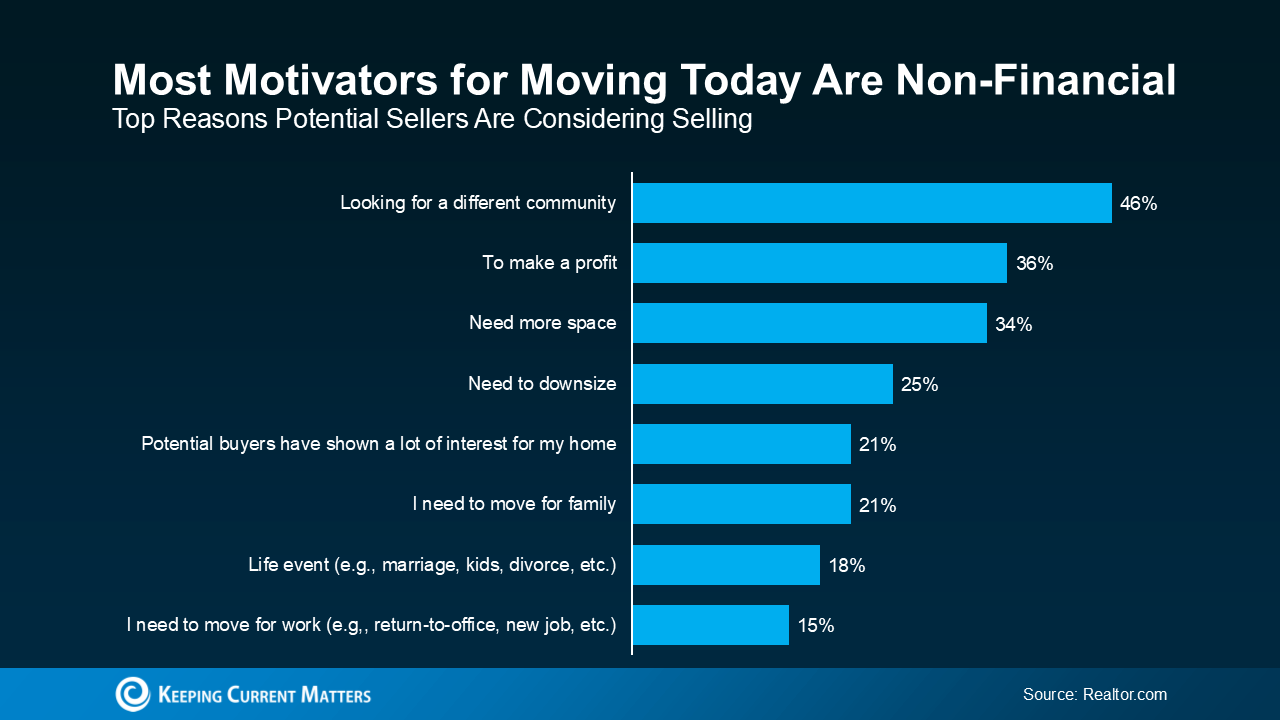

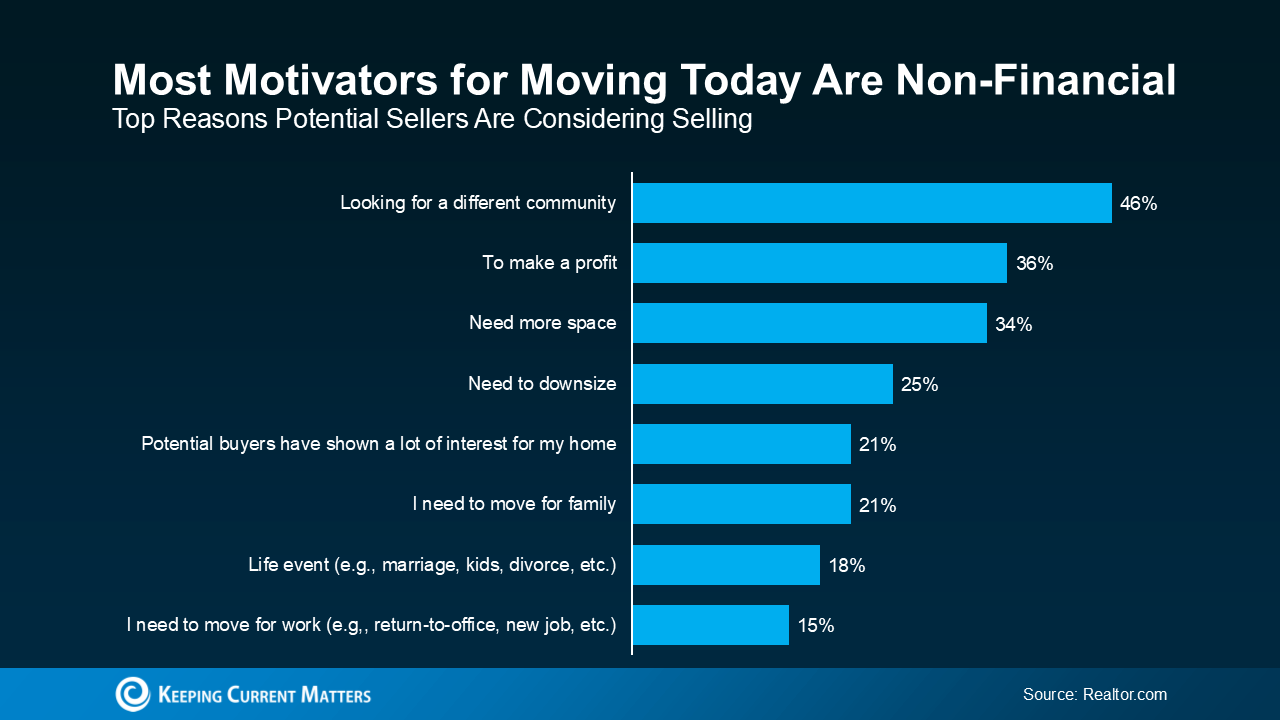

The Biggest Reasons People Are Moving Right Now

Why are some homeowners willing to take on a higher rate?A survey from Realtor.com helps shed light on that. It shows79% of homeowners considering selling today are doing it out of necessity. And that same survey says most of the necessary reasons people are moving are non-financial in nature (see graph below):

Do any of these reasons resonate for you, too?

Do any of these reasons resonate for you, too?

- You Need More Space: Whether it’s a new baby, children needing their own rooms, or having your parents move in so it’s easier to take care of them, outgrowing your space can happen fast.

- You Need Less Space: The kids are out of the house now and you’re craving a life that’s a little simpler. Downsizing can be a major relief: fewer rooms to clean, less to maintain, and lower utility bills, too.

- You Want to Be Closer to Family: Whether it’s to help with grandchildren or care for aging parents, sometimes the pull of being near loved ones outweighs the math.

- A Relationship in Your Life Has Changed: Divorce, separation, or moving in together after a marriage or new partnership – all can create the need for a fresh start and a new place to call home.

- Your Job Is Taking You Somewhere New: If you finally landed your dream job or your partner’s company is relocating, you may need to move too.

What About Mortgage Rates?

Yes, experts expect mortgage rates to ease, but slowly. The latest projections show only modest declines this year – not the 3% you may be hoping for (see graph below):

So, while waiting for a big drop in rates might sound strategic, it could just mean more time feeling stuck in a space that no longer fits. And for many, that waiting game has already gone on long enough.

So, while waiting for a big drop in rates might sound strategic, it could just mean more time feeling stuck in a space that no longer fits. And for many, that waiting game has already gone on long enough.

According to Realtor.com, nearly 2 in 3 potential sellers have been thinking about moving for over a year. If you’re one of them, maybe it’s time to ask:

How much longer are you willing to press pause on your life?

Bottom Line

Maybe your current house fit your life five years ago. But that “for now” house you bought in 2020? It just can’t deliver on what you need in 2025. And that’s not just okay, it’s normal.

Mortgage rates are part of the equation, for sure. But the bigger question is:

What kind of home do you need to support the life you’re living now?

Talk to CARE Group about what’s changed, and what kind of move would actually take your life forward.

Let’s connect and plan your next steps. Call or text us! 🙂

CA Real Estate Group | Caliber RE Group

Christine Almarines @christine_almarines

Realtor DRE# 01412944 | (714) 476-4637

Anaid Bautista @anaidrealtor

Realtor DRE# 02179675 | (949) 391-8266

Speaks Spanish

Letty Luna @lettylunarealestate

Realtor DRE# 02174000 | (562) 879-4181

Speaks Spanish

Keeping Current Matters | May 19, 2025

If you’re a homeowner, chances are you’ve built up a lot of wealth – just by living in your house and watching its value grow over time. And that equity? It’s something that could help change your child’s life.

Since affordability is still a challenge, a lot of first-time buyers are struggling to buy a home in today’s market. Even if they have a stable job and a solid plan, buying can still feel out of reach. But that’s where your equity could make all the difference.

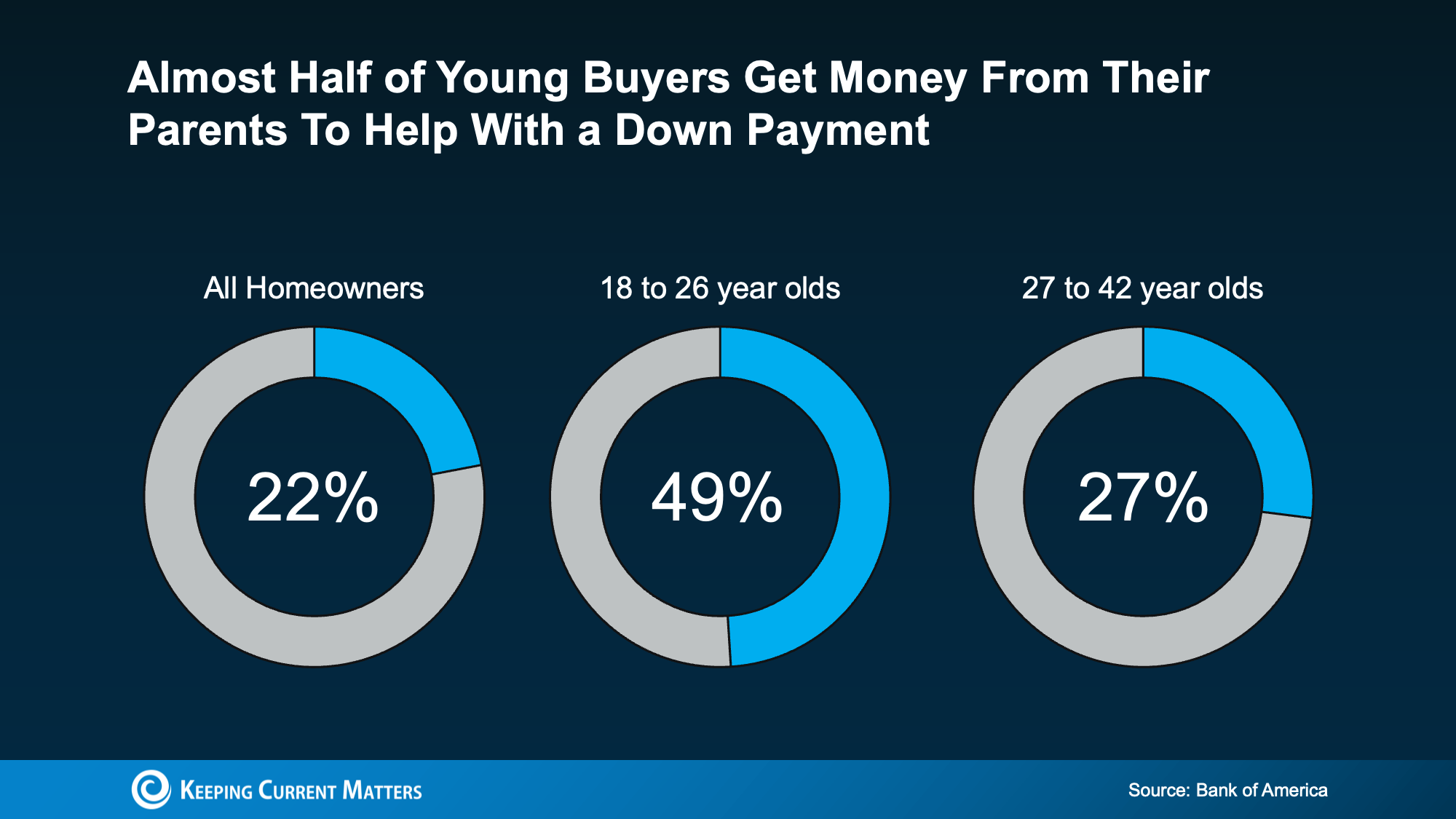

To give you an idea, the average homeowner with a mortgage has $311,000 worth of equity, according to Cotality (formerly CoreLogic). That’s significant. And some parents are using a portion of their equity to help their children become homeowners, too.

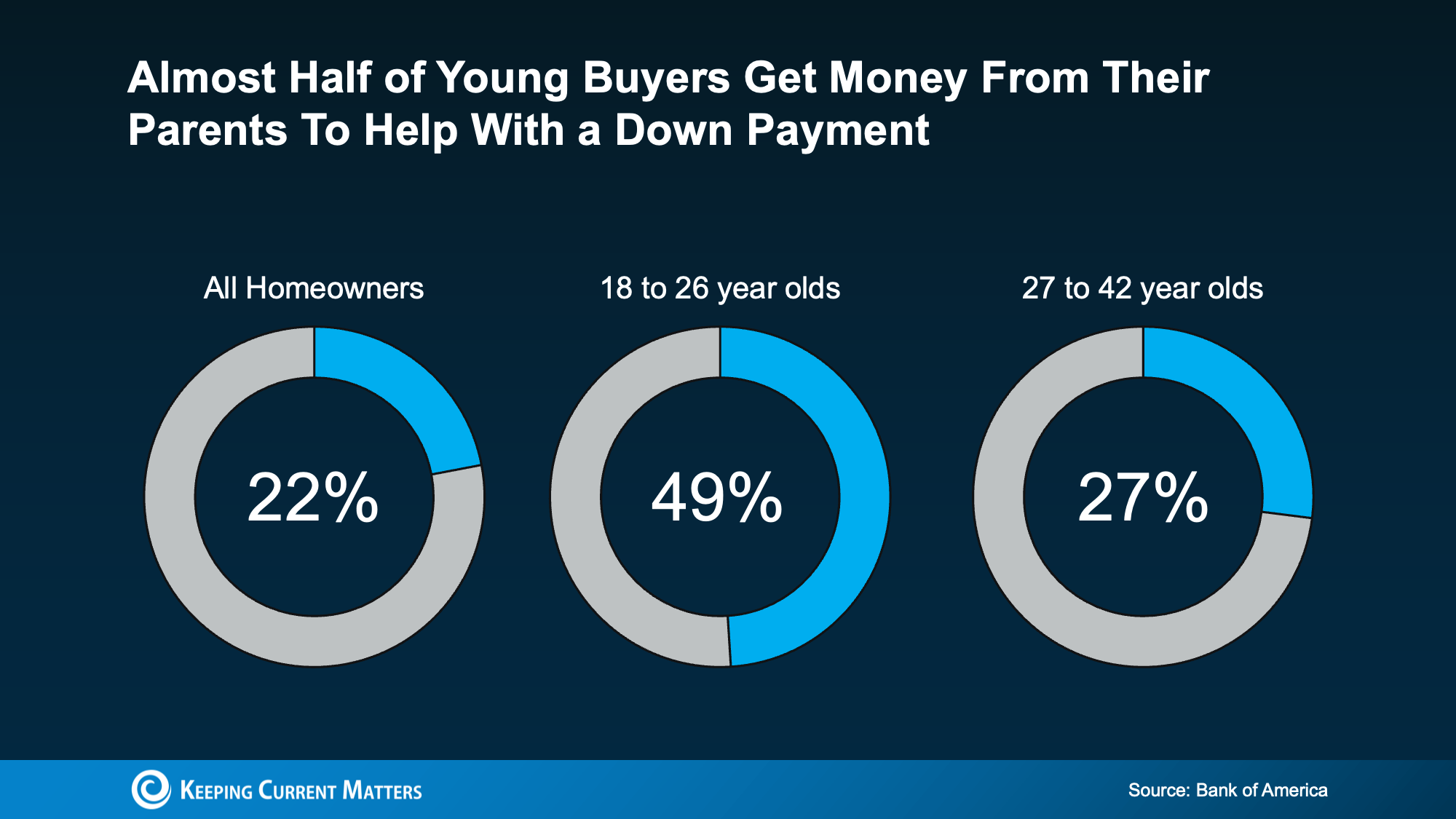

According to Bank of America, 49% of buyers between 18 and 26 got money from their parents to use toward their down payment (see chart below):

Even though the data doesn’t specify how many parents used their equity, the wealth they’ve built through homeownership may have helped make it possible – especially given how much equity the average homeowner has today.

Even though the data doesn’t specify how many parents used their equity, the wealth they’ve built through homeownership may have helped make it possible – especially given how much equity the average homeowner has today.

While what’s right for each person’s specific situation will vary on a case-by-case basis, that’s a powerful legacy to pass on. It helps those younger people buy a home, build equity of their own, and begin the next chapter of their life with a little less financial stress and a lot more stability. And for those parents? It’s a way to turn what they’ve built into something deeply meaningful.

This isn’t just about money. For many homeowners, it’s about being the reason their child gets to say, “we got the house.” And giving them the kind of head start they might’ve only dreamed of at their age. And here’s the part that really sticks. Compare the Market says:

“Of those who did receive monetary aid from parents and grandparents to buy a house, 45% of Americans said they would not have been able to purchase a house without financial support from parents and grandparents.”

Bottom Line

Your equity could be the thing that makes homeownership possible for your children when they might not be able to do it on their own. So, here’s the question.

If helping your kids buy a home was more feasible than you thought, would you want to explore that option?

If you want to learn more or find out the best way to make it happen, talk to @carealestategroup and they’ll get you in touch with a lender and a financial advisor you can trust.

Let’s connect and plan your next steps. Call or text us! 🙂

CA Real Estate Group | Caliber RE Group

Christine Almarines @christine_almarines

Realtor DRE# 01412944 | (714) 476-4637

Anaid Bautista @anaidrealtor

Realtor DRE# 02179675 | (949) 391-8266

Speaks Spanish

Letty Luna @lettylunarealestate

Realtor DRE# 02174000 | (562) 879-4181

Speaks Spanish

Keeping Current Matters | Apr 30, 2025

For a long time, the housing market was all sunshine for sellers. Homes were flying off the shelves, and buyers had to compete like crazy. But lately, things are starting to shift. Some areas are still super competitive for buyers, while others are seeing more homes sit on the market, giving buyers a bit more breathing room.

In other words, it’s a tale of two markets, and knowing which one you’re in makes a huge difference when you move.

What Is a Buyer’s Market vs. a Seller’s Market?

In a buyer’s market, there are a lot of homes for sale, and not as many people buying. With fewer buyers competing for these homes, that means they generally sit on the market longer, they might not sell for as much as they would in a seller’s market, and buyers have more room to negotiate.

On the flip side, in a seller’s market, there aren’t enough homes for sale for the number of buyers who are trying to purchase them. Homes sell faster, sellers often get multiple offers, and prices shoot higher because buyers are willing to pay more to win the home.

The Market Is Starting To Balance Out

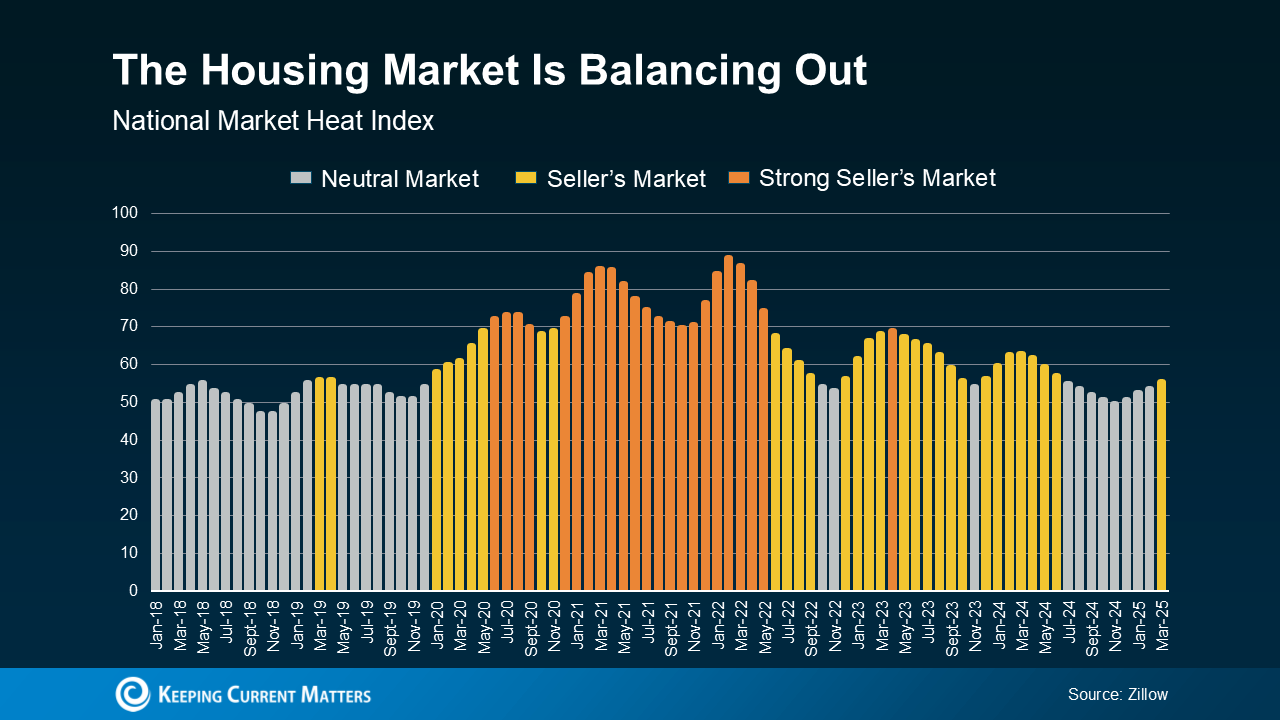

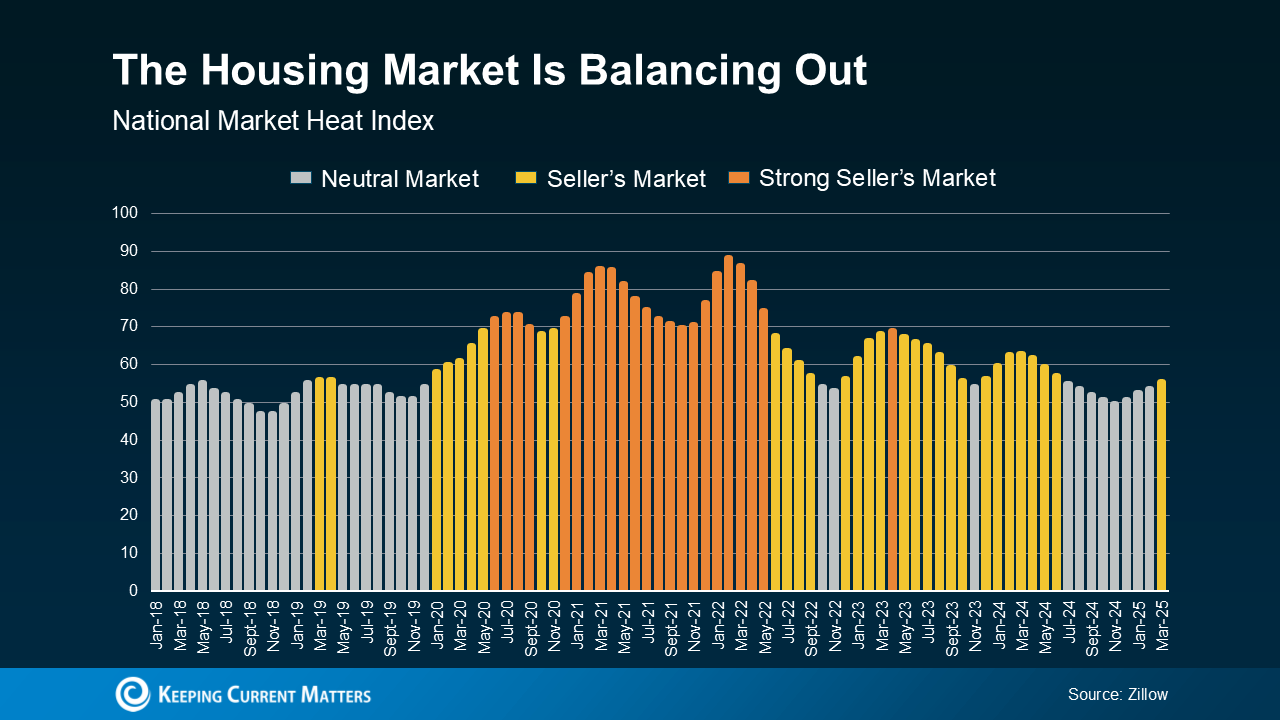

For years, almost every market in the country was a strong seller’s market. That made it tough for buyers – especially first-timers. But now, things are shifting. According to Zillow, the national housing market is balancing out (see graph below):

The index used in this graph measures whether the national housing market is more of a seller’s market, buyer’s market, or neutral market – basically, whether it favors buyers, sellers, or if it’s not really swinging either way. Each month, the market is measured between 0 and 100. The closer to 100, the bigger the advantage sellers have.

The index used in this graph measures whether the national housing market is more of a seller’s market, buyer’s market, or neutral market – basically, whether it favors buyers, sellers, or if it’s not really swinging either way. Each month, the market is measured between 0 and 100. The closer to 100, the bigger the advantage sellers have.

The orange bars in the middle of the graph show the years when sellers had their strongest advantage, from 2020 to early 2022. But, as time has gone on, the market has become more balanced. It shifted from a strong seller’s market to a less intense one. And lately, it’s been neutral more than anything else (that’s the gray bars on the right side of the graph). That means buyers are gaining some negotiating power again.

In a more balanced or neutral market, homes tend to stay on the market a little longer, bidding wars are less common, and sellers may need to make more concessions – like price reductions or helping with closing costs. That shift gives today’s buyers more opportunities and less competition than a couple of years ago.

Why Are Things Changing?

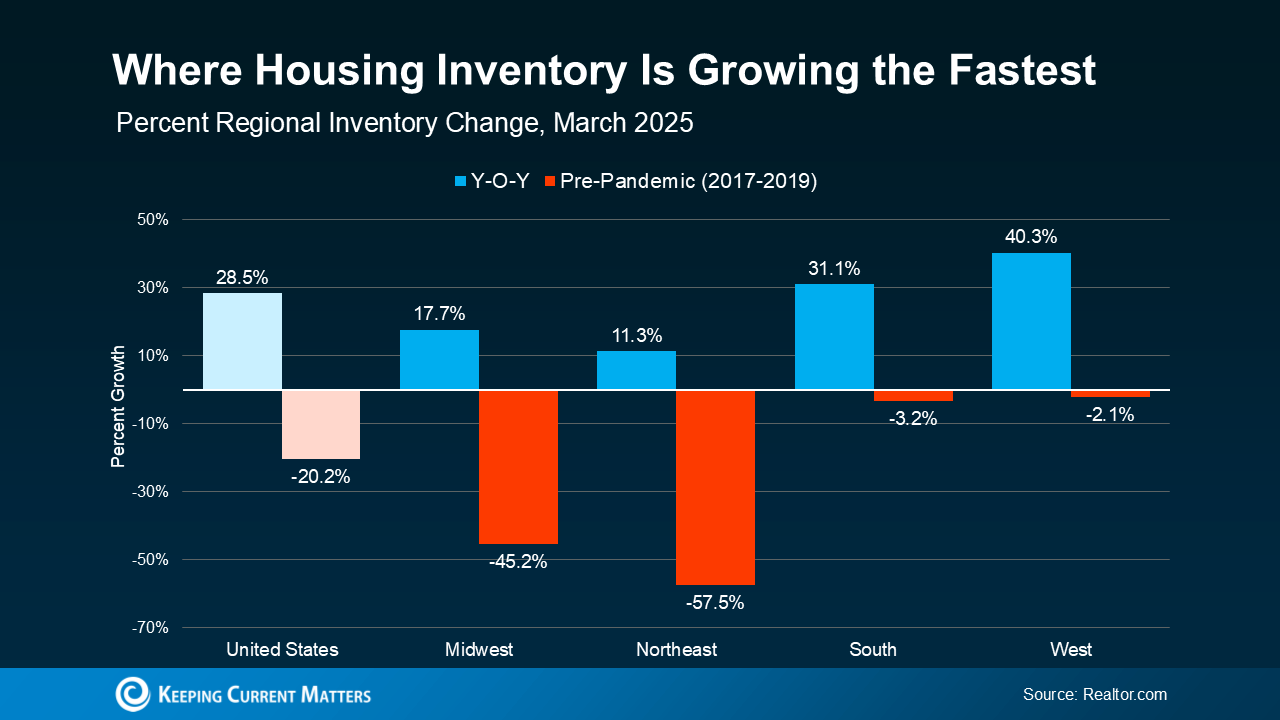

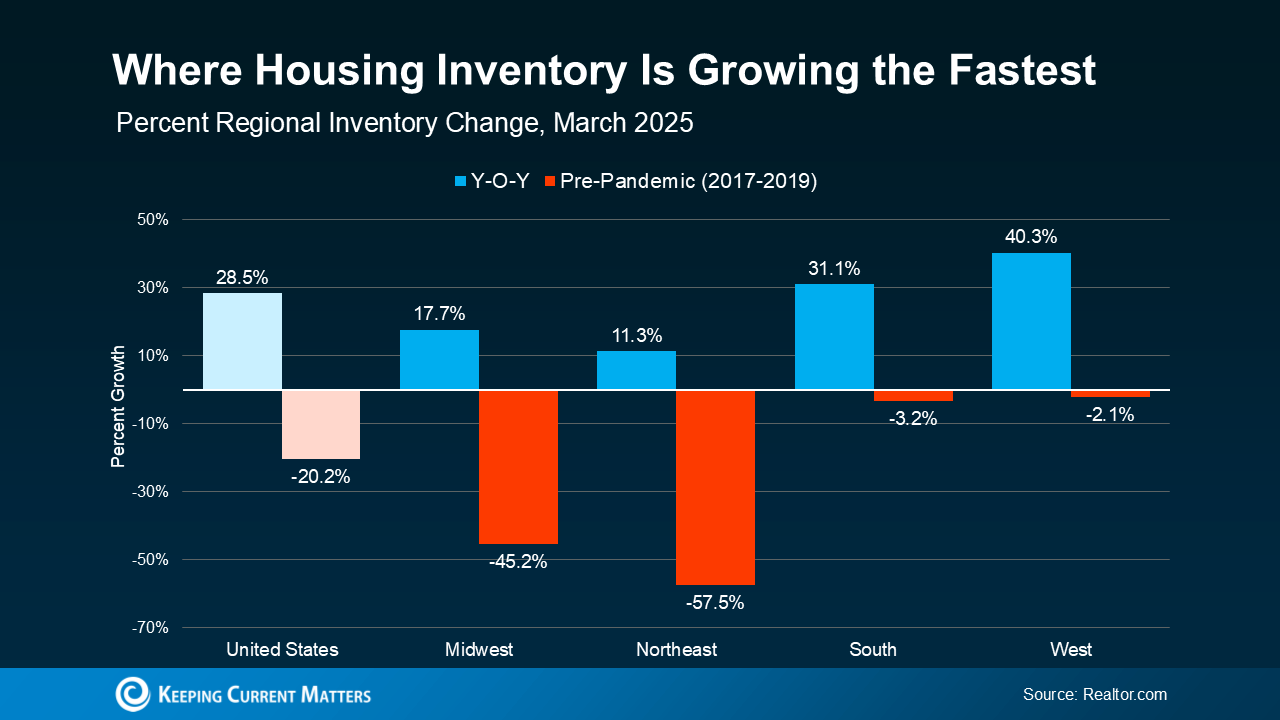

Inventory plays a big role. When there are more homes for sale, buyers have more options – and that cools down home price growth. As data from Realtor.com shows, the supply of available homes for sale isn’t growing at the same rate everywhere (see graph below):

This graph shows how inventory has changed compared to last year (blue bars) and compared to 2017–2019 (red bars) in different regions of the country.

This graph shows how inventory has changed compared to last year (blue bars) and compared to 2017–2019 (red bars) in different regions of the country.

The South and West regions of the U.S. have seen big jumps in housing inventory in the past year (that’s the blue on the right). Both are almost back to pre-pandemic levels. That’s why more buyer’s markets are popping up there.

But in the Northeast and Midwest, inventory is still very low compared to pre-pandemic (that’s why those red bars are so big). That means those areas are more likely to stay seller’s markets for now.

What This Means for You

Every local market is different. Even if the national headlines say one thing, your town (or even your neighborhood) could be telling a totally different story.

Knowing which type of market you’re in helps you make smarter decisions for your move. That’s why working with a local real estate agent is so important right now.

As Zillow says:

“Agents are experts on their local markets and can craft buying or selling strategies tailored to local market conditions.”

Agents understand the unique trends in your area and can help you make the best choices, whether you’re buying or selling. With their expert strategies, you can move no matter which way the market is leaning, because they know how to navigate various levels of buyer competition, how to find hidden gems locally, how to price a house right, how to negotiate based on who has more leverage, and more.

Bottom Line

If you’re ready to make a move, or even just thinking about it, connect with a local real estate agent. They’d love to help you understand your local market and create a game plan that works for you.

What’s one thing you’re curious about when it comes to the market in your area?

Let’s connect and plan your next steps. Find out if we’re the right real estate team for you!

CA Real Estate Group | Caliber RE Group

Christine Almarines @christine_almarines

Realtor DRE# 01412944 | (714) 476-4637

christine@carealestategroup.com

Anaid Bautista @anaidrealtor

Realtor DRE# 02179675 | (949) 391-8266

anaid@carealestategroup.com

Speaks Spanish

Letty Luna @lettylunarealestate

Realtor DRE# 02174000 | (562) 879-4181

letty@carealestategroup.com

Speaks Spanish

PT Nguyen @sellsocalbuypt

Realtor DRE# 02223919 | (714) 756-0240

pt@carealestategroup.com

Speaks Vietnamese

Keeping Current Matters | Mar 24, 2025

Spring is in full swing, and the housing market is picking up along with it. And if you’ve been wondering whether now is the right time to buy or sell, here’s the inside scoop on why this spring may be a great time to make your move.

1. There Are More Homes for Sale

After a long stretch of tight inventory, the number of homes for sale is finally improving. According to recent national data from Realtor.com, active listings are up 27.5% compared to this time last year.

Look at the graph below and follow the green line for 2025. You can see, even though inventory levels still haven’t returned to pre-pandemic norms (shown in gray), that number is higher than it has been going into the spring market over the past few years (see graph below):

Buyers: This means you have more choices, and you can be more selective.

Buyers: This means you have more choices, and you can be more selective.

Sellers: With more homes available than in recent years, you’re more likely to find what you’re looking for when you move. And knowing that inventory is still below more normal levels means there will be demand for your home when you sell it, too.

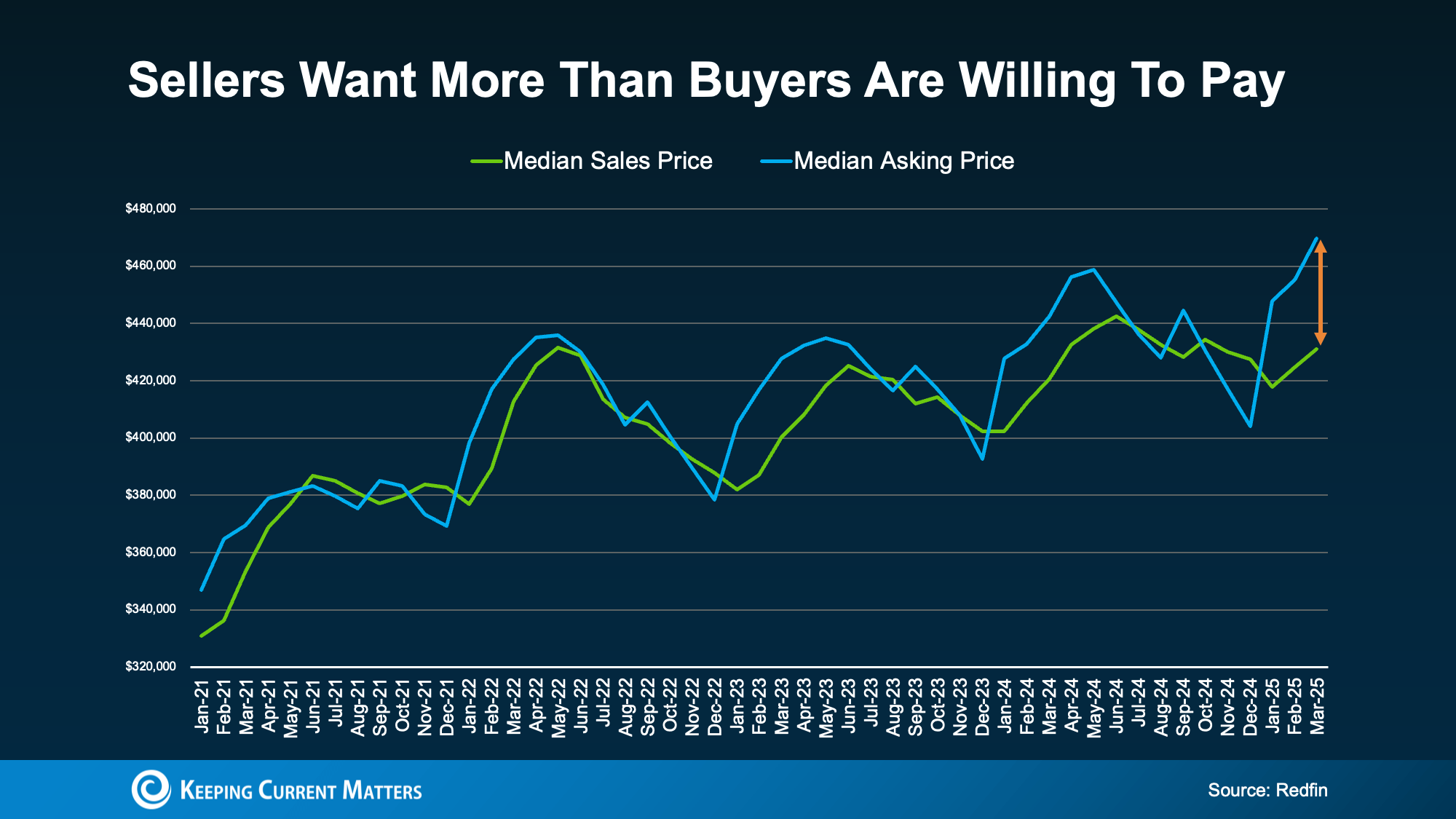

2. Home Price Growth Is Moderating

As inventory grows, the pace of home price growth is slowing down – and that will continue into the spring market. This is because prices are driven by supply and demand. When there are more homes for sale, buyers have more options, so there’s less competition for each house. Rising supply and less buyer competition causes price growth to slow, but it should still remain positive in most markets. As Freddie Mac says:

“In 2025, we expect the pace of house price appreciation to moderate from the levels seen in 2024, while still maintaining a positive trajectory.”

And while prices aren’t dropping at the national level, every market is different. Some areas are seeing stronger price growth, while others are cooling off or even seeing some price declines.

Buyers: The slower pace of growth means prices aren’t rising as quickly as before – and that’s a relief. Any home you buy now is likely to appreciate in value over time, helping you build equity.

Sellers: While prices are still rising, you might need to adjust your expectations. Overpricing your house in a more balanced market could mean it takes longer to sell. Pricing your house competitively is going to be key to attracting offers.

3. Mortgage Rates Are Stabilizing

One of the biggest hurdles for buyers over the past couple of years has been high, volatile mortgage rates. But there’s some good news – overall, they’ve stabilized in recent weeks – and have even declined a bit since the beginning of this year. And while that decrease hasn’t been a big drop, stabilizing mortgage rates has helped make buying a home a bit more predictable. According to Selma Hepp, Chief Economist at CoreLogic:

“With the spring homebuying season upon us, the recent improvements in mortgage rates may help invite homebuyers back into the market.”

Buyers: When mortgage rates are more stable, it’s easier to plan ahead because you have a better idea of what your future payment might be. But remember, rates will continue to be volatile. So, lean on your agent and your lender to make sure you know what the latest mortgage rate means for you.

Sellers: Slightly lower rates that are starting to stabilize are encouraging more buyers to move forward with their plans. That’s good for demand when you’re planning to sell your house.

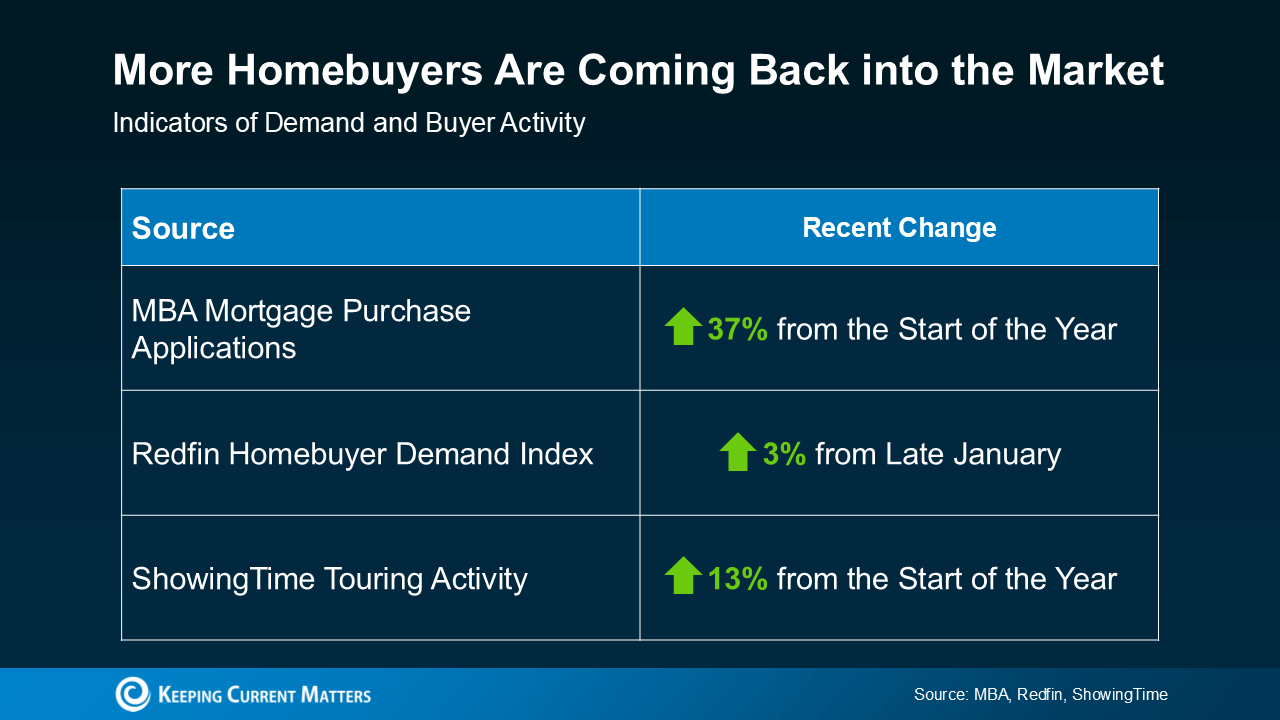

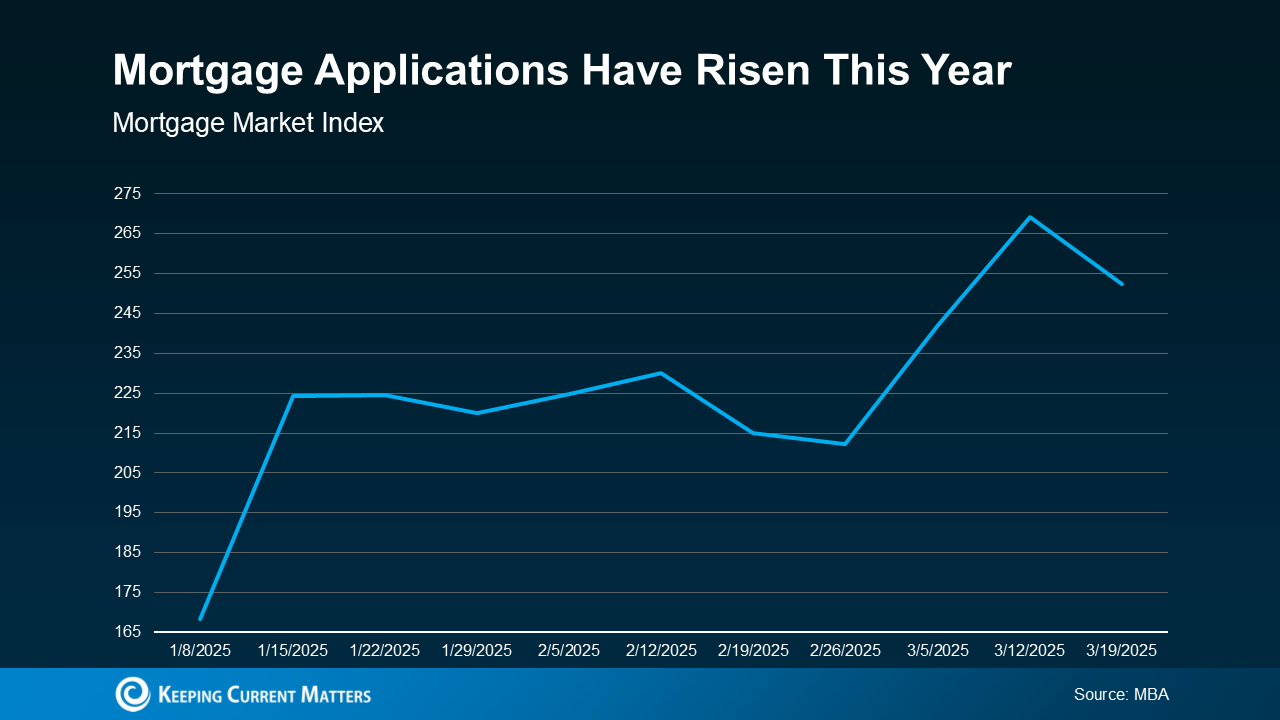

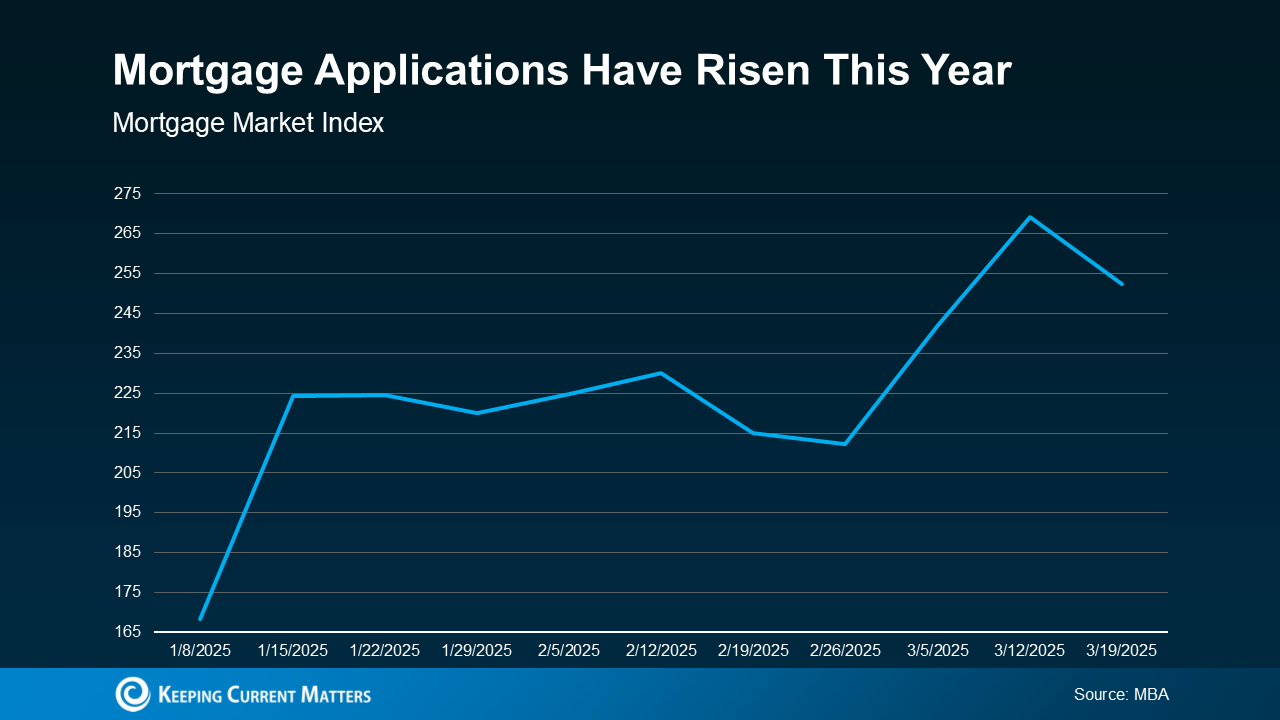

4. More Buyers Are Returning

With more inventory, slowing price growth, and stabilizing mortgage rates, buyers are gaining confidence and coming back into the market. Demand is picking up, and data from the Mortgage Bankers Association (MBA) shows an increase in mortgage applications compared to the start of the year (see graph below):

Buyers: Acting sooner rather than later could be a smart move before your competition heats up even more.

Buyers: Acting sooner rather than later could be a smart move before your competition heats up even more.

Sellers: This is great news for you – more buyers mean a better chance of selling your house quickly.

Bottom Line

Do you have questions about what the spring market means for you? Connect with a local real estate agent and talk about how to craft your plan this season.

Keeping Current Matters | Mar 7, 2025

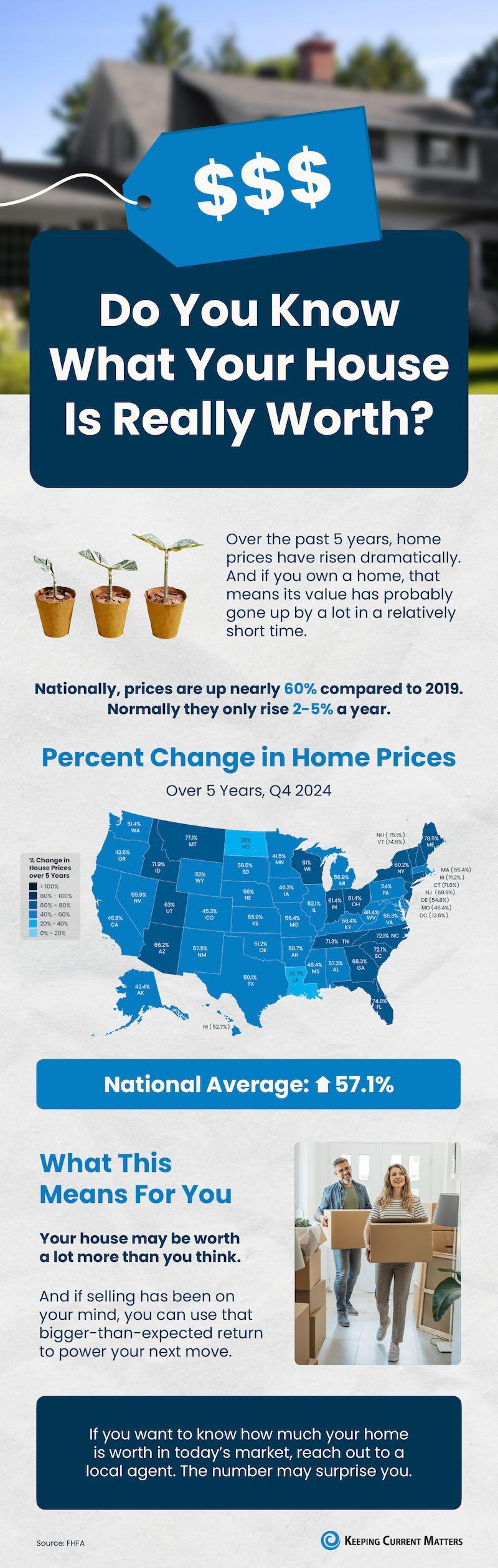

Some Highlights

- Over the past 5 years, home prices have risen dramatically. If you own a home, that means your house may be worth a lot more than you think.

- Nationally, prices are up nearly 60% since 2019. And, if selling has been on your mind, you can use that bigger-than-expected return to power your next move.

- If you want to know how much your home is worth in today’s market, reach out to CA Real Estate Group. The number may surprise you.

Let’s connect and plan your next steps. Find out if we’re the right real estate team for you!

CA Real Estate Group | Caliber RE Group

Christine Almarines @christine_almarines

Realtor DRE# 01412944 | (714) 476-4637

Anaid Bautista @wealthwithanaid

Realtor DRE# 02179675 | (949) 391-8266

Letty Luna @lettylunarealestate

Realtor DRE# 02174000 | (562) 879-4181

PT Nguyen @sellsocalbuypt

Realtor DRE# 02223919 | (714) 756-0240

Keeping Current Matters | Mar 4, 2025

For the past few years, it’s been mostly a seller’s market. But dynamics are shifting as the number of homes for sale grows. And that means that the market is balancing out a bit. As a result, some sellers are finding they need to be more flexible to close a deal. One strategy that can help? Offering concessions.

As the National Association of Realtors (NAR) explains:

“As home inventory begins to grow and buyers regain some advantage in the market, sellers may consider offering more in negotiations to make the deal more attractive and get to the closing table.”

What Are Seller Concessions?

Concessions are homebuying costs that a seller agrees to cover as a way to get their house sold. And based on data from the National Association of Realtors (NAR), nearly 1 out of every 4 sellers (24%) offered a concession in 2024. Here are a few of the most common types of concessions:

- Covering Closing Costs: The seller pays for part (or all) of the buyer’s closing costs, like appraisal fees, title insurance, or loan fees.

- Price Adjustments: Instead of making repairs, a seller might lower the purchase price to make up for updates the buyer will need to tackle.

- Adding a Home Warranty: A seller may throw in a home warranty, giving the buyer peace of mind key repairs will be covered in the first year.

And don’t worry. This doesn’t mean you have to come up with more cash to make it happen. These are things that get subtracted from your profits at closing – not more funds you have to bring to the table. And not all concessions are about money.

There are other extras you could throw in. Like, if your buyer is coming from an apartment and has never had a yard before, they may ask if you’d be willing to leave your lawn mower behind. That’s another lever you could pull to keep them happy.

How Concessions Help Sellers

Offering concessions can be a smart strategy for sellers to get a deal done.As Dennis Shirshikov, Professor of Finance and Economics, City University of New York/Queens College told The Mortgage Reports:

“Pricing homes realistically and being willing to offer concessions, such as covering a portion of closing costs or including upgrades, will be key to closing deals . . . in a less frenzied market.”

For example, let’s say you accepted an offer from a buyer, but after their inspection, you found out there are some repairs they want you to tackle before you hand over the keys.

Rather than starting at square one and searching for a new buyer, you could offer a concession. One option is you can take on the repairs and cover the costs yourself. But, if you really don’t want the hassle of dealing with contractors, you could reduce your price by however much repairs would cost. Alternatively, you could offer to pay a portion of your buyer’s closing expenses with the idea they’d use the money they saved at closing toward doing the repairs themselves.

Either way, a concession can be a great way to meet in the middle. However, it’s important to have an agent on your side to help with these negotiations.

A good real estate agent can help you decide when and how to offer concessions, so you don’t give away too much while still ensuring your house gets sold. It’s all about finding the right balance.

Bottom Line

With the market becoming more balanced, seller concessions are coming back into play in some areas. The key is having an agent to help guide you through the process, so things work out in your favor.

What’s a concession you’d consider to move things along?

Let’s connect and plan your next steps. Find out if we’re the right real estate team for you!

CA Real Estate Group | Caliber RE Group

Christine Almarines @christine_almarines

Realtor DRE# 01412944 | (714) 476-4637

Anaid Bautista @wealthwithanaid

Realtor DRE# 02179675 | (949) 391-8266

Letty Luna @lettylunarealestate

Realtor DRE# 02174000 | (562) 879-4181

PT Nguyen @sellsocalbuypt

Realtor DRE# 02223919 | (714) 756-0240

Do any of these reasons resonate for you, too?

Do any of these reasons resonate for you, too? So, while waiting for a big drop in rates might sound strategic, it could just mean more time feeling stuck in a space that no longer fits. And for many, that waiting game has already gone on long enough.

So, while waiting for a big drop in rates might sound strategic, it could just mean more time feeling stuck in a space that no longer fits. And for many, that waiting game has already gone on long enough.

Buyers: This means you have more choices, and you can be more selective.

Buyers: This means you have more choices, and you can be more selective. Buyers: Acting sooner rather than later could be a smart move before your competition heats up even more.

Buyers: Acting sooner rather than later could be a smart move before your competition heats up even more.