Wondering what’s in store for the housing market this year? And more specifically, what it all means for you if you plan to buy or sell a home? The best way to get that information is to lean on the pros.

Experts are constantly updating and revising their forecasts, so here’s the latest on two of the biggest factors expected to shape the year ahead: mortgage rates and home prices.

Will Mortgage Rates Come Down?

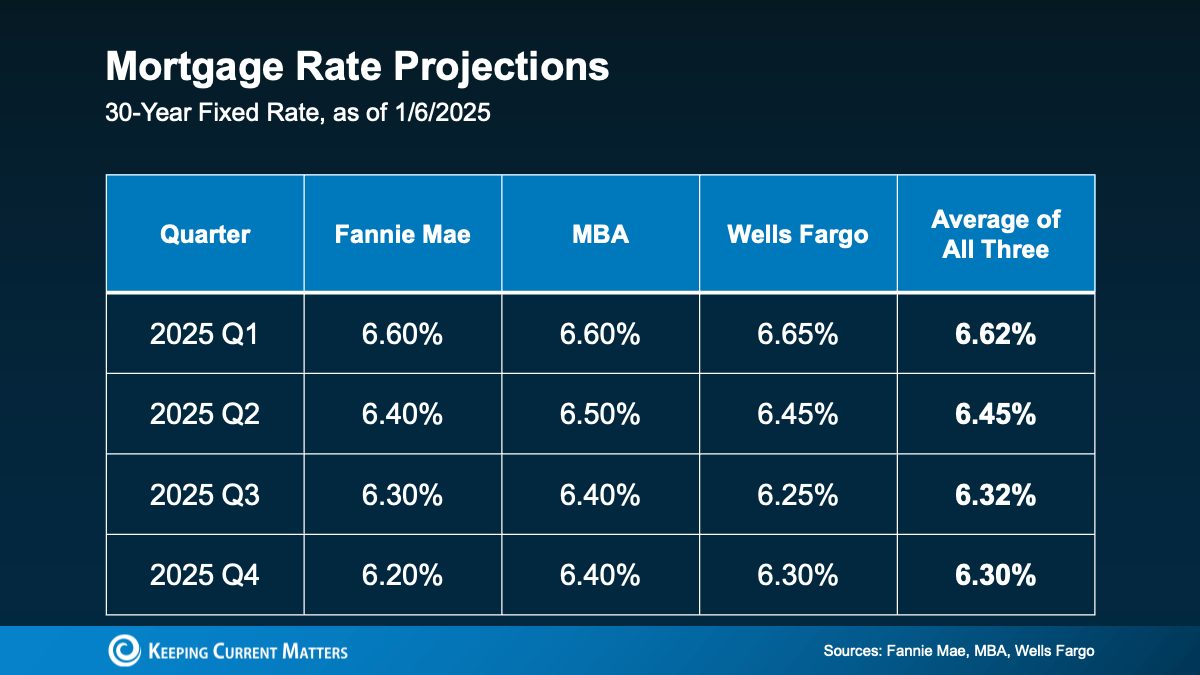

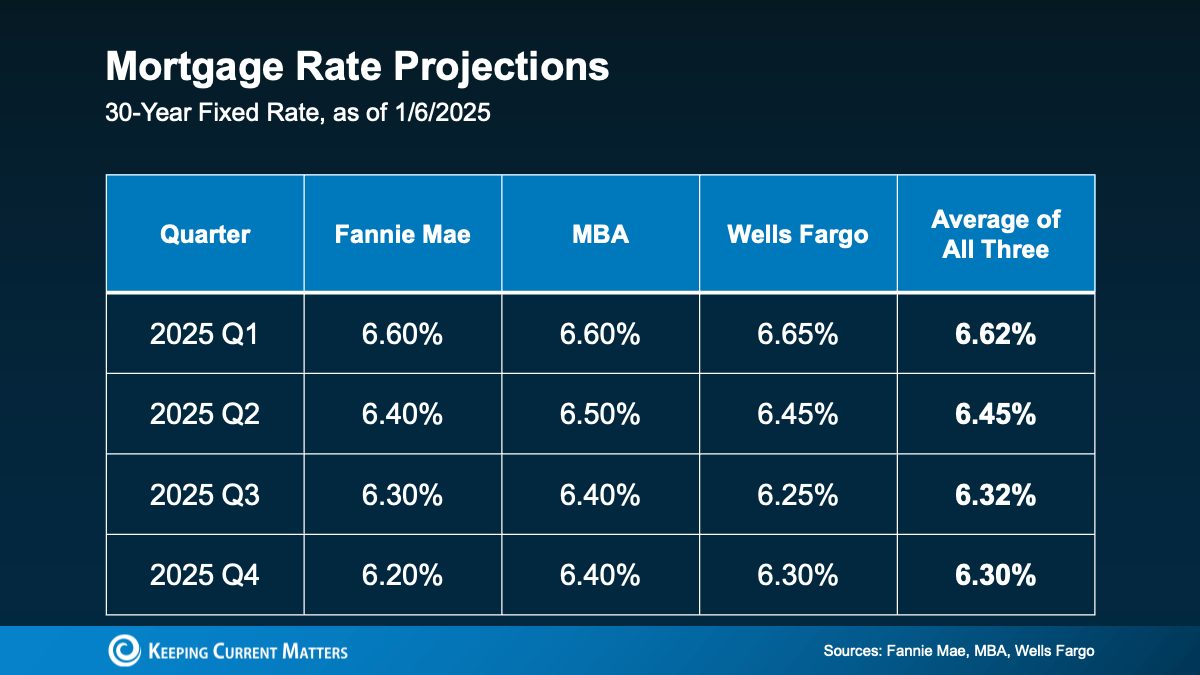

Everyone’s keeping an eye on mortgage rates and waiting for them to come down. So, the question is really: how far and how fast? The good news is they’re projected to ease a bit in 2025. But that doesn’t mean you should expect to see a return of 3-4% mortgage rates. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“Are we going to go back to 4%? Per my forecast, unfortunately, we will not. It’s more likely that we’ll go back to 6%.”

And the other experts agree. They’re forecasting rates could settle in the mid-to-low 6% range by the end of the year (see chart below):

But you should remember, this will continue to change as new information becomes available. Expert forecasts are based on what they know right now. And since everything from inflation to economic drivers have an impact on where rates go from here, some ups and downs are still very likely. So, don’t get caught up in the exact numbers here and try to time the market. Instead, focus on the overall trend and on what you can actually control.

But you should remember, this will continue to change as new information becomes available. Expert forecasts are based on what they know right now. And since everything from inflation to economic drivers have an impact on where rates go from here, some ups and downs are still very likely. So, don’t get caught up in the exact numbers here and try to time the market. Instead, focus on the overall trend and on what you can actually control.

A trusted lender and an agent partner will make sure you’ve always got the latest data and the context on what it really means for you and your bottom line. With their help, you’ll see even a small decline can help bring down your future mortgage payment.

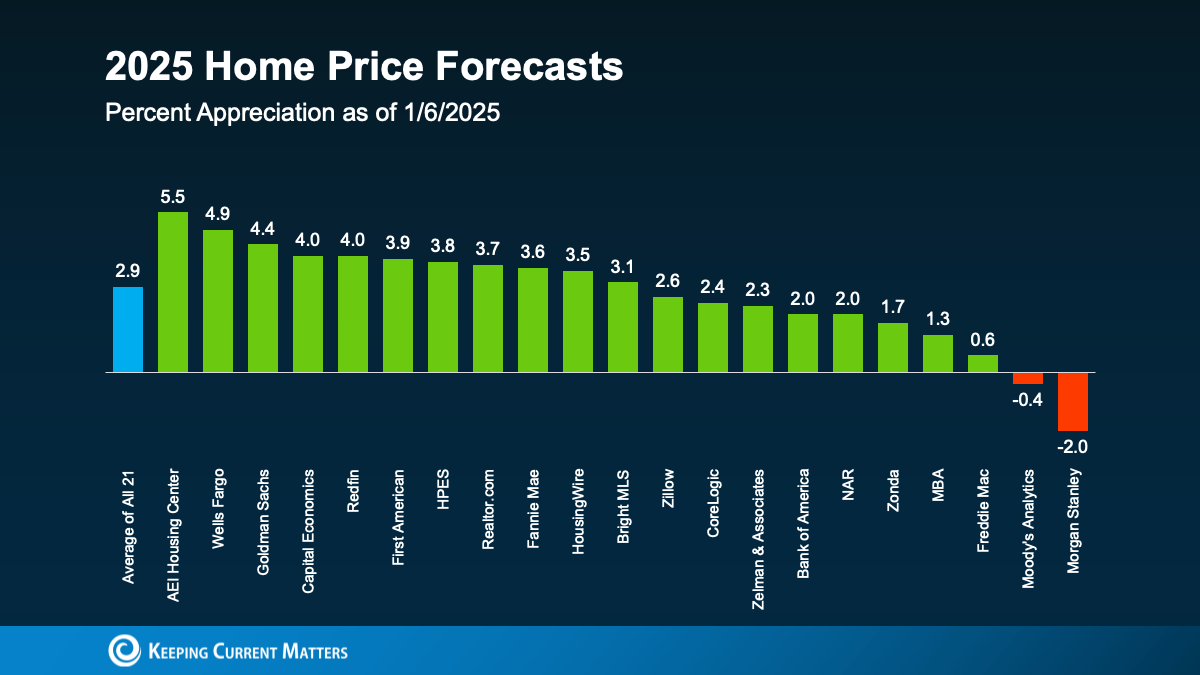

Will Home Prices Fall?

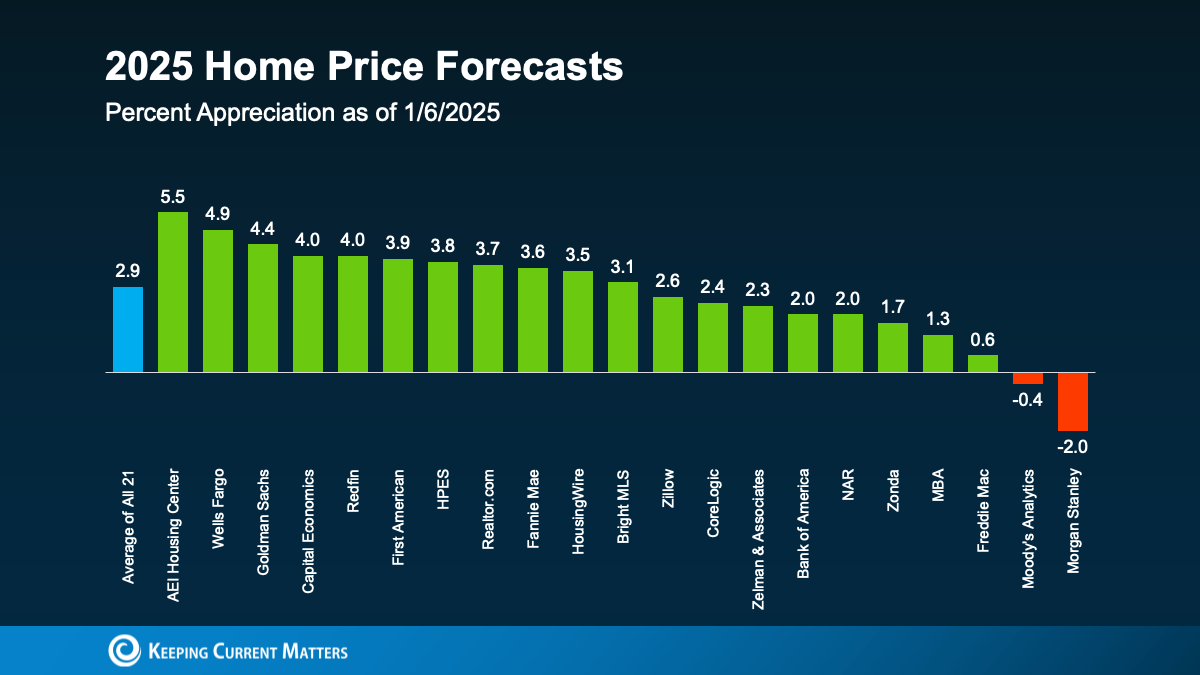

The short answer? Not likely. While mortgage rates are expected to ease, home prices are projected to keep climbing in most areas – just at a slower, more normal pace. If you average the expert forecasts together, you’ll see prices are expected to go up roughly 3% next year, with most of them hitting somewhere in the 3 to 4% range. And that’s a much more typical and sustainable rise in prices (see graph below):

So don’t expect a sudden drop that’ll score you a big deal if you’re thinking of buying this year. While that may sound disappointing if you’re hoping prices will come down, refocus on this. It means you won’t have to deal with the steep increases we saw in recent years, and you’ll also likely see any home you do buy go up in value after you get the keys in hand. And that’s actually a good thing.

So don’t expect a sudden drop that’ll score you a big deal if you’re thinking of buying this year. While that may sound disappointing if you’re hoping prices will come down, refocus on this. It means you won’t have to deal with the steep increases we saw in recent years, and you’ll also likely see any home you do buy go up in value after you get the keys in hand. And that’s actually a good thing.

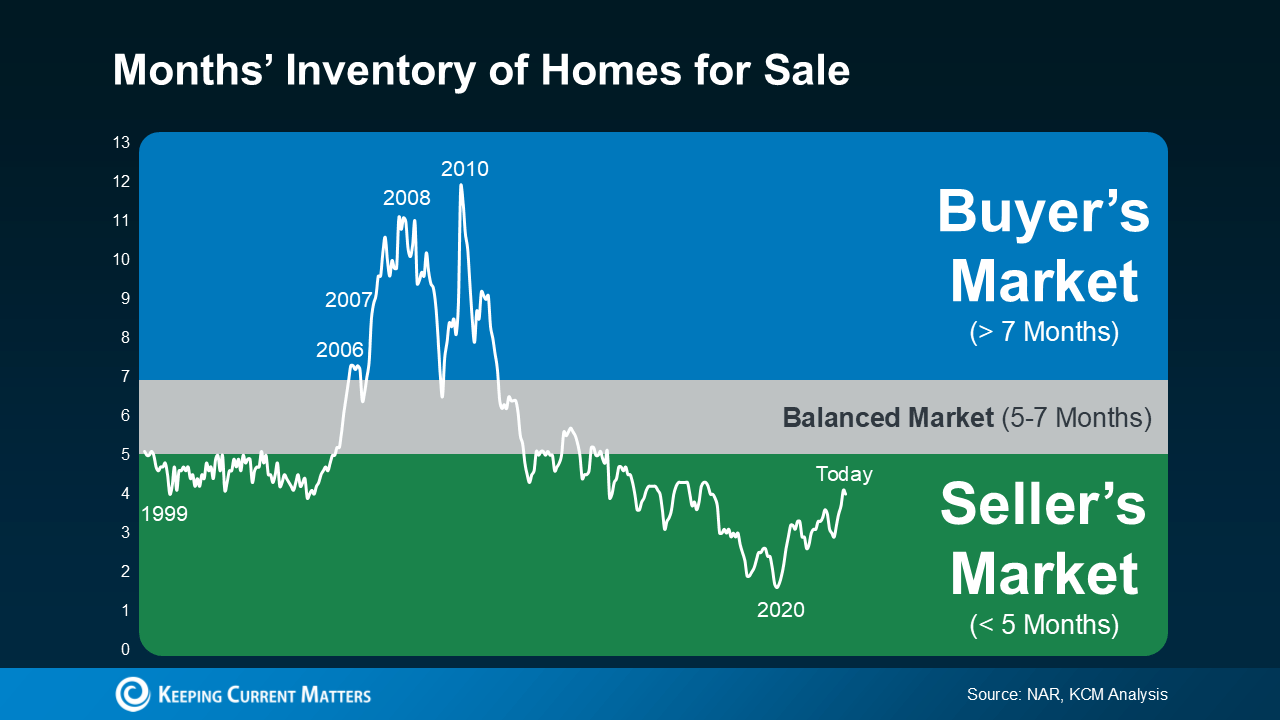

And if you’re wondering how it’s even possible prices are still rising, here’s your answer. It all comes down to supply and demand. Even though there are more homes for sale now than there were a year ago, it’s still not enough to keep up with all the buyers out there. As Redfin explains:

“Prices will rise at a pace similar to that of the second half of 2024 because we don’t expect there to be enough new inventory to meet demand.”

Keep in mind, though, the housing market is hyper-local. So, this will vary by area. Some markets will see even higher prices. And some may see prices level off or even dip a little if inventory is up in that area. In most places though, prices will continue to rise (as they usually do).

If you want to find out what’s happening where you live, you need to lean on an agent who can explain the latest trends and what they mean for your plans.

Bottom Line

The housing market is always shifting, and 2025 will be no different. With rates likely to ease a bit and prices rising at a more normal and sustainable pace, it’s all about staying informed and making a plan that works for you.

Reach out to a local real estate pro to get the scoop on what’s happening in your area and advice on how to make your next move a smart one.

Keeping Current Matters | Dec 24, 2024

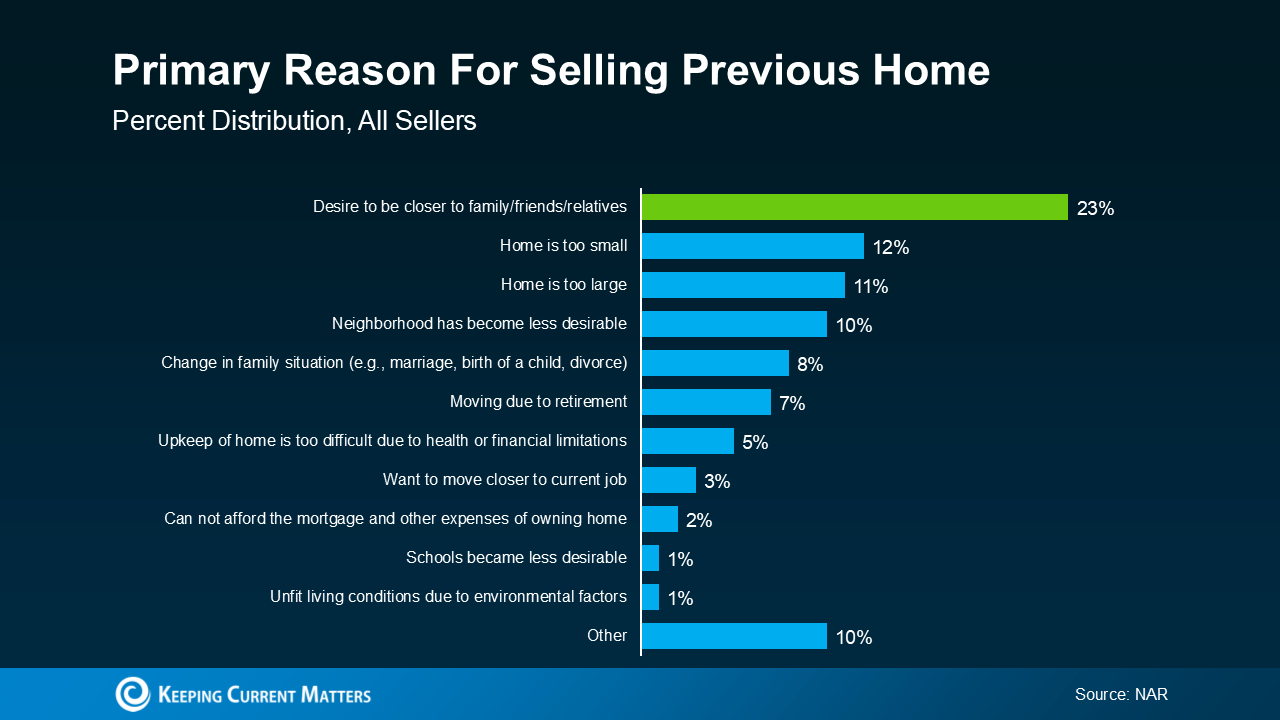

Have you ever thought about packing up and moving to be closer to the people who mean the most to you? Maybe you’re tired of long drives to see your family or wish your kids could spend more time with their grandparents. Clearly, a lot of other people feel the same way.

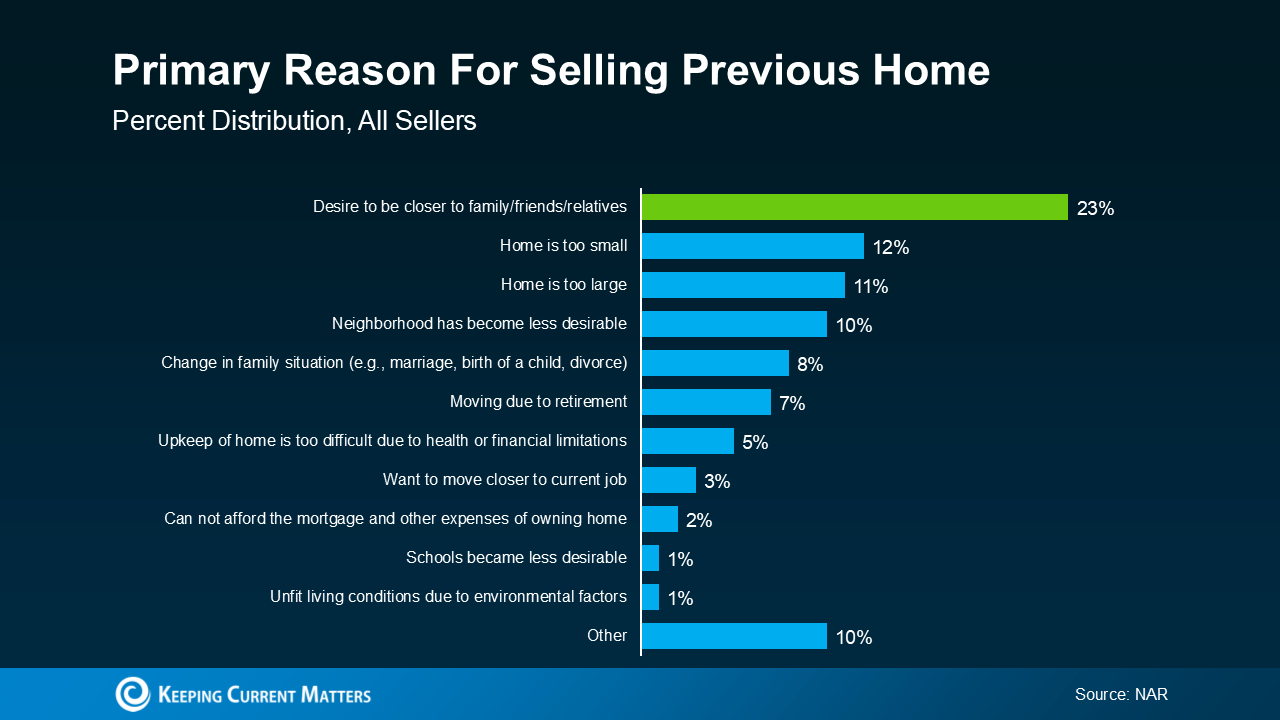

According to recent data from the National Association of Realtors (NAR), the desire to be near family and friends is the #1 reason people move (see graph below):

That’s because moving isn’t just about finding a new house – it’s about living a life where you’re surrounded by the people who matter most. Whether it’s catching up over weeknight dinners, watching your kids play with their cousins, or just knowing someone’s there when you need them, living near loved ones changes everything.

That’s because moving isn’t just about finding a new house – it’s about living a life where you’re surrounded by the people who matter most. Whether it’s catching up over weeknight dinners, watching your kids play with their cousins, or just knowing someone’s there when you need them, living near loved ones changes everything.

Let’s dive into why so many people are making this move and how it could be the best decision for you, too.

Why Family Comes First

Living near family and friends is a universal motivator that cuts across all types of buyers, whether you’re buying your first home or making a big lifestyle change.

But it’s especially important to repeat buyers. Unlike first-time homebuyers, who may be more focused on looking in more affordable areas, repeat buyers often have more flexibility on where they live. Many Baby Boomers, for example, have built significant equity in their homes, giving them the freedom to prioritize what matters most – like retiring near their grandkids. As Ali Wolf, Chief Economist at Zonda, says:

“25% of Baby Boomer households plan to retire near their children and grandchildren . . .”

Making a move to be closer to friends and family is all about creating a meaningful next chapter in your life where loved ones are just around the corner.

The Benefits of Living Near Loved Ones

But moving closer isn’t just a lifestyle choice – it’s a decision that offers real benefits:

- Spending More Time Together Whether it’s joining family dinners, going to weekend activities, or simply having someone nearby to talk to, these moments strengthen relationships and make life more fulfilling.

- Sharing Resources Living close to family can provide practical advantages, too – like sharing childcare, tools, or household items.

- Cutting Down on Travel Instead of spending hours on the road to spend time together, you can enjoy more spontaneous visits. This not only enhances your quality of life, but it also provides peace of mind in case of emergencies.

- Being There for Big Moments It also offers both emotional and practical support during life’s milestones. From graduations to tough times, being close to loved ones helps you feel connected and cared for.

Ready To Make Your Move?

At the end of the day, home isn’t just a place you live – it’s where your people are. Whether you’re looking to spend more quality time with family or enjoy the practical benefits of being closer to loved ones, the decision to move closer to those you care about is a deeply personal one.

Bottom Line

If you’re thinking about making a change, CA Real Estate Group would love to help. Together, you can explore neighborhoods that brings you closer to the people and places you love most.

Let’s Connect

Let’s connect and plan your next steps. Find out if we’re the right real estate team for you!

CA Real Estate Group | Caliber RE Group

Christine Almarines @christine_almarines

Realtor DRE# 01412944 | (714) 476-4637

Anaid Bautista @wealthwithanaid

Realtor DRE# 02179675 | (949) 391-8266

Letty Luna @lettylunarealestate

Realtor DRE# 02174000 | (562) 879-4181

PT Nguyen @sellsocalbuypt

Realtor DRE# 02223919 | (714) 756-0240

Coast One Mortgage | November 27, 2020The holiday months and winter may not be traditional peak homebuying seasons – there are historically less homes on the market – but there are actually advantages to being a buyer during the holiday season. With less competition, tax benefits, and motivated sellers, the holidays are actually a great time to buy a home. According to a report from ATTOM Data Solutions, December 26 is the #1 day of the year to purchase a home. Think of it like the Black Friday of real estate.

Here are some benefits and tips on buying a home during the holiday season.

1. Have a clear focus

In order to take advantage of savings during this time, you need to be organized and have a clear idea of what you want in a home so you can act quickly if needed. Make sure you have all of your financial documentation ready, have saved up a down payment, and have your “wants/needs” list on hand.

2. Look for motivated sellers

Many sellers who list their home during the holidays are motivated to sell for a variety of reasons. Whatever the reason, you can benefit by negotiating a great price on the house. Consider other incentives to ask for, like an adjusted closing date that works for you.

Available homes might have been on the market for some time, or you could even come across an “old expired listing” that didn’t previously sell during the original listing period and is active again. Private sellers are not the only motivated sellers during this season. Banks and other financial institutions are motivated to get foreclosed properties off of their books before the end of the year. Ask your real estate agent about these types of properties.

3. Tax benefits

Depending on your financial situation, and what your tax liability looks like for the upcoming calendar year, you could qualify for some tax benefits purchasing a home this time of year.

If you itemize deductions when you file taxes, you may be able to deduct points purchased upon closing, property taxes, and mortgage interest rates. If you’re purchasing a home as an investment asset, and have a business entity, there may be even more tax benefits available to you. Make sure you talk to your accountant for specific details.

4. Work with a well-connected real estate agent

Since fewer properties are listed between Halloween and New Year’s, you’ll want early access to the homes you’re most interested in. If you have a connected real estate agent, they’ll know about available properties ahead of time and be on the lookout for hidden gems or unpublicized listings.

Make sure your real estate agent’s communication style gels with yours, too. If you’re trying to take advantage of holiday listings, you’ll want your realtor to be responsive to both you and the seller’s agent of the property you’re interested in.

5. Inquire about Pocket Listings

Pocket listings are homes not listed on the local MLS (multiple listing service) or otherwise publicized. Sellers who want to maintain a certain level of privacy will often put their home up as a pocket listing. This is when having a savvy, connected real estate agent will really help you. Less visibility also means less competition for you as a buyer!

If you’ve found a home you love, or are ready to purchase a home, now might be the time for you! With less competition, you might have more luck putting down a smaller earnest money deposit – something that could be less successful when sellers are fielding multiple offers during busier times of year.

Take advantage of the perks and don’t let the holidays deter you from making an offer on a home this season.

Keeping Current Matters | Dec 3, 2024

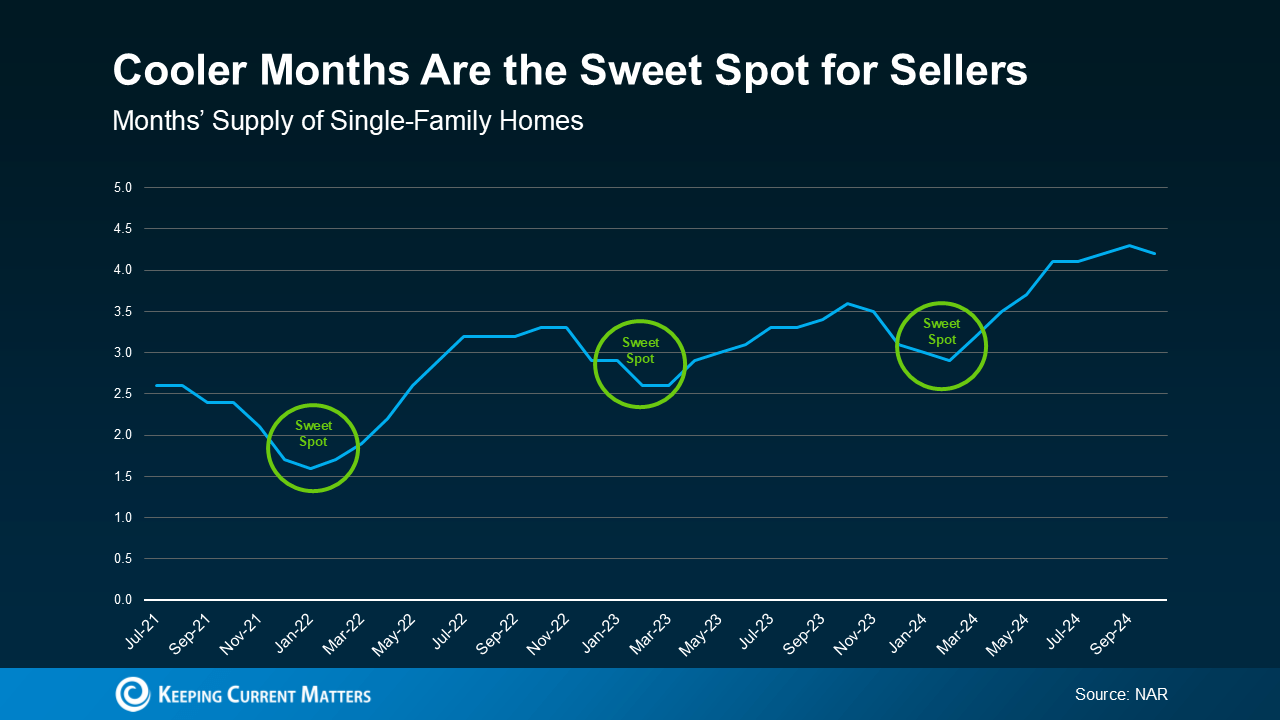

A lot of people assume spring is the ideal time to sell a house. And sure, buyer demand usually picks up at that time of year. But here’s the catch: so does your competition because a lot of people put their homes on the market at the same time.

So, what’s the real advantage of selling your house before spring? It’ll stand out.

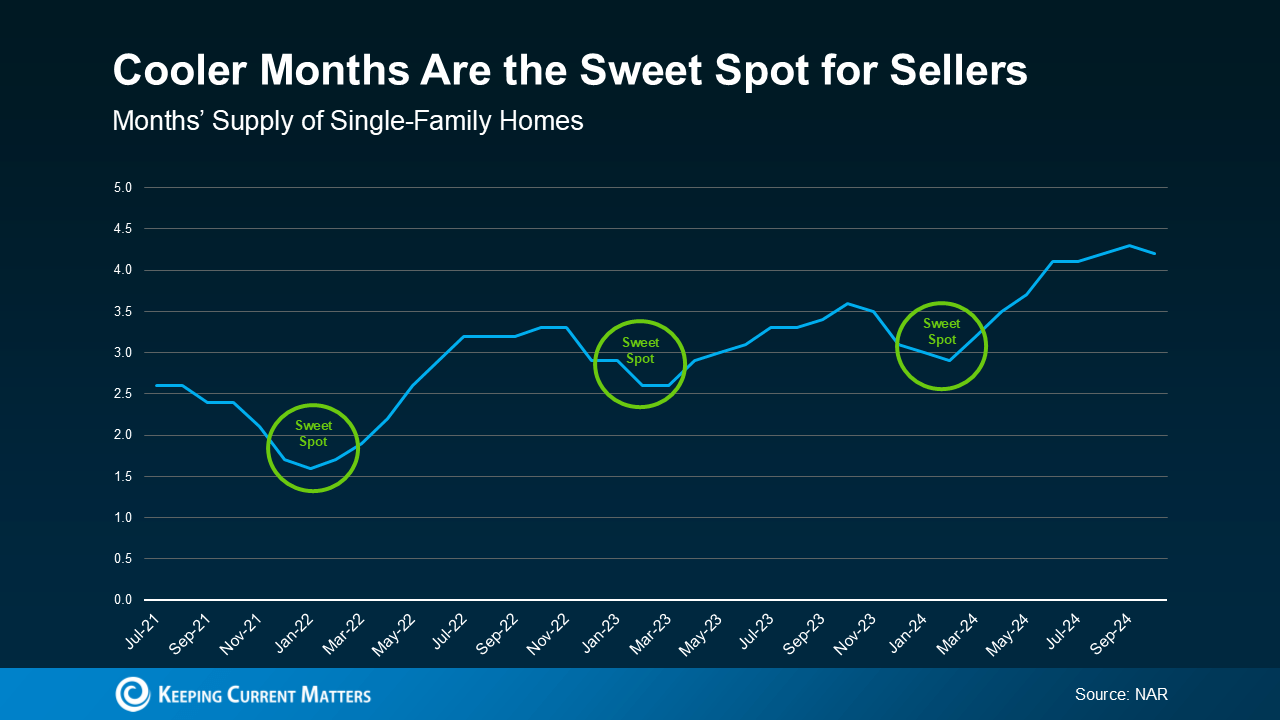

Historically, the number of homes for sale tends to drop during the cooler months – and that means buyers have fewer options to choose from.

You can see how that trend played out over the past few years in this data from the National Association of Realtors (NAR). Each time, the supply of homes for sale dipped during these cooler months. And then, after each winter lull, inventory started to climb as more sellers jumped into the market closer to spring (see graph below):

Here’s why knowing how this trend works gives you an edge. While inventory is higher this year than it‘s been in the last few winters, if you work with an agent to list now, it’ll still be in this year’s sweet spot. So, while other sellers are taking their homes off the market, you can sell before the spring wave of new listings hits, and your house will have a better chance of standing out.

Here’s why knowing how this trend works gives you an edge. While inventory is higher this year than it‘s been in the last few winters, if you work with an agent to list now, it’ll still be in this year’s sweet spot. So, while other sellers are taking their homes off the market, you can sell before the spring wave of new listings hits, and your house will have a better chance of standing out.

Why wait until spring when you can get ahead of the curve now?

Fewer Listings Also Means More Eyes on Your Home

Another big perk of selling in the winter? The buyers who are looking right now are serious about making a move.

During this season, the window-shopper crowd tends to stay busy with other things, like holiday celebrations, and avoids looking for homes when the weather’s cooler. So, the buyers out looking aren’t casually browsing—they’re motivated, whether it’s because of a job relocation, a lease ending, or some other time-sensitive reason. And those are the types of buyers you want to work with. Investopedia explains:

“. . . if your house is up for sale in the winter and someone is looking at it, chances are that person is serious and ready to buy.”

Bottom Line

With less competition and serious buyers on the hunt, you’ll be in a great position to sell your house this winter. Connect with CA Real Estate Group to get the process started. Call Team Lead Christine Almarines for a free consultation at (714) 476-4637.

Keeping Current Matters | Oct 30, 2024

No one likes making mistakes, especially when they happen in what’s likely the biggest transaction of your life – buying a home.

That’s why partnering with a trusted agent and real estate team like CA Real Estate Group is so important. Here’s a sneak peek at the most common missteps buyers are making in today’s market and how a great agent will help you steer clear of each one.

Trying To Time the Market

Many buyers are trying to time the market by waiting for home prices or mortgage rates to drop. This can be a really risky strategy because there’s so much at play that can have an impact on those things. As Elijah de la Campa, Senior Economist at Redfin, says:

“My advice for buyers is don’t try to time the market. There are a lot of swing factors, like the upcoming jobs report and the presidential election, that could cause the housing market to take unexpected twists and turns. If you find a house you love and can afford to buy it, now’s not a bad time.”

Buying More House Than You Can Afford

If you’re tempted to stretch your budget a bit further than you should, you’re not alone. A number of buyers are making this mistake right now.

But the truth is, it’s actually really important to avoid overextending your budget, especially when other housing expenses like home insurance and taxes are on the rise. You want to talk to the pros to make sure you understand what’ll really work for you. Bankrate offers this advice:

“Focus on what monthly payment you can afford rather than fixating on the maximum loan amount you qualify for. Just because you can qualify for a $300,000 loan doesn’t mean you can comfortably handle the monthly payments that come with it along with your other financial obligations.”

Missing Out on Assistance Programs That Can Help

Saving up for the upfront costs of homeownership takes some careful planning. You’ve got to think about your closing costs, down payment, and more. And if you don’t work with a team of experienced professionals, you could miss out on programs out there that can make a big difference for you. This is happening more than you realize.

According to Realtor.com, almost 80% of first-time buyers qualify for down payment assistance – but only 13% actually take advantage of those programs. So, talk to a lender about your options. Whether you’re buying your first house or your fifth, there may be a program that can help.

Not Leaning on the Expertise of a Pro

This last one may be the most important of all. The very best way to avoid making a mistake that’s going to cost you is to lean on a pro. With the right team of experts, you can easily dodge these missteps.

Bottom Line

The good news is you don’t have to deal with any of these headaches. Connect with CA Real Estate Group so you have a pro on your side who can help you avoid these costly mistakes.

CA Real Estate Group | Caliber RE Group

Christine Almarines @christine_almarines

Realtor DRE# 01412944 | (714) 476-4637

Anaid Bautista @wealthwithanaid

Realtor DRE# 02179675 | (949) 391-8266

Letty Luna @lettylunarealestate

Realtor DRE# 02174000 | (562) 879-4181

PT Nguyen @sellsocalbuypt

Realtor DRE# 02223919 | (714) 756-0240

Keeping Current Matters | Oct 22, 2024

If your goal is to sell your house in 2025, now’s the time to start prepping. Even though it might seem like there’s plenty of time between now and the new year, you should get a head start on any updates or repairs you want to make now. As Danielle Hale, Chief Economist at Realtor.com, says:

“ . . . now is the time to start thinking about what you need for your next home and then taking those steps to prepare to list . . . We have survey data that says 47 percent of sellers are taking longer than a month to get their home ready to sell, so getting them to start that process early can mean more flexibility.”

By starting your prep work early, you’ll give yourself plenty of time to get your house market-ready by the end of the year. But be sure to partner with a great agent before you get started, so you have expert insight into what repairs are worth it based on your local market.

Why Starting Early Is Key

To get the best price and sell quickly, it’s important that your home looks its best. And that means it’s up to you to make the necessary repairs, declutter, and even consider updates that could add value as part of getting your house ready to list.

By starting now, you can tackle things one task at a time. Whether it’s fixing that leaky faucet, refreshing your landscaping, or painting a room, getting an early start gives you the flexibility to do the job right and with as little stress as possible. Because, if you wait to knock items off your list later on, they could quickly stack up and get overwhelming. As Realtor.com explains:

“There are some important repairs to make before selling a house, so don’t be in too much of a hurry to get your home listed … if you move too fast, buyers see right through the fact that you skipped important home renovations. And this . . . might end up costing you time and money.”

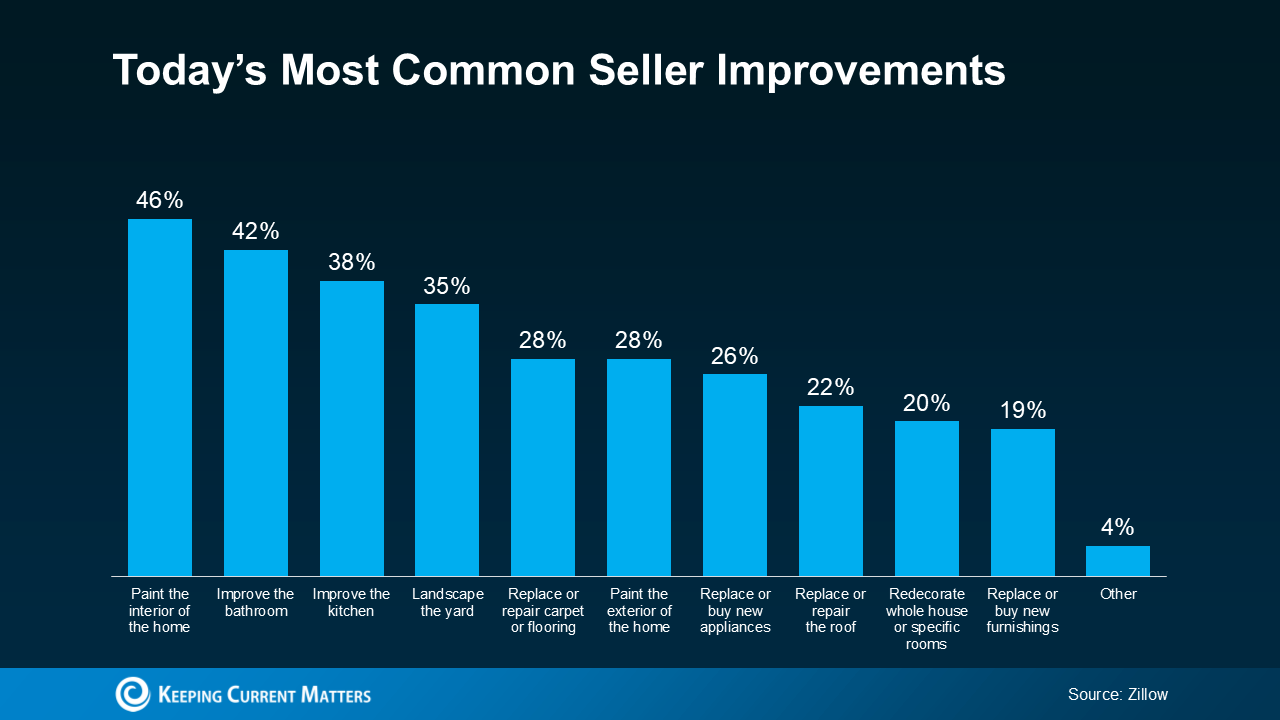

What Should You Focus On?

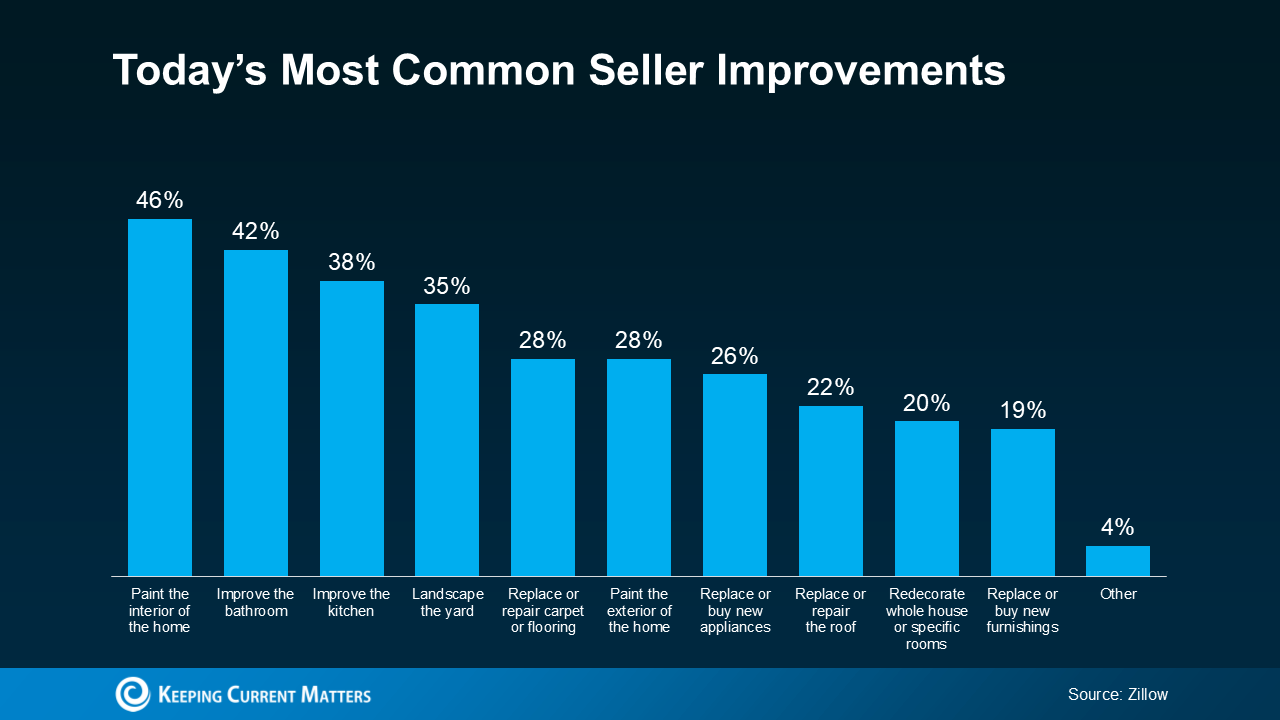

Feeling motivated to start chipping away at that to-do list, but not sure where to start? Here’s a look at the most common improvements other sellers are making today (see graph below):

The Importance of Working with a Local Agent

The Importance of Working with a Local Agent

And while that data gives you a starting point, it shouldn’t be seen as a comprehensive list. What buyers want in your area may be different, and only a local agent will have this in-depth understanding.

For example, if homes in your area are selling quickly with updated kitchens, your agent might suggest focusing on minor kitchen improvements rather than spending money on other areas that won’t offer as much return. They’ll also help you figure out if tackling larger projects, such as replacing your roof or upgrading your HVAC system, is worth it based on other recently sold homes. As Point says:

“Not all renovations are created equal, and focusing on upgrades that offer the highest potential for increasing your home’s value is key.”

And remember, it’s not just big-ticket items that can have an impact. Your agent will also speak to some of the smaller details – like cleaning up your yard, adding fresh mulch, or painting your front door – to make a real difference in how buyers feel about your home. This type of expert eye is crucial to help your house sell fast and for top dollar.

Bottom Line

Thinking of selling your house next year? Don’t wait until the last minute to get it ready. By getting a head start now, you can ensure everything is in place by the time the new year rolls around.

Need advice on what to tackle first? Connect with a CA Real Estate Group agent.

CA Real Estate Group | Caliber RE Group

Christine Almarines @christine_almarines

Realtor DRE# 01412944 | (714) 476-4637

Languages: English, Tagalog

Anaid Bautista @wealthwithanaid

Realtor DRE# 02179675 | (949) 391-8266

Languages: English, Spanish

Letty Luna @lettylunarealestate

Realtor DRE# 02174000 | (562) 879-4181

Languages: English, Spanish

PT Nguyen @sellsocalbuypt

Realtor DRE# 02223919 | (714) 756-0240

Languages: English, Vietnamese

Keeping Current Matters | Aug 29, 2024

Lower mortgage rates and rising inventory are giving home buyers a window of opportunity at an unusual time of year. Lower mortgage rates have improved affordability significantly for home buyers, and competition among them could extend into the fall instead of fading away as is typical at this time of year.

Mortgage rate drops equate to serious savings

Mortgage rate declines have made buying a home “affordable” again at the national level (meaning monthly payments generally take less than one-third of median household income), assuming a buyer puts 20% down and before taxes and insurance are accounted for. Nationwide, the monthly payment on a typical home purchase has fallen by more than $100 since a peak in May. That drop is more than $300 a month in the ultraexpensive San Francisco metro area.

Lower rates also make it easier for buyers to qualify for a mortgage on more of the inventory listed in a given area, functionally increasing the choices available to them.

Home shoppers gain choices, bargaining power

Beyond lower costs, a number of metrics are moving in buyers’ favor. The Zillow market heat index shifted from being in favor of sellers into neutral territory in July. For the past two years, sellers held their edge nationally until October.

Homes are taking longer to sell than in recent history, but shorter than in pre-pandemic times. Homes that sold in August took 20 days to go pending, two more than in July, but about six days faster than at this time of year before the pandemic. And while inventory growth has slowed, nearly 1.18 million homes are on the market, more than any month since September 2020.

Added interest could extend summertime competition

Lower rates could stall or slow the cooldown in housing market activity that typically takes place this time of year, because right now buyers are more likely to be motivated by lower rates than sellers are.

Spring is normally the prime time to list because sellers often want to make sure they are in their new home before the school year and fall holidays start. Most homeowners (80%) are influenced to sell by life events, such as an addition to the family or a new job, and not necessarily by optimizing the mortgage rate on their next home, according to Zillow surveys.

Some signals are already pointing to an altered trajectory in the housing market. The share of listings on Zillow with a price cut ticked down from July to August, reversing an upward trend of rising every month since March. Just under 26% of homes on the market had a price cut in August. That’s relatively high for this time of year, but not a record, as seen in recent months.

Home values

This month, the typical home in the US was $362,143. The typical monthly mortgage payment, assuming 20% down, was $1,827. Lower mortgage rates pushed monthly mortgage costs down 3.4% from July to August.

- Home values climbed month-over-month in 9 of the 50 largest metro areas in August. Gains were biggest in Buffalo (0.7%), New York (0.6%), Providence (0.4%), Hartford (0.3%), and Philadelphia (0.3%).

- Home values fell, on a monthly basis, in 37 major metro areas. The largest monthly drops were in San Francisco (-1.3%), San Jose (-1.1%), Austin (-1%), Denver (-0.7%), and New Orleans (-0.6%).

- Home values are up from year-ago levels in 44 of the 50 largest metro areas. Annual price gains are highest in San Jose (9.1%), Hartford (8%), Providence (7.1%), New York (7%), and San Diego (6.2%).

- Home values are down from year-ago levels in 5 major metro areas. The largest drops were in New Orleans (-4.6%), Austin (-4.6%), San Antonio (-2.9%), Birmingham (-0.9%), and Dallas (-0.4%).

- The typical mortgage payment is down 2.9% from last year and has increased by 103.8% since pre-pandemic.

Inventory & new listings

- New listings decreased by 1.1% month-over-month in August.

- New listings increased by 0.8% this month compared to last year.

- New listings are 21.3% lower than pre-pandemic levels.

- For-sale inventory (the number of listings active at any time during the month) in August increased by 0.2% from last month.

- There were 22.1% more for-sale listings active in August compared to last year.

- Inventory levels are -30.8% lower than pre-pandemic levels for the month.

Price cuts & share sold above list

- 25.9% of listings in August had a price cut, compared to 26.2% in July and 23.4% in August 2023.

- 33.4% of homes sold above their list price last month. That’s compared to 35.4% in June and 39.1% in July of 2023.

Newly Pending Sales

- Newly pending listings decreased by 5% in August from the prior month.

- Newly pending listings decreased by 2.9% from last year.

- Median days to pending, the typical time since initial list date for homes that went under contract in a month, is at 20 days in August, up 2 days since last month.

- Median days to pending increased by 7 days from last year.

Market Heat Index

- Zillow’s market heat index shows the nation is currently a neutral market.

- The strongest seller’s markets in the country are Buffalo, Hartford, San Jose, Boston, and New York.

- The strongest buyer’s markets in the country are New Orleans, Miami, Jacksonville, Austin, and Tampa.

Rents

- Asking rents increased by 0.2% month-over-month in August. The pre-pandemic average for this time of year is 0.4%.

- Rents are now up 3.4% from last year.

- Rents fell, on a monthly basis, in 2 major metro areas – Austin (-0.4%) and Boston (-0.1%).

- Rents are up from year-ago levels in 49 of the 50 largest metro areas. Annual rent increases are highest in Hartford (7.7%), Cleveland (7.2%), Louisville (7.1%), Richmond (6.8%), and Virginia Beach (6.6%).

Zillow Writer: Skylar Olsen

Even though inventory is still below more normal pre-pandemic levels, it’s improved a lot in the past year. And the best part is, experts say it’ll grow another 10 to 15% this year. That means you have more options for your move – and the best chance in years to find a home you love.

Even though inventory is still below more normal pre-pandemic levels, it’s improved a lot in the past year. And the best part is, experts say it’ll grow another 10 to 15% this year. That means you have more options for your move – and the best chance in years to find a home you love.

The Importance of Working with a Local Agent

The Importance of Working with a Local Agent

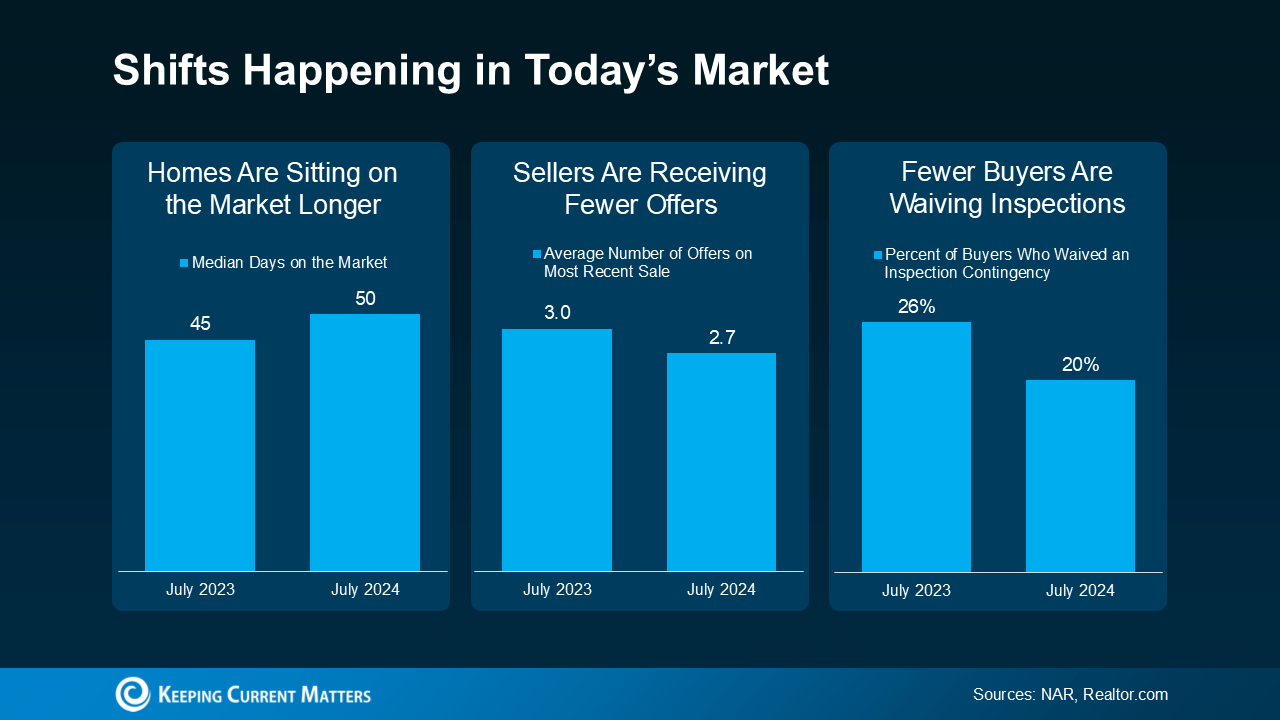

Homes Are Sitting on the Market Longer: Since more homes are on the market, they’re not selling quite as fast. For buyers, this means you may have more time to find the right home. For sellers, it’s important to

Homes Are Sitting on the Market Longer: Since more homes are on the market, they’re not selling quite as fast. For buyers, this means you may have more time to find the right home. For sellers, it’s important to