Keeping Current Matters | Sep 13, 2024

Some Highlights

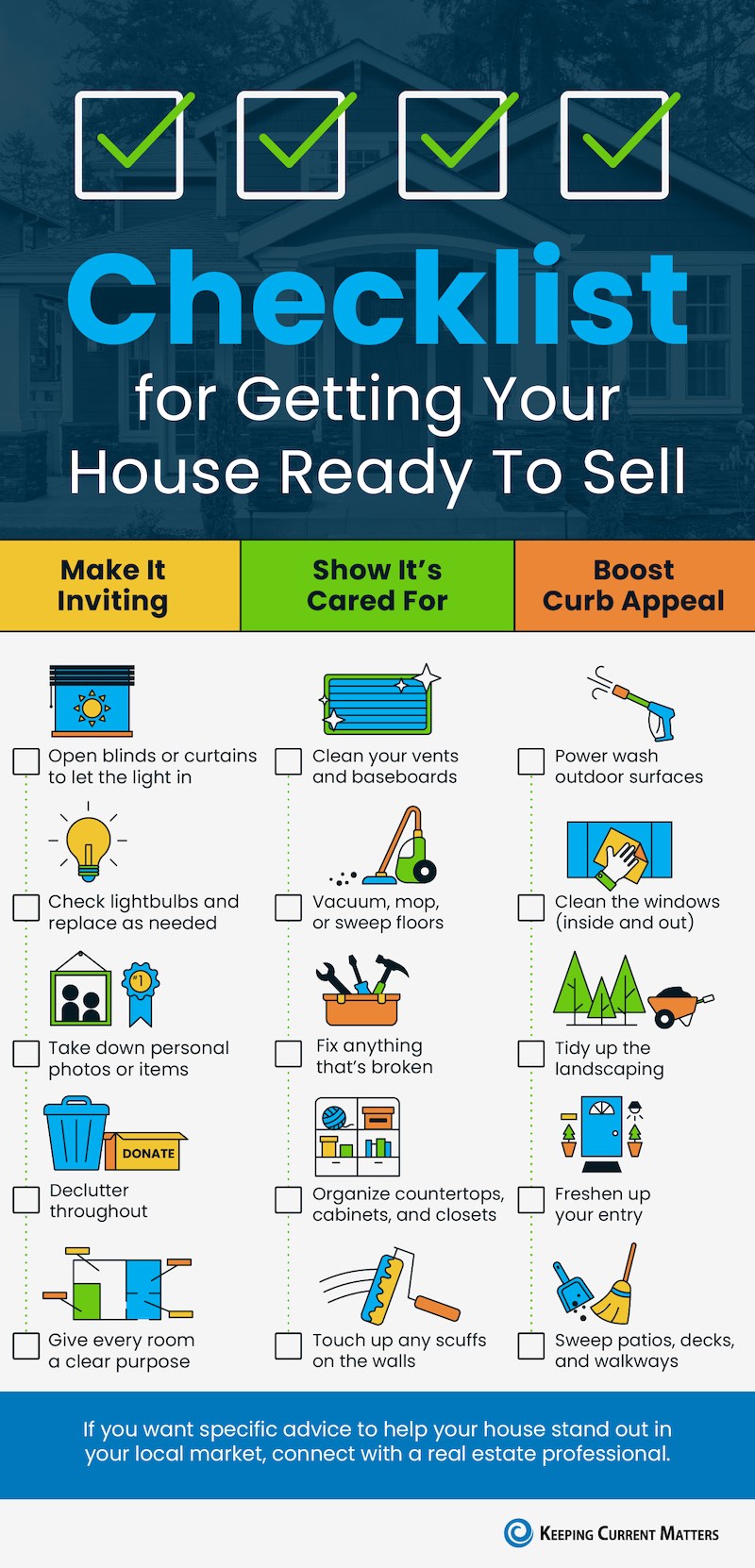

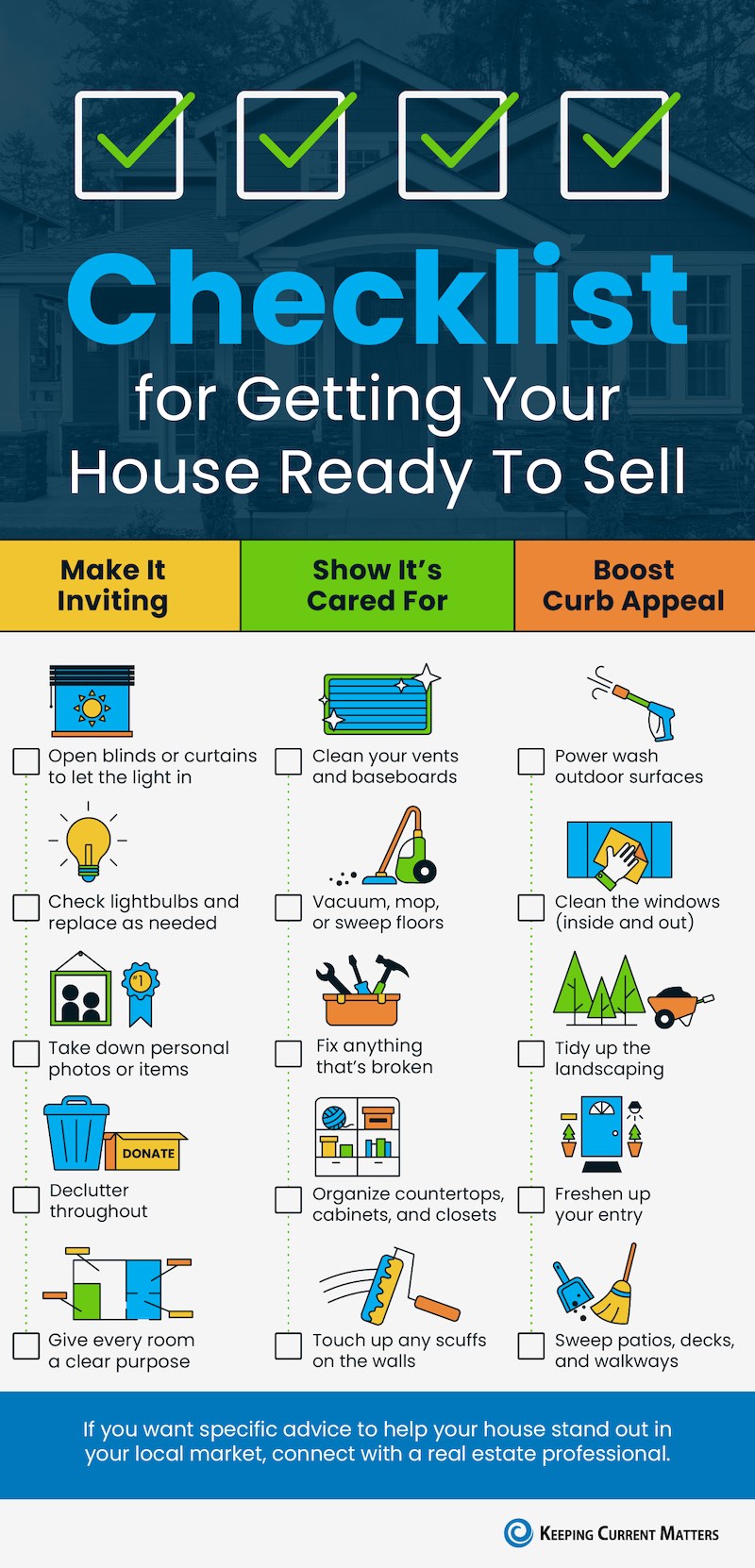

- Getting your house ready to sell? Here’s a few tips on what you may want to do to prepare.

- Focus on making it inviting, showing it’s cared for, and boosting your curb appeal.

- If you want specific advice to help your house stand out in your local market, connect with CA Real Estate Group.

CA Real Estate Group | Caliber RE Group

Christine Almarines @carealestategroup

Realtor DRE# 01412944 | (714) 476-4637

Anaid Bautista @wealthwithanaid

Realtor DRE# 02179675 | (949) 391-8266

Letty Luna @lettylunarealestate

Realtor DRE# 02174000 | (562) 879-4181

PT Nguyen @sellsocalbuypt

Realtor DRE# 02223919 | (714) 756-0240

August 17, 2024 marks a seismic shift in the real estate industry.

It’s a day that will reshape how buyers and sellers interact, and most importantly, it will redefine the relationship between buyers and their agents.

For those of us who have been in real estate for decades, this change feels almost revolutionary. But the seeds of this transformation were planted back in the 1990s when buyers first began advocating for buyer’s agents to be true fiduciaries, safeguarding their interests above all else. This movement was driven by a desire for transparency, accountability, and a partnership that ensured buyers were fully represented in one of the most significant financial decisions of their lives.

The Shift in Commissions

Traditionally, buyer agents were compensated through the MLS, with commissions often baked into the sale price of a home. Come August 17th, however, this practice will no longer be the default. Commissions for buyer agents will be removed from the MLS, meaning buyers and agents alike will be in the dark about whether compensation is available. This is a significant departure from the status quo, where both parties had clear expectations going into a transaction.

New Requirements for Buyers

Another key change is the introduction of mandatory signed agreements before buyers can even tour a property privately with an agent. These agreements come in various forms:

- Exclusive Buyer Agency Contract: A commitment that binds the buyer to an agent for a specified period, often requiring compensation upfront for their services.

- Single Property Tour Form: A more flexible agreement for buyers who want to tour a specific property without long-term commitment.

- Non-Exclusive Buyer Agency Contract: Ideal for investors, this agreement allows buyers to work with multiple agents simultaneously, offering flexibility in their search.

The introduction of these forms signals a new era where the choice of representation matters more than ever. Buyers must be more strategic in selecting their agents, ensuring they align with their needs and goals.

Historical Context: The Evolution of Buyer Representation

In the 1990s, the concept of a buyer’s agent being a fiduciary was a radical idea. Before that, most agents worked primarily for the seller, even if they were showing homes to buyers. The introduction of buyer agency contracts changed the game, giving buyers their own advocates in the transaction process. Today’s changes build on that legacy, pushing the industry toward even greater transparency and fairness.

What Buyers Need to Do Now

As we navigate this new landscape, it’s crucial for buyers to understand their options and the implications of these changes:

- Educate Yourself: Understanding the different types of agreements and how they affect your buying power is more important than ever.

- Choose Wisely: The agent you work with will significantly impact your experience and outcome. Make sure they are fully informed and able to articulate their value proposition.

- Plan Ahead: The days of casually touring homes without a plan are over. Buyers must now be more deliberate in their approach, ensuring they have the right representation in place from the start.

Questions to Consider

- Are you prepared for the new requirements in the home-buying process starting August 17th?

- How will the removal of buyer agent commissions from the MLS affect your home search strategy?

- What should you look for in a buyer’s agent in this new era of real estate?

Conclusion

The real estate market is on the cusp of a significant change, but with the right preparation and understanding, buyers and sellers can navigate these new waters successfully. Who you work with matters more than ever, and having the right representation can make all the difference in achieving your real estate goals. That’s why you can call any of our CA Real Estate Group agents to help you navigate your next real estate purchase or sale.

CA Real Estate Group | Caliber RE Group

👩🏻 Christine Almarines @christine_almarines

Realtor DRE# 01412944 | (714) 476-4637

👩🏻 Anaid Bautista @wealthwithanaid

Realtor DRE# 02179675 | (949) 391-8266

Hablo español

👩🏻 Letty Luna @lettylunarealestate

Realtor DRE# 02174000 | (562) 879-4181

👩🏻 PT Nguyen @sellsocalbuypt

Realtor DRE# 02223919 | (714) 756-0240

Mike Urban is an Award-Winning Boston Realtor. Featured In: 🏆Boston 25 News, Times-Tribune, Abington Suburban. Published on Aug 9, 2024.

Are you on the fence about whether to sell your house now or hold off? It’s a common dilemma, but here’s a key point to consider: your lifestyle might be the biggest factor in your decision. While financial aspects are important, sometimes the personal motivations for moving are reason enough to make the leap sooner rather than later.

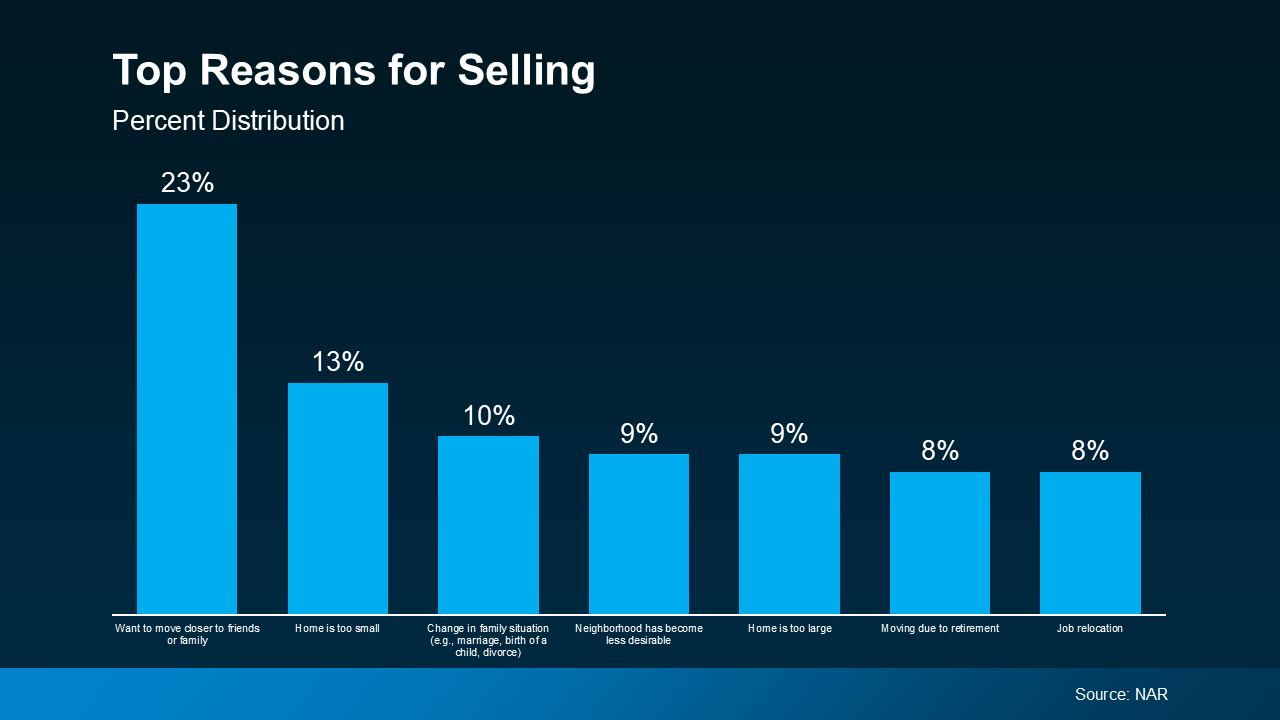

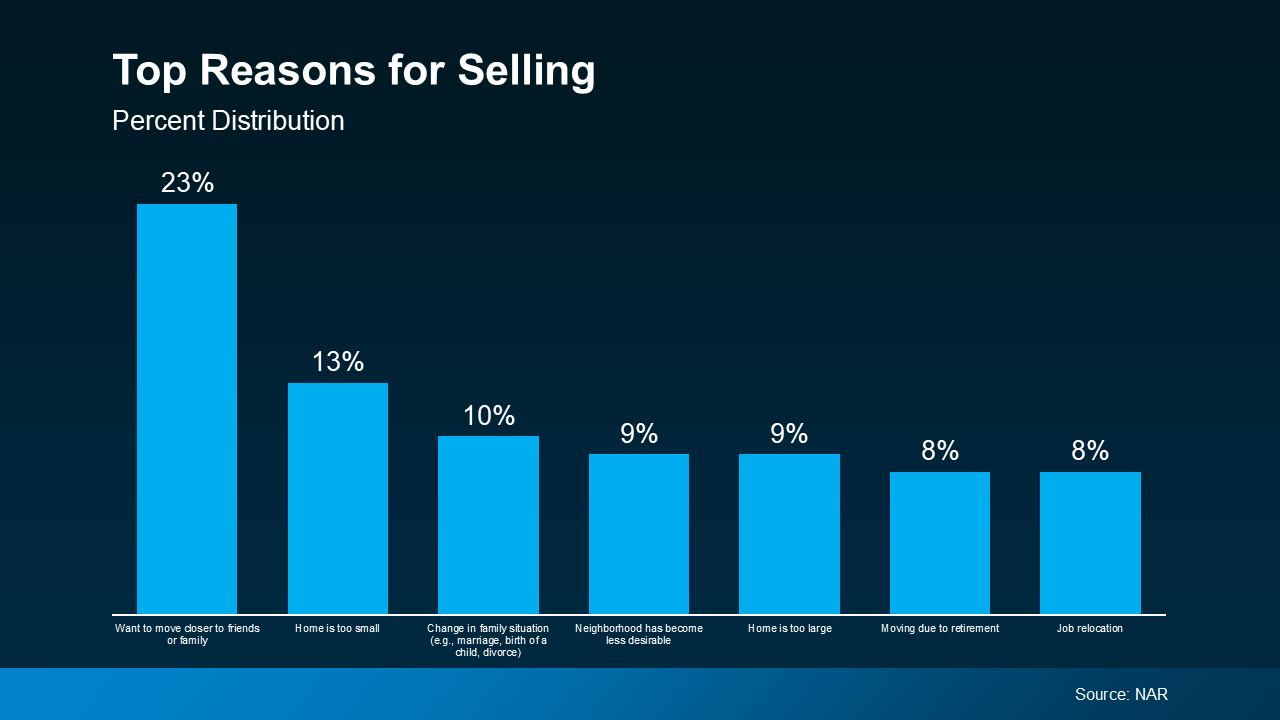

An annual report from the National Association of Realtors (NAR) offers insight into why homeowners like you chose to sell. All of the top reasons are related to life changes. As the graph below highlights:

As the visual shows, the biggest motivators were the desire to be closer to friends or family, outgrowing their current house, or experiencing a significant life change like getting married or having a baby. The need to downsize or relocate for work also made the list.

As the visual shows, the biggest motivators were the desire to be closer to friends or family, outgrowing their current house, or experiencing a significant life change like getting married or having a baby. The need to downsize or relocate for work also made the list.

If you, like the homeowners in this report, find yourself needing features, space, or amenities your current home just can’t provide, it may be time to consider talking to a real estate agent about selling your house. Your needs matter. That agent will walk you through your options and what you can expect from today’s market, so you can make a confident decision based on what matters most to you and your loved ones.

Your agent will also be able to help you understand how much equity you have and how it can make moving to meet your changing needs that much easier. As Danielle Hale, Chief Economist at Realtor.com, explains:

“A consideration today’s homeowners should review is what their home equity picture looks like. With the typical home listing price up 40% from just five years ago, many home sellers are sitting on a healthy equity cushion. This means they are likely to walk away from a home sale with proceeds that they can use to offset the amount of borrowing needed for their next home purchase.”

Bottom Line

Your lifestyle needs may be enough to motivate you to make a change. If you want help weighing the pros and cons of selling your house, connect with CA Real Estate Group today.

CA Real Estate Group | Caliber RE Group

👩🏻 Christine Almarines @christine_almarines

Realtor DRE # 01412944

(714) 476-4637 | christine@carealestategroup.com

👩🏻 Anaid Bautista @wealthwithanaid

Realtor DRE# 02179675

(949) 391-8266 | anaid@carealestategroup.com

👩🏻 Letty Luna @lettylunarealestate

Realtor DRE# 02174000

(562) 879-4181 | letty@carealestategroup.com

👩🏻 PT Nguyen @sellsocalbuypt

Realtor DRE# 02223919

(714) 756-0240 | letty@carealestategroup.com

When you’re thinking about buying a home, your credit score is one of the biggest pieces of the puzzle. Think of it like your financial report card that lenders look at when trying to figure out if you qualify, and which home loan will work best for you. As the Mortgage Report says:

“Good credit scores communicate to lenders that you have a track record for properly managing your debts. For this reason, the higher your score, the better your chances of qualifying for a mortgage.”

The trouble is most buyers overestimate the minimum credit score they need to buy a home. According to a report from Fannie Mae, only 32% of consumers have a good idea of what lenders require. That means nearly 2 out of every 3 people don’t.

So, here’s a general ballpark to give you a rough idea. Experian says:

“The minimum credit score needed to buy a house can range from 500 to 700, but will ultimately depend on the type of mortgage loan you’re applying for and your lender. Most lenders require a minimum credit score of 620 to buy a house with a conventional mortgage.”

Basically, it varies. So, even if your credit isn’t perfect, there are still options out there. FICO explains:

“While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy, including the level of risk it finds acceptable. There is no single “cutoff score” used by all lenders, and there are many additional factors that lenders may use . . .”

And if your credit score needs a little TLC, don’t worry—Experian says there are some easy steps you can take to give it a boost, including:

1. Pay Your Bills on Time

Lenders want to see that you can reliably pay your bills on time. This includes everything from credit cards to utilities and cell phone bills. Consistent, on-time payments show you’re a responsible borrower.

2. Pay Off Outstanding Debt

Paying down what you owe can help lower your overall debt and make you less of a risk to lenders. Plus, it improves your credit utilization ratio (how much credit you’re using compared to your total limit). A lower ratio means you’re more reliable to lenders.

3. Don’t Apply for Too Much Credit

While it might be tempting to open more credit cards to build your score, it’s best to hold off. Too many new credit applications can lead to hard inquiries on your report, which can temporarily lower your score.

Bottom Line

Your credit score is crucial when buying a home. Even if your score isn’t perfect, there are still pathways to homeownership. Let’s connect if you want to go over your options with an expert.

Let’s connect and plan your next steps. Find out if we’re the right real estate team for you!

CA Real Estate Group | Caliber RE Group

👩🏻 Christine Almarines @christine_almarines

Realtor DRE# 01412944 | (714) 476-4637

👩🏻 Anaid Bautista @wealthwithanaid

Realtor DRE# 02179675 | (949) 391-8266

Hablo español

Realtor.com | Aug 13, 2024

The high mortgage rates that have paralyzed America’s housing market are falling—and could nosedive further by the end of the year.

Rates for a 30-year fixed mortgage plunged to 6.47%—the lowest in over a year—for the week ending Aug. 8, according to Freddie Mac.

And with inflation losing steam and the economy cooling, expectations are high that the Federal Reserve could make not just one, but two rate cuts by the end of this year.

As a result, Realtor.com® senior economist Ralph McLaughlin expects mortgage rates to drop further in September and December, which is “encouraging news for potential homebuyers who have been waiting to participate in the market.”

This is also encouraging news for homeowners who might be thinking of selling. Is it time to finally list their property on the market? And if they do, what should they expect?

To help shed some light on what’s coming down the pike for home sellers, here’s what real estate experts predict will happen to the housing market once rates take the plunge.

The ‘lock-in effect’ will ease—and homeowners will start selling

A recent Realtor.com analysis found that 86% of homeowners have mortgage rates below 6%. Understandably, many feel “locked in,” unwilling to trade in their low rate for today’s higher ones if they sell and buy again.

“Home sellers have been sitting on the sidelines, not wanting to give up their COVID-era interest rates,” says Tan Tunador, vice president and senior loan officer with Atlantic Coast Mortgage.

But once rates drop further, that could change.

“The faster rates drop, the less homeowners will be held in place and we could see both new inventory and more sales,” says Danielle Hale, chief economist of Realtor.com.

“There are a significant number of sellers that couldn’t stomach—right or wrong—going from a 4% rate to a 7.5% rate,” says Mason Whitehead, a Dallas-based branch manager for Churchill Mortgage. “But they can stomach going from 4% to something in the 5% to 6% range.”

More homebuyers will enter the market

In the same vein that sellers have felt frozen in place, buyers have felt iced out of the market. But if mortgage rates continue to decline, then experts predict more buyers who’ve been on the sidelines finally jump into the market.

“When rates drop, I think you will see pent-up demand hit the market again,” says Whitehead.

Some buyers, like sellers, shelved their house hunt because they felt the payment was too high, but a lower rate makes home shopping more affordable.

“For some that didn’t qualify at 7.5%, they will qualify at 6%,” says Whitehead. “So you have more people able to buy as well.”

In other words, once rates fall, the market will see both more sellers willing to sell, and buyers willing and able to buy.

Sales will come on fast and strong

Any seller thinking of listing would be wise to start prepping right now.

“Mortgage rates have been improving, and they are bringing potential buyers out early, many of whom gave up on buying, either because of the low housing inventory or the higher rate environment the past few years,” says Tunador. “For sellers, listing their house early may give them the opportunity to sell before their competition hits the market.”

Other experts agree: There are definitely signs homebuying activity is beginning to bounce off the mat.

“Mortgage applications have perked up, and refinancing activity also looks to be picking up as rates go lower and owners carrying elevated mortgage rates seek to reduce their monthly payments,” says Charlie Dougherty, director and senior economist at Wells Fargo.

“All told, mortgage applications remain low, but the recent upturn is a promising sign that buying activity is starting to heat up and defrost a housing market frozen by higher interest rates,” adds Dougherty.

And if mortgage rates continue to shift south, things might get even toastier.

“When mortgage rates [stay in] a sub-6.5% average, we will really see the housing inventory increase and sales activity boom,” says Tunador.

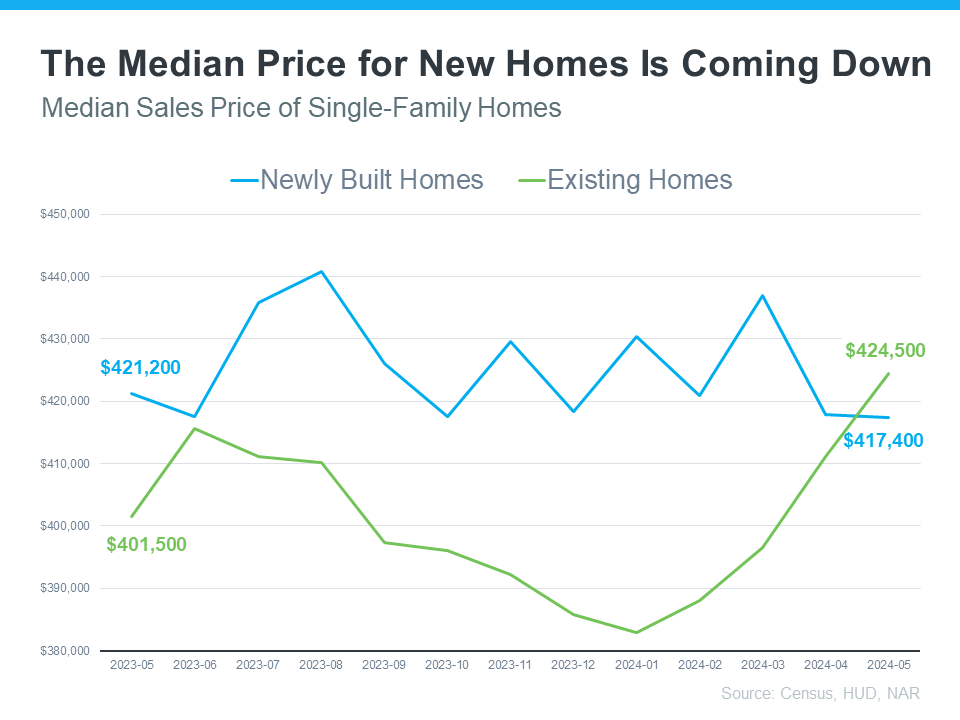

Home prices will likely remain high

The good news for sellers is that even as the market gets moving, home prices are expected to remain high, or dip only slightly.

“Sellers will continue to be in a historically strong position, as the U.S. housing market is still short millions of homes,” says Dan Hnatkovskyy, co-founder and CEO of NewHomesMate. “Assuming there isn’t a severe recession, we will likely see only modest price decreases in most markets in 2024.”

However, Hnatkovskyy says that formerly hot markets like Denver, Austin, TX, and Phoenix may see a more significant drop in housing prices as smaller investor money sits on the sidelines for most of 2024. But in general, experts don’t see home prices taking a major dive as interest rates start to descend.

Even so, it will be smart for sellers not to get too cocky with their home pricing.

“Sellers may benefit from realistic pricing and encouraging buyer competition,” says Cassandra Happe, an analyst for WalletHub. “Working with a real estate agent to price strategically and enhancing online presence with 3D tours can maximize the chances of a quick and profitable sale.”

In other words, sellers shouldn’t set their hopes price too high lest they price themselves out of the market.

“Housing affordability will likely remain strained given still-high mortgage rates and the rapid run-up in home prices over the past three years,” says Dougherty. A shaky economy could “keep the pace of home sales relatively tepid.”

Multiple offers may make a comeback

The increase in competition among buyers might mean that sellers once again find themselves in the enviable position of being able to choose from several offers for their homes.

“Sellers will be in luck when mortgage rates start to drop: They’ll have multiple offers to consider and have some extra leverage when negotiating,” predicts Bryson Taggart, senior agent partnership manager for Opendoor. “For example, sellers receiving multiple offers can drive up the price of their home or waive contingencies for an easier close and a more convenient timeline.”

Still, sellers need to remember that the highest offer isn’t always the best offer.

“I advise sellers to evaluate offer terms holistically and select the one that aligns best with their wants and needs,” says Taggart.

For some, that could be an offer from a more qualified buyer or a cash buyer, which provides less of a risk for fall-throughs. If a seller is planning to also purchase a home, they should pick a buyer with favorable terms for an efficient close.

Enjoy these helpful tips and advice in this month’s edition of “Insights on Real Estate”:

1️⃣ Updated Rules for Selling a House;

2️⃣ Enchant Buyers With Stunning Fall Curb Appeal;

3️⃣ Understanding Down Payment Assistance Programs;

4️⃣ The Difference Between a CMA and an Appraisal; and

5️⃣ Pro Tips for Market-Savvy Home Buyers

Let’s connect and plan your next steps. Find out if we’re the right real estate team for you!

CA Real Estate Group | Caliber Real Estate Group

👩🏻 Christine Almarines @christine_almarines

Realtor DRE# 01412944 | 714-476-4637

👩🏻 Anaid Bautista @wealthwithanaid

Realtor DRE# 02179675 | 949-391-8266

Keeping Current Matters | Aug 5, 2024

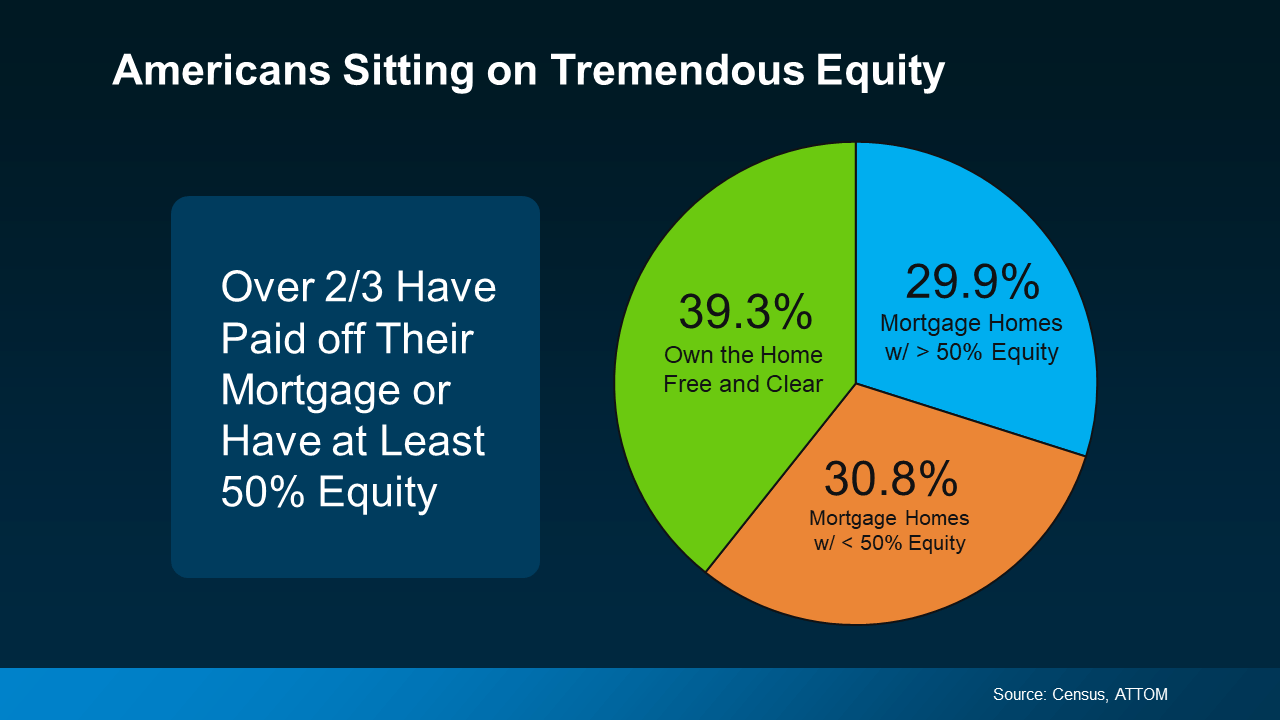

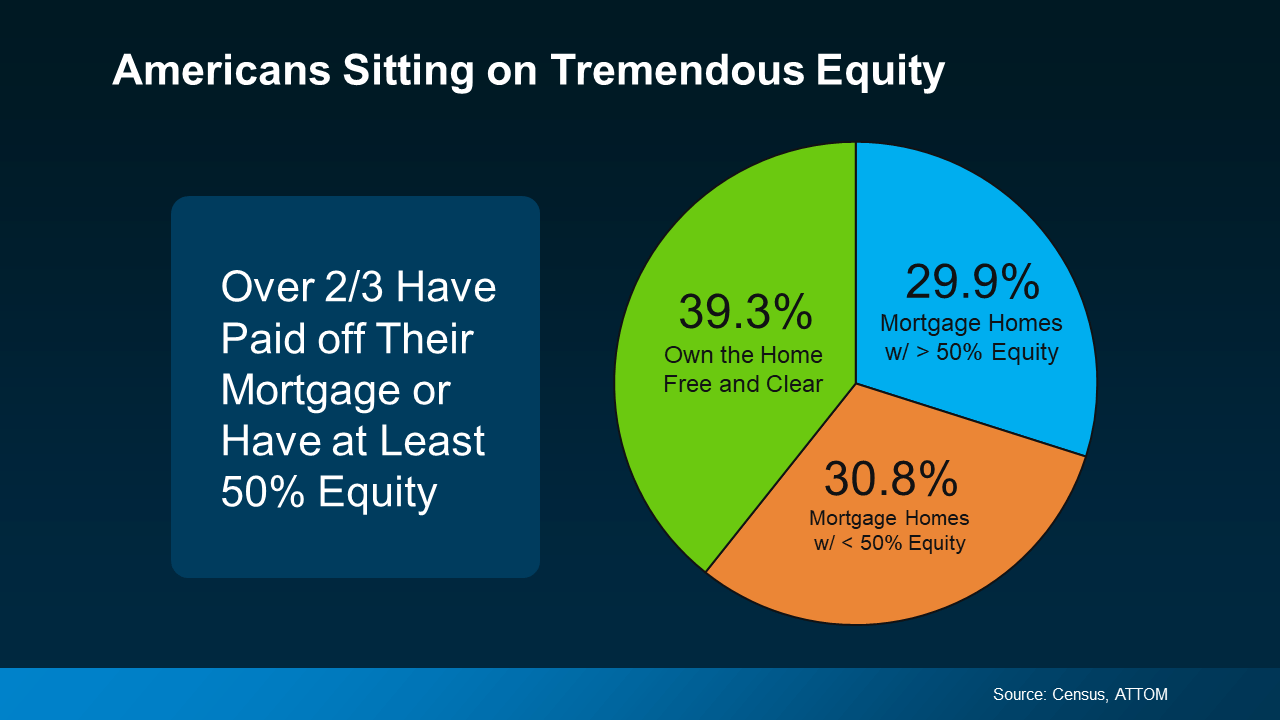

Curious about selling your home? Understanding how much equity you have is the first step to unlocking what you can afford when you move. And since home prices rose so much over the past few years, most people have much more equity than they may realize.

Here’s a deeper look at what you need to know if you’re ready to cash in on your investment and put your equity toward your next home.

Home Equity: What Is It and How Much Do You Have?

Home equity is the difference between how much your house is worth and how much you still owe on your mortgage. For example, if your house is worth $400,000 and you only owe $200,000 on your mortgage, your equity would be $200,000.

Recent data from the Census and ATTOM shows Americans have significant equity right now. In fact, more than two out of three homeowners have either completely paid off their mortgages (shown in green in the chart below) or have at least 50% equity in their homes (shown in blue in the chart below):

Today, more homeowners are getting a larger return on their homeownership investments when they sell. And if you have that much equity, it can be a powerful force to fuel your next move.

Today, more homeowners are getting a larger return on their homeownership investments when they sell. And if you have that much equity, it can be a powerful force to fuel your next move.

What You Should Do Next

If you’re thinking about selling your house, it’s important to know how much equity you have, as well as what that means for your home sale and your potential earnings. The best way to get a clear picture is to work with your agent, while also talking to a tax professional or financial advisor. A team of experts can help you understand your specific situation and guide you forward.

Bottom Line

Home prices have gone up, which means your equity probably has too. Connect with local real estate agents like CA Real Estate Group so you can find out how much equity you have in your home and move forward confidently when you sell.

Let’s connect and plan your next steps. Find out if we’re the right real estate team for you!

CA Real Estate Group | Caliber RE Group

👩🏻 Christine Almarines @christine_almarines and @carealestategroup

Realtor DRE# 01412944 | (714) 476-4637

👩🏻 Anaid Bautista @wealthwithanaid

Realtor DRE# 02179675 | (949) 391-8266

Hablo español

Keeping Current Matters | Jul 30, 2024

The housing market is going through a transition. Higher mortgage rates are causing more moderate buyer activity at the same time the supply of homes for sale is growing.

And if you aren’t working with an agent, you may not realize that. Here’s the downside. If you’re not informed, you can’t adjust your strategy or expectations to today’s market. And that can lead to a number of costly mistakes.

Here’s a look at some of the most common ones – and how an agent will help you avoid them when you sell.

1. Overpricing Your House

Many sellers set their asking price too high and that’s why there’s an uptick in homes with price reductions today. An unrealistic price will deter potential buyers, cause an appraisal issue, or lead to your house sitting on the market longer. An article from the National Association of Realtors (NAR) explains:

“Some sellers are pricing their homes higher than ever just because they can, but this may drive away serious buyers and result in unapproved appraisals . . .”

To avoid falling into this trap, partner with a pro. An agent uses recent sales of similar homes, the condition of your house, local market trends, and so much more to find the price that’ll attract more buyers and open the door for multiple offers and a faster sale.

2. Skipping the Small Stuff

You may try to skip important repairs, thinking you can pass the task on to your buyer. But visible issues (even if they’re small) can turn off potential buyers and result in lower offers or demands for concessions. As Money Talks News says:

“Home shoppers like to turn on lights, flush toilets and run the water. If these basic things don’t work, they may assume you’ve skipped other maintenance. Homes that appear neglected aren’t likely to fetch top price.”

If you want to get your house ready to sell, the best place to turn to for advice is your agent. They’ll be able to do a walk-through with you and point out anything you’ll need to tackle before the photographer comes in.

3. Not Looking at Things Objectively

Buyers today are feeling the pinch of high home prices and mortgage rates. With affordability that tight, they may come in with an offer that’s lower than you’d want to see – especially if you didn’t stage, price, or market the house well.

It’s important you don’t take this personally. Getting overly emotional can put the sale at risk. As an article from Ramsey Solutions says:

“Remember, a buyer’s offer is not a reflection of their opinion of your home or your housekeeping abilities. . . The sale of your home is strictly a business transaction. If they start out with a low offer, don’t take it personally and get emotional. Instead, channel that energy toward negotiating. Work with your agent and make a counteroffer.”

4. Being Unwilling To Negotiate

The supply of homes for sale has grown. That means buyers have more options, and with that comes more negotiation power. As a seller, you may see more buyers getting an inspection, requesting repairs, or asking for help with closing costs today. You need to be prepared to have those conversations. As U.S. News Real Estate explains:

“If you’ve received an offer for your house that isn’t quite what you’d hoped it would be, expect to negotiate . . . the only way to come to a successful deal is to make sure the buyer also feels like he or she benefits . . . consider offering to cover some of the buyer’s closing costs or agree to a credit for a minor repair the inspector found.”

An agent will walk you through what levers you may want to pull based on your own goals, budget, and timeframe.

5. Not Using a Real Estate Agent

Notice anything? For each of these mistakes, partnering with an agent helps prevent them from happening in the first place. That makes trying to sell your house without an agent’s help the biggest mistake of all.

Real estate agents have experience and expertise in pricing, marketing, negotiating, and more. That knowledge streamlines the selling process and usually results in drumming up more interest and ultimately can get you a higher final price.

Bottom Line

If you want to avoid making mistakes like these, you need to work with a CA Real Estate Group agent.

CA Real Estate Group | Caliber RE Group

👩🏻 Christine Almarines @carealestategroup

Realtor DRE# 01412944 | 714-476-4637

👩🏻 Anaid Bautista @wealthwithanaid

Realtor DRE# 02179675 | 949-391-8266

Hablo español

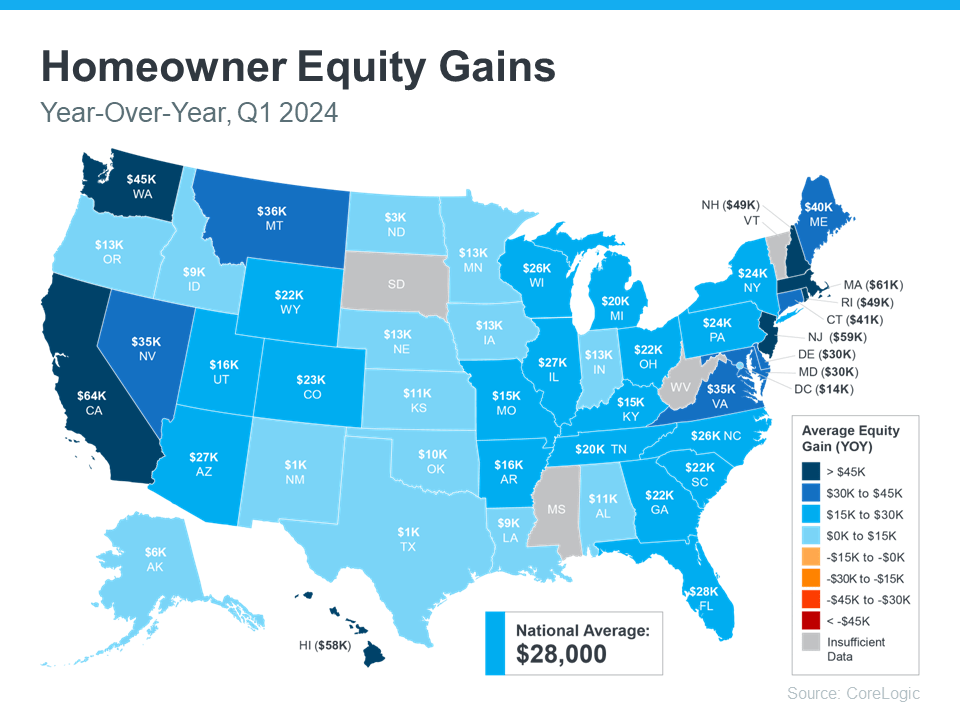

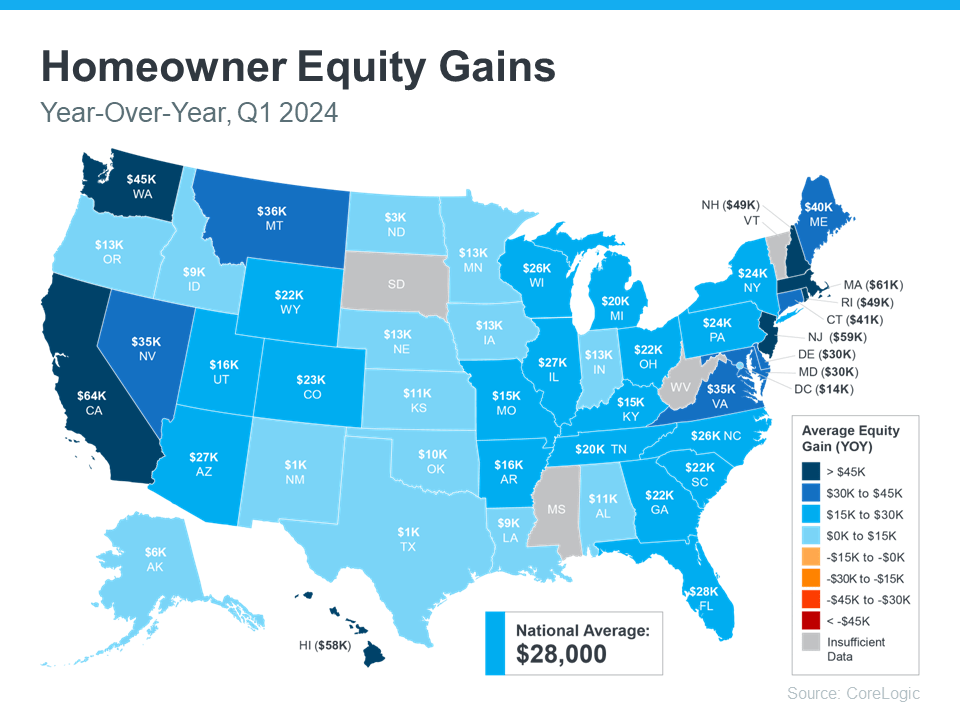

If you own a home, your net worth has probably gone up a lot over the past year. Home prices have been rising, which means you’re building equity much faster than you might think. Here’s how it works.

Equity is the current value of your home minus what you owe on the loan.

Over the past year, there have still been more people wanting to buy than there are homes available for sale, and that’s pushed prices up. That rise in prices has translated directly into increasing equity for homeowners.

How Much Equity Have You Earned over the Past 12 Months?

According to the latest Homeowner Equity Insights from CoreLogic, the average homeowner’s equity has grown by $28,000 in the last year alone.

That’s the national average, so if you want to see what’s happening in your state, check out the map below. It uses data from CoreLogic to show how much equity has grown in each state over the past year. You’ll notice every single state with sufficient data saw annual equity gains:

What If You Bought Your House Before the Pandemic?

If you bought your house before the pandemic, the equity news is even better. According to data from Realtor.com, home prices shot up by 37.5% from May 2019 to May 2024, meaning your home’s value has likely increased significantly. Ralph McLaughlin, Senior Economist at Realtor.com, says:

“Homeowners have seen extraordinary gains in home equity over the past five years.”

To give context to how much equity can stack up over time, Selma Hepp, Chief Economist at CoreLogic, explains the total equity the typical homeowner has today:

“With home prices continuing to reach new highs, owners are also seeing their equity approach the historic peaks of 2023, close to a total of $305,000 per owner.”

How Your Rising Home Equity Can Help You

With how prices skyrocketed a few years ago, and the ongoing price growth today, homeowners clearly have substantial equity built up – and that has some serious benefits.

You could use it to start a business, fund an education, or even to help you afford your next home. When you sell, the equity you’ve built up comes back to you, and may be enough to cover a big part – or even all – of your next home’s down payment.

Bottom Line

If you’re planning to move, the equity you’ve gained can really help. Curious about how much you have and how you can use it to help pay for your next home? Connect with CA Real Estate Group.

CA Real Estate Group | Caliber RE Group

👩🏻 Christine Almarines @carealestategroup

Realtor DRE# 01412944 | 714-476-4637

👩🏻 Anaid Bautista @wealthwithanaid

Realtor DRE# 02179675 | 949-391-8266

Hablo español

As the visual shows, the biggest motivators were the desire to be closer to friends or family, outgrowing their current house, or experiencing a significant life change like getting married or having a baby. The need to downsize or relocate for work also made the list.

As the visual shows, the biggest motivators were the desire to be closer to friends or family, outgrowing their current house, or experiencing a significant life change like getting married or having a baby. The need to downsize or relocate for work also made the list.