Summer is officially here and that means it’s the perfect time to start planning where you want to vacation and unwind this season. If you’re excited about getting away and having some fun in the sun, it might make sense to consider if owning your own vacation home is right for you.

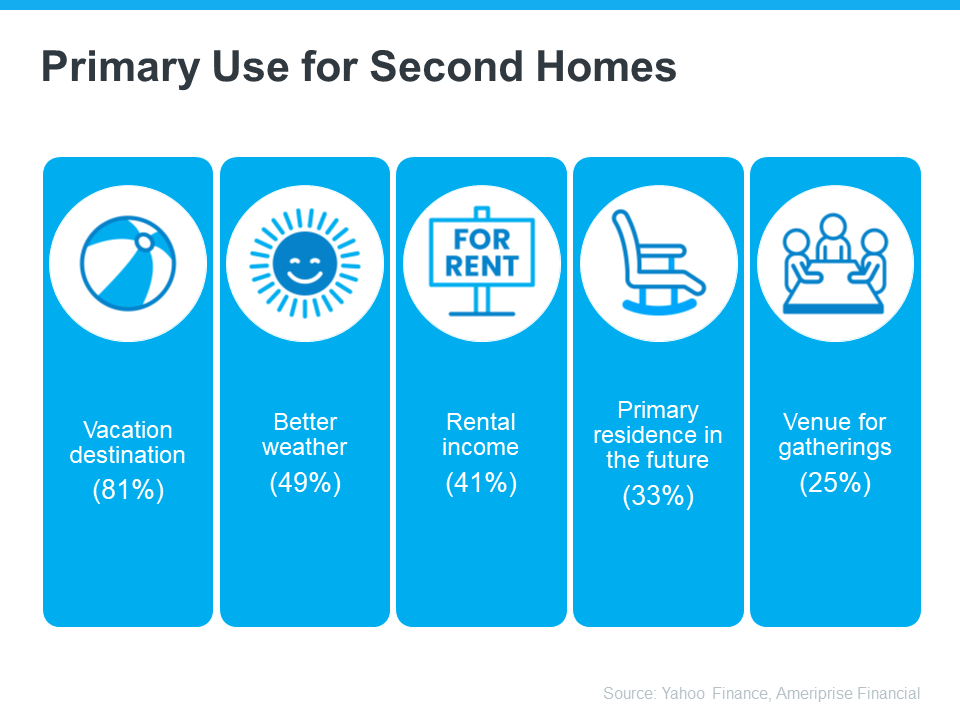

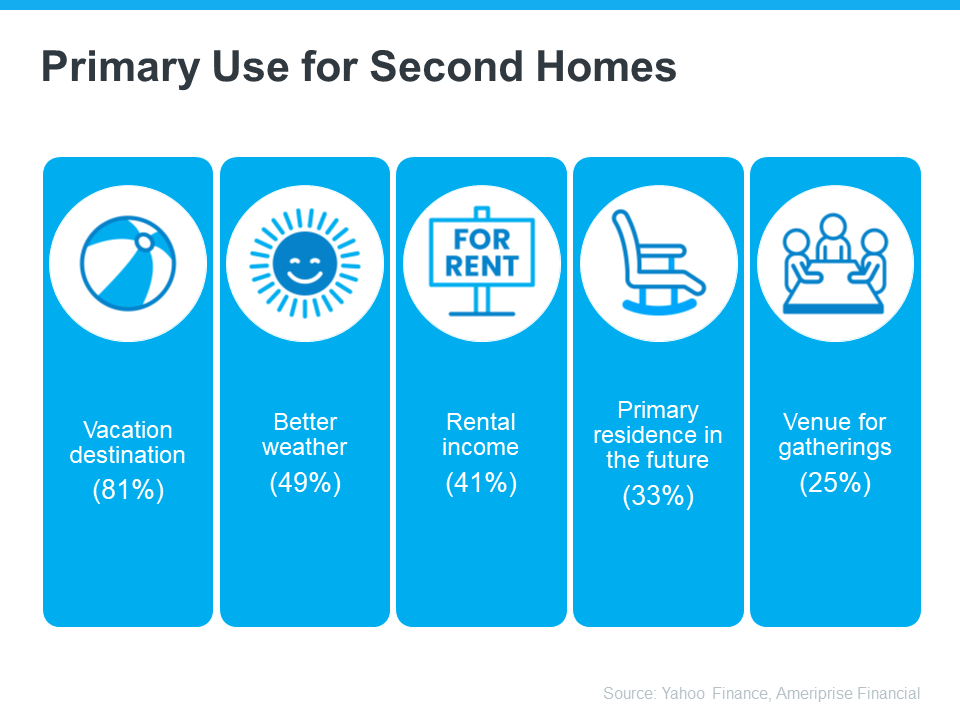

An Ameriprise Financial survey sheds light on why people buy a second, or vacation, home (see below):

- Vacation destination or a place to get away from the stresses of everyday life (81%) – Having a second home to use as a vacation spot can be a special place where you go to relax and take a break from your daily routines and stressors. It also means you won’t have to worry about finding somewhere to stay when you go there.

- Better weather (49%) – Buying in a place where there may be nicer weather can be a great escape, especially if it’s cold or rainy where you usually live. It lets you enjoy sunny days and warm temperatures, even when it’s not so nice back home.

- Rental income (41%) – You can rent it out to other people when you’re not using it, which can help you make some extra money.

- Primary residence in the future (33%) – You can eventually move into the home full-time during retirement. That means you can enjoy vacations there now and have a getaway ready for your future.

- Having a venue for gatherings with family and friends (25%) – It would be a special spot where you can have parties, regular family trips, and create fun memories.

Ways To Buy Your Vacation Home

And you don’t have to be wealthy to buy a vacation home. Bankrate shares two tips for how to make this dream more achievable for anyone who’s interested:

- Buy with loved ones or friends: If you’re okay with sharing the vacation home, you can go in on the purchase price together and pool your resources to make it more affordable.

- Put a savings plan in place: This will require patience and persistence but consider adding a vacation home savings plan to your budget and contributing to it monthly.

Finding Your Dream Spot with a Little Help from an Agent

If the idea of basking in the sun at your very own vacation home sounds appealing, you might want to start looking now. Summer’s when everyone’s trying to buy their slice of paradise, so it’s best to start early.

Your first move is to team up with a real estate agent. They know all the ins and outs of the area you want to be in, and which homes you should look at. Plus, they can give you the lowdown on everything you need to know about having a second home and how it can benefit you. The same article from Bankrate says:

“Buying real estate in a new area — or even one you’ve vacationed in for many years — requires expert guidance. That makes it a good idea to work with an experienced local lender who specializes in loans for vacation homes and a local real estate professional. Local lenders and Realtors will understand the required rules and specifics for the area you are buying, and a local Realtor will know what properties are available.”

Bottom Line

If the idea of owning your own vacation home appeals to you, connect with CA Real Estate Group.

CA Real Estate Group | Caliber RE Group

👩🏻 Christine Almarines @christine_almarines

Realtor DRE# 01412944 | 714-476-4637

👩🏻 Anaid Bautista @wealthwithanaid

Realtor DRE# 02179675 | 949-391-8266

Hablo español

Keeping Current Matters | Jun 21, 2024

Some Highlights

- Considering selling your house without an agent? You should know there are some serious downsides to handling it on your own.

- You’ll be missing out on marketing tools that draw in more buyers, pricing and market expertise, essential negotiation skills, in-depth knowledge of the fine print in contracts, and so much more.

- Don’t take all of this responsibility on. Instead, connect with a CA Real Estate Group agent so you have someone with the knowledge and experience you’ll need on your side.

Let’s connect and plan your next steps. Find out if we’re the right real estate team for you!

CA Real Estate Group | Caliber RE Group

👩🏻 Christine Almarines @carealestategroup

Realtor DRE# 01412944 | 714-476-4637

👩🏻 Anaid Bautista @wealthwithanaid

Realtor DRE# 02179675 | 949-391-8266

Hablo español

Some Highlights

- If your needs have changed, now’s a great time to sell and get the features you want most.

- Many buyers are eager to move between the school years, so you may see a faster sale, multiple offers, a higher final sales price, and more.

- If you want to get your house ready for a summer listing, connect with CA Real Estate Group. Give Christine Almarines a call at 714-476-4637!

Keeping Current Matters | Apr 16, 2024

If you’ve got a move on your mind, you may be wondering whether you should wait to sell until mortgage rates come down before you spring into action. Here’s some information that could help answer that question for you.

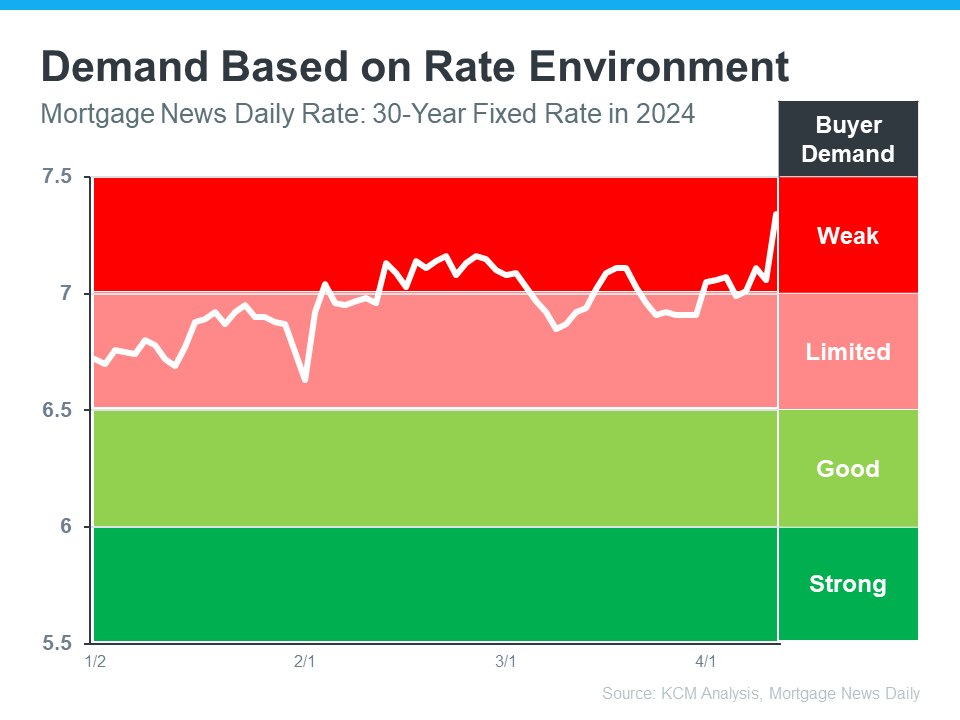

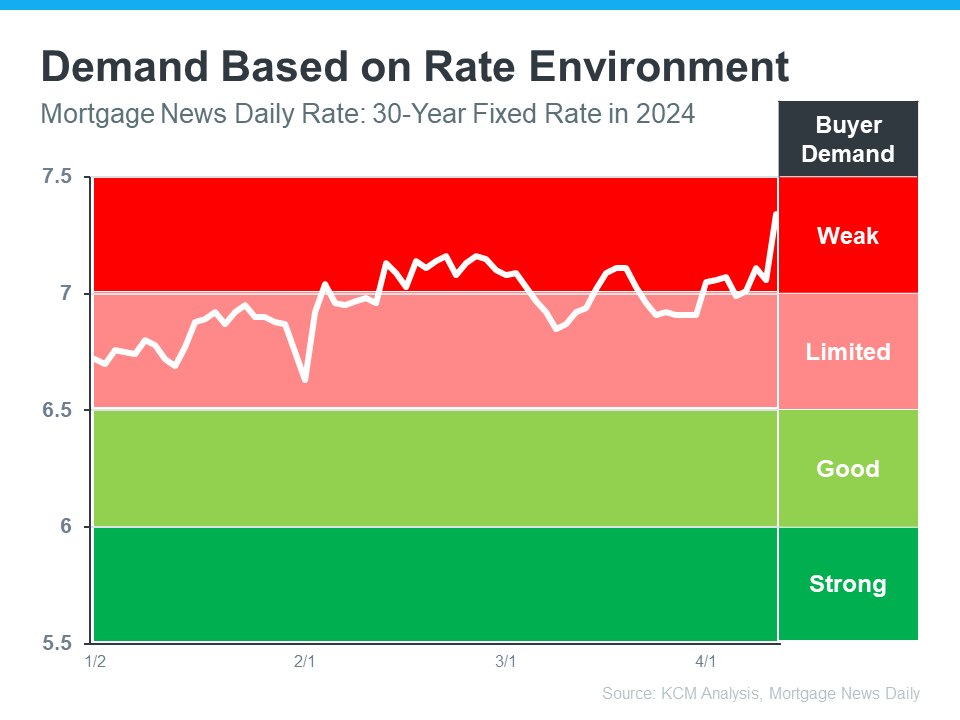

In the housing market, there’s a longstanding relationship between mortgage rates and buyer demand. Typically, the higher rates are, you’ll see lower buyer demand. That’s because some people who want to move will be hesitant to take on a higher mortgage rate for their next home. So, they decide to wait it out and put their plans on hold.

But when rates start to come down, things change. It goes from limited or weak demand to good or strong demand. That’s because a big portion of the buyers who sat on the sidelines when rates were higher are going to jump back in and make their moves happen. The graph below helps give you a visual of how this relationship works and where we are today:

As Lisa Sturtevant, Chief Economist for Bright MLS, explains:

“The higher rates we’re seeing now [are likely] going to lead more prospective buyers to sit out the market and wait for rates to come down.”

Why You Might Not Want To Wait

If you’re asking yourself: what does this mean for my move? Here’s the golden nugget. According to experts, mortgage rates are still projected to come down this year, just a bit later than they originally thought.

When rates come down, more people are going to get back into the market. And that means you’ll have a lot more competition from other buyers when you go to purchase your next home. That may make your move more stressful if you wait because greater demand could lead to an increase in multiple offer scenarios and prices rising faster.

But if you’re ready and able to sell now, it may be worth it to get ahead of that. You have the chance to move before the competition increases.

Bottom Line

If you’re thinking about whether you should wait for rates to come down before you move, don’t forget to factor in buyer demand. Once rates decline, competition will go up even more. If you want to get ahead of that and sell now, talk to a CA Real Estate Agent.

Let’s connect and plan your next steps. Find out if we’re the right real estate team for you!

CA Real Estate Group | Caliber RE Group

👩🏻 Christine Almarines @carealestategroup

Realtor DRE# 01412944 | 714-476-4637

👩🏻 Anaid Bautista @wealthwithanaid

Realtor DRE# 02179675 | 949-391-8266

Hablo español

Keeping Current Matters | Apr 1, 2024

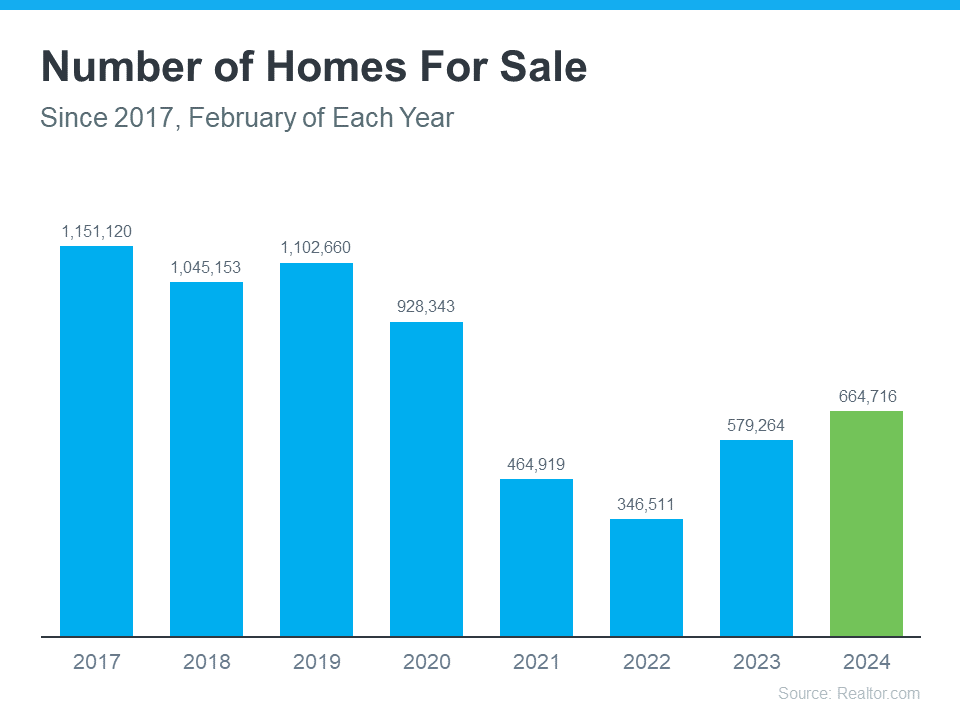

Are you thinking about making a move? If so, now may be the perfect time to start the process. That’s because experts say the best week to list your house is just around the corner.

A recent Realtor.com study looked at housing market trends over the past several years (with the exception of 2020, since it was an unusual year), and found the best week to put your house on the market this year is April 14-20:

“Every year, one week stands out from the rest as that perfect stretch of time when it’s great to be a home seller. This year, the week of April 14–20 is the best time to sell—that is, if sellers want to see lots of interest in their homes, sell quickly, and pocket some extra cash, according to Realtor.com® data.”

Here’s why this matters for you. While the spring market is a great time to sell no matter the week, this may be the peak sweet spot. And if you’ve been putting your plans on the back burner and waiting for the right time to act, this could be the nudge you need to make your move happen. As Hannah Jones, Senior Economic Research Analyst at Realtor.com explains:

“The third week of April brings the best combination of housing market factors for sellers. The best week offers higher buyer demand, lower competition [from other sellers], and fewer price reductions than the typical week of the year.”

But, if you want to get in on the action, you’ll need to move quickly and lean on the pros. Your local real estate agent is the perfect go-to when it comes to figuring out a plan to prep your house and get it on the market.

They’ll be able to offer advice to balance your target listing date with what you need to do from a repair and renovation standpoint. And they can walk you through exactly how to prioritize your list so you know what to tackle first.

For example, if your house is already in good shape, you’ll be able to really focus in on the smaller things that are easy to do and make a big impact. As an article from Investopedia says:

“You won’t have time for any major renovations, so focus on quick repairs to address things that could deter potential buyers.”

Here are some specific examples from that article:

Just remember, even if you’re not ready to list within the next couple of weeks, that’s okay. The window of opportunity doesn’t close when this week ends. Spring is the peak homebuying season and it’s still a seller’s market, so you’ll be in the driver’s seat all season long.

Bottom Line

Ready to get the ball rolling? Connect with a real estate agent to schedule a time to go over your next steps.

Keeping Current Matters | Apr 3, 2024

This report specifically benefits our Single Women Home Buyers to provide insight into the demographics, financial profiles, home buying motivations & lending experiences of women who purchase homes on their own.

We’d be happy to walk through this report with you.

Let’s connect and plan your next steps and find out if we’re the right real estate team for you!

CA Real Estate Group | Caliber Real Estate Group

👩🏻 Christine Almarines @carealestategroup

Realtor DRE# 01412944 | 714-476-4637

Tagalog speaking

👩🏻 Anaid Bautista @wealthwithanaid

Realtor DRE# 02179675 | 949-391-8266

Spanish speaking

By NerdWallet | Jan 30, 2024

Debt-to-income ratio shows how your debt stacks up against your income. Lenders use DTI to assess your ability to repay a loan.

Nerdy takeaways

- Debt-to-income ratio represents the percentage of your monthly income that goes to debt payments.

- Lenders use DTI — along with credit history and other factors — to evaluate if a borrower can repay a loan.

- Lenders have different DTI requirements. Personal loan companies may allow higher DTIs than mortgage lenders.

Debt-to-income ratio divides your total monthly debt payments by your gross monthly income, giving you a percentage. Here’s what to know about DTI and how to calculate it.

How to calculate your debt-to-income ratio

To manually calculate DTI, divide your total monthly debt payments by your monthly income before taxes and deductions are taken out. Multiply that number by 100 to get your DTI expressed as a percentage.

Here’s an example: A borrower with rent of $1,200, a car payment of $400, a minimum credit card payment of $200, and a gross monthly income of $6,000 has a debt-to-income ratio of 30%. In this example, $1,800 is the sum of all debt payments. When you divide $1,800 by $6,000 and then multiply that answer by 100, you get 30.

To get the most accurate DTI ratio, make sure to include all your debt payments and income sources.

Debt payments can include:

- Rent or mortgage payments.

- Auto loan payments.

- Student loan payments.

- Minimum credit card payments.

- Personal loan payments.

- Other debt payments, such as the minimum payment on a home equity line of credit.

- Child support, alimony, or other court-ordered payments.

Don’t include other monthly expenses, such as:

- Groceries.

- Gas.

- Utility payments.

- Phone bills.

- Health insurance.

- Auto insurance.

- Child care payments.

- Recreational spending.

Include all sources of income, such as:

- Salary from full-time work.

- Part-time wages.

- Freelance income.

- Bonuses.

- Child support or alimony received.

- Social security benefits.

- Rental property income.

How lenders view your DTI ratio

Lenders look at debt-to-income ratios because research shows borrowers with high DTIs have more trouble making consistent payments.

Each lender sets its own DTI requirement, but not all creditors publish them. Generally, a personal loan can have a higher allowable maximum DTI than a mortgage.

You may find personal loan companies willing to lend money to consumers with debt-to-income ratios of 50% or more, and some exclude mortgage debt from the DTI calculation. That’s because one of the most common uses of personal loans is to consolidate credit card debt, which can help you pay off debt faster and lower your DTI.

Does your DTI affect your credit score?

Your debt-to-income ratio does not affect your credit scores; credit-reporting agencies may know your income, but they don’t include it in their calculations.

Credit utilization, or the amount of credit you’re using compared with your credit limits, does affect your credit scores. Credit reporting agencies know your available credit limits, both on individual loan accounts and in total. Most experts advise keeping the balances on your cards no higher than 30% of your credit limit, and lower is better.

How to understand DTI ratio

DTI can help you determine how to handle your debt and whether you have too much debt.

Here’s a general breakdown:

- DTI is less than 36%: Your debt is likely manageable, relative to your income. You shouldn’t have trouble accessing new lines of credit.

- DTI is 36% to 42%: This level of debt could cause lenders concern, and you may have trouble borrowing money. Consider paying down what you owe. You can probably take a do-it-yourself approach; two common methods are debt avalanche and debt snowball.

- DTI is 43% to 50%: Paying off this level of debt may be difficult, and some creditors may decline applications for more credit. If you have primarily credit card debt, consider a credit card consolidation loan. You may also want to look into a debt management plan from a nonprofit credit counseling agency. Such agencies typically offer free consultations and will help you understand all of your debt relief options.

- DTI is over 50%: Paying down this level of debt will be difficult, and your borrowing options will be limited. Weigh different debt relief options, including bankruptcy, which may be the fastest and least damaging option.

Ways to lower your DTI ratio

Reduce your debt-to-income ratio to improve your chances of qualifying for future credit.

- Increase your income. Make more money by selling items online or starting a side gig, even for a short period, like babysitting or dog walking.

- Reduce your debt. Paying down your credit card balance can reduce your minimum monthly payments. Your DTI will also go down if you pay off installment loans, like student loans or a car loan.

- Refinance or consolidate debt. Refinancing or consolidating debt at a lower interest rate could lower your monthly payments and therefore reduce your DTI. Negotiating a longer repayment term could also lower your monthly debt payments, though you may wind up paying more interest over time.

- Avoid taking on additional debt. Try not to add to your credit card balance or take out additional loans if you want to lower your DTI.

Keeping Current Matters | Feb 26, 2024

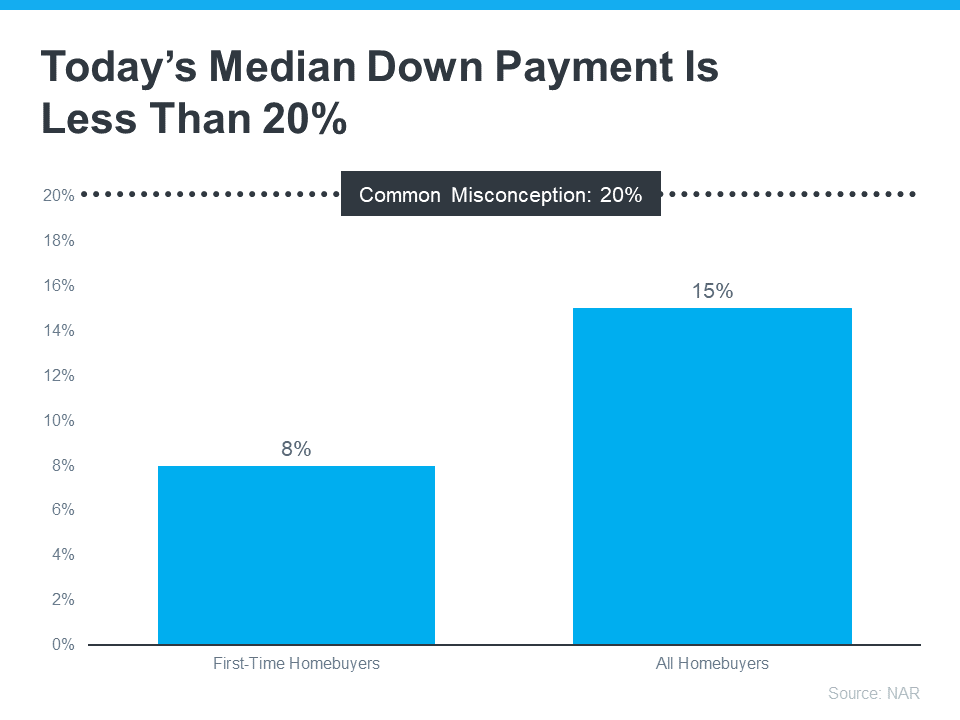

If you’re planning to buy your first home, saving up for all the costs involved can feel daunting, especially when it comes to the down payment. That might be because you’ve heard you need to save 20% of the home’s price to put down. Well, that isn’t necessarily the case.

Unless specified by your loan type or lender, it’s typically not required to put 20% down. That means you could be closer to your homebuying dream than you realize.

As The Mortgage Reports says:

“Although putting down 20% to avoid mortgage insurance is wise if affordable, it’s a myth that this is always necessary. In fact, most people opt for a much lower down payment.”

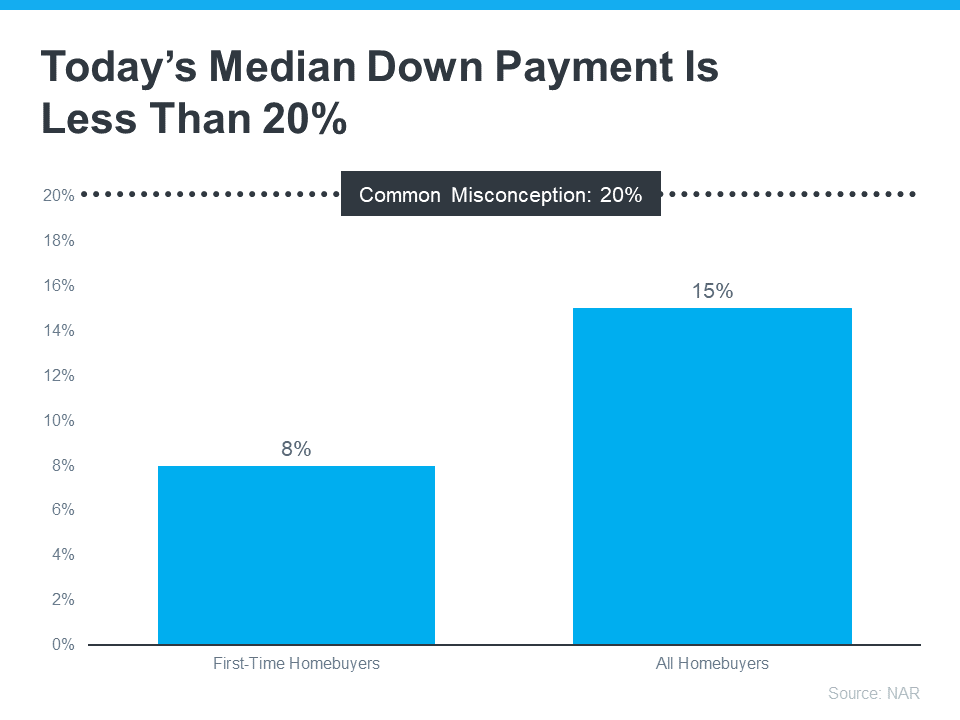

According to the National Association of Realtors (NAR), the median down payment hasn’t been over 20% since 2005. In fact, for all homebuyers today it’s only 15%. And it’s even lower for first-time homebuyers at just 8% (see graph below):

The big takeaway? You may not need to save as much as you originally thought.

Learn About Resources That Can Help You Toward Your Goal

According to Down Payment Resource, there are also over 2,000 homebuyer assistance programs in the U.S., and many of them are intended to help with down payments.

Plus, there are loan options that can help too. For example, FHA loans offer down payments as low as 3.5%, while VA and USDA loans have no down payment requirements for qualified applicants.

With so many resources available to help with your down payment, the best way to find what you qualify for is by consulting with your loan officer or broker. They know about local grants and loan programs that may help you out.

Don’t let the misconception that you have to have 20% saved up hold you back. If you’re ready to become a homeowner, lean on the professionals to find resources that can help you make your dreams a reality. If you put your plans on hold until you’ve saved up 20%, it may actually cost you in the long run. According to U.S. Bank:

“. . . there are plenty of reasons why it might not be possible. For some, waiting to save up 20% for a down payment may “cost” too much time. While you’re saving for your down payment and paying rent, the price of your future home may go up.”

Home prices are expected to keep appreciating over the next 5 years – meaning your future home will likely go up in price the longer you wait. If you’re able to use these resources to buy now, that future price growth will help you build equity, rather than cost you more.

Bottom Line

Keep in mind that you don’t always need a 20% down payment to buy a home. If you’re looking to make a move this year, reach out to a trusted real estate professional to start the conversation about your homebuying goals.

Keeping Current Matters | Feb 8, 2024

Are you on the fence about selling your house? While affordability is improving this year, it’s still tight. And that may be on your mind. But understanding your home equity could be the key to making your decision easier. An article from Bankrate explains:

“Home equity is the difference between your home’s value and the amount you still owe on your mortgage. It represents the paid-off portion of your home.

You’ll start off with a certain level of equity when you make your down payment to buy the home, then continue to build equity as you pay down your mortgage. You’ll also build equity over time as your home’s value increases.”

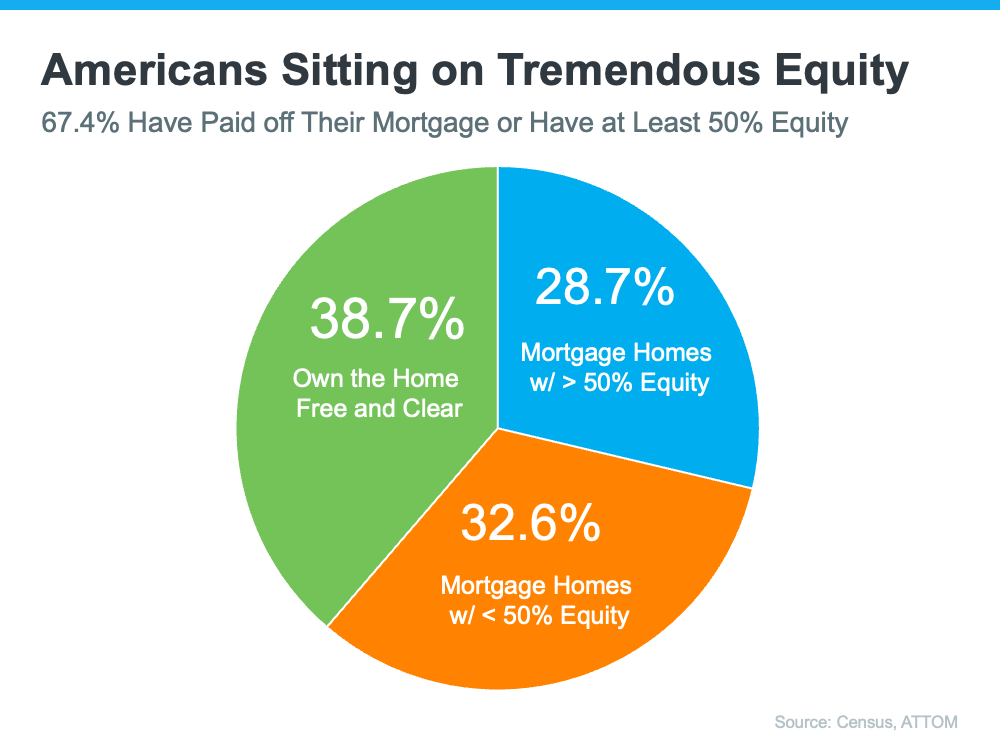

Think of equity as a simple math equation. It’s the value of your home now minus what you owe on your mortgage. And guess what? Recently, your equity has probably grown more than you think.

In the past few years, home prices skyrocketed, which means your home’s value – and your equity – likely shot up, too. So, you may have more equity than you realize.

How To Make the Most of Your Home Equity Right Now

If you’re thinking about moving, the equity you have in your home could be a big help. According to CoreLogic:

“. . . the average U.S. homeowner with a mortgage still has more than $300,000 in equity . . .”

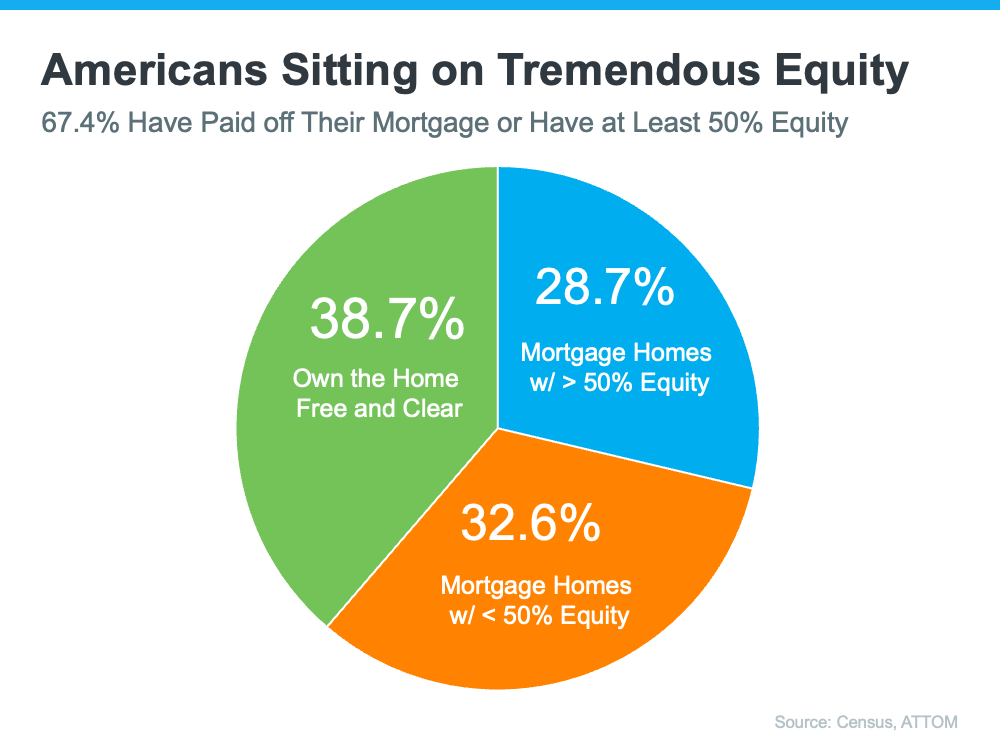

Clearly, homeowners have a lot of equity right now. And the latest data from the Census and ATTOM shows over two-thirds of homeowners have either completely paid off their mortgages (shown in green in the chart below) or have at least 50% equity (shown in blue in the chart below):

That means roughly 70% have a tremendous amount of equity right now.

After you sell your house, you can use your equity to help you buy your next home. Here’s how:

- Be an all-cash buyer: If you’ve been living in your current home for a long time, you might have enough equity to buy your next home without having to take out a loan. If that’s the case, you won’t need to borrow any money or worry about mortgage rates. Investopedia states:

“You may want to pay cash for your home if you’re shopping in a competitive housing market, or if you’d like to save money on mortgage interest. It could help you close a deal and beat out other buyers.”

- Make a larger down payment: Your equity could also be used toward your next down payment. It might even be enough to let you put a larger amount down, so you won’t have to borrow as much money. The Mortgage Reports explains:

“Borrowers who put down more money typically receive better interest rates from lenders. This is due to the fact that a larger down payment lowers the lender’s risk because the borrower has more equity in the home from the beginning.”

The Easy Way To Find Out How Much Equity You Have

To find out how much equity you have in your home, ask a real estate agent you trust for a Professional Equity Assessment Report (PEAR).

Bottom Line

Planning a move? Your home equity can really help you out. Let’s connect to see how much equity you have and how it can help with your next home.

👩🏻 Christine Almarines @carealestategroup

Realtor DRE# 01412944 | 714-476-4637

Tagalog speaking

👩🏻 Anaid Bautista @singlemomrealtor

Realtor DRE# 02179675 | 949-391-8266

Spanish speaking