Keeping Current Matters | Nov 3, 2023

Some Highlights

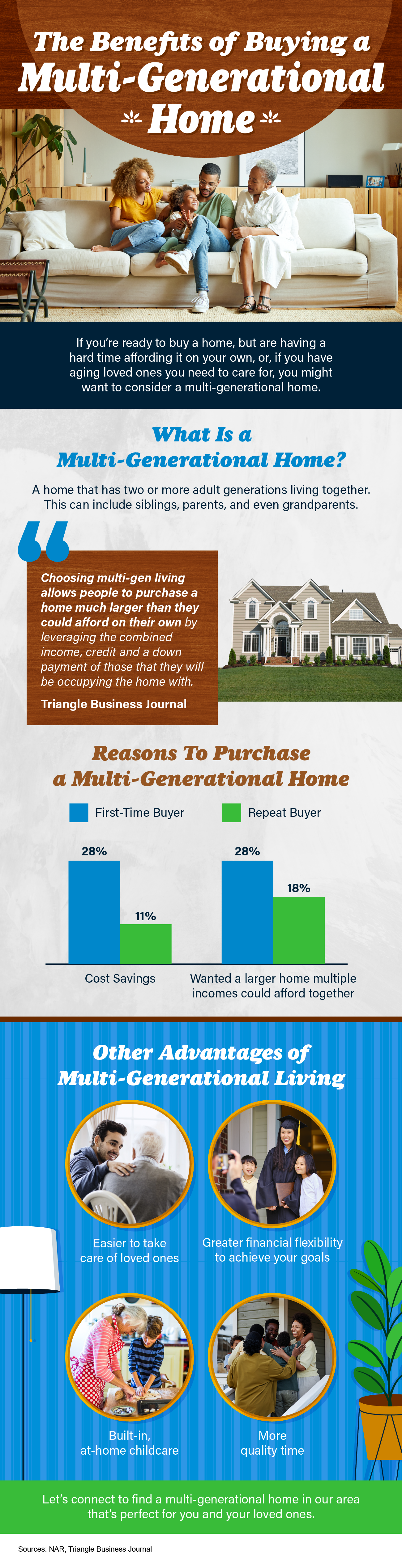

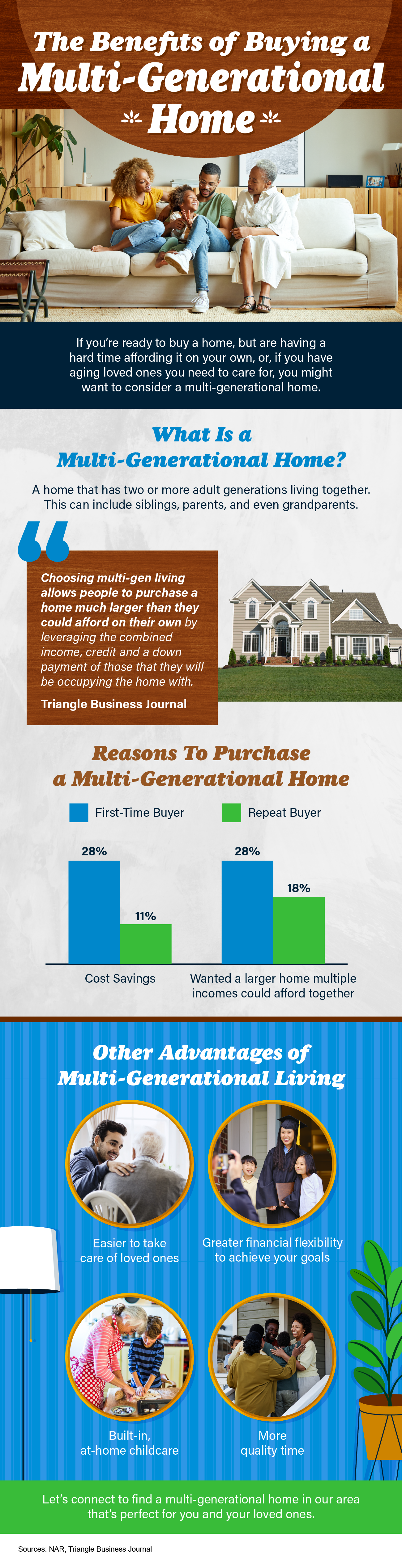

- If you’re ready to buy a home but are having a hard time affording it on your own, or, if you have aging loved ones you need to care for, you might want to consider a multi-generational home.

- Living with siblings, parents, and even grandparents can help you save money, give or receive childcare, and spend quality time together.

- Let’s connect to find a home in your area that’s perfect for you and your loved one’s needs.

Christine Almarines @christine_almarines

Realtor DRE# 01412944 | 714-476-4637

Michelle Kim @michellejeankim_homes

Realtor DRE# 01885912 | 714-253-7531

Anaid Bautista @singlemomrealtor

Realtor DRE# 02179675 | 949-391-8266

Keeping Current Matters | Oct 24, 2023

When it comes to selling your house, you’re probably trying to juggle the current market conditions and your own needs as you plan your move.

One thing that may be working in your favor is how few homes there are for sale right now. Here’s what you need to know about the current inventory situation and what it means for you.

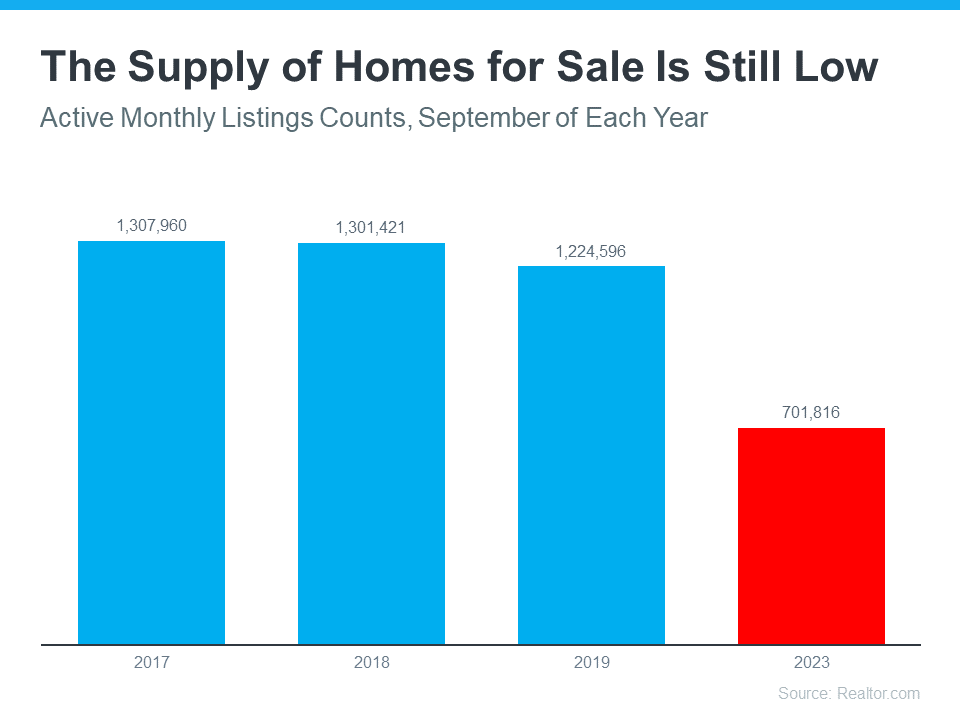

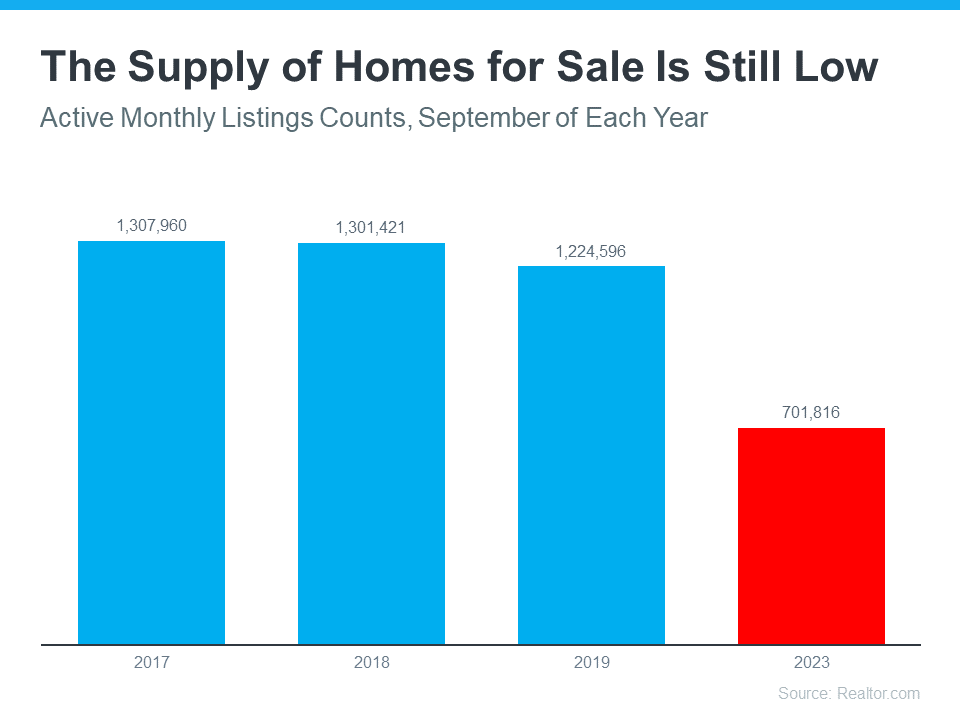

The Supply of Homes for Sale Is Far Below the Norm

When you’re selling something, it helps if what you’re selling is in demand, but is also in low supply. Why? That makes it even more desirable since there’s not enough to go around. That’s exactly what’s happening in the housing market today. There are more buyers looking to buy than there are homes for sale.

To tell the story of just how low inventory is, here’s the latest information on active listings, or homes available for sale. The graph below uses data from Realtor.com to show how many active listings there were in September of this year compared to what’s more typical in the market.

As you can see in the graph, if you look at the last normal years for the market (shown in the blue bars) versus the latest numbers for this year (shown in the red bar), it’s clear inventory is still far lower than the norm.

What That Means for You

Buyers have fewer choices now than they did in more typical years. And that’s why you could still see some great perks if you sell today. Because there aren’t enough homes to go around, homes that are priced right are still selling fast and the average seller is getting multiple offers from eager buyers. Based on the latest data from the Confidence Index from the National Association of Realtors (NAR):

- 69% of homes sold in less than a month.

- 2.6 offers: the average number of offers on recently sold homes.

An article from Realtor.com also explains how the limited number of houses for sale benefits you if you’re selling:

“. . . homes spent two weeks less on the market this past month than they did in the average September from 2017 to 2019 . . . as still-limited supply spurs homebuyers to act quickly . . .”

Bottom Line

Because the supply of homes for sale is so low, buyers desperately want more options – and your house may be just what they’re looking for. Let’s connect to get your house listed at the right price for today’s market. You could still see it sell quickly and potentially get multiple offers.

Keeping Current Matters | October 18, 2023

If you’re considering selling your house right now, it’s likely because something in your life has changed. And while things like mortgage rates play a big role in your decision, you don’t want that to overshadow why you thought about making a move in the first place.

It’s true mortgage rates are higher right now, and that has an impact on affordability. As a result, some homeowners are deciding they’ll wait to sell because they don’t want to move and have a higher mortgage rate on their next home.

But your lifestyle and your changing needs matter, too. As a recent article from Realtor.com says:

“No matter what interest rates and home prices do next, sometimes homeowners just have to move—due to a new job, new baby, divorce, death, or some other major life change.”

Here are a few of the most common reasons people choose to sell today. You may find any one of these resonates with you and may be reason enough to move, even today.

Relocation

Some of the things that can motivate a move to a new area include changing jobs, a desire to be closer to friends and loved ones, wanting to live in your ideal location, or just looking for a change in scenery.

For example, if you just landed your dream job in another state, you may be thinking about selling your current home and moving for work.

Upgrading

Many homeowners decide to sell to move into a larger home. This is especially common when there’s a need for more room to entertain, a home office or gym, or additional bedrooms to accommodate a growing number of loved ones.

For example, if you’re living in a condo and your household is growing, it may be time to find a home that better fits those needs.

Downsizing

Homeowners may also decide to sell because someone’s moved out of the home recently and there’s now more space than needed. It could also be that they’ve recently retired or are ready for a change.

For example, you’ve just kicked off your retirement and you want to move somewhere warmer with less house to maintain. A different home may be better suited for your new lifestyle.

Change in Relationship Status

Divorce, separation, or marriage are other common reasons individuals sell.

For example, if you’ve recently separated, it may be difficult to still live under one roof. Selling and getting a place of your own may be a better option.

Health Concerns

If a homeowner faces mobility challenges or health issues that require specific living arrangements or modifications, they might sell their house to find one that works better for them.

For example, you may be looking to sell your house and use the proceeds to help pay for a unit in an assisted-living facility.

With higher mortgage rates and rising prices, there are some affordability challenges right now – but your needs and your lifestyle matter too. As a recent article from Bankrate says:

“Deciding whether it’s the right time to sell your home is a very personal choice. There are numerous important questions to consider, both financial and lifestyle-based, before putting your home on the market. . . . Your future plans and goals should be a significant part of the equation . . .”

Bottom Line

If you want to sell your house and find a new one that better fits your needs, let’s connect. That way, you’ll have someone to guide you through the process and help you find a home that works for you.

For Sellers, Interest Rates, Demographics, Selling Myths

CONTACT ANY ONE OF OUR @CAREALESTATEGROUP AGENTS:

👩🏻 Christine Almarines @christine_almarines

Realtor DRE# 01412944 | 714-476-4637

👩🏻 Michelle Kim @michellejeankim_homes I speak Korean!

Realtor DRE# 01885912 | 714-253-7531

👩🏻 Anaid Bautista @singlemomrealtor I speak Spanish!

Realtor DRE# 02179675 | 949-391-8266

CA Real Estate Group | Powered by Keller Williams Realty

CONTACT ANY ONE OF OUR @CAREALESTATEGROUP AGENTS:

👩🏻 Christine Almarines @christine_almarines

Realtor DRE# 01412944 | 714-476-4637

👩🏻 Michelle Kim @michellejeankim_homes I speak Korean!

Realtor DRE# 01885912 | 714-253-7531

👩🏻 Anaid Bautista @singlemomrealtor I speak Spanish!

Realtor DRE# 02179675 | 949-391-8266

CA Real Estate Group | Powered by Keller Williams Realty

KeepingCurrentMatters.com | Sep 13, 2023

Are you a baby boomer who’s lived in your current house for a long time and you’re ready for a change? If you’re thinking about selling your house, you have a lot to consider. Will you move to a different state or stay nearby? Is it time to downsize or do you want more space to accommodate your loved ones? But maybe the biggest consideration boils down to this – will you buy your next home or choose to rent instead?

That decision ultimately depends on your current situation and your future plans. Here are two important factors to help you decide what’s right for you.

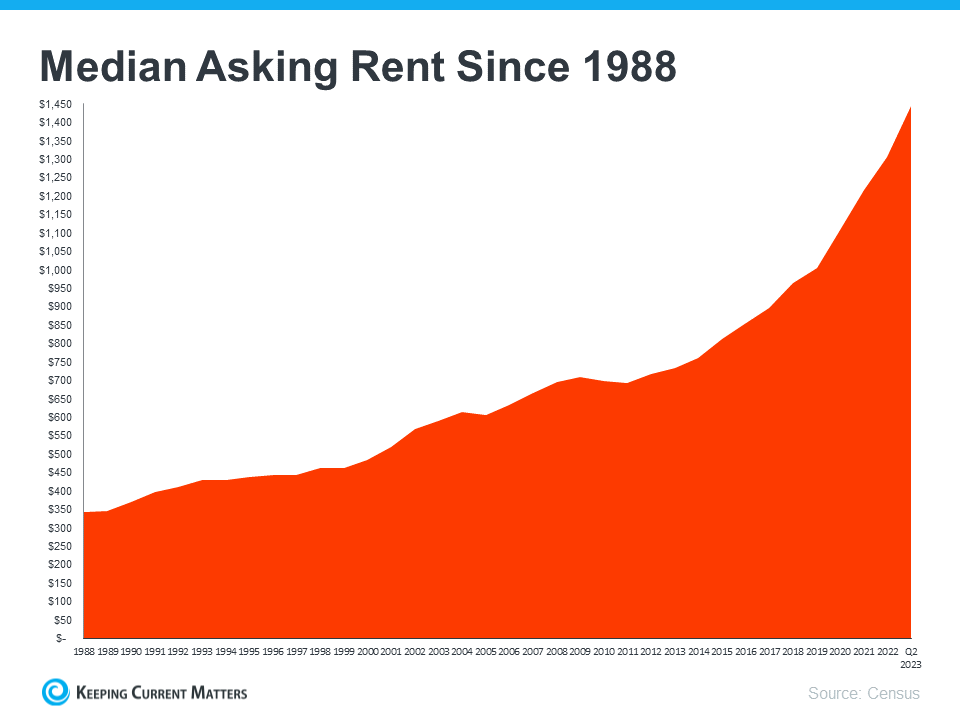

Expect Rents to Keep Going Up

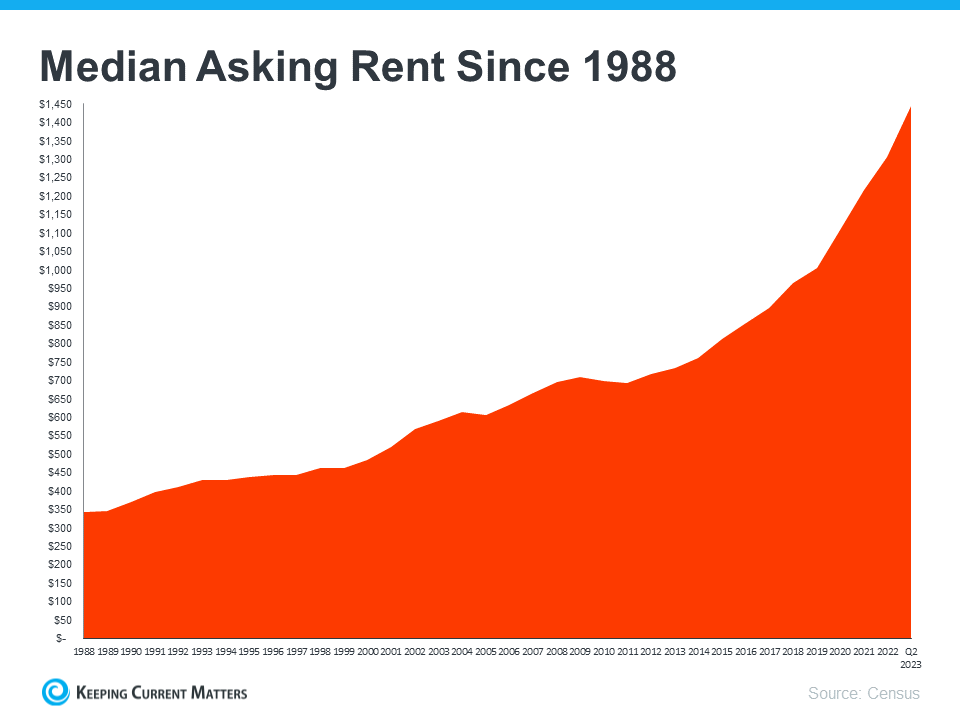

The graph below uses data from the Census to show how rents have been climbing steadily since 1988: Rents have been going up consistently over the long run. If you choose to rent, there’s a risk your rental payment will go up each time you renew your lease. Having a higher rental expense may not be something you want to deal with every year.

Rents have been going up consistently over the long run. If you choose to rent, there’s a risk your rental payment will go up each time you renew your lease. Having a higher rental expense may not be something you want to deal with every year.

When you buy a home with a fixed-rate mortgage, it helps stabilize your monthly housing payment. This allows you to lock in your monthly payment for the duration of your home loan. That keeps your payments steady and predictable for the long haul. Freddie Mac sums it up like this:

“. . . homeowners with fixed-rate loans will see little to no change to their monthly housing cost over the life of their loan. You can be confident in knowing that your mortgage payments won’t change much in the long term, even when life’s other costs do.”

Owning Your Home Comes with Unique Benefits

According to AARP, buying your next home is a better long-term strategy than renting:

“Though each option has pros and cons, buying provides more pros, with a broader range of benefits.”

To help you choose what you’ll do after you sell, here are just a few of the benefits of homeownership that article covers:

- Owning your home can help you save money for the future. Your home, and the equity you build as a homeowner, can provide generational wealth that could be passed on to loved ones, giving them a better life.

- You might not have to pay a monthly mortgage payment at all. If you have enough equity to buy your next home outright, you wouldn’t have a monthly mortgage payment. While you might still need to cover property taxes or maintenance fees, not having to worry about a monthly mortgage payment could be a big relief.

- Aging in place can be simpler. If your needs change, owning your home gives you the freedom to make renovations and updates that can make everyday life easier.

Bottom Line

If you’re a baby boomer who’s wondering whether you should buy or rent your next home, call Christine Almarines at CA Real Estate Group for advice at (714) 476-4637. With rents going up and homeownership providing so many benefits, it may make sense to consider buying your next home.

KeepingCurrentMatters.com | Sep 1, 2023

Some Highlights

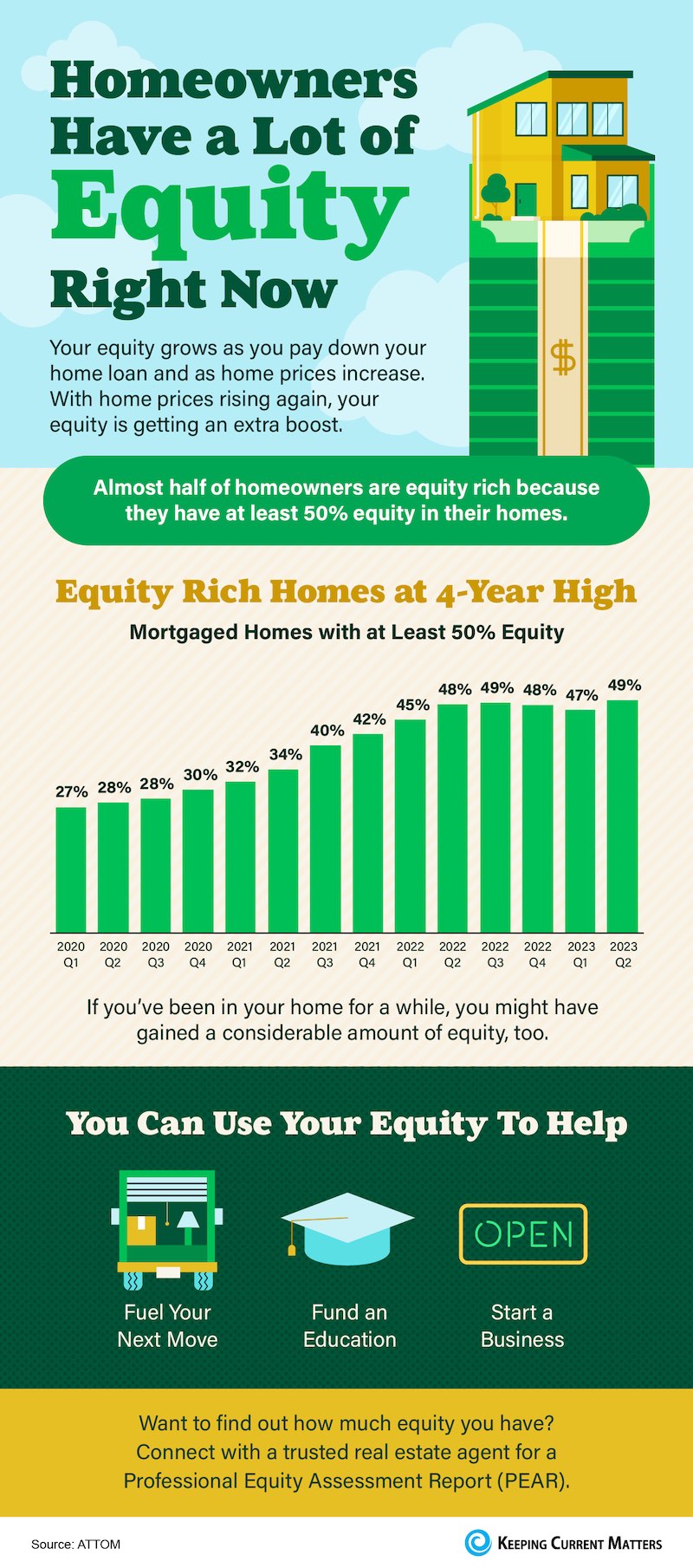

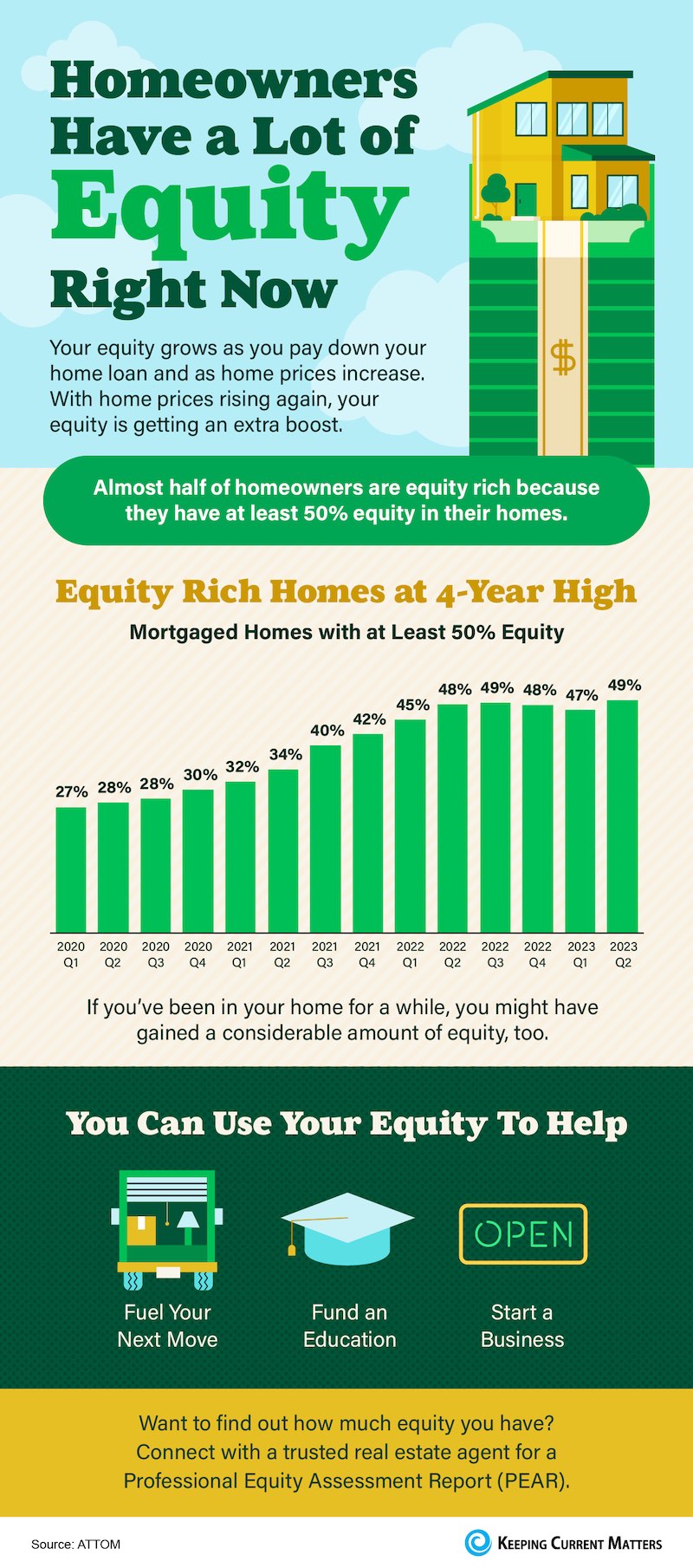

- Your equity grows as you pay down your home loan and as home prices increase. With home prices rising again, your equity is getting an extra boost.

- Almost half of homeowners are equity rich because they have at least 50% equity in their homes. If you’ve been in your home for a while, you might have gained a considerable amount of equity, too.

- Want to find out how much equity you have? Connect with a trusted real estate agent for a Professional Equity Assessment Report (PEAR). Call Christine Almarines and the CA Real Estate Group for a consultation today by calling or texting (714) 476-4637.

- Find out how much your home would be valued at in today’s market > CLICK HERE

Don’t Fall for the Next Shocking Headlines About Home Prices

If you’re thinking of buying or selling a home, one of the biggest questions you have right now is probably: what’s happening with home prices? And it’s no surprise you don’t have the clarity you need on that topic. Part of the issue is how headlines are talking about prices.

They’re basing their negative news by comparing current stats to the last few years. But you can’t compare this year to the ‘unicorn’ years (when home prices reached record highs that were unsustainable). And as prices begin to normalize now, they’re talking about it like it’s a bad thing and making people fear what’s next. But the worst home price declines are already behind us. What we’re starting to see now is the return to more normal home price appreciation.

To help make home price trends easier to understand, let’s focus on what’s typical for the market and omit the last few years since they were anomalies.

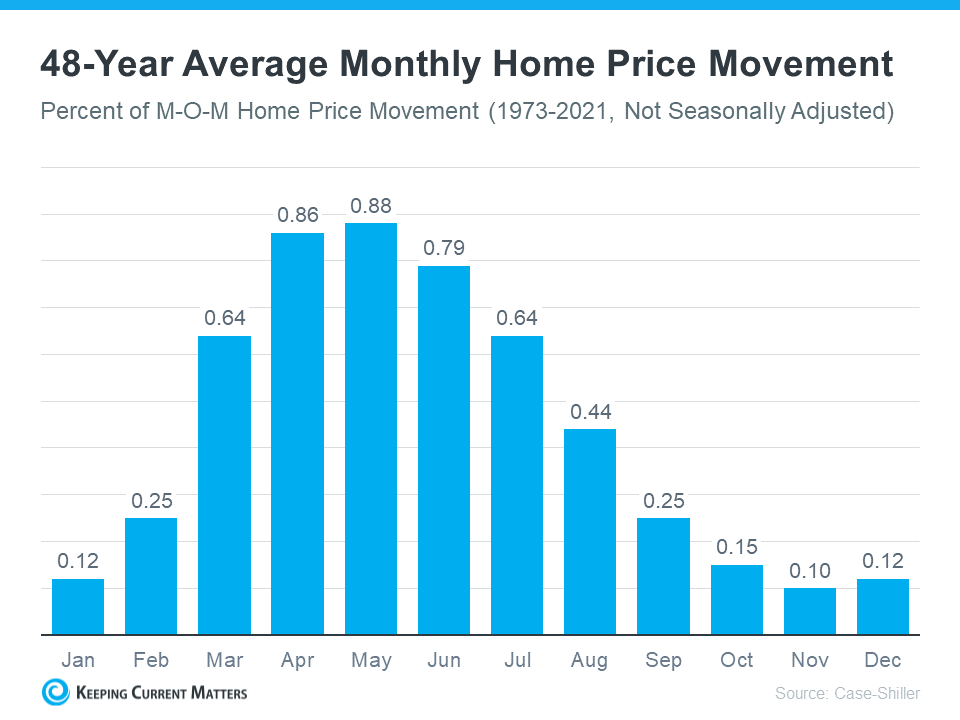

Let’s start by talking about seasonality in real estate. In the housing market, there are predictable ebbs and flows that happen each year. Spring is the peak homebuying season when the market is most active. That activity is typically still strong in the summer but begins to wane as the cooler months approach. Home prices follow along with seasonality because prices appreciate most when something is in high demand.

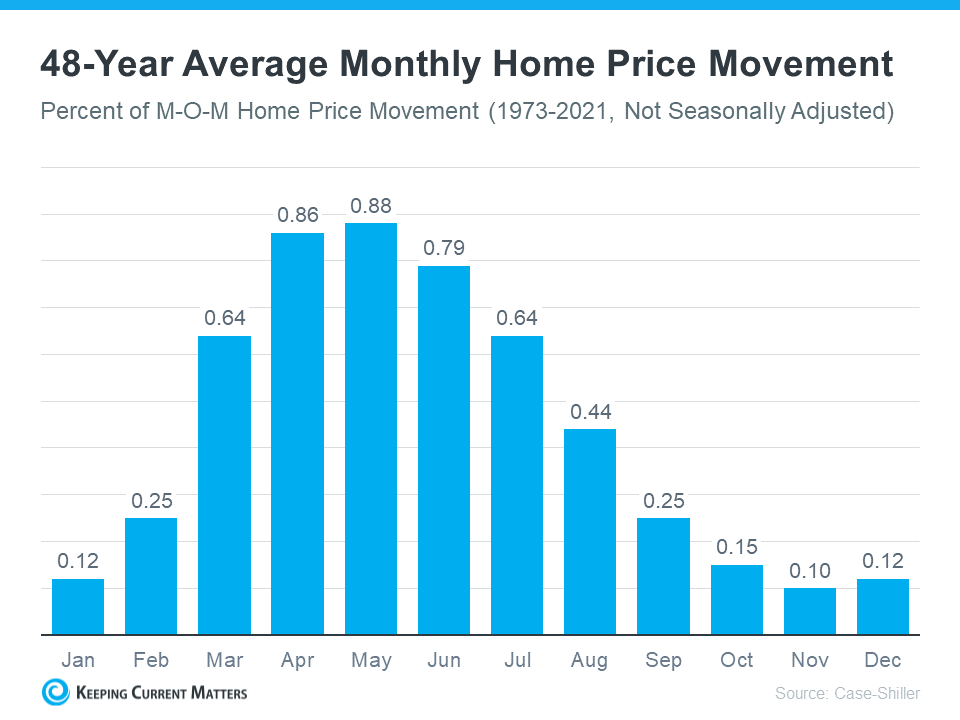

That’s why, before the abnormal years we just experienced, there was a reliable long-term home price trend. The graph below uses data from Case-Shiller to show typical monthly home price movement from 1973 through 2021 (not adjusted, so you can see the seasonality):

As the data from the last 48 years shows, at the beginning of the year, home prices grow, but not as much as they do entering the spring and summer markets. That’s because the market is less active in January and February since fewer people move in the cooler months. As the market transitions into the peak homebuying season in the spring, activity ramps up, and home prices go up a lot more in response. Then, as fall and winter approach, activity eases again. Price growth slows, but still typically appreciates.

Why This Is So Important to Understand

In the coming months, as the housing market moves further into a more predictable seasonal rhythm, you’re going to see even more headlines that either get what’s happening with home prices wrong or, at the very least, are misleading. Those headlines might use a number of price terms, like:

- Appreciation: when prices increase.

- Deceleration of appreciation: when prices continue to appreciate, but at a slower or more moderate pace.

- Depreciation: when prices decrease.

They’re going to mistake the slowing home price growth (deceleration of appreciation) that’s typical of market seasonality in the fall and winter and think prices are falling (depreciation). Don’t let those headlines confuse you or spark fear. Instead, remember it’s normal to see a deceleration of appreciation, slowing home price growth, as the months go by.

Bottom Line

If you have questions about what’s happening with home prices in your area, connect with CA Real Estate Group. Call Christine Almarines at (714) 476-4637.

https://www.carealestategroup.com/monthly-newsletters/july-2023-newsletter/

keepingcurrentmatters.com | May 25, 2023

If you’re trying to decide if now’s the time to sell your house, here’s what you should know. The limited number of homes available right now gives you a big advantage. That’s because there are more buyers out there than there are homes for sale. And, with so few homes on the market, buyers will have fewer options, so you set yourself up to get the most eyes possible on your house.

Here’s what industry experts are saying about why selling now has its benefits:

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR):

“Inventory levels are still at historic lows. Consequently, multiple offers are returning on a good number of properties.”

Selma Hepp, Chief Economist at CoreLogic:

“We have not seen the traditional uptick in new listings from existing homeowners, so undersupply of housing will continue to heighten market competition and put pressure on prices in most regions. Some markets are already heating up considerably, but price premiums that we saw last spring and summer are unlikely.”

Clare Trapasso, Executive News Editor at Realtor.com:

“Well-priced, move-in ready homes with curb appeal in desirable areas are still receiving multiple offers and selling for over the asking price in many parts of the country . . .”

Jeff Tucker, Senior Economist at Zillow:

“. . . sellers who price and market their home competitively shouldn’t have a problem finding a buyer.”

Bottom Line

If you’re thinking about selling your house, connect us at CA Real Estate Group and we can share the expert insights you need to make the best possible move today. Call Christine Almarines at 714-476-4637.