Jun 21, 2023

If you’re looking to buy or sell a home 🏠, you’ve probably heard the term “seller’s market,” but what is a seller’s market, and how does it affect your homebuying process? 🤔

A seller’s market often results in higher home prices and bidding wars on desirable properties. When you find a property you want to buy 😍, it’s best to have a CA Real Estate Group agent 💁🏻♀️ on your side to help you navigate the waters of the seller’s market.

Let’s take a closer look 🧐 at a seller’s market over the next few Wednesdays, see how it differs from a buyer’s market, and how we can help you through the current real estate trends. 📈📉📊

June 14, 2023

From YouTube to TikTok to the backyard barbecue, there are plenty of narratives regarding the pending doom for housing that the underlying data does not support.

It’s a hot market that we’re advising all Sellers take advantage of! ACT SOON and contact us to get your home sold for a great price!

Keeping Current Matters | May 26, 2023

Facts & Numbers vs Assumptions – Part 2

I love what I do and I love crunching numbers, sometimes being creative and finding a way to maximize my clients cash assets, putting them in a good financial position for years to come. Meaning that I like to act like a financial planner, making sure that the borrower doesn’t always use all of their assets, especially in today’s market.

Before you continue with this post, you will need to read part 1, Planting Seeds in the Borrower’s Head. If you want the cliff notes version, read the next few sentences below.

I truly believe as a loan officer, that I do my job as well as I can, with pride and satisfaction. That a realtor should not give mortgage advice deeper than the basics. The basics would be to know what programs are good in your area, and that you ask a few simple questions to make some determinations. Other than that, the realtor should not get into the rates and down payments. I hope to explain better below.

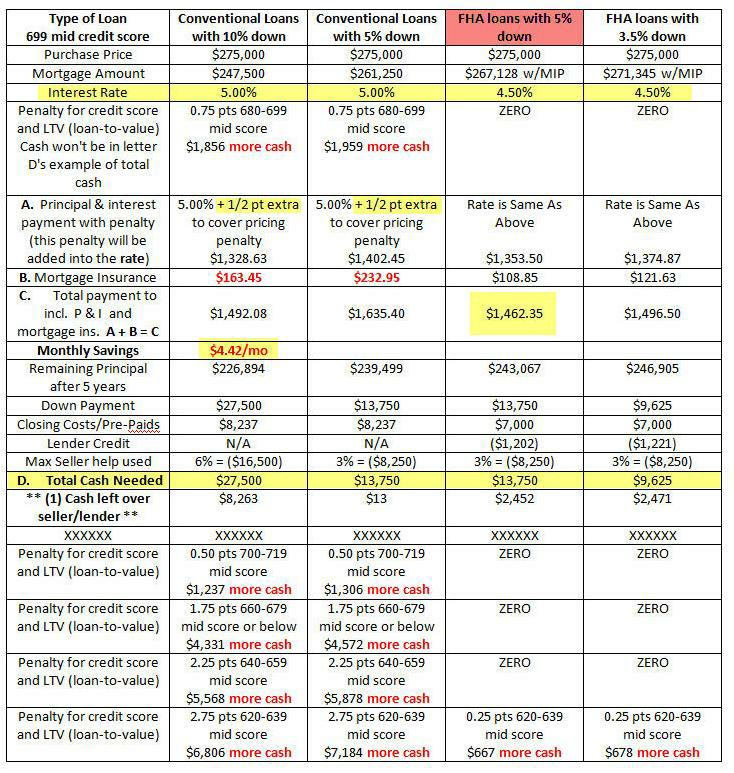

So what am I questioning? It’s when a realtor makes a statement such as this one. “home buyers can receive 6% closing help with 10% down. Which benefits our buyers more, making a larger down payment or paying their cash for closing costs???” – How about possibly neither, which I will show below. The last comment was followed with this kind of comment. – “The lower interest rates often offered with 10% down compared with FHA may make the conventional more attractive. “ These same statements are mentioned in part one and written by Lenn Harley.

If you remember the title of Part 1, it was Planting seeds in the borrower’s head. Read my conclusion in part 1. I truly believe when you talk about such statements, that you could be planting a seed in the borrower’s head. This could confuse the borrower or even worse, make them choose your thoughts without knowing the details. Let me show you what I am talking about.

Key Important Points –

The scenarios used below are based on a mid credit score of 699.

Now, there are a few other scenarios, such as lender paid mortgage insurance (LPMI) or 80/10 or lender paid closing costs (which you increase the interest rate which pays for some closing costs), and a few other mortgage insurance programs. But I just wanted to give you an idea on the statements that were mentioned above and how one needs to be careful in what they state to the buyer.

On another note, FHA is trying to reduce the seller help from 6% to 3%. HUD seeks public comment on three main issues for FHA loans. In the examples above, I decided to pretend that FHA’s seller help was reduce to 3%.

Reminder : – Comparing 10% down conventional with 3.5% down FHA – In regards to the money that you don’t use on the FHA loan, you either save it as cash on hand or you could invest it. You can usually get a 6% to 7% return on your money. If you have a decent idea or work with a good financial planner, you could get 9% to 10%. If you really know what you are doing and or are aggressive, you could get like 12% return. And please don’t read into those that sell you the idea to pay down your house off in half the time. There are some scams out there. They work, but not as advertised. Secondly, you will be writing off less interest if you pay off your house quicker. And the interest write off on the interest rate itself, depending on your interest rate, might not be as much as you think. Just food for thought and showing the complexities when comparing different types of mortgages.

Key Important Reminder –

Lender Overlays and different PMI companies (private mortgage companies) have different guidelines and rules. Also, when doing a conventional loan with MI, you will also have to send the file to the MI company to be underwritten. So even if your company says yes, the MI company could still say no. On FHA loans, it’s just underwritten once.

Conclusion : Many would think and or assume that with 10% down on a conventional mortgage, that it could be cheaper in interest rate and in payment than on a FHA mortgage with 3.5% down. And in some cases, even though your down payment is more with a conventional loan, it could cost you more out of pocket or possibly more within the price of the home because some sellers will tack on the seller concessions onto the price. And look at the fact that you added about $6,000 of upfront mortgage insurance on the FHA loan, yet the FHA loans look to be cheaper all the way around. And you can compare the principal balances after 5 years and how much cash that you kept in your pocket with a lower monthly payment. Food for thought.

Cash is King – I highlighted the FHA loan scenario with 5% down. As you can see, the mortgage payment would actually be about $30 less than when putting 10% down. What I hear so many people focus on is the fact that they don’t want to be underwater on the property. People, buying a home is suppose to be an investment and in many cases, a long term investment. This is a whole other topic, but it needs to be discussed. You just never know what will be around the corner and having a larger savings could save you down the road. I wrote an excellent series on this topic. Click on the Cash is King link. Part 2 of 3 –

Numbers don’t lie, uneducated facts or assumptions do.

UPDATE : I had originally worked on this post starting at 3:30 am this morning and had most of it done by 7 am. But I didn’t submit it because I had to check out one issue and then the day got away from me. But Mr. Stevens of FHA has announced new upfront mortgage insurance changes and changes for the monthly. In my opinion, the 5% comparisons, FHA loans will still be the best option, even with a credit score of 699 or less. In regards to the 10% down on conventional loans? The payment might be better by $100, but still keeping in mind that you are keeping $13,000 in your pocket. You need to think of the trade off and your future. Here is the link to the letter from FHA. Bill approved to give FHA the ability to change upfront and monthly mortgage insurance. I will be writing about this tomorrow and giving examples. thanks

Orange County Housing Report:

Housing Insanity Returns

April 17, 2023

Copyright 2023- Steven Thomas, Reports On Housing – All Rights Reserved. This report may not be reproduced in whole or part without express written permission from the author.

Identity theft is a really serious problem for many Americans. The fallout from having your information stolen and misused can last for years. That’s why it’s crucial to protect both your personal and financial information when purchasing a home. Here are some steps you can take to safeguard yourself during the process.

Secure Personal Information

Keep any documentation that includes your social security number, birth date, driver’s license number, and financial account numbers in a secure place. When you do share, make sure they’re transmitted through an encrypted platform or delivered in person.

Look Out for Phishing Scams

Be cautious with unsolicited emails or phone calls asking for personal information. Never open any suspicious-looking email, even if it appears to be from your lender or title company. Always verify the identity of all phone callers.

Use Secure Websites

When searching for homes or mortgage information online, browse sites that start with “https” and have a padlock icon in the address bar, which indicates a safe connection.

Monitor Your Credit Report

Check for suspicious activity, such as unauthorized loans or accounts. Do this often, as identity thieves usually act quickly.

Know Who Has Access

Confirm who will have access to your information, in what setting they’ll see it and how it will be disposed of once it’s no longer needed.

Shred Sensitive Documents

After the home-buying process is complete, take it upon yourself to shred sensitive documents.

Buying a home is fun and exciting, but it’s important to stay vigilant with your personal information. A licensed real estate professional and reputable lender will be invaluable in providing financial protection and peace of mind.

The global smart home market is expected to exceed $170 billion by 2025, according to Strategy Analytics. In the U.S. alone, 37% of households already owned one or more smart devices by 2020. So what do you do with all this smart tech when you sell your property?

Clearly identify what you intend to take with you to avoid any last-minute confusion that could jeopardize your deal. The rule of thumb says any smart tech that’s connected, mounted or nailed down stays with the house. Common examples include smart blinds, HVAC controls, exterior floodlights, and alarm systems. On the other hand, sellers typically take smaller, freestanding devices like smart speakers.

Before the closing date, sellers should wipe their digital account information and log out of all smart systems. As an extra kindness to their buyers, sellers could create a list of all smart items that will stay, including warranty information, age of the product, proof of purchase, names and model numbers, and instructions on how to do a factory reset.

Even if you have enough cash to buy your house outright, it may not necessarily be the best decision for you. Consider the following pros and cons, then discuss your options with a qualified tax adviser or financial planner.

Pros

Making a cash offer greatly reduces the amount of paperwork (and fees) involved in buying a house and can save thousands of dollars in mortgage interest and closing costs. Also, owning a debt-free property can provide financial peace of mind.

Cons

Some buyers feel more comfortable keeping more of their assets liquid for greater flexibility or in case of emergency. Depending on your savings and investment income, you may prefer to take advantage of the tax deductions available on mortgage interest.

If it looks cool while keeping you cool, it must be stylish home tech.

Household devices and appliances that function well and have a sleek, modern design define stylish home tech. This includes products such as smart home systems, smart lighting, comprehensive entertainment packages, and appliances with advanced features and design.

Today’s sophisticated tech allows you to easily set up and operate various home elements. Lighting and window coverings can be controlled from a smartphone or tablet. Innovative TVs can stream content or respond to voice commands. Some front doors come equipped with motion-activated lights and a video doorbell. You can even buy a wall-mounted, Wi-Fi enabled air conditioner that’s disguised as framed artwork.

Modern kitchen appliances have certainly evolved to be both functional and chic, with enhancements like energy efficiency, quiet operation and touch controls. Many manufacturers also offer a variety of slick finishes, including fingerprint-proof stainless steel, shatterproof glass doors and panels that change colors to reflect the home’s design palette. Now that’s some trendy tech.

You put your best foot forward for a job interview. Selling a house is no different. Instead of a stylish suit and top-notch grooming, your property will be dressed for success with a modest investment in these essential details.

©2023 The Personal Marketing Company. All rights reserved. Reproductions in any form, in part or in whole, are prohibited without written permission. If your property is currently listed for sale or lease, this is not intended as a solicitation of that listing. The material in this publication is for your information only and not intended to be used in lieu of seeking additional consumer or professional advice. All trademarked names or quotations are registered trademarks of their respective owners. ©2023 The Personal Marketing Company. All rights reserved. Reproductions in any form, in part or in whole, are prohibited without written permission. If your property is currently listed for sale or lease, this is not intended as a solicitation of that listing. The material in this publication is for your information only and not intended to be used in lieu of seeking additional consumer or professional advice. All trademarked names or quotations are registered trademarks of their respective owners.

The Personal Marketing Company |

KTLA.com | Dec 18, 2022

As housing and living costs remain unaffordable for many living in Los Angeles, new data shows plenty of residents are migrating to more affordable locales.

A new SmartAsset study shows the migration trend to more affordable cities has created a series of “boomtowns” across America.

These cities saw the largest increase in population, income and available housing over a five-year period from 2016-2021.

Three Southern California cities, in particular saw the largest growth — Menifee, Chino and Victorville.

Located in Riverside County, the population in Menifee has increased by 20.21% to around 106,400 residents between 2016-2021. Workers in the city experienced an increase of over 42% in incomes. Housing availability has also boomed, rising by almost 20% over five years.

Residents enjoy the sparse suburban feel with plenty of local parks and outdoor activities. Menifee’s residents are mostly comprised of families and retired folks, according to Niche. Average home prices are $572,051, according to Zillow.

Chino ranked highest for its five-year housing and income growth among the winner’s list. The number of housing units increased by almost 30% while the median household income increased by around 42% to $97,473. Chino’s population is just under 93,000.

Located in San Bernardino County, locals say the Chino is a suburban town with easy access to dining, entertainment and plenty of outdoor parks. Its residents are a mix of families and young professionals. The median home price is $715,682 according to Zillow.

The population in this San Bernardino County has grown by 11% over the past five years while housing units have increased by 15%. Local businesses have also increased by 12%, according to the study.

Locals say Victorville is a great place to raise a family, boasting low crime rates, great schools and affordable housing. The median home price is $415,547, according to Zillow. Its residents are a mix of young families and retirees.

Here are the Top Boomtowns in America in 2022 according to SmartAsset:

To narrow down the final list, researchers analyzed data for 500 of the largest cities using seven metrics:

Thinking of moving to a “boomtown”? Experts say timing is important to reap the most benefits.

“Moving to a boomtown at its earliest stages can be a great opportunity for entrepreneurs and investors, as there’s still plenty of room for growth,” said Edith Reads, senior editor at TradingPlatforms.“ And for those who are looking for a job, there are usually plenty of opportunities available in rapidly growing cities. However, if a city has already reached its peak, it may be too late to get in on the action. In this case, it may be wiser to wait until the city’s growth slows down before making the move. This way, you can avoid getting caught in the midst of a housing or job crunch.”

Check out SmartAsset’s full study of America’s Top Boomtowns in 2022.

Keeping Current Matters | Feb 10, 2023

This infographic shows how to win as a BUYER in today’s housing market. Main take-aways:

💭 DM us @carealestategroup and let’s chat about the best options for you!

💡 For more home maintenance tips, real estate advice, and fun family ideas, follow us at @carealestategroup — we are more than just real estate!

CA Real Estate Group | KW Realty

@carealestategroup @christine_almarines @michellejeankim_homes @estheroh_realtor @__minheok @singlemomrealtor

Keeping Current Matters | Feb 17, 2023

This infographic shows that the spring housing market could be a sweet spot for sellers. Main points:

💭 DM us @carealestategroup and let’s chat about the best options for you!

💡 For more home maintenance tips, real estate advice, and fun family ideas, follow us at @carealestategroup — we are more than just real estate!

CA Real Estate Group | KW Realty

@carealestategroup @christine_almarines @michellejeankim_homes @estheroh_realtor @__minheok @singlemomrealtor

Stock prices and mergers often take center stage in business news reports, while small businesses are treated more like the ensemble cast. But maybe it should be the other way around. Small businesses account for a staggering 99.9% of American companies, according to the U.S. Small Business Administration Office of Advocacy.

And when they say small, they mean small. The majority of small businesses have one owner and no staff, and many have fewer than 20 employees. Still, nearly half of all jobs come from small businesses. In the past 25 years, small businesses have accounted for more than two-thirds of U.S. jobs.

With so much focus on tech giants and mega-corporations, sometimes the more subtle trends and new ideas coming from small businesses aren’t as apparent. Meaningful analysis of the U.S. economy should examine what’s happening in businesses of all sizes.

During 2022, the most profitable small businesses showed many entrepreneurs using their skills and interests to help other companies grow. Others focused on providing value by making everyday life more convenient or pleasant. Both online and in-person services have displayed solid growth and earning potential.

According to NerdWallet.com, these were last year’s most profitable types of small businesses.

“Money doesn’t grow on trees!” Parents have said this to their children for generations, but the key is to back it up with information that shows how money does grow. Experts say teaching children the value of saving money is crucial to future financial stability. Saving also helps develop other good habits like discipline, goal setting, planning, and delayed gratification.

Overall, it’s wise to discuss age-appropriate money matters with your family to foster healthy, lifelong relationships with household finances.

Do airlines have to compensate you if they delay or cancel your flight? Are you entitled to hotel or meal vouchers? Answers can vary, so be sure you understand your rights before you fly.

Find out what to do if your luggage is lost or you get bumped because of overbooking, mechanical problems or weather delays. You can find up-to-date information on the Department of Transportation’s new Airline Customer Service Dashboard at Transportation.gov.

Consider buying your tickets with a credit card that covers flight cancellations and service interruptions. Be aware of airline policies before purchasing tickets so you know what to expect in the event of a problem.

Pro Tip: Invest in a luggage tag with GPS tracking.

Finding ways to reduce expenses isn’t always easy. But with some planning and creativity, you may discover surprising ways to revise your budget and lower your monthly costs. Try tracking your spending for several weeks, then prioritize needs and wants. Use this information and these tips to save on major expenditures.

Mortgage

If your mortgage payment is too high, think about moving to a more affordable home. You can also explore additional options, such as raising the deductible on your homeowner’s insurance policy or bundling your home and auto insurance.

Utilities

Ask your cable, internet and cellphone providers for their best promotions. Research other utility options and switch to low-cost alternatives whenever available.

Transportation

If it’s practical, consider using public transportation. Refinance or trade in your car for a less expensive model. Look for a better deal on car insurance, and be sure to request all available discounts.

Food

Shop weekly grocery promotions, and buy only as much produce as you can use before it spoils. Cook at home more often and prepare enough food to save for leftovers.

Entertainment

Audit your streaming, subscriptions and other memberships for redundancies or little-used entertainment services.

Instead of scrolling through social media when you have time to kill, why not get something done? Try these tips and tricks to boost your productivity no matter what kind of smartphone you have.

©2023 The Personal Marketing Company. All rights reserved. Reproductions in any form, in part or in whole, are prohibited without written permission. If your property is currently listed for sale or lease, this is not intended as a solicitation of that listing. The material in this publication is for your information only and not intended to be used in lieu of seeking additional consumer or professional advice. All trademarked names or quotations are registered trademarks of their respective owners. ©2023 The Personal Marketing Company. All rights reserved. Reproductions in any form, in part or in whole, are prohibited without written permission. If your property is currently listed for sale or lease, this is not intended as a solicitation of that listing. The material in this publication is for your information only and not intended to be used in lieu of seeking additional consumer or professional advice. All trademarked names or quotations are registered trademarks of their respective owners.

The Personal Marketing Company |